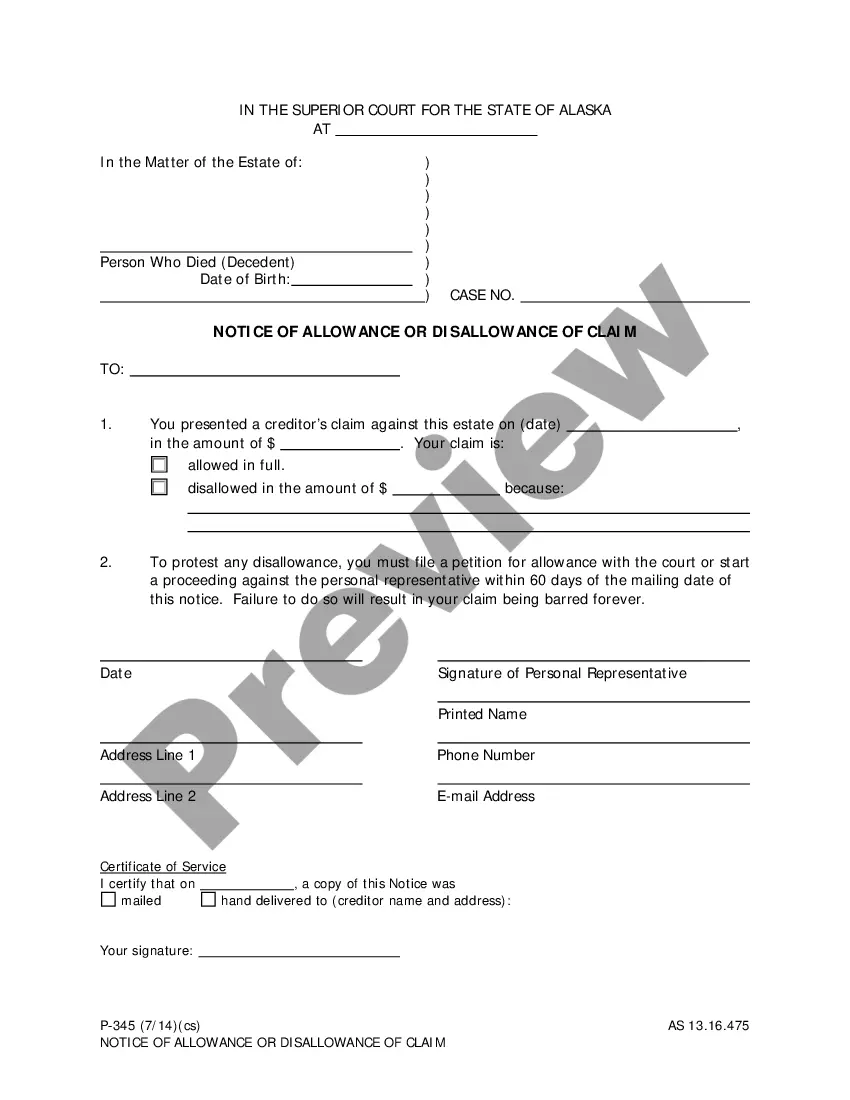

The Alaska Notice of Allowance or Disallowance of Claim is a legal document issued by the Alaska Department of Natural Resources (DNR) in response to an application for an oil and gas lease. The notice informs the applicant whether their application for the lease has been accepted or rejected. The notice includes information about the rights and obligations of the applicant, including the terms of the lease, the royalty schedule, and the amount of rent due on the lease. It also provides information about the process of appeal and the timeline for filing an appeal with the DNR. There are two types of Alaska Notice of Allowance or Disallowance of Claim: 1. Notice of Allowance: This type of notice informs the applicant that their application for an oil and gas lease has been accepted. 2. Notice of Disallowance: This type of notice informs the applicant that their application for an oil and gas lease has been rejected. It will also explain the reasons for the rejection.

Alaska Notice of Allowance or Disallowance of Claim

Instant download

Public form

Description

Notice of Allowance or Disallowance of Claim

How to fill out Alaska Notice Of Allowance Or Disallowance Of Claim?

US Legal Forms provides the easiest and most economical method to locate suitable official templates.

It is the most comprehensive online collection of business and personal legal documents crafted and verified by legal professionals. Here, you can discover printable and editable forms that adhere to federal and state regulations - similar to your Alaska Notice of Allowance or Disallowance of Claim.

Acquiring your template requires just a few straightforward steps. Users who already possess an account with an active subscription only need to Log In to the online platform and download the document onto their device. Later, they can find it in their profile under the My documents section.

- Review the form description or preview the document to confirm you’ve selected the one matching your needs, or find another using the search bar above.

- Select Buy now when you’re confident of its suitability for all the criteria, and choose the subscription plan you prefer.

- Create an account with our platform, Log In, and complete your subscription purchase using PayPal or your credit card.

- Choose the desired file format for your Alaska Notice of Allowance or Disallowance of Claim and download it onto your device using the correct button.