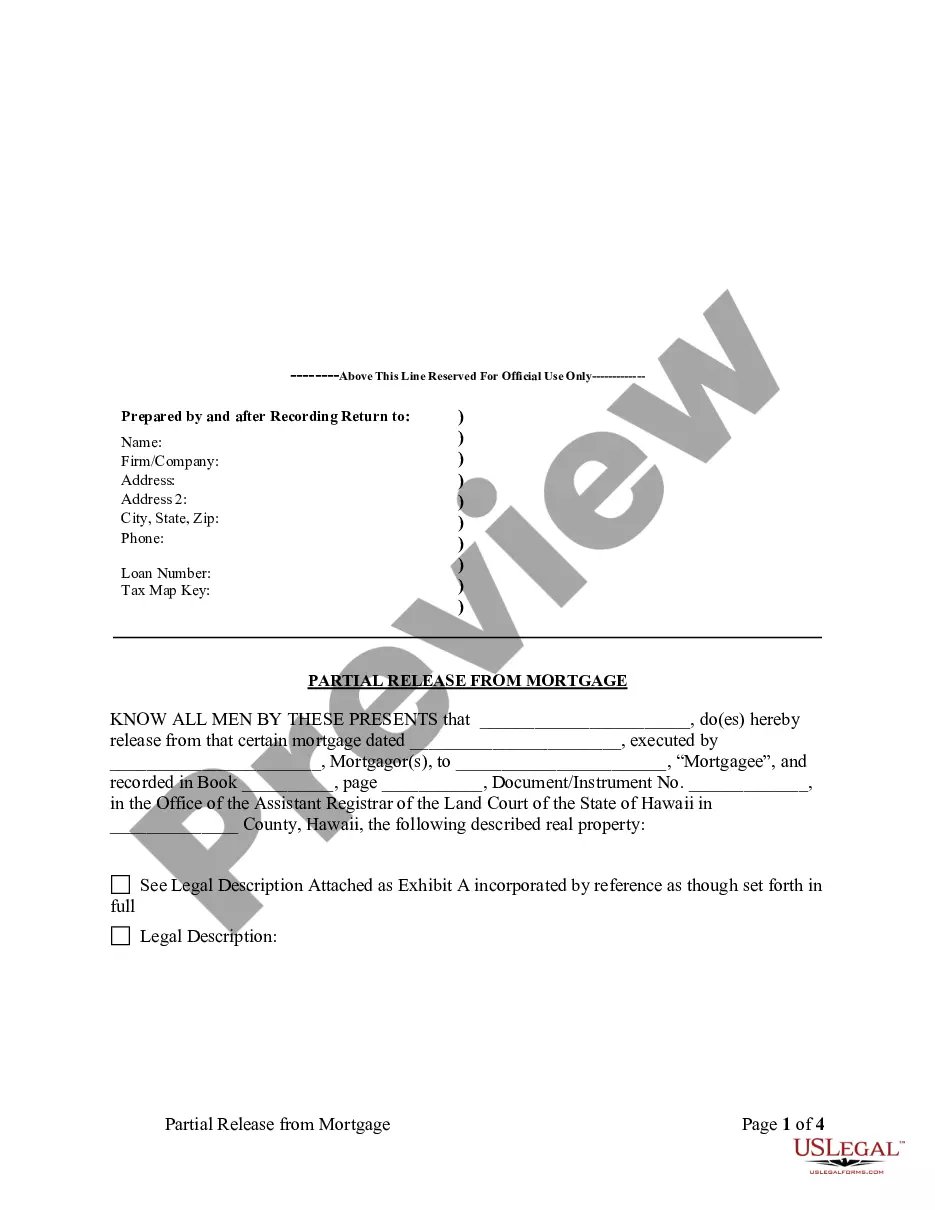

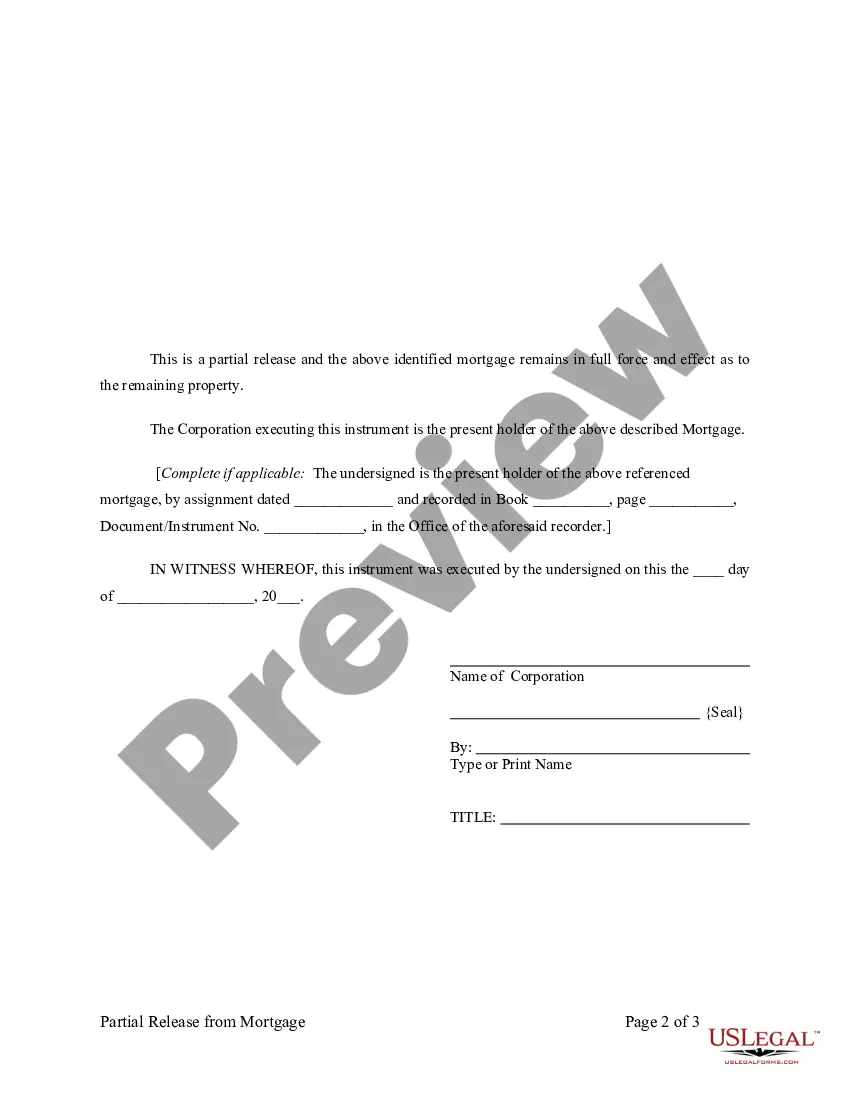

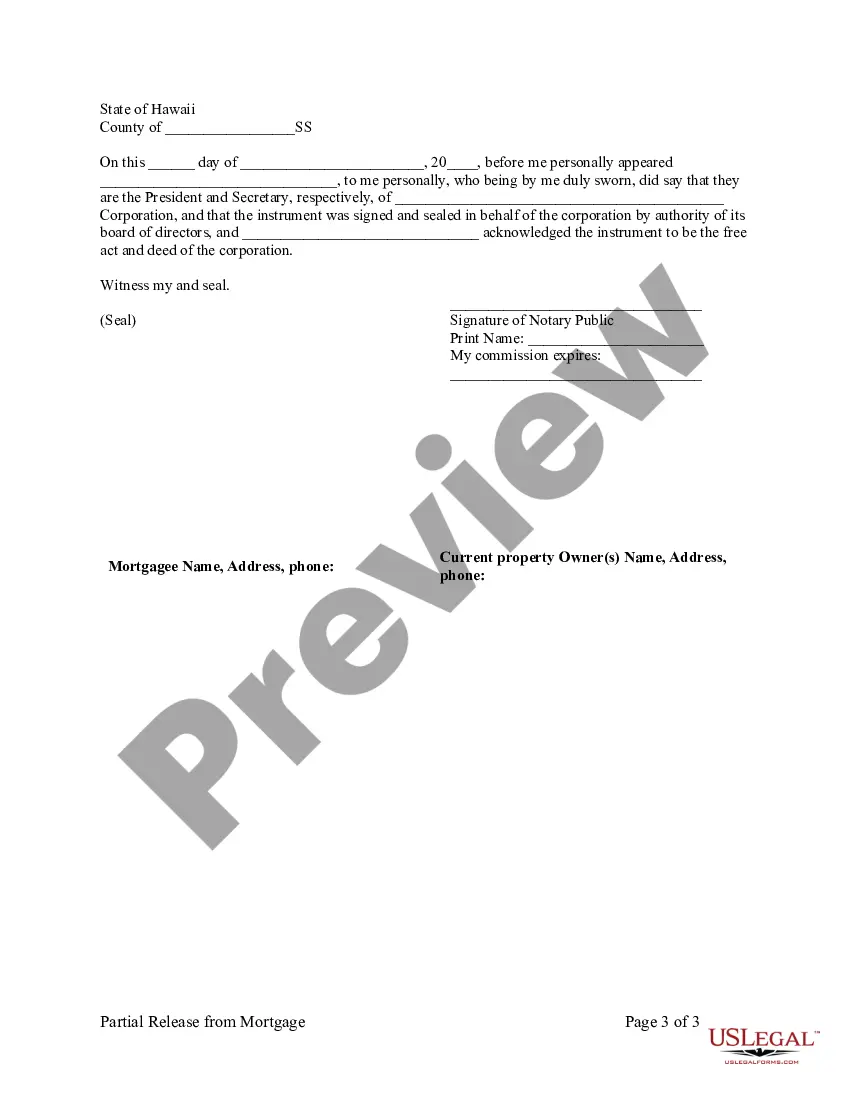

Hawaii Partial Release of Property From Mortgage for Corporation

Description

How to fill out Hawaii Partial Release Of Property From Mortgage For Corporation?

Obtain one of the most comprehensive collections of approved documents.

US Legal Forms is a platform to locate any state-specific paperwork in moments, including Hawaii Partial Release of Property From Mortgage for Corporation templates.

No need to waste your time searching for a court-acceptable template.

After choosing a payment plan, create your account. Pay using a credit card or PayPal. Download the document to your device by clicking the Download button. That's it! You need to submit the Hawaii Partial Release of Property From Mortgage for Corporation form and verify its accuracy. To ensure everything is correct, consult with your local legal adviser for assistance. Join and easily explore over 85,000 valuable templates.

- To utilize the document repository, select a subscription and set up your account.

- If you are already registered, simply Log In and press the Download button.

- The Hawaii Partial Release of Property From Mortgage for Corporation document will be automatically saved in the My documents section (a section for all documents you download on US Legal Forms).

- To establish a new account, refer to the brief instructions below.

- If you plan to use a state-specific document, ensure you select the proper state.

- If feasible, review the description to understand all of the details of the document.

- Utilize the Preview option if available to view the details of the document.

- If all is correct, click on the Buy Now button.

Form popularity

FAQ

In most cases, the lender is not the grantor on a mortgage; the borrower is typically the grantor. The lender holds the security interest in the property while the borrower retains ownership. In a Hawaii Partial Release of Property From Mortgage for Corporation, the lender grants the release by providing documentation that recognizes the removal of certain property from the mortgage. This distinction is essential for understanding your mortgage structure.

To achieve a Hawaii Partial Release of Property From Mortgage for Corporation, you will need several documents. Typically, you must present the original mortgage, any required fees, and potentially an appraisal of the property. It is also helpful to have a clear agreement with the lender regarding the terms of the partial release. Utilizing our resources can streamline this process, making it less daunting.

In a Hawaii Partial Release of Property From Mortgage for Corporation, the grantor is usually the borrower or property owner who is seeking the partial release. This individual or entity has agreed upon the release terms with the lender. The lender, acting as the grantee, benefits by retaining a mortgage on the remaining property. Understanding the role of the grantor is crucial for corporations navigating property transactions.

A quitclaim deed functions by allowing the current owner to relinquish all rights to the property to someone else without affirming the legitimacy of the title. This method may be beneficial for transferring property quickly or among family members. However, unlike other deeds, it does not provide any assurance that there are no outstanding claims or mortgages, including the considerations for a Hawaii Partial Release of Property From Mortgage for Corporation, which makes understanding your rights and responsibilities vital.

To transfer ownership of a property in Hawaii, you typically need to execute a deed, such as a quitclaim or warranty deed, depending on your needs. It is essential to record the deed with the Bureau of Conveyances to ensure the change is legally recognized. If your transfer involves addressing a mortgage situation, such as the Hawaii Partial Release of Property From Mortgage for Corporation, using a reliable platform like USLegalForms can simplify the process and ensure proper documentation.

One major disadvantage of a quitclaim deed is that it does not provide any warranties or guarantees about the property's title. This means the recipient takes on the risk of any existing liens or other claims, which could complicate future transactions, especially regarding the Hawaii Partial Release of Property From Mortgage for Corporation. Furthermore, using a quitclaim deed can sometimes lead to disputes if the original owner still has obligations related to the property, making clarity crucial.

A quitclaim deed in Hawaii allows a property owner to transfer their interest in real estate to another party without making any guarantees about the property title. This type of deed is often used for informal transfers, such as between family members or to clear up title issues. It's important to understand that a quitclaim deed does not remove any existing liens or mortgages on the property, including those pertaining to the Hawaii Partial Release of Property From Mortgage for Corporation.

Obtaining an old mortgage discharge involves contacting the original lender if they’re still in business, or obtaining it from the county recorder's office if the lender is no longer available. Having the original documents will help smooth this process. For corporations in Hawaii, uslegalforms provides resources to get the necessary paperwork efficiently.

To obtain a partial release of a mortgage, you typically need to submit a request to your lender along with relevant information about the property. It's important to include details on why you need the release and how it pertains to your business plans. Companies in Hawaii can benefit from using uslegalforms to streamline this process and ensure all documentation is complete.

Losing your lien release letter can create challenges, but it is possible to obtain a replacement. You can contact the lender or use uslegalforms to simplify the process of retrieving necessary documents. Having a clear lien release is crucial when it comes to proving ownership of the property in a Hawaii Partial Release of Property From Mortgage for Corporation.