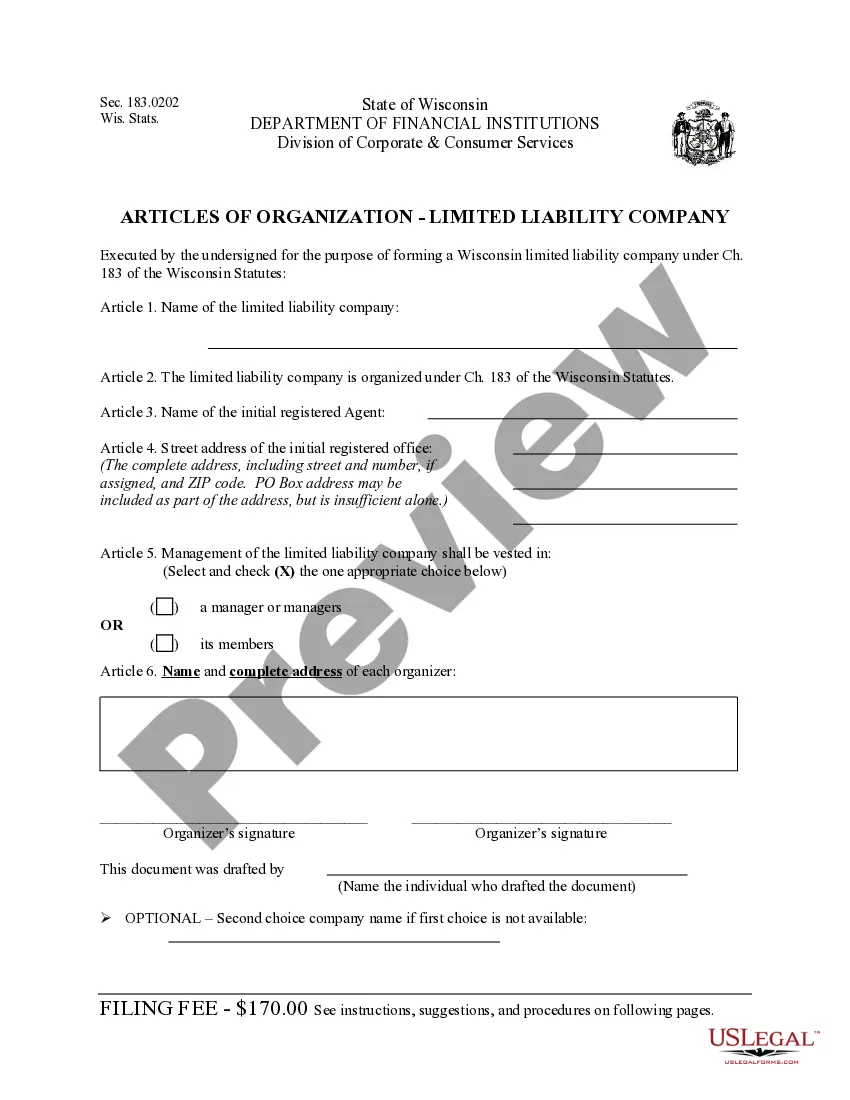

This Professional Limited Liability Company - PLLC Formation Package state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new Professional Limited Liability Company. The form contains basic information concerning the PLLC, normally including the PLLC's name, purpose and duration of the PLLC, the registered address, registered agent, and related information.

Wisconsin Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Wisconsin Professional Limited Liability Company PLLC Formation Package?

Out of the great number of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms prior to buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All of the documents available on the service have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, look for the form, press Download and obtain access to your Form name in the My Forms; the My Forms tab holds all your downloaded forms.

Stick to the guidelines below to get the form:

- Once you find a Form name, make certain it’s the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Look for a new template using the Search engine if the one you have already found is not appropriate.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

Once you have downloaded your Form name, you may edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service offers fast and easy access to samples that fit both legal professionals and their customers.

Form popularity

FAQ

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. Expedited Processing will reduce that time to about 10 business days or less with the exception of just a few states.

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

How much does it cost to form an LLC in Wisconsin? The Wisconsin Department of Financial Institutions charges a $170 fee to file the Articles of Organization by mail and $130 to file online.

STEP 1: Name your Wisconsin LLC. STEP 2: Choose a Registered Agent in Wisconsin. STEP 3: File the Wisconsin LLC Articles of Organization. STEP 4: Create a Wisconsin LLC Operating Agreement. STEP 5: Get a Wisconsin LLC EIN.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.