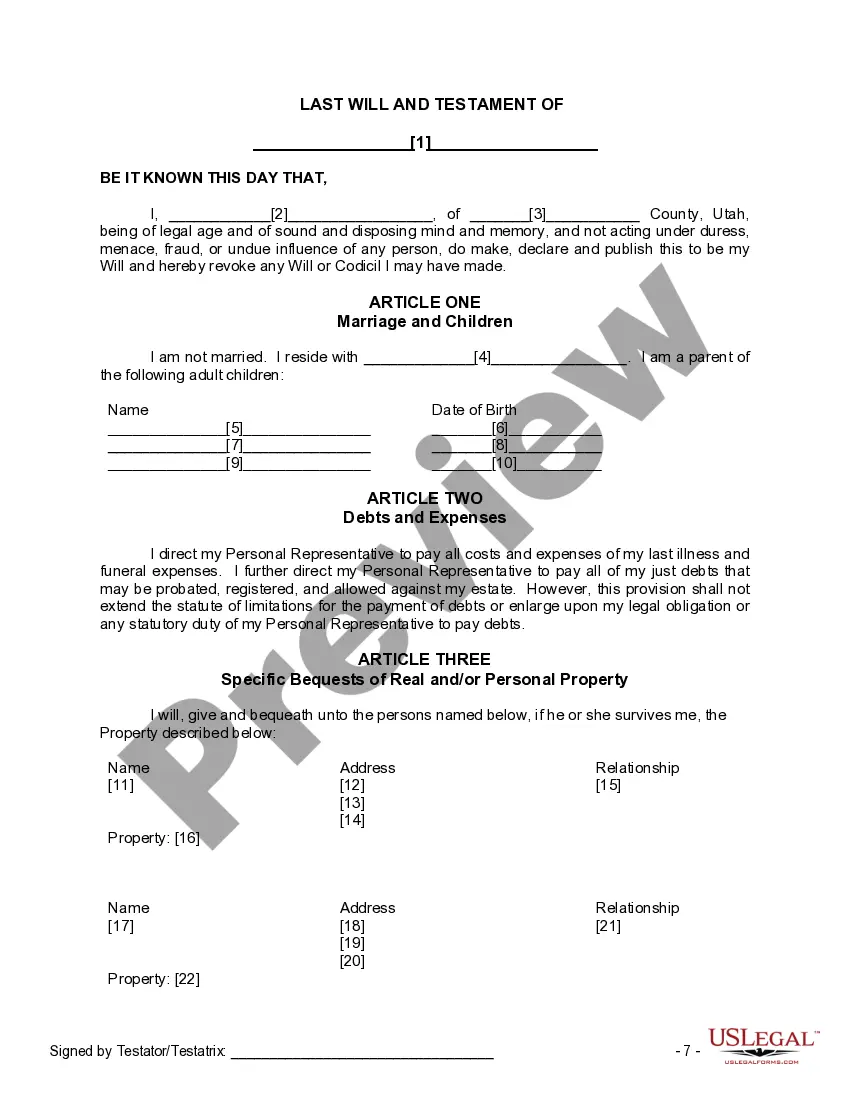

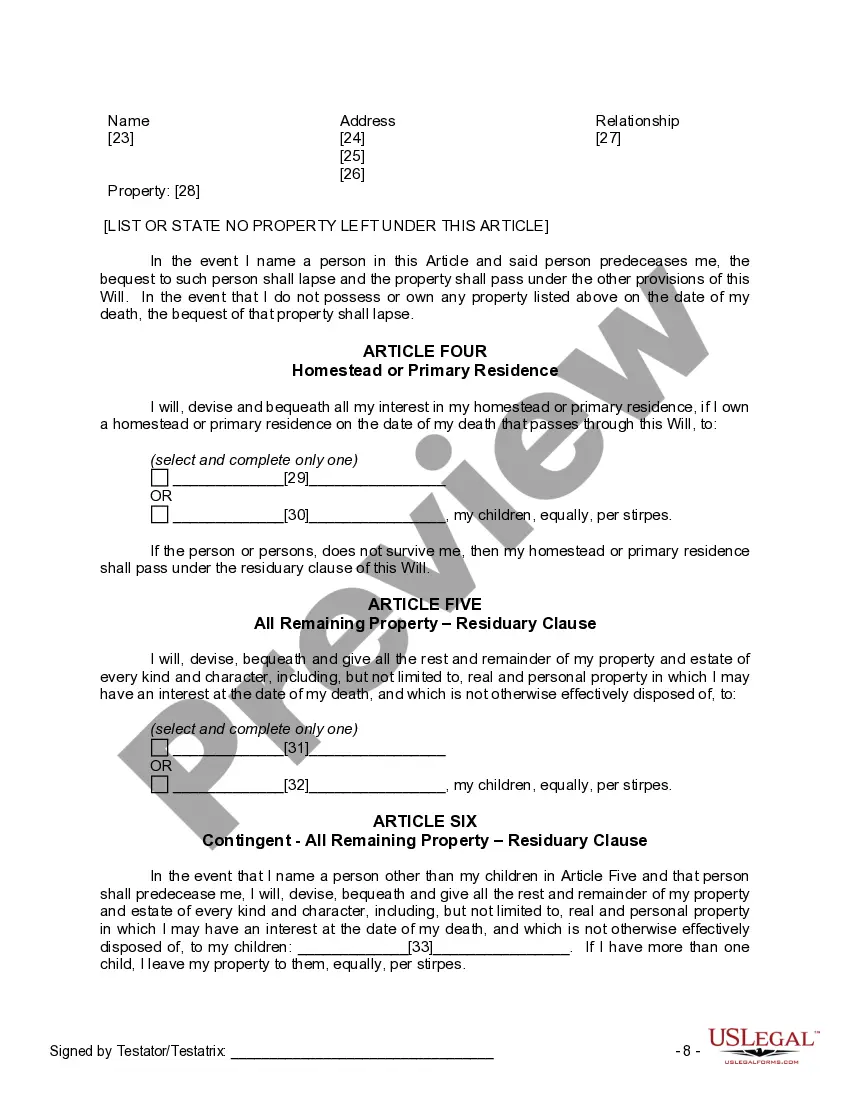

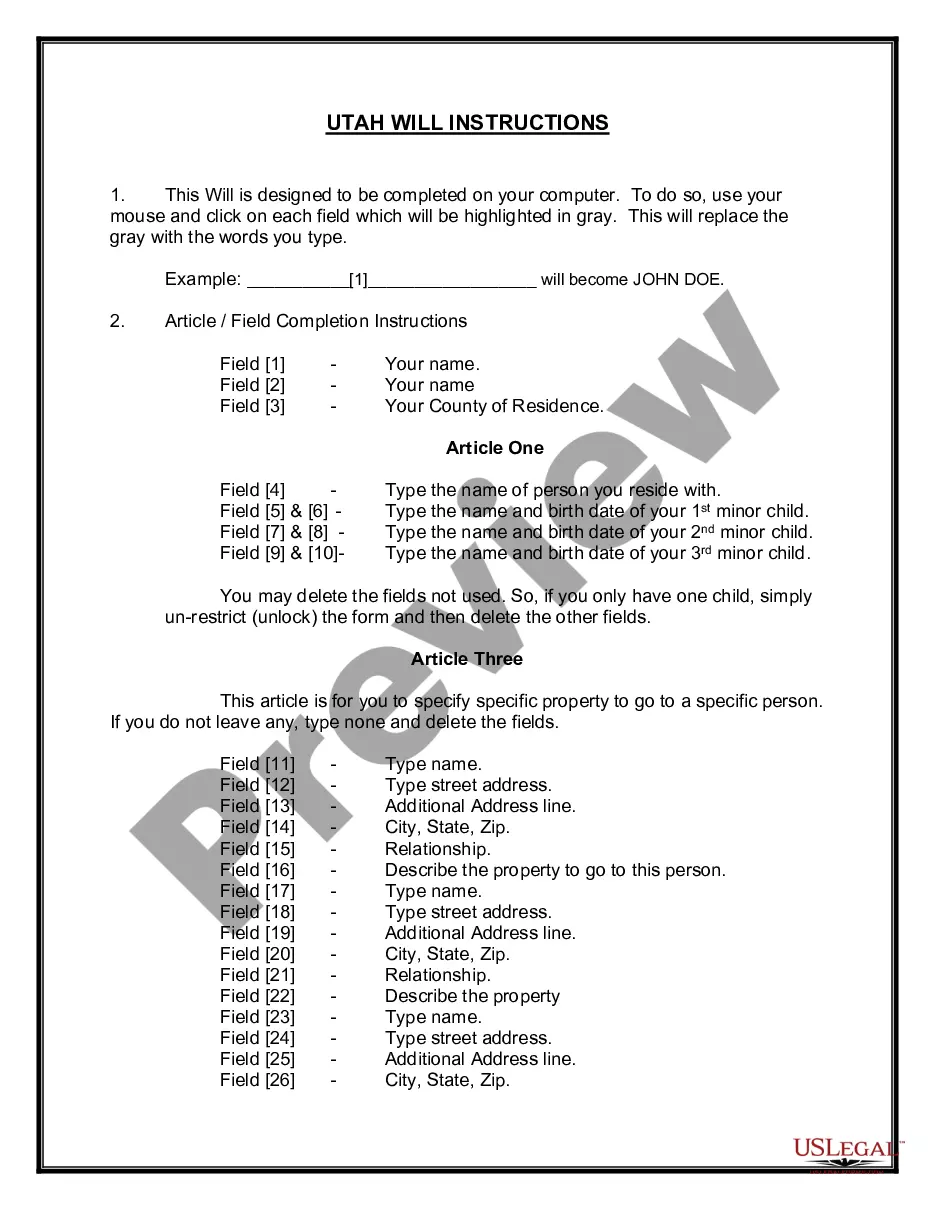

Mutual Wills Package of Last Wills and Testaments for Man and Woman living together not Married with Adult Children

In the Utah Advance Health Care Directive Act,

a declarant is a person 18 years of age or older who has completed and signed or directed the signing of an advance health care directive.

a directive is a written document voluntarily executed by or on behalf of a person.

a directive in writing is any printed or hand-written directive.

a persistent vegetative state is a state of severe mental impairment, in which only involuntary bodily functions are present and the person totally lacks higher cortical and cognitive function but maintains vegetative brain stem processes for which there exists no reasonable expectation of regaining significant cognitive function as diagnosed by two physicians, one of whom shall be the attending physician, in accordance with reasonable medical judgment.

a terminal condition is a condition caused by injury, disease, or illness, which regardless of the application of life sustaining procedures, would within reasonable medical judgment produce death, and where the application of life sustaining procedures serve only to postpone the moment of death of the person.

The Directive (75-2a-104)

An individual 18 years of age or older may execute a directive. The directive is binding upon attending physicians and all other providers of medical services.The directive shall be: in writing; signed by the declarant or by another person in the declarant's presence and by the declarant's expressed direction; dated; and signed in the presence of two or more witnesses 18 years of age or older. Neither of the witnesses may be: the person who signed the directive on behalf of the declarant; related to the declarant by blood or marriage; entitled to any portion of the estate of the declarant according to the laws of intestate succession of this state or under any will or codicil of the declarant; directly financially responsible for the declarant's medical care; or any agent of any health care facility in which the declarant is a patient at the time the directive is executed. The directive must be in substantially the statutory form.

Revocation (75-2a-114)

A directive may be revoked at any time by the declarant or by the person or persons who signed a directive on behalf of a declarant by: being obliterated, burned, torn, or otherwise destroyed or defaced in any manner indicating an intention to effect revocation; a written revocation of the directive signed and dated by the declarant or by a person signing on behalf of the declarant or acting at the direction of the declarant; oral expression of an intent to revoke the directive in the presence of a witness 18 years of age or older who signs and dates a written instrument confirming that the expression of intent was made. An oral revocation not otherwise known to the attending physician becomes binding only upon receipt by the attending physician and other providers of medical service of a written revocation. There is no criminal or civil liability on the part of any person for failing to act upon a revocation made under this part unless that person has actual knowledge of the revocation.