Sample Letter for Judicial Foreclosure

Definition and meaning

A Sample Letter for Judicial Foreclosure is a formal document used by lenders or legal representatives to initiate a judicial foreclosure process on a property. This letter serves as a notification to the borrower regarding the lender's intent to foreclose due to defaulted payments. The letter typically outlines relevant details such as loan numbers, property descriptions, and the reasons for foreclosure.

How to complete a form

To complete a Sample Letter for Judicial Foreclosure, follow these steps:

- Fill in the date at the top of the letter.

- Include the recipient's name, company, and address.

- Clearly state the purpose of the letter, including relevant loan numbers and property details.

- Describe any findings from a title search, if applicable.

- Request a response from the recipient regarding how they wish to proceed.

Who should use this form

This form is primarily intended for mortgage lenders, legal representatives, and banks involved in the foreclosure process. It may also be used by individuals who are seeking legal recourse to initiate a foreclosure on property due to unpaid debts. Users must have a basic understanding of foreclosure laws to ensure compliance and proper usage.

Key components of the form

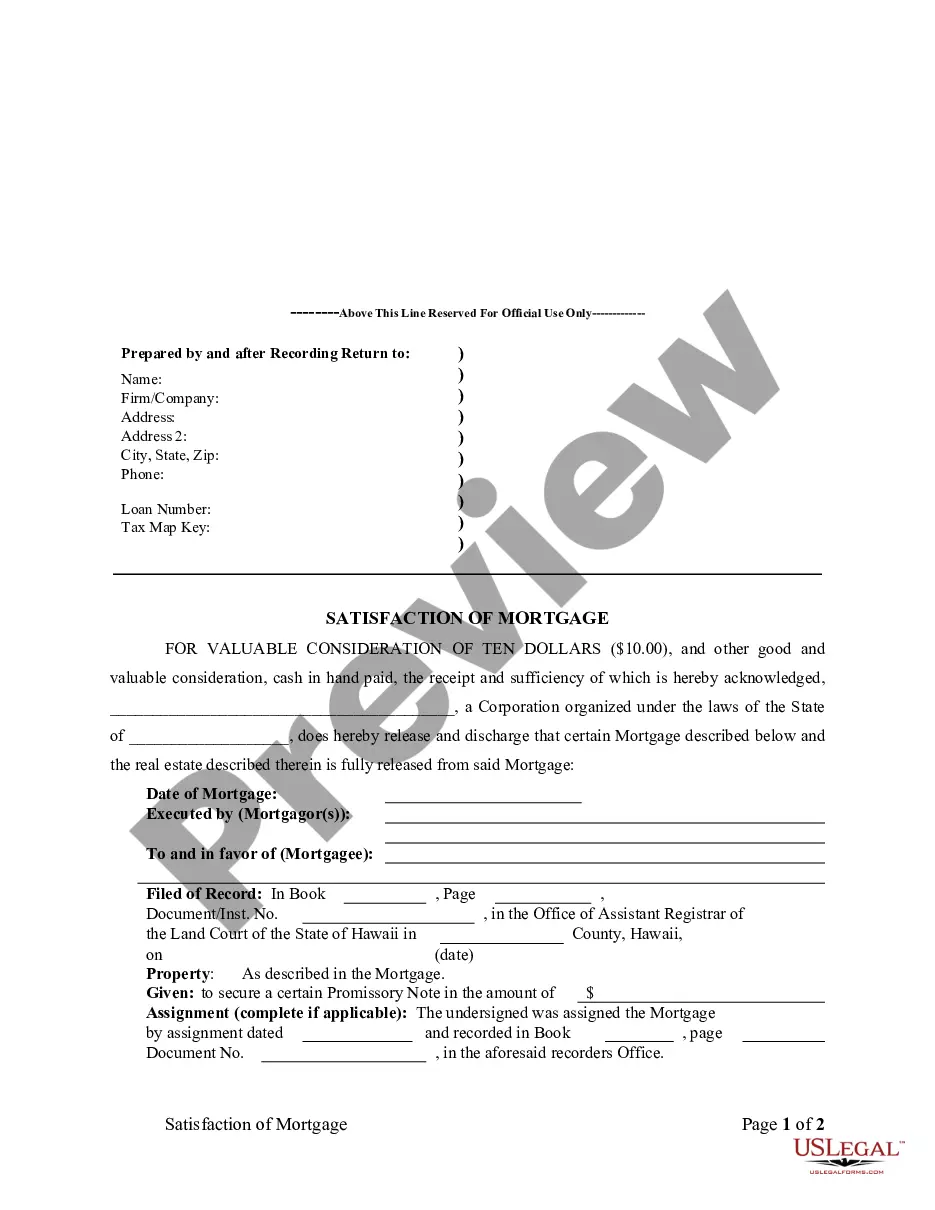

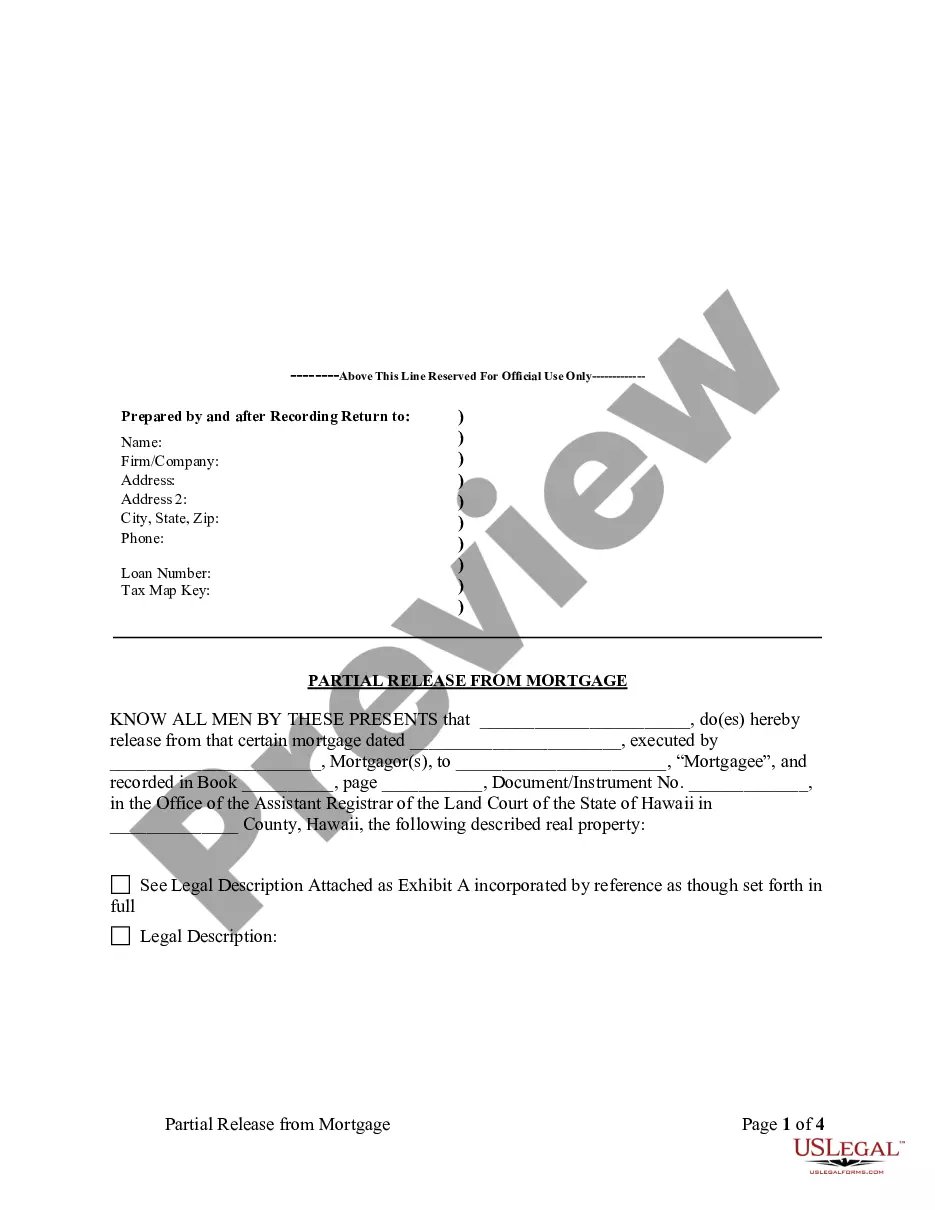

A Sample Letter for Judicial Foreclosure typically includes the following key components:

- Date of the letter

- Borrower’s name and contact information

- Lender’s name and contact details

- Loan and file numbers

- Description of the property in question

- Findings from any title search conducted

- Instructions for the borrower on how to respond

Common mistakes to avoid when using this form

When utilizing a Sample Letter for Judicial Foreclosure, avoid these common mistakes:

- Failing to include accurate property descriptions.

- Omitting necessary loan or file numbers.

- Not providing clear instructions for how the borrower should respond.

- Using overly technical language that may confuse recipients.

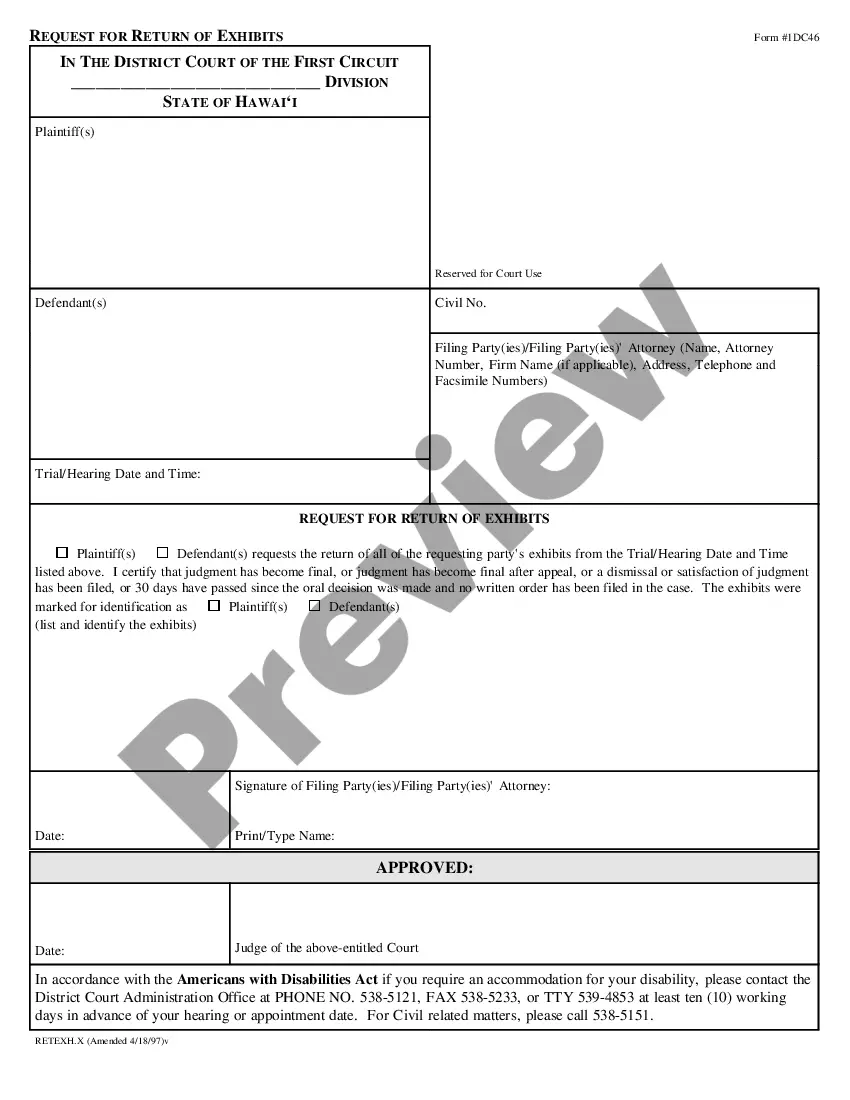

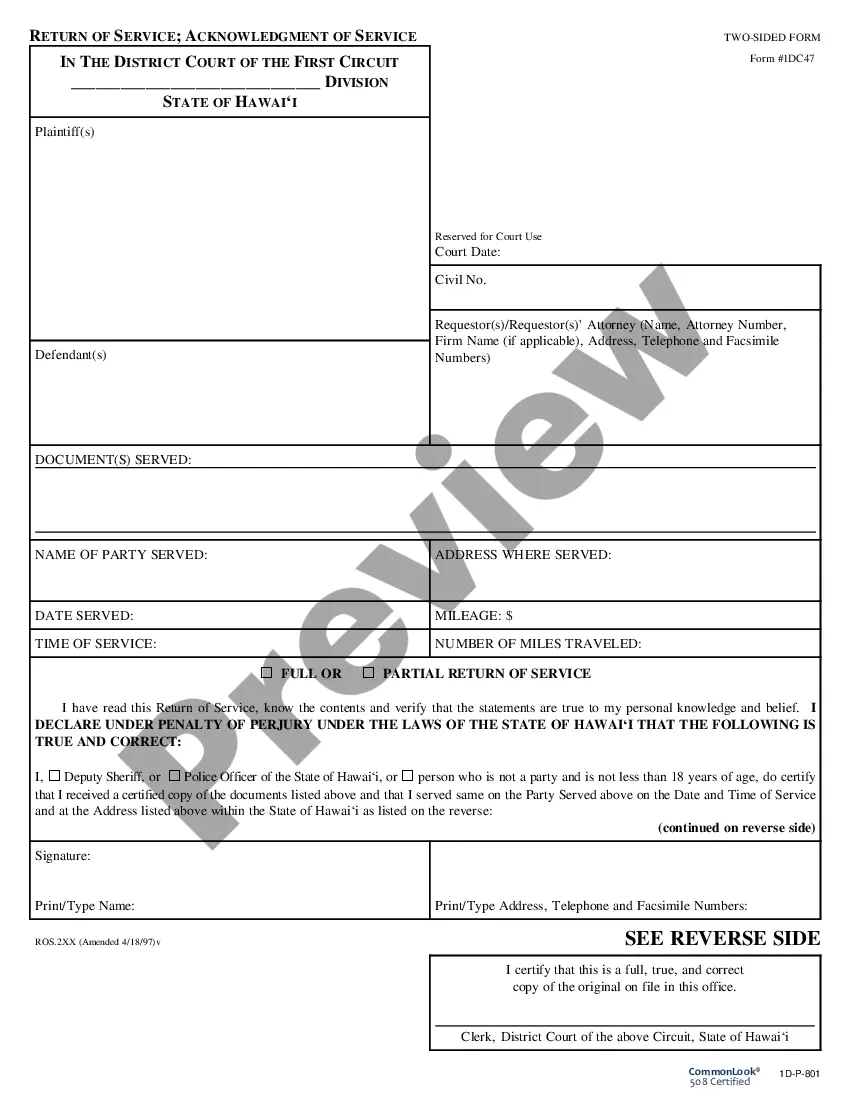

What documents you may need alongside this one

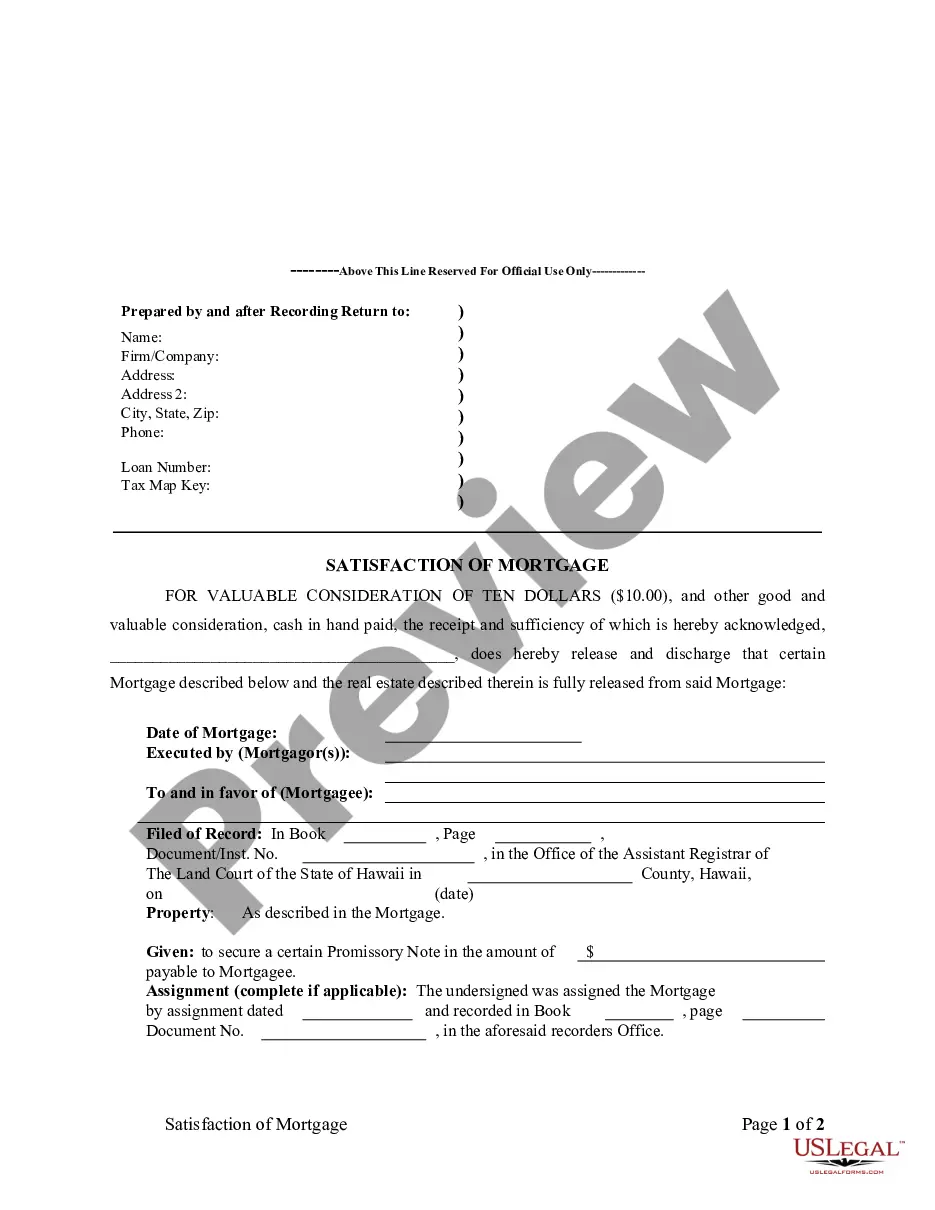

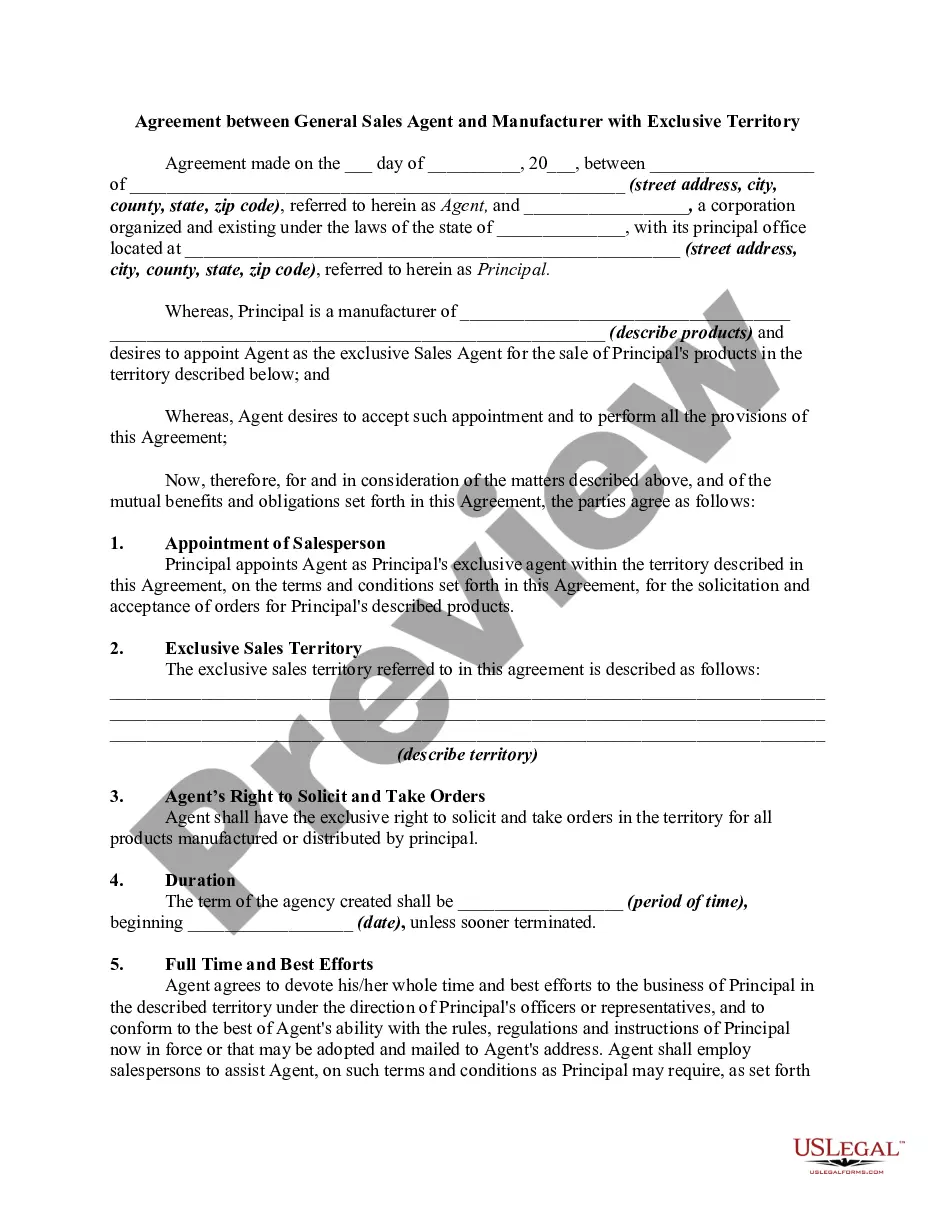

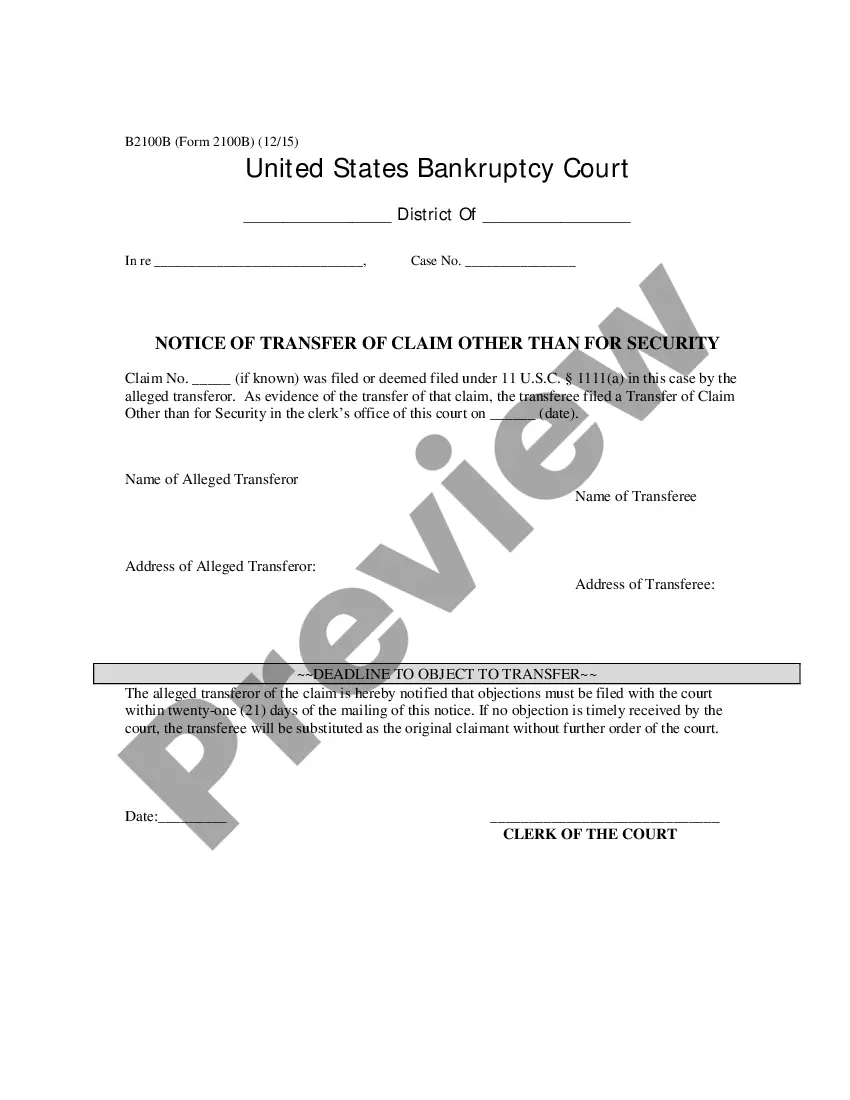

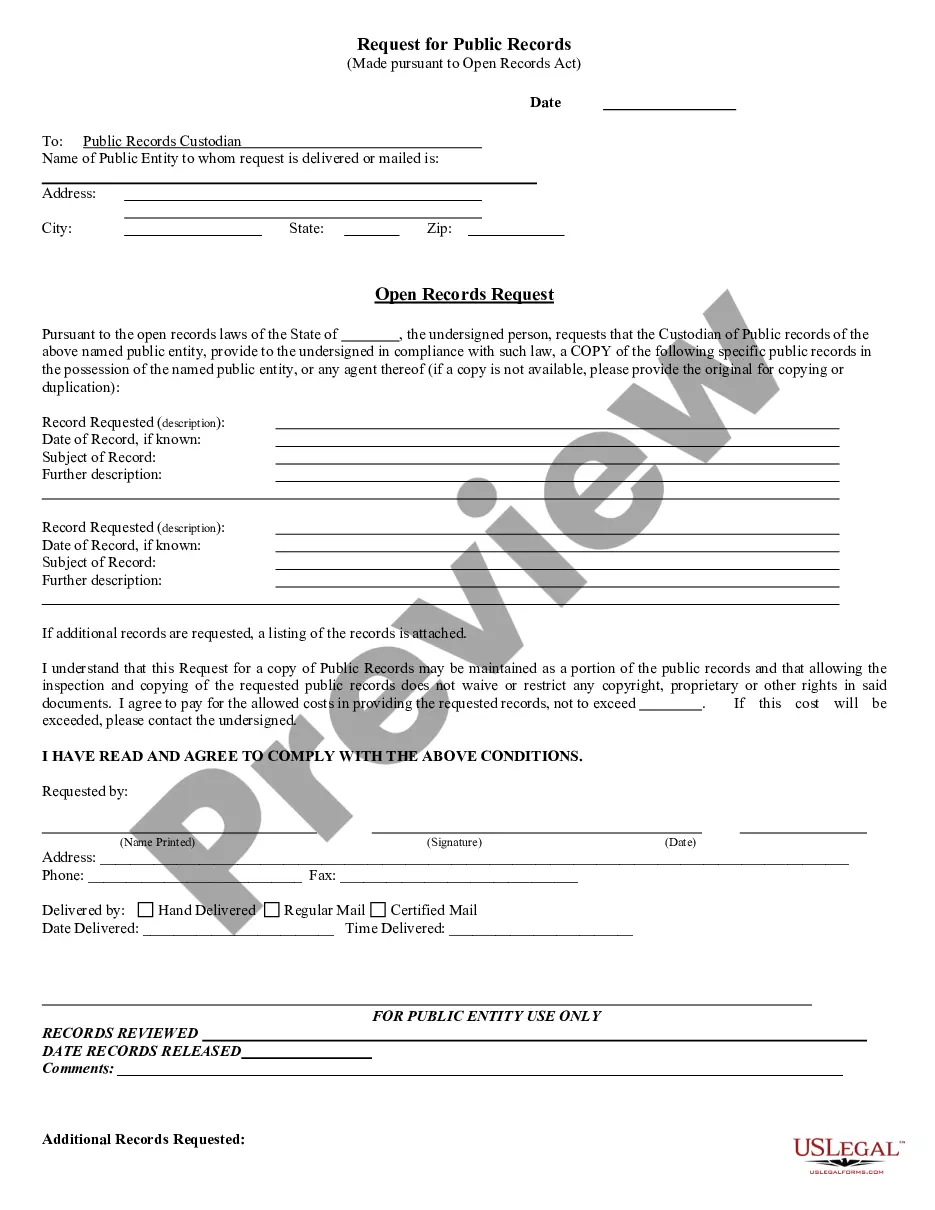

Along with a Sample Letter for Judicial Foreclosure, you may need to provide the following documents:

- Loan agreement or promissory note

- Notice of default

- Title search report

- Any previous correspondence related to the foreclosure

Form popularity

FAQ

In a non-judicial foreclosure, the lender is proceeding on the basis that the mortgage or deed of trust provides for its right of foreclosure. This means that your lawsuit will ask the judge to stop the foreclosure proceeding until they can review your argument against the foreclosure.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

You can bring your loan current and stave off the foreclosure sale filing by paying the past due amount, plus penalties.You typically have to reinstate at least five days before the lender's deadline or risk the lender rejecting your payment and proceeding with a sale.

A lender can rescind a foreclosure sale if a borrower requests to reinstate the loan agreements and then makes payment to bring the loan balance current, provided this is done more than five days before the scheduled sale date.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.