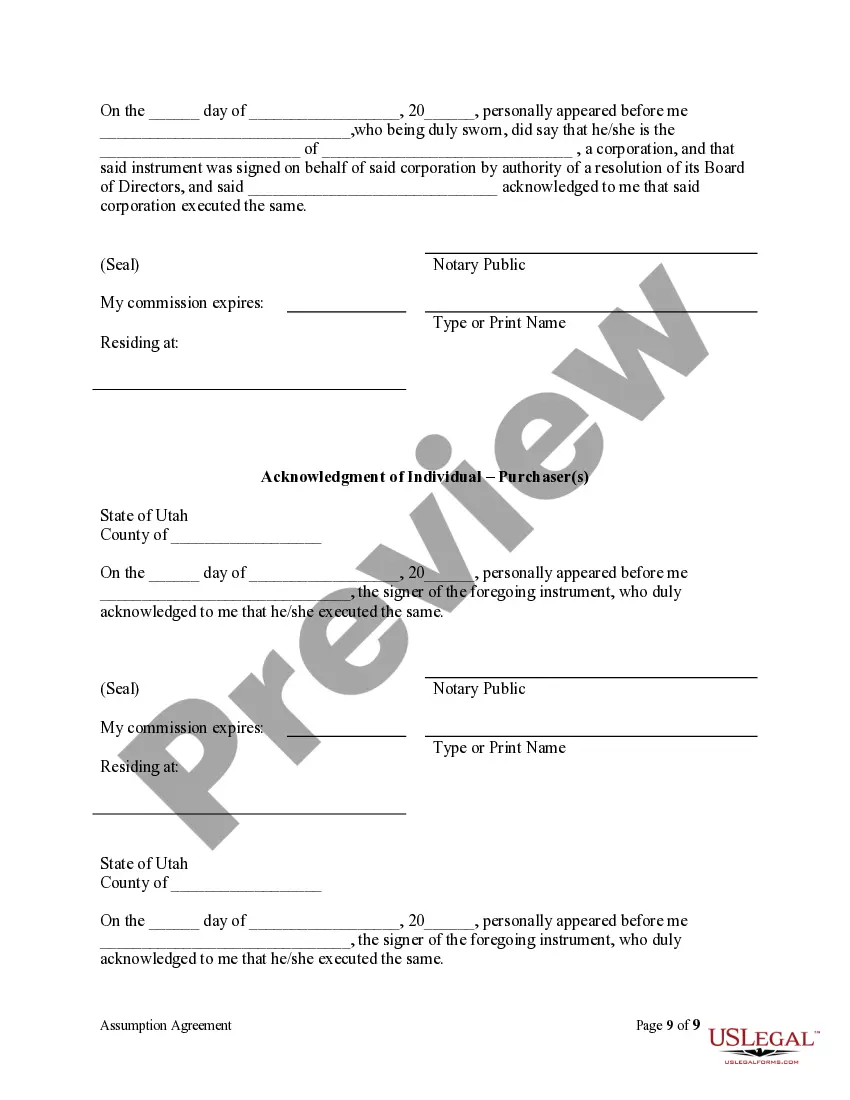

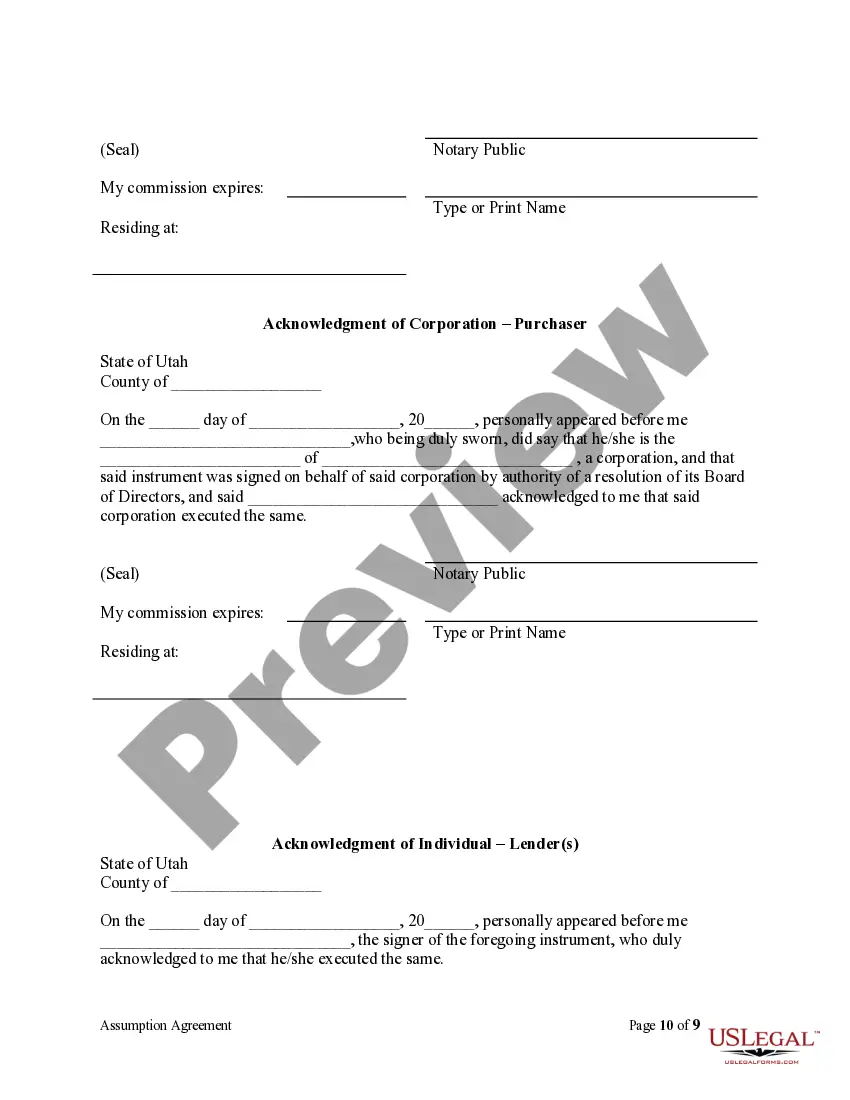

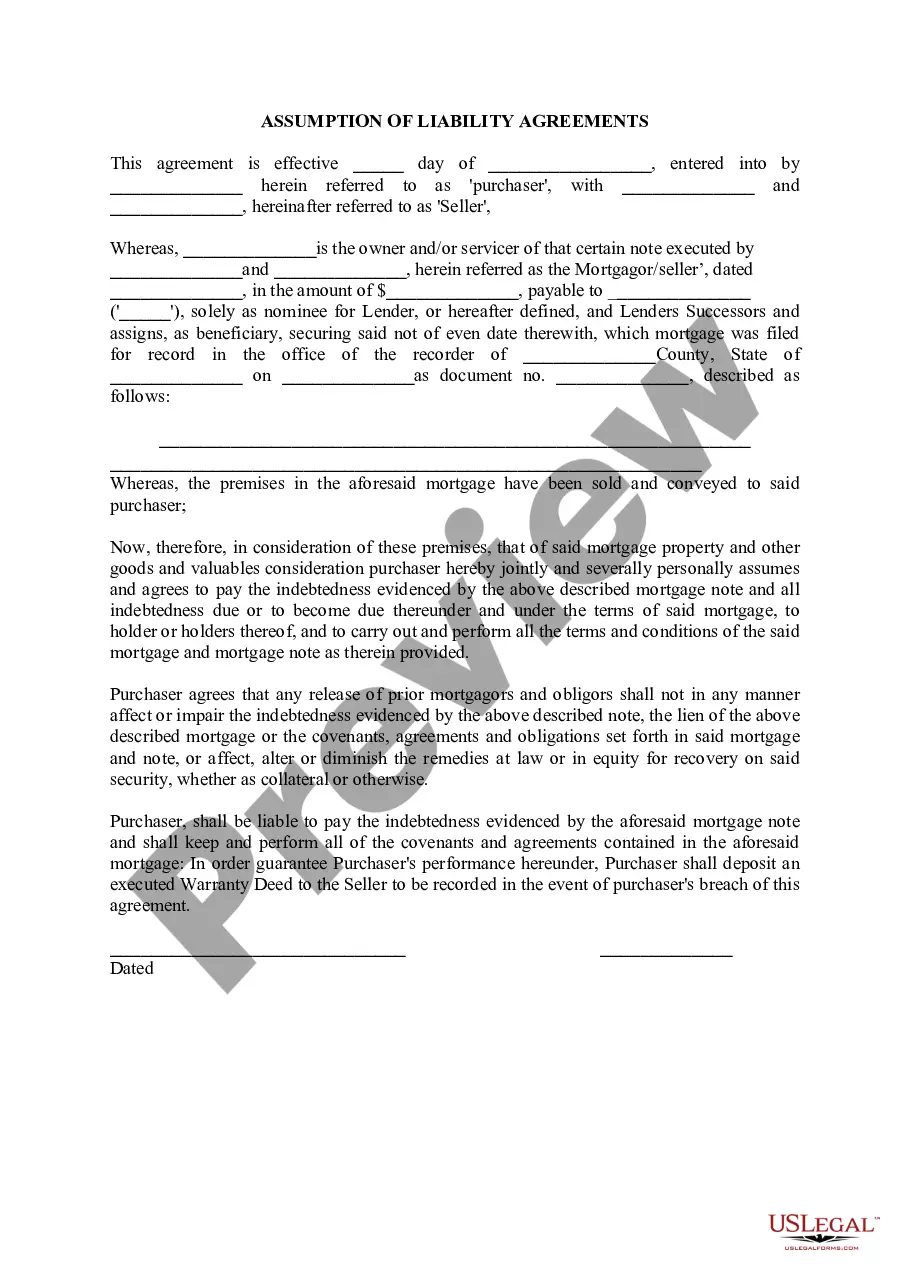

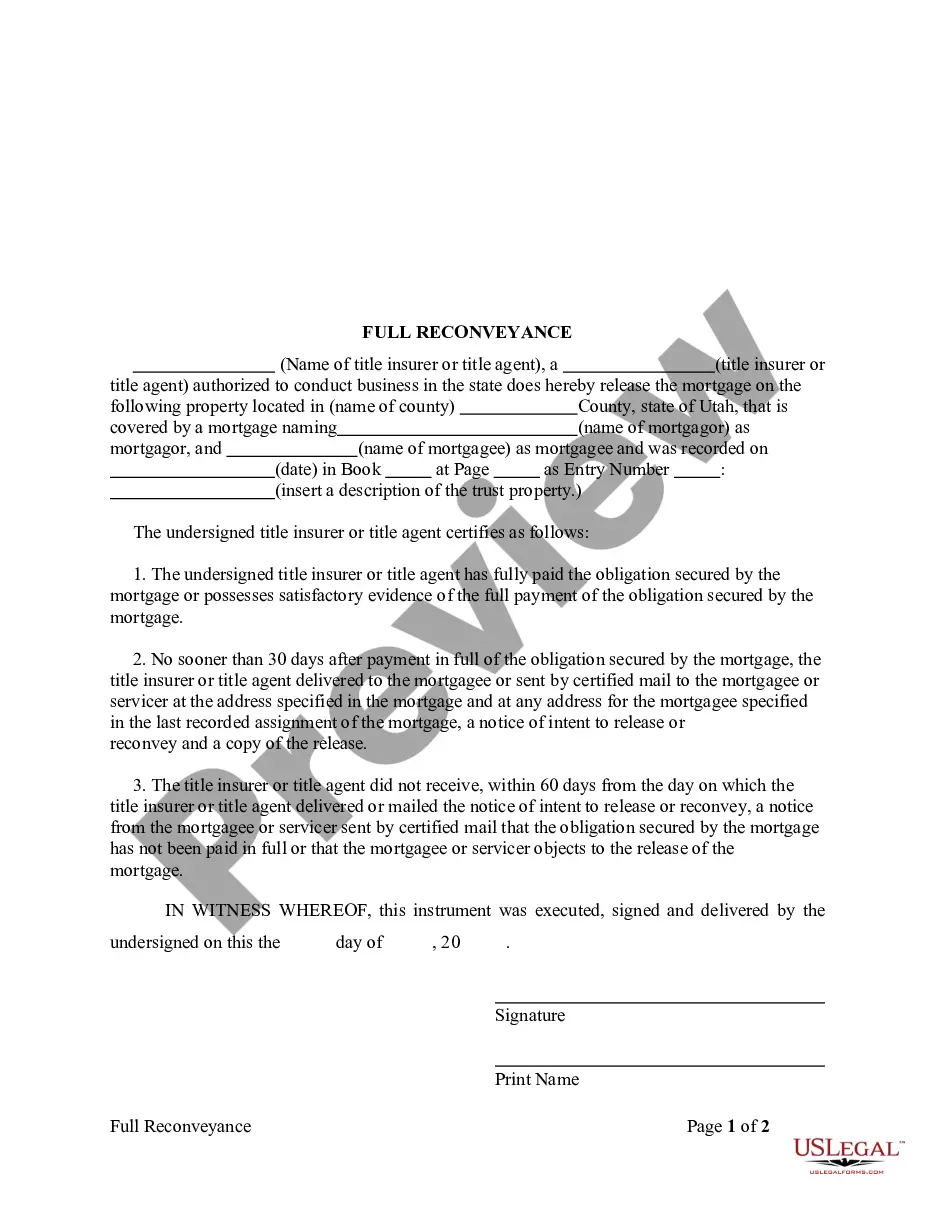

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Utah Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Utah Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Searching for a Utah Assumption Agreement of Deed of Trust and Release of Original Mortgagors online might be stressful. All too often, you find documents that you believe are alright to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be included to the My Forms section. If you do not have an account, you have to register and select a subscription plan first.

Follow the step-by-step recommendations below to download Utah Assumption Agreement of Deed of Trust and Release of Original Mortgagors from our website:

- See the document description and press Preview (if available) to check if the template meets your requirements or not.

- In case the document is not what you need, get others using the Search field or the listed recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted templates, users may also be supported with step-by-step guidelines concerning how to get, download, and fill out templates.

Form popularity

FAQ

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

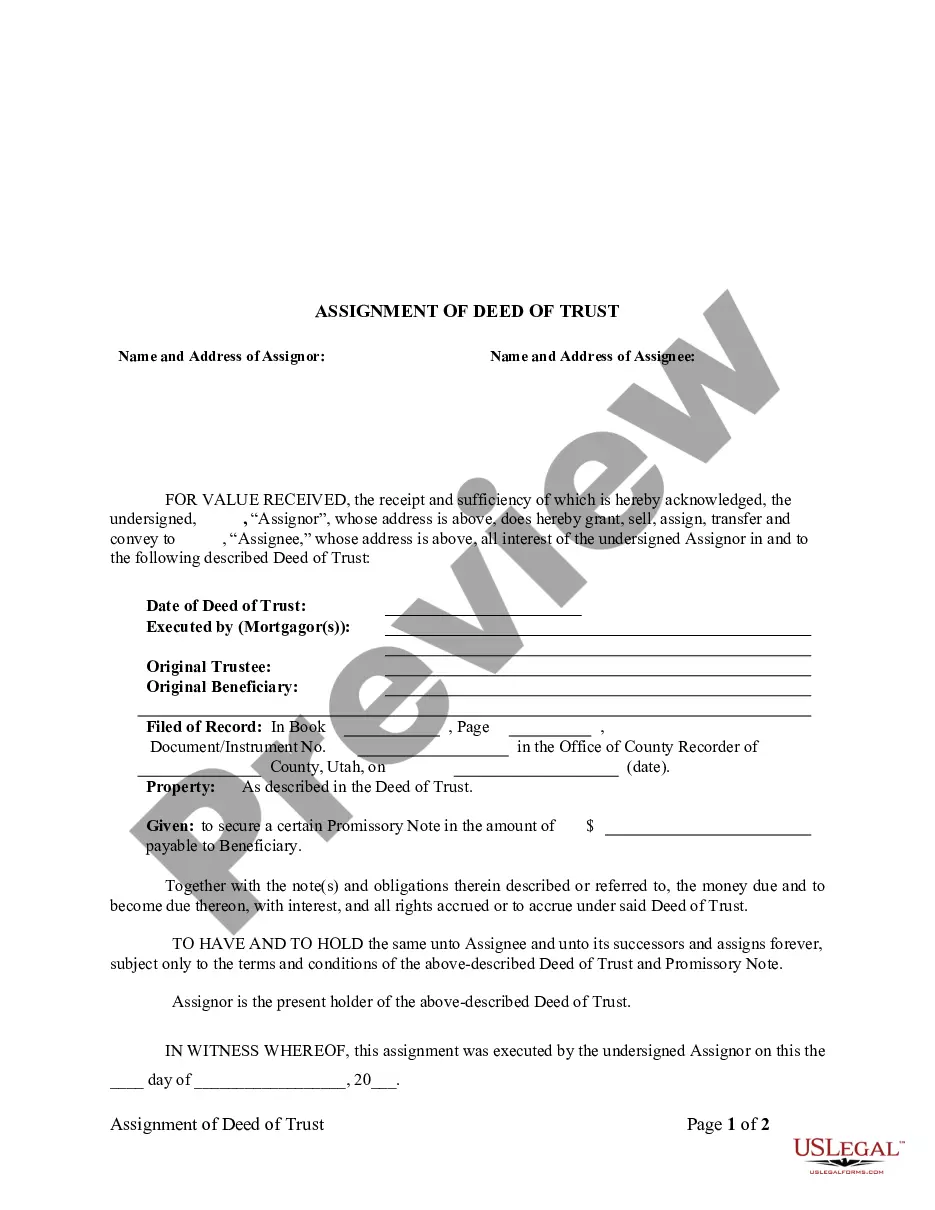

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.The trustee, however, holds the legal title to the property.

They serve different purposes and are signed by different parties. The warranty deed transfers the property's ownership from the current owner to the new buyer, while the deed of trust ensures the lender has interest in the property in the event a buyer defaults on the loan.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.