Alaska Business Credit Application

Overview of this form

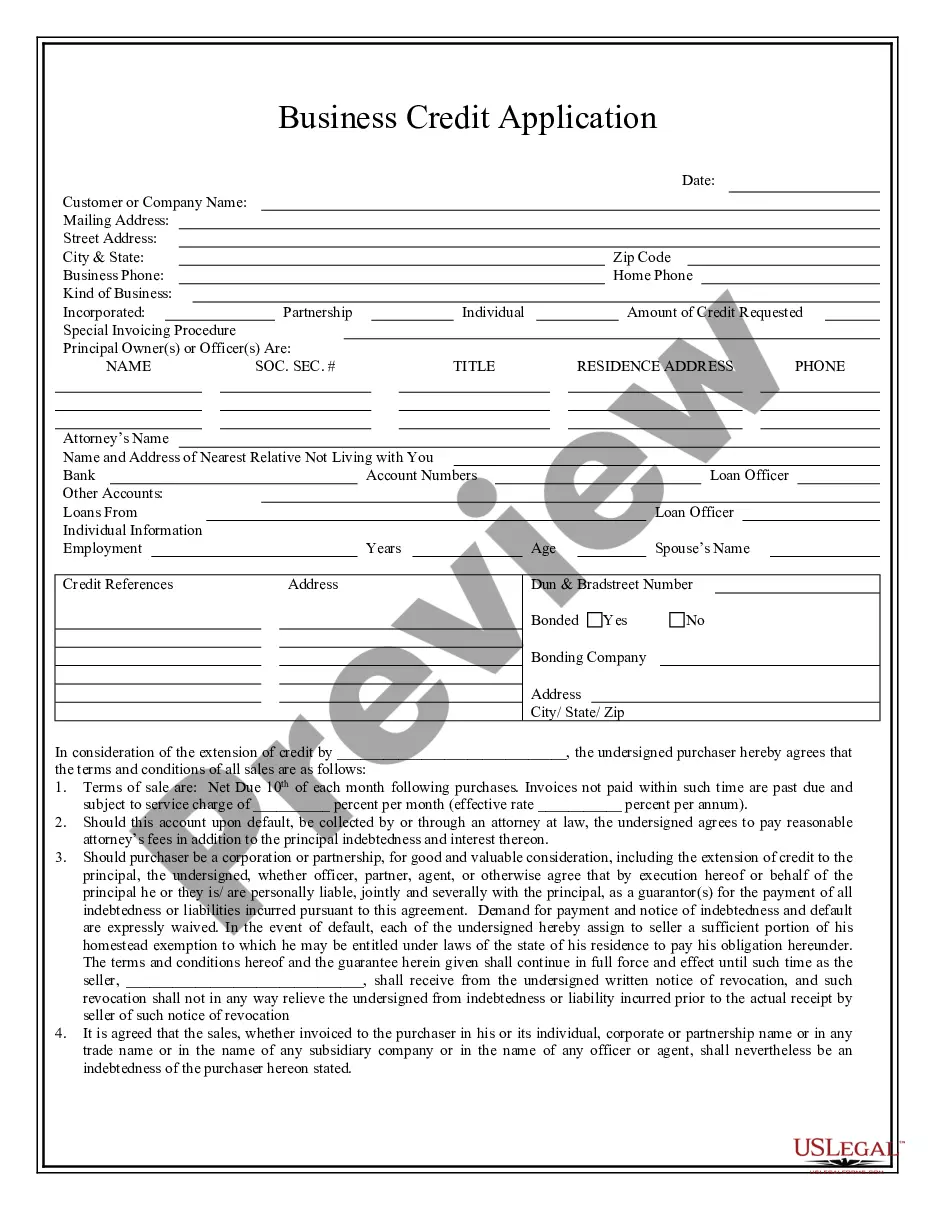

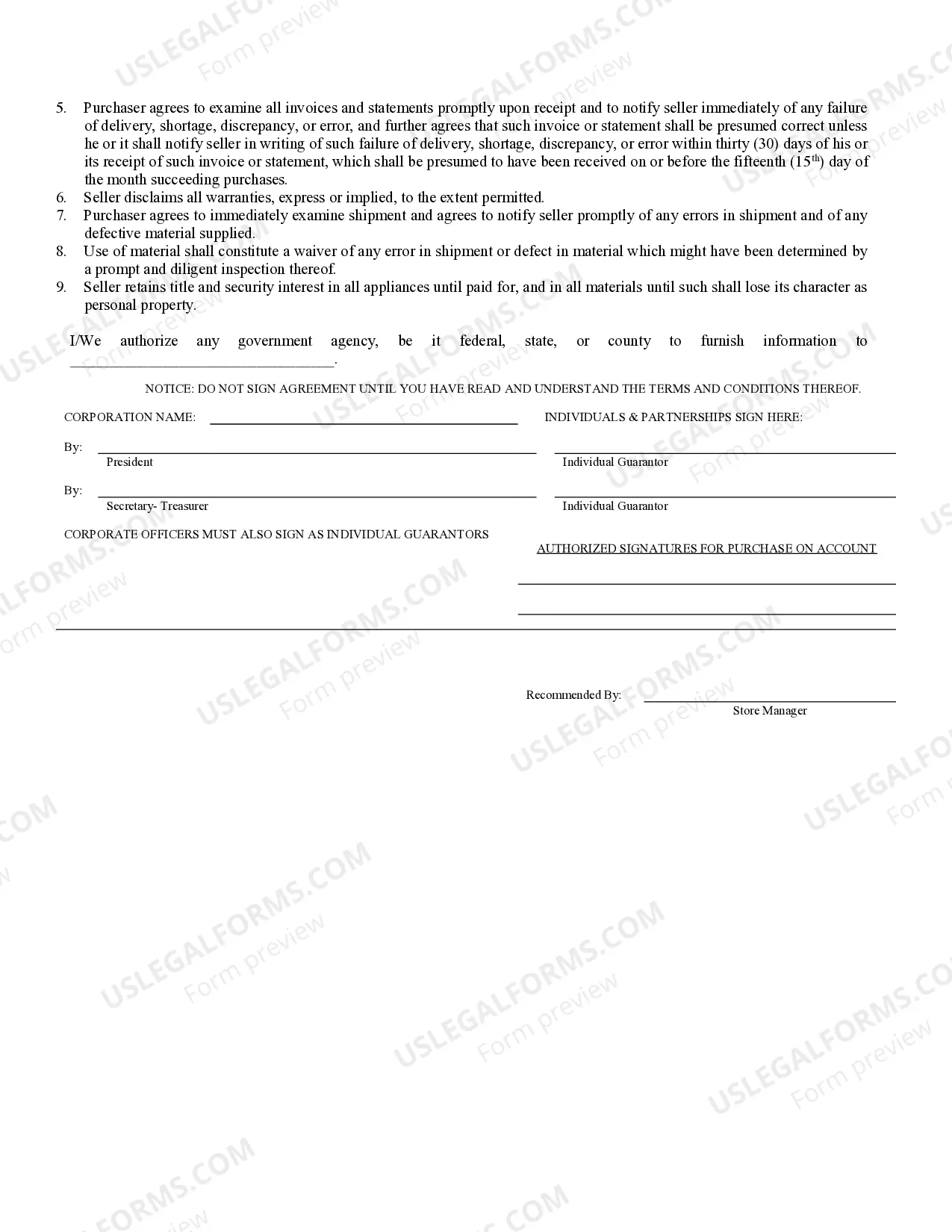

The Business Credit Application is a legal document used by individuals or businesses to apply for credit from a seller for the purchase of goods or services. This form outlines the terms of repayment, including interest rates and conditions for default, making it essential for establishing credit terms between a seller and a buyer. It is distinct from other credit forms by providing specific clauses related to liability and warranties, ensuring clarity in the seller-buyer relationship.

Key parts of this document

- Seller's and purchaser's information.

- Terms of sale and payment, including due dates.

- Default provisions and associated charges.

- Personal liability clauses for corporate or partnership purchasers.

- Waivers of demand for payment and notices of default.

- Legal disclaimers regarding warranties and title retention.

Situations where this form applies

This form is typically used when a buyer wants to establish a credit account with a seller for purchasing goods or services. It is particularly relevant for businesses seeking to manage their finances by obtaining credit for inventory or operational supplies. Using this application ensures that both parties have a clear understanding of repayment expectations and legal obligations.

Who can use this document

- Business owners looking to purchase on credit.

- Corporations or partnerships seeking to establish credit accounts.

- Individuals acting on behalf of a business requiring goods or services.

- Sellers who want a formal agreement outlining credit terms.

Steps to complete this form

- Identify the seller's and purchaser's complete names and contact information.

- Specify the sale terms, including payment due dates and any interest rates.

- Read and understand all conditions related to default and liabilities.

- Enter the required signatures from the authorized individuals.

- Review the completed application for accuracy and clarity.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to read the terms and conditions thoroughly before signing.

- Not providing complete or accurate information about the business.

- Overlooking the requirement for multiple signatures if applicable.

- Neglecting to notify the seller of discrepancies within the specified timeframe.

Why use this form online

- Ease of access: Downloadable format for immediate use.

- Editability: Customize the form to suit your specific business needs.

- Reliability: Drafted by licensed attorneys to ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Most small business owners who apply for business credit cards apply using their personal credit, not their business credit. Because of this, if a business owner's credit report isn't in good shape with a score of at least 640 to 700, depending on the card they're applying for they may be denied.

There are several easy approval business credit cards. That's because the easiest business credit cards to get only require fair or bad credit. They include Capital One Spark Classic for Business, the Staples Business Credit Card, and the Wells Fargo Business Secured Credit Card.

Ink Business Cash® Credit Card: Best No Annual Fee Business Card.Ink Business UnlimitedA® Credit Card: Best Flat Rate Rewards for Business.The Blue BusinessA® Plus Credit Card from American Express: Best for Business Flexible Rewards.Ink Business PreferredA® Credit Card: Best Travel Rewards Business Card.Best Business Credit Cards Of 2021 Forbes Advisor\nwww.forbes.com > advisor > credit-cards > best > business

Limited Credit: Capital One Spark Classic for Business. You'll get 1% cash back on all purchases. Fair Credit: Staples Business Credit Card. Bad Credit: Wells Fargo Business Secured Credit Card. Personal Option: Discover it Secured Credit Card.

Small business credit card applications may be turned down for a wide range of reasons. It can be something as simple as a phone number not matching your credit report, or the issue may be more complex. Don't give up hope right away. Even if you don't get instant approval, you could still get the card in the mail.

How to get a business credit card with no business. Just about anyone can get a business credit card. You don't need to be running a corporation, but you do need to be able to list some kind of business, even if it's just your one-person side hustle.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.