Wisconsin Warranty Deed to Child Reserving a Life Estate in the Parents

About this form

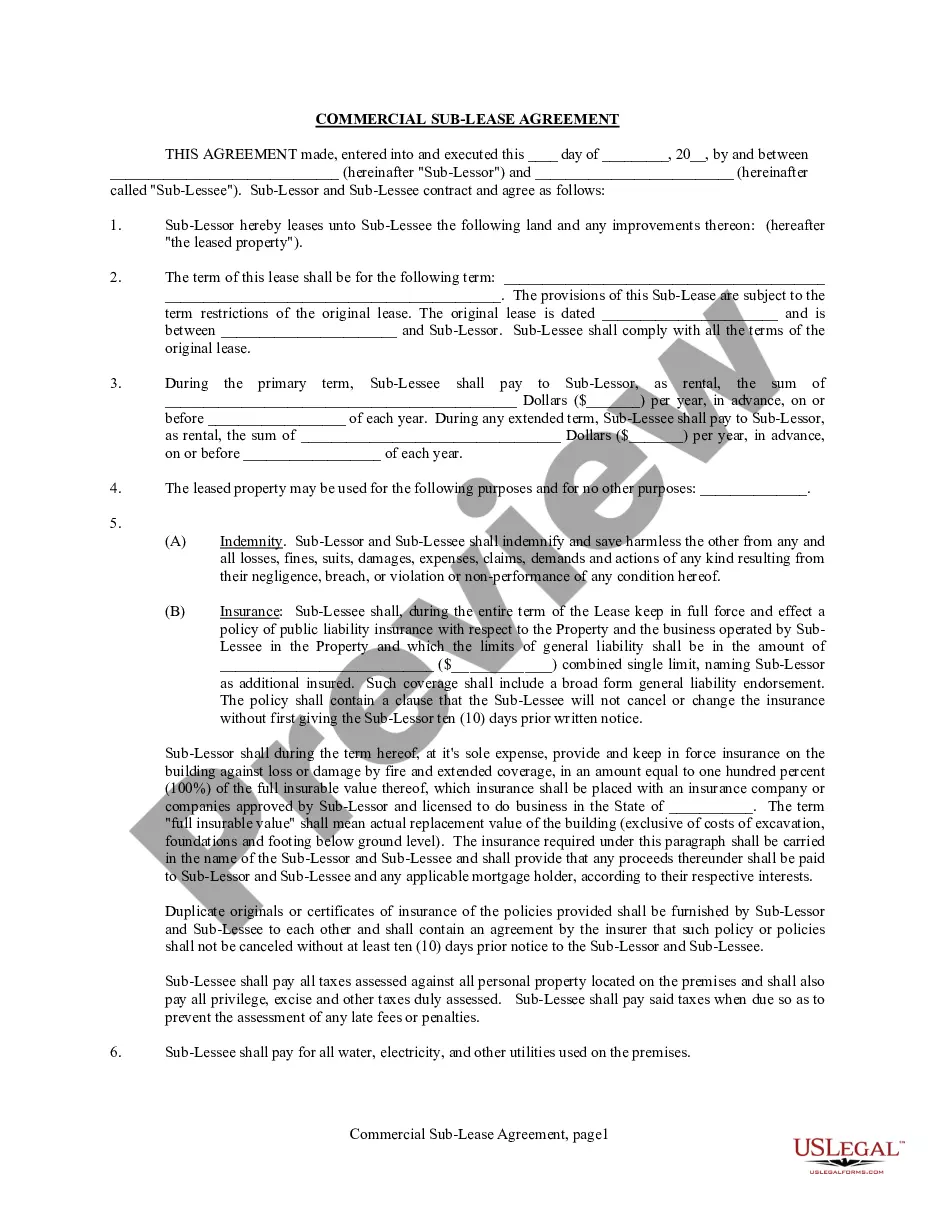

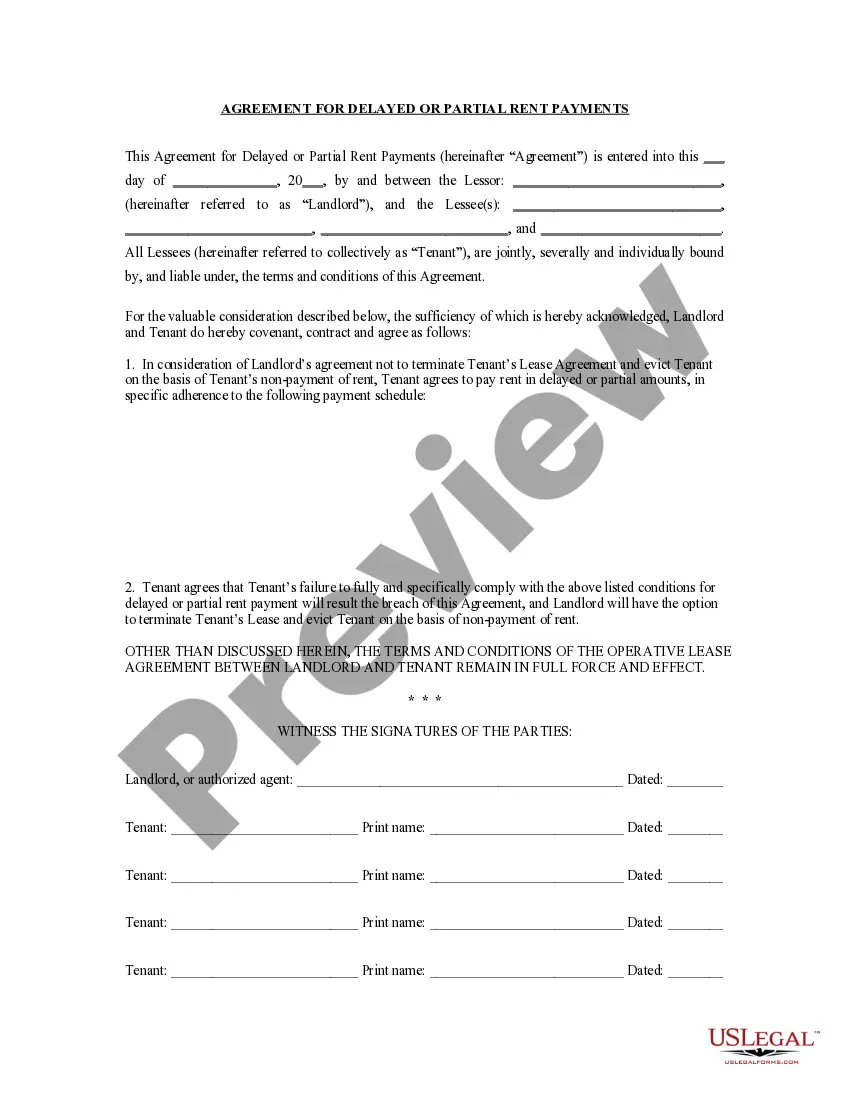

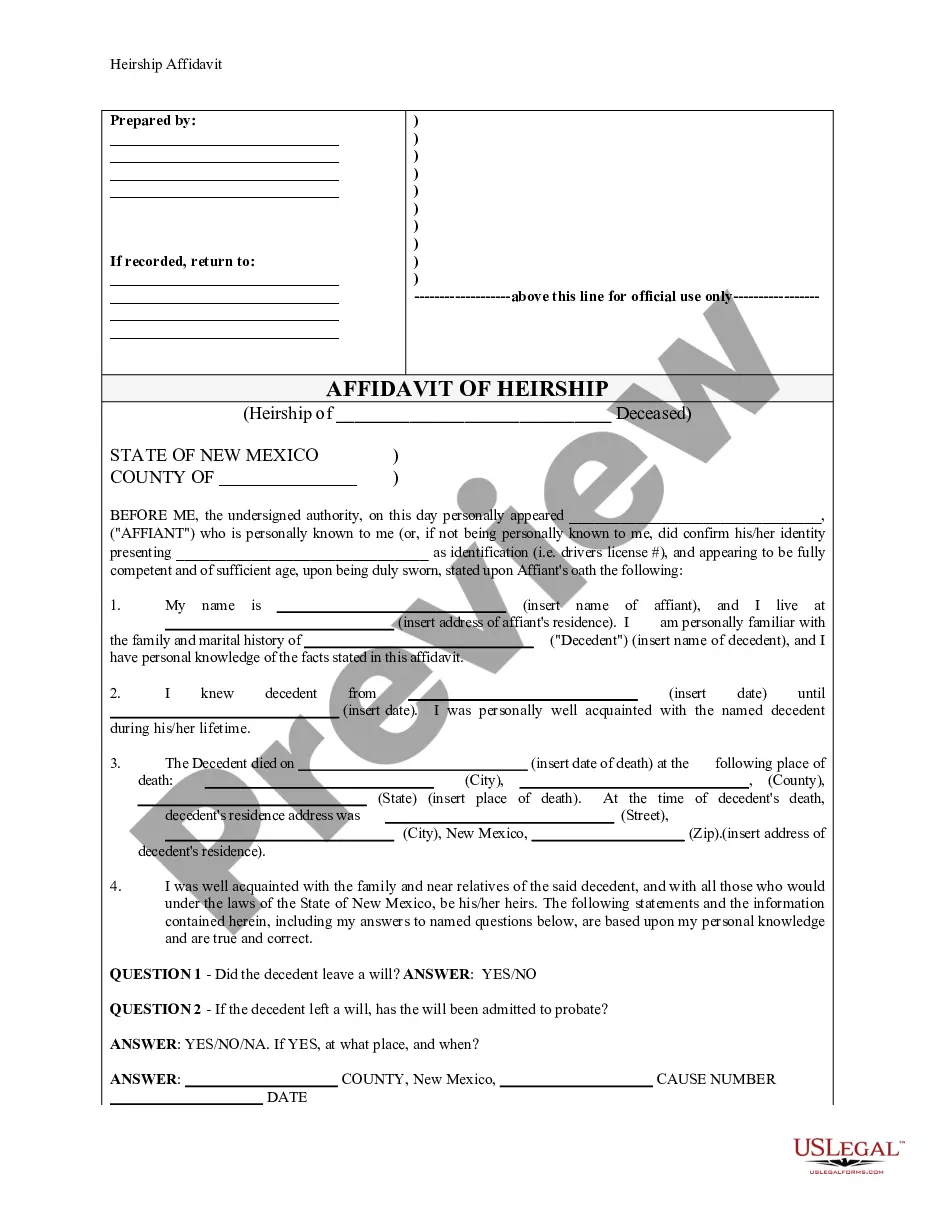

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer ownership of property to their child while retaining a life estate. This means that the parents can continue to live on and use the property for the rest of their lives, even though the child is the new owner. This form is particularly useful for estate planning, helping to avoid probate and ensure property is passed directly to heirs without complications.

Key parts of this document

- Identification of the grantor(s) and grantee(s).

- Description of the property being transferred.

- Details regarding the reservation of the life estate for the parents.

- Provisions related to easements and mineral rights, if applicable.

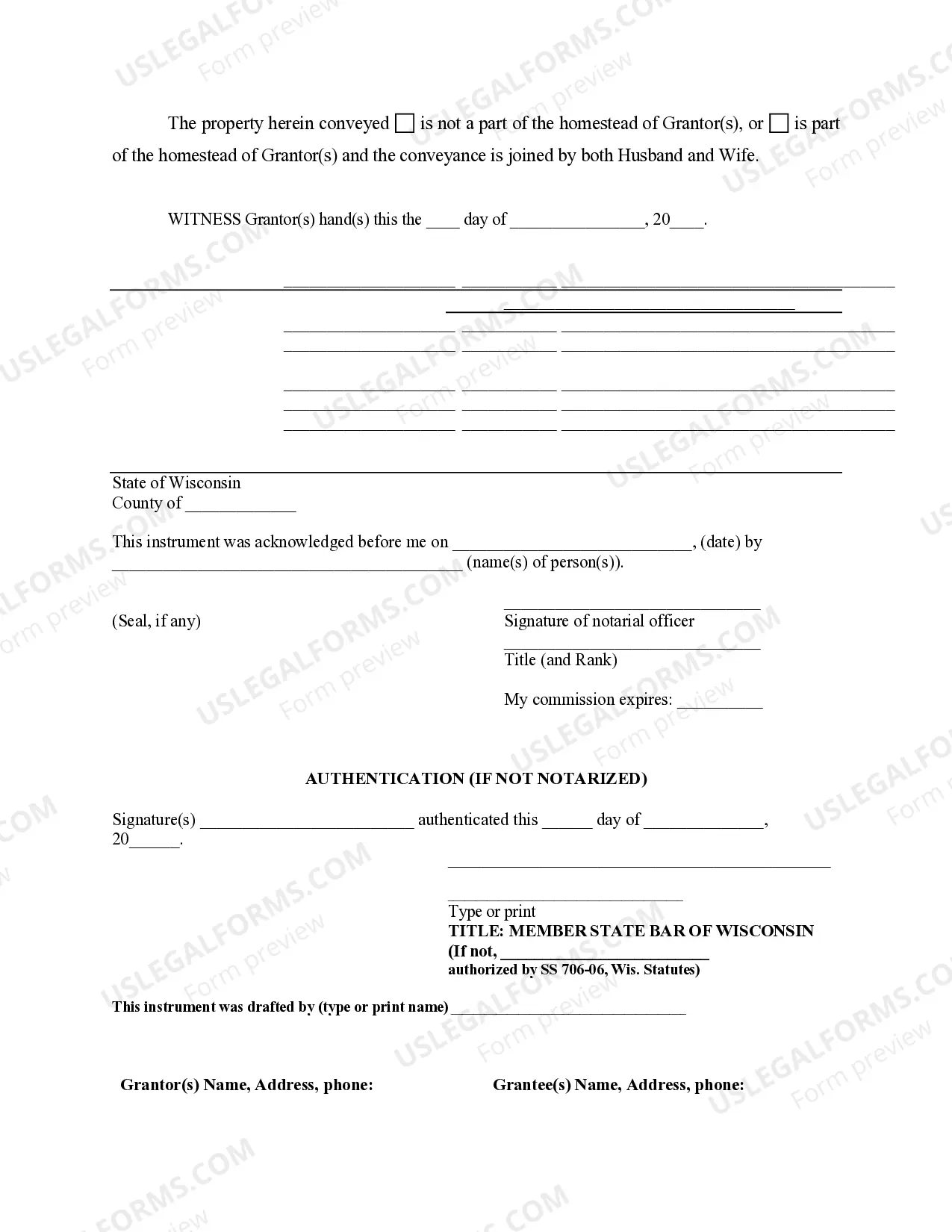

- Signature and acknowledgment sections for notarization.

When this form is needed

This form is ideal for parents who wish to convey property to their child while retaining the right to use and benefit from that property during their lifetime. It can be used in situations where parents want to ensure that their property remains within the family, facilitating a smooth transition of ownership upon their passing.

Who needs this form

This form is suitable for:

- Parents who own real estate and wish to transfer it to their child.

- Individuals interested in estate planning strategies that involve maintaining control over property during their lifetime.

- Families looking to simplify property ownership transfer upon death, avoiding probate complications.

Steps to complete this form

- Identify the parties involved by entering the names of the grantor(s) and grantee(s).

- Clearly describe the property being conveyed, ensuring all legal descriptions are accurate.

- Specify the reservation of the life estate, indicating the rights retained by the parents.

- Observe local laws regarding notarization and ensure both grantors sign the document.

- Complete any additional requirements such as including information about easements or mineral rights, if applicable.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include a clear description of the property being transferred.

- Not specifying the terms of the life estate properly.

- Omitting signatures or not having the form notarized as required.

Benefits of completing this form online

- Convenience of completing the form from home at your own pace.

- Editability allows for corrections and improvements before finalizing.

- Reliable access to professionally drafted legal forms.

Looking for another form?

Form popularity

FAQ

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.