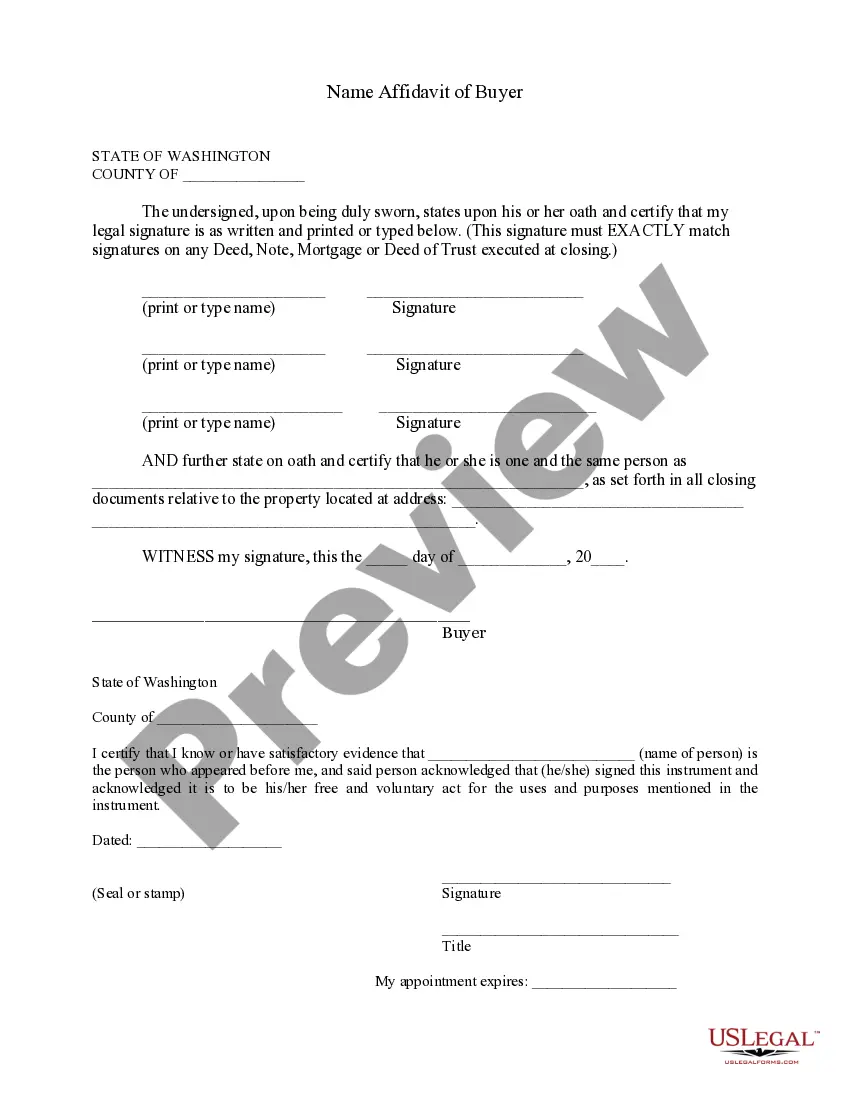

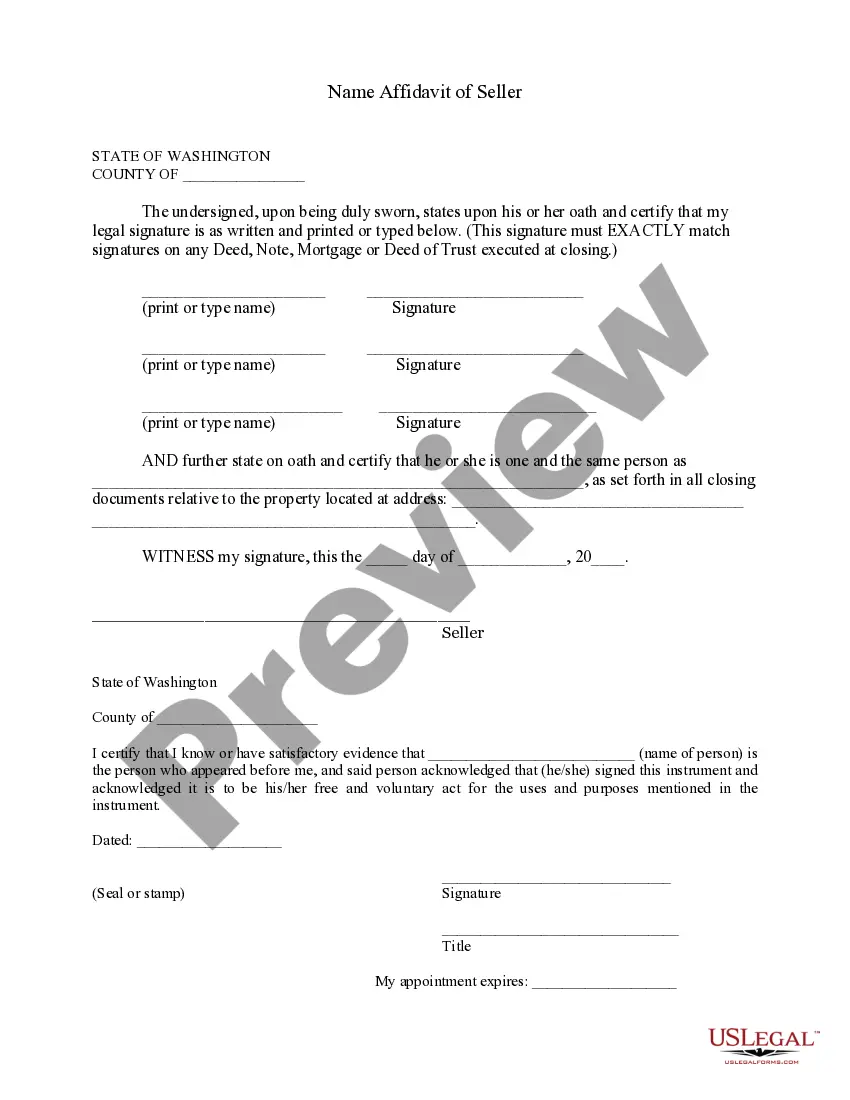

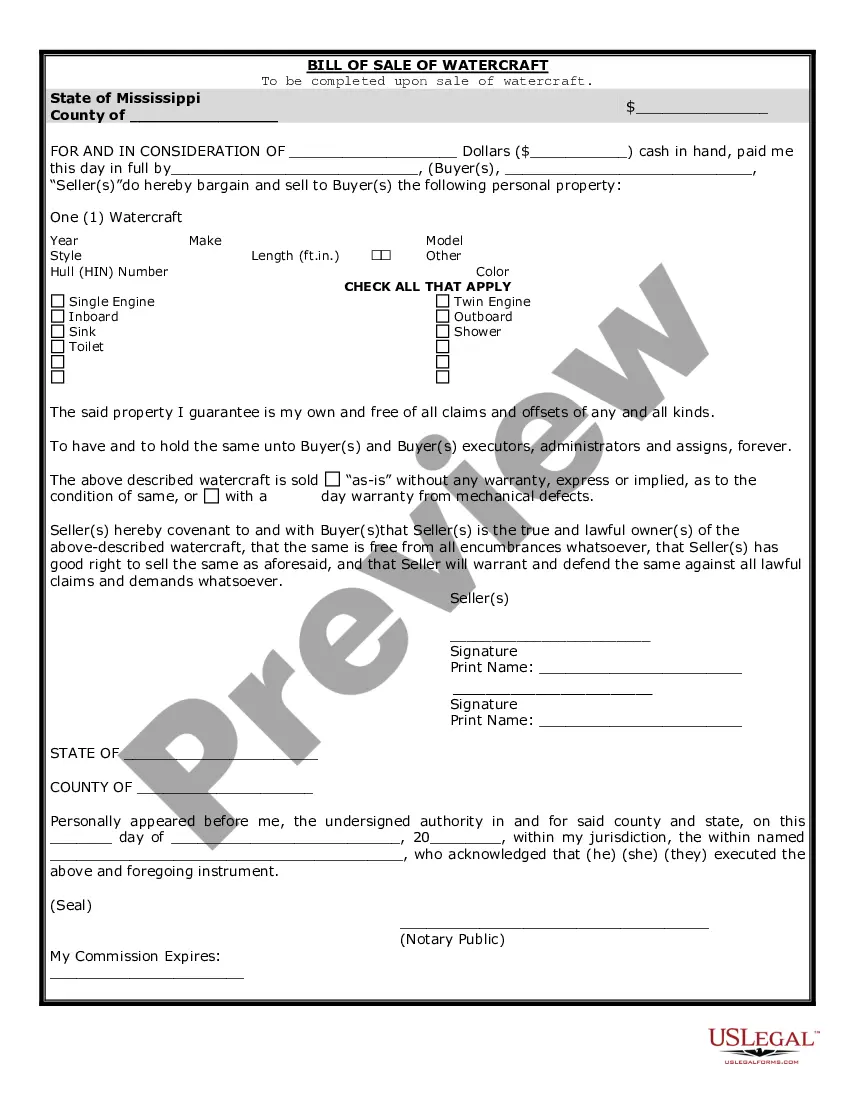

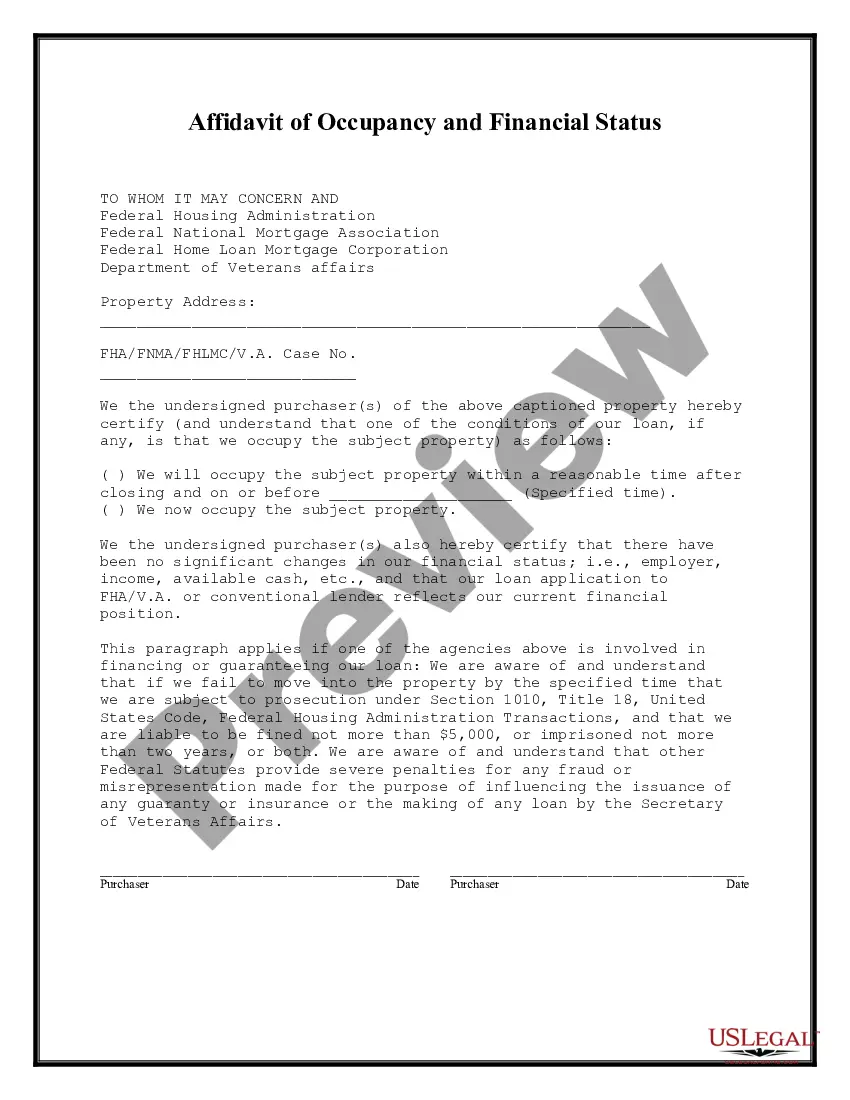

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

Washington Affidavit of Occupancy and Financial Status

Description

How to fill out Washington Affidavit Of Occupancy And Financial Status?

Out of the great number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its comprehensive library of 85,000 samples is categorized by state and use for efficiency. All of the forms available on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name in the My Forms; the My Forms tab holds your saved documents.

Follow the tips listed below to obtain the form:

- Once you find a Form name, make certain it’s the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Look for a new template through the Search field in case the one you’ve already found is not proper.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you have downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our platform offers easy and fast access to templates that suit both attorneys and their customers.

Form popularity

FAQ

Lenders will take a variety of things into account when determining whether you intend to live in a house and take occupancy type into consideration because people are much less likely to default on the mortgage of a house they are living in.

Lenders and loan officers confirm that they regularly encounter falsehoods about occupancy.Depending on the lender, buyers might be able to save a half to a full percentage point off the interest rate on the loan by calling their purchase a principal residence.

Owner-occupants are residents that own the property that they live at. Some loans are only available to owner-occupants and not absentee owners or investors. To be considered owner-occupied, residents usually must move into the home within 60 days of closing and live there for at least a year.

If you're struggling financially and having trouble paying your mortgage, you may find a field inspector knocking on your door. These inspectors verify that a home remains occupied after its owners miss a mortgage payment. If you're still living in your home, the inspector won't perform an interior search.

Lenders will take a variety of things into account when determining whether you intend to live in a house and take occupancy type into consideration because people are much less likely to default on the mortgage of a house they are living in.

Lenders usually stipulate that homeowners have 30 days after closing to occupy a primary residence. To verify the person moving in is actually the owner, the lender may call the house and ask to speak to the homeowner.The lender may also drive past the house looking for a rental sign in the yard.

Basically, the FHA does require your home to be owner-occupied if you use FHA financing. But, as you can see, there are several exceptions to the rule. Before you decide to do anything, always check with your lender.