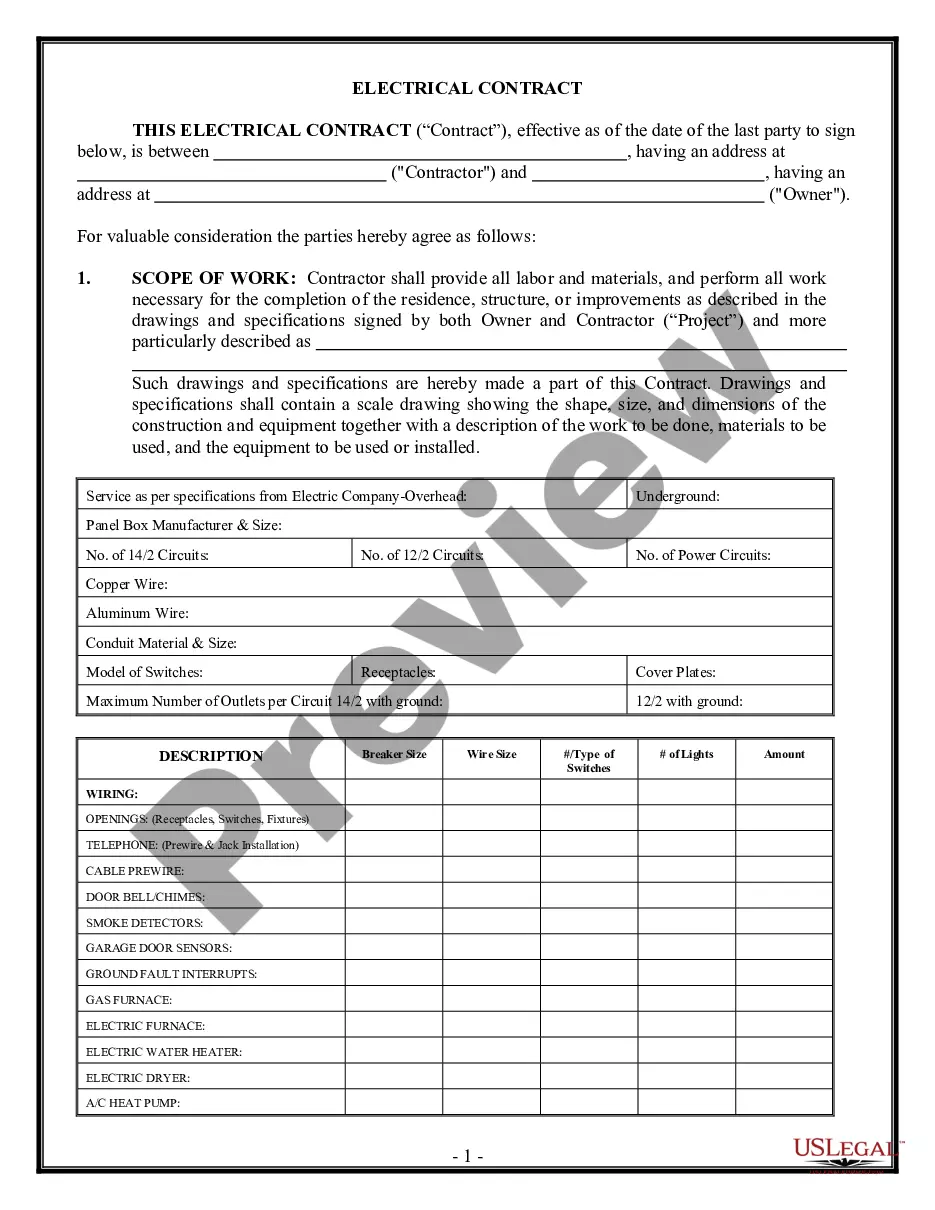

This form is designed for use between Commercial Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Washington.

Washington Commercial Contract for Contractor

Description

How to fill out Washington Commercial Contract For Contractor?

Searching for a Washington Commercial Contract for Contractor on the internet might be stressful. All too often, you find papers that you believe are alright to use, but find out afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys in accordance with state requirements. Get any form you are looking for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be included to the My Forms section. In case you do not have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step instructions listed below to download Washington Commercial Contract for Contractor from the website:

- Read the form description and click Preview (if available) to check whether the template suits your expectations or not.

- In case the document is not what you need, find others with the help of Search field or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, customers will also be supported with step-by-step instructions concerning how to find, download, and fill out templates.

Form popularity

FAQ

You need a license if you meet one or more of the following criteria: Your business requires city and state endorsements. You are doing business using a name other than your full name legal name. You plan to hire employees within the next 90 days.

Open a Business Bank Account This is a critical step that many new independent contractors miss. You must separate your personal money from your business money.Make sure that you are setting aside some money in your business bank account to help you pay quarterly taxes.

Avoid companies that require an upfront deposit of more than 10 percent. Try to include language in the contract that holds back a percentage of the total price, called a retainage, until you're sure the work was done well. A 10 percent retainage is common for residential remodeling work.

Can I give out Form 1099Misc as an individual and not as a registered business to someone who did freelance work for me this year.As a private person, you are not required to issue a form 1099-MISC.

Tax Does not collect retail sales tax on road work where the road is a city, county, or federal road. Roads for the state of Washington are subject to sales tax.Tax Contractor is defined by law as the consumer and must pay sales/use tax on all materials used, applied, or installed by him.

Be sure you need a contractor's license. Register your business with the WA Secretary of State. Register with the Department of Revenue. Get an EIN Number. Get bonded. Obtain proof of insurance. Submit your application.

Business and occupation tax: Washington's business and occupation (B&O) tax is levied on the gross receipts of business operations. This means there are no deductions for labor, materials, taxes or other costs of doing business.

Independent contractors must register with the Department of Revenue unless they: Make less than $12,000 a year before expenses; Do not make retail sales; Are not required to pay or collect any taxes administered by the Department of Revenue.

The term independent contractor describes the relationship between a client and a self-employed person who provides services as an autonomous business rather than as a full-time employee.They then transfer their bottom-line Schedule C business profit to Form 1040, Schedule SE, Self-Employment Tax.