Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

Key Concepts & Definitions

An agreement of shareholders of a close corporation is a legally binding document among the shareholders of a privately held corporation. This agreement outlines the rights, responsibilities, and obligations of shareholders and includes provisions on the management and operation of the corporation, buy-sell provisions, and dispute resolution mechanisms.

Step-by-Step Guide

- Identify the Parties: List all shareholders of the corporation to be included in the agreement.

- Determine Voting Rights: Define how voting rights are distributed among shareholders for decisions affecting the corporation.

- Outline Share Transfer Restrictions: Specify any restrictions on the sale or transfer of shares to maintain control within the existing group of shareholders.

- Set Dispute Resolution Mechanisms: Agree on methods for dispute resolution, aiming to handle conflicts internally before seeking external help.

- Review with Legal Counsel: Before finalizing, have the agreement reviewed by a legal professional specializing in corporate law.

Risk Analysis

- Lack of Agreement: Without a formal agreement, disputes may become significantly challenging to resolve, possibly leading to litigation or dissolution.

- Inadequate Provisions: Insufficient details in the agreement can leave gaps in understanding, leading to conflicts.

- Outdated Agreements: Not updating agreements to reflect current laws can lead to parts of it being unenforceable.

Best Practices

- Regular Updates: Review and update the shareholders' agreement regularly or when significant changes occur within the corporation or legal environment.

- Clear Language: Use unambiguous language to avoid interpretations that could lead to disputes.

- Fair Provisions: Make sure the agreement serves all shareholders equitably, safeguarding both majority and minority interests.

Common Mistakes & How to Avoid Them

- Overlooking Buy-Sell Provisions: Ensure the agreement includes clear buy-sell clauses to handle the departure of shareholders smoothly.

- Ignoring Tax Implications: Consult tax professionals to understand potential impacts on shareholders and the corporation.

- Underestimating the Need for Flexibility: Design the agreement to accommodate future changes in the business landscape or shareholder objectives.

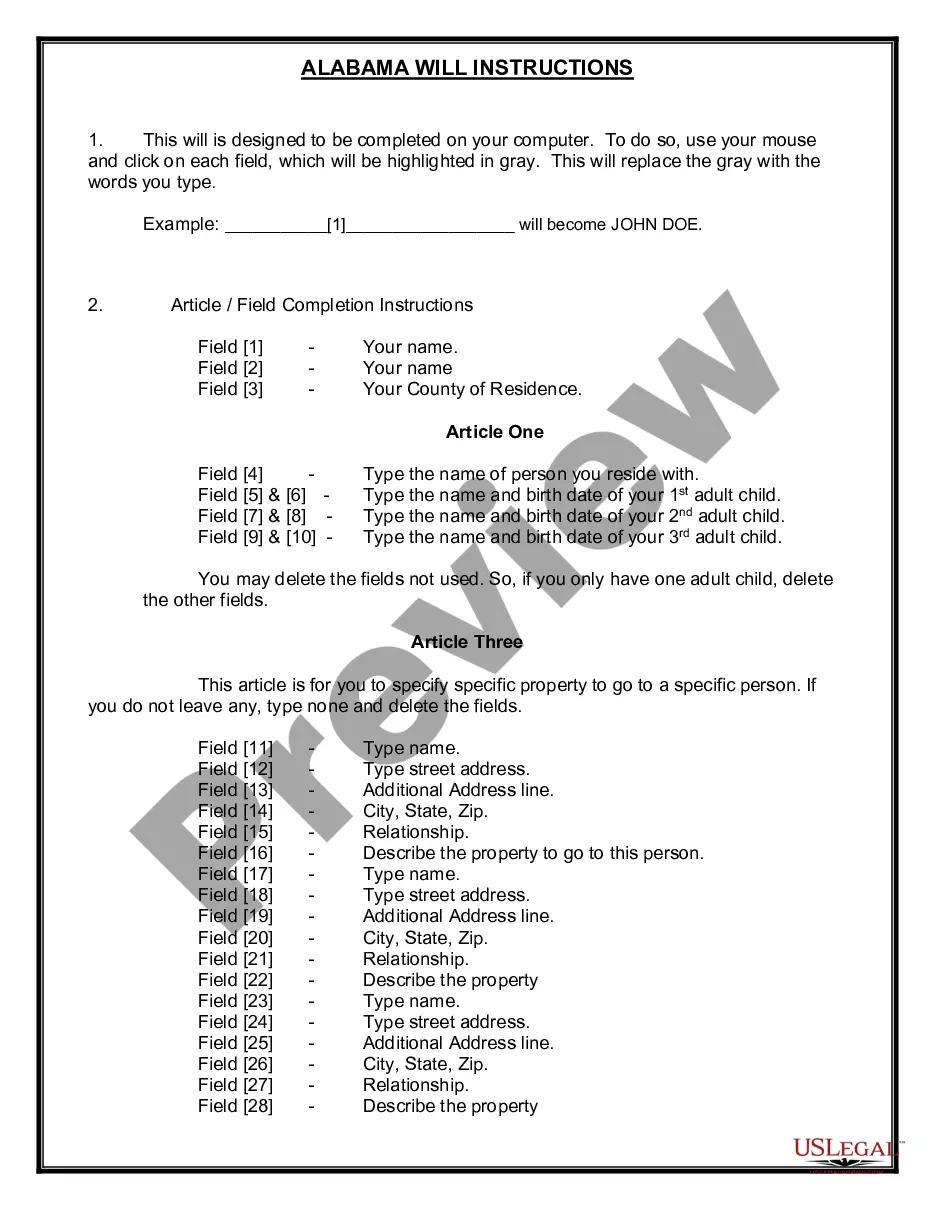

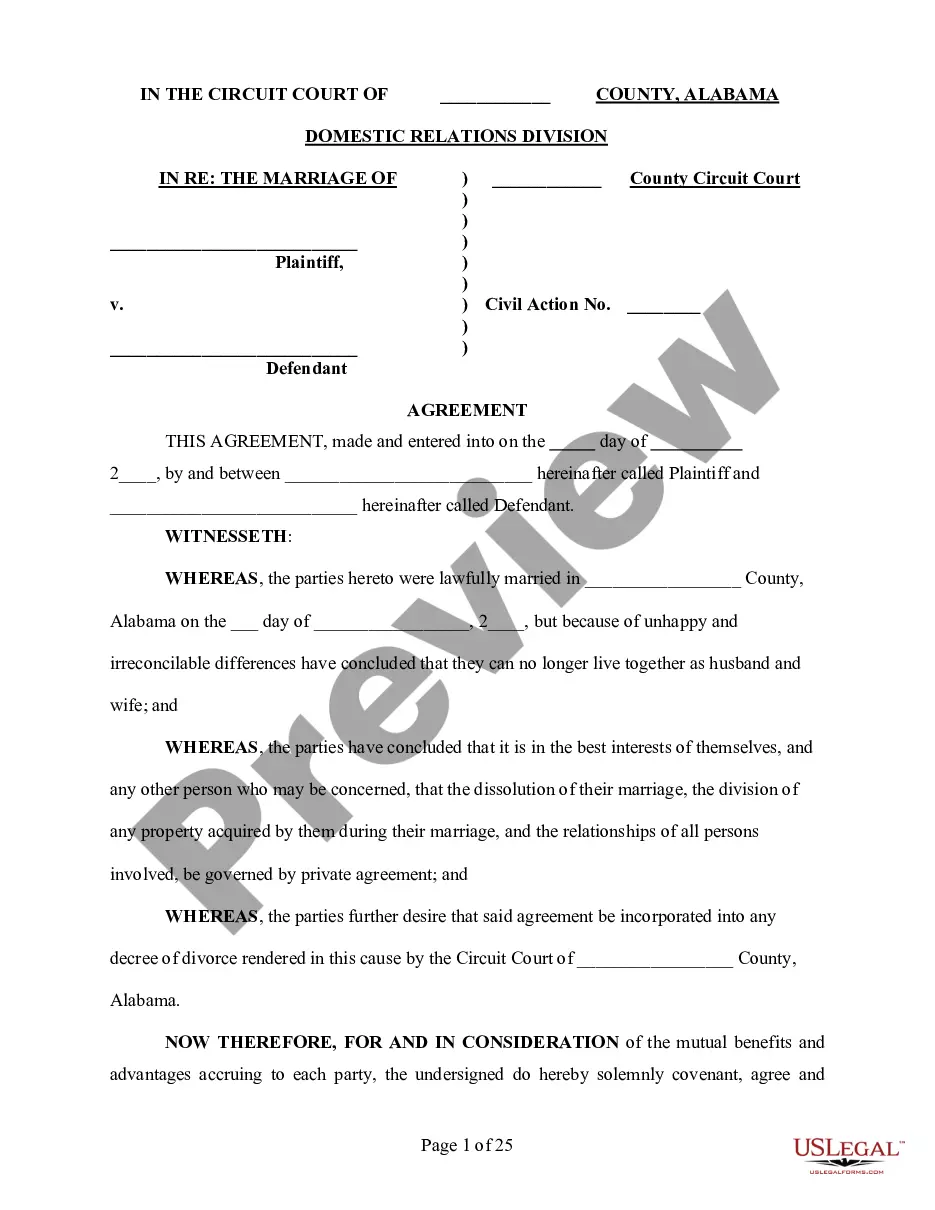

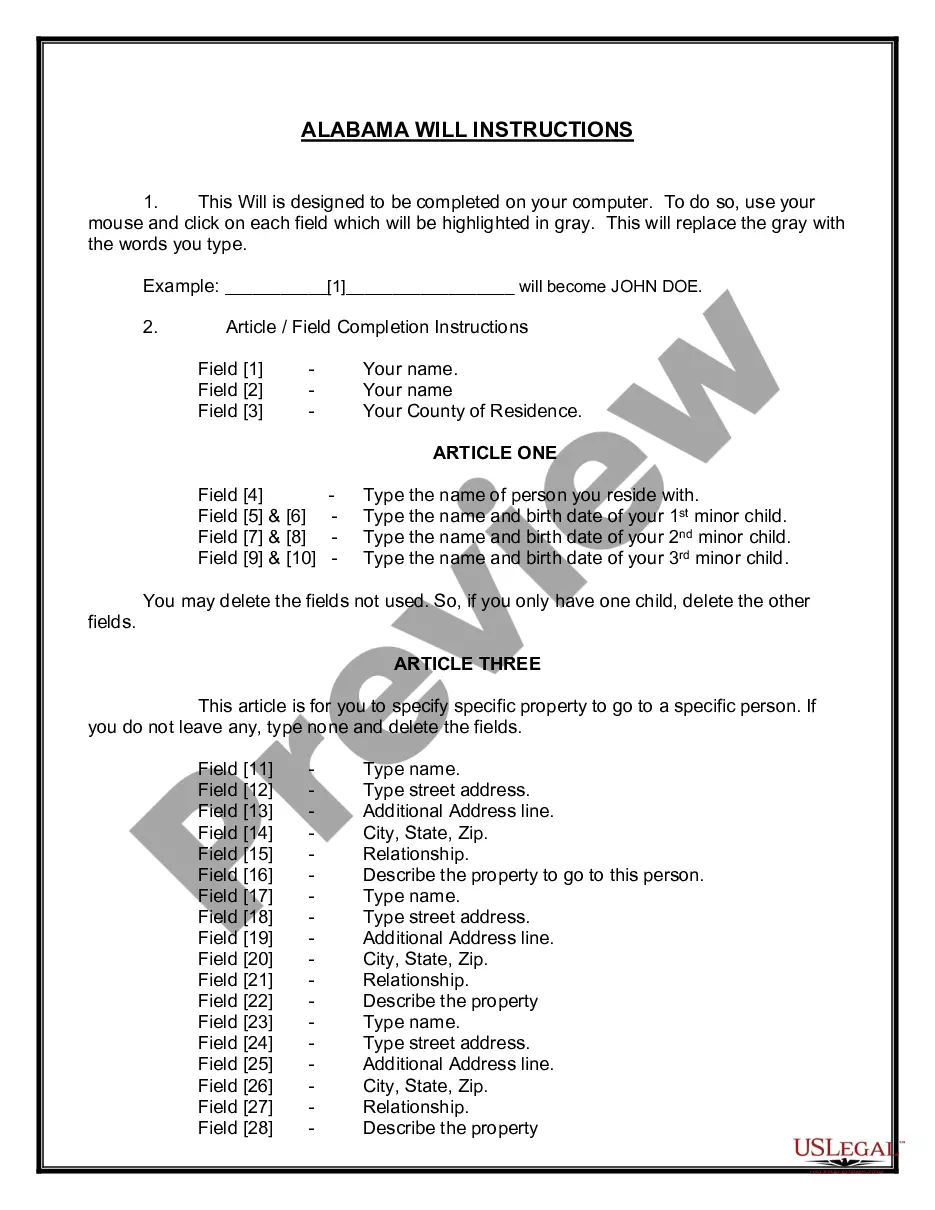

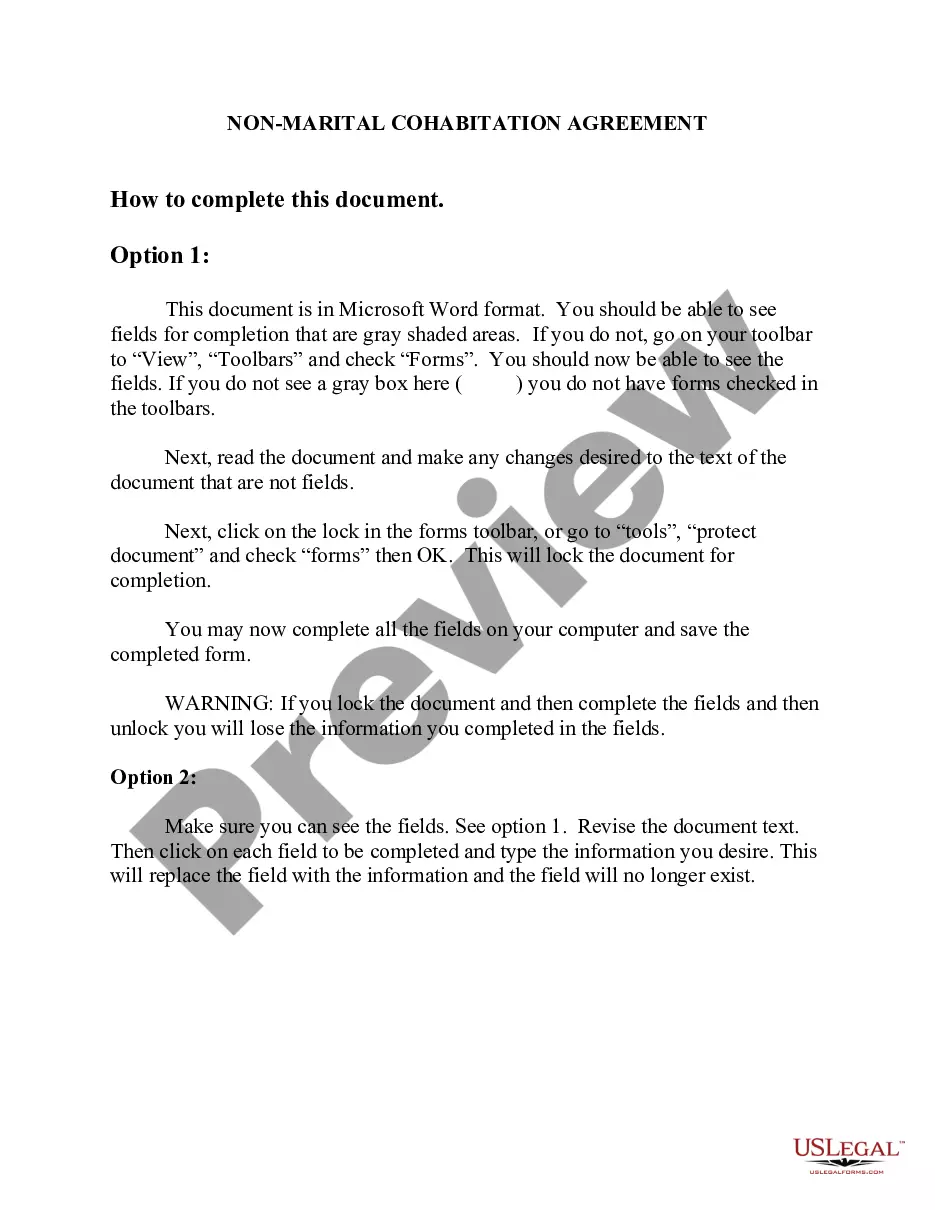

How to fill out Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Aren't you sick and tired of choosing from countless samples every time you want to create a Agreement of Shareholders of a Close Corporation with Management by Shareholders? US Legal Forms eliminates the lost time an incredible number of American citizens spend browsing the internet for perfect tax and legal forms. Our expert team of attorneys is constantly modernizing the state-specific Samples collection, so that it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription need to complete quick and easy actions before having the capability to get access to their Agreement of Shareholders of a Close Corporation with Management by Shareholders:

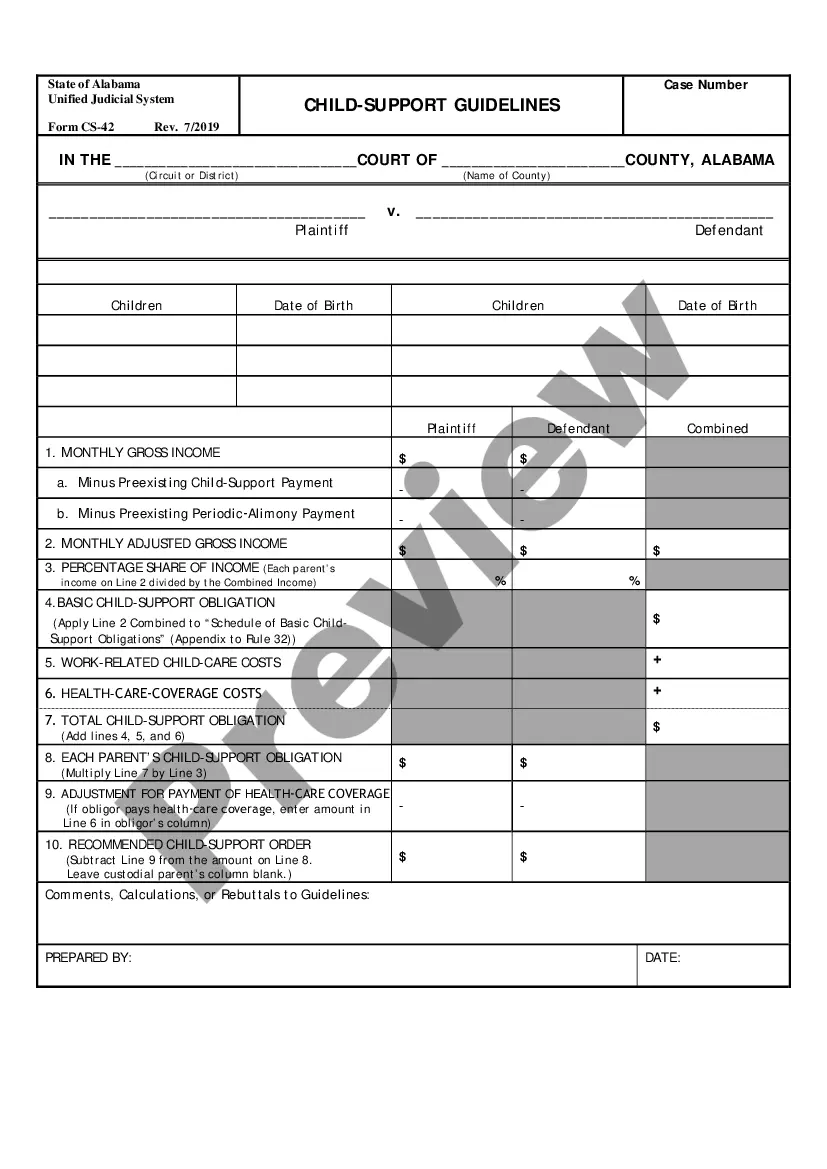

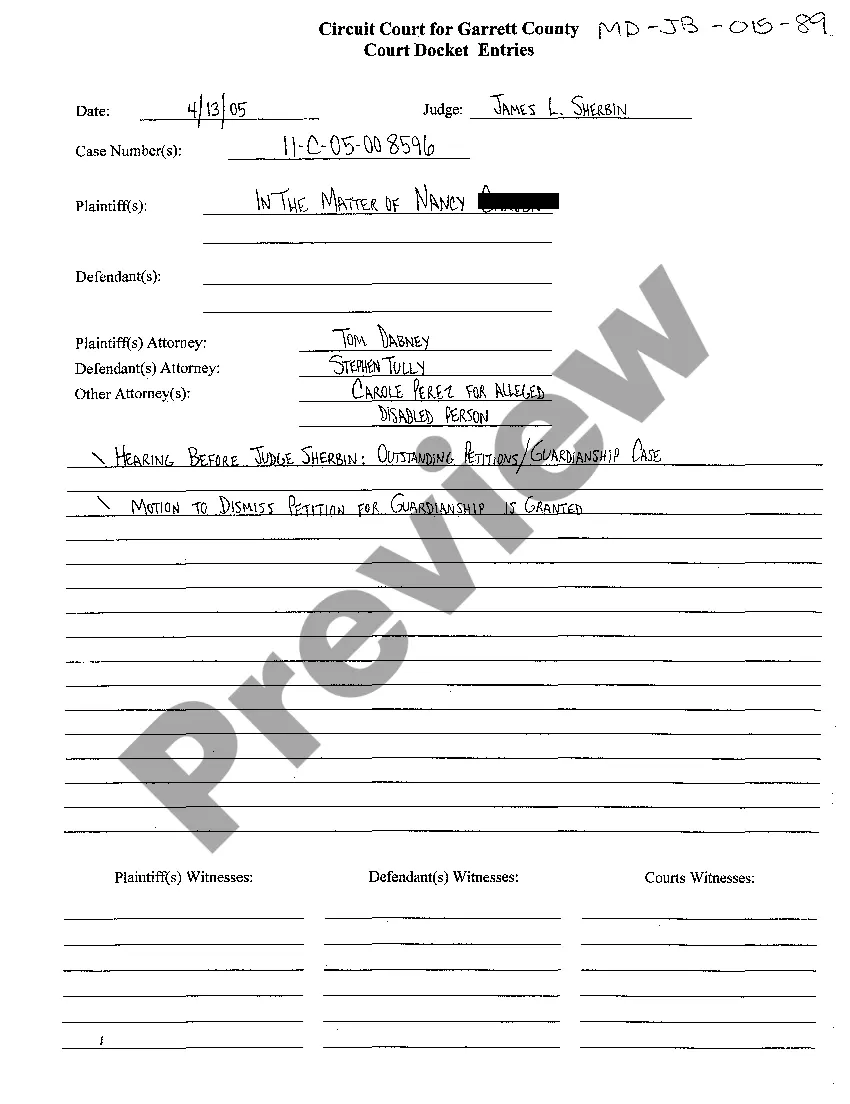

- Use the Preview function and look at the form description (if available) to make sure that it is the best document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template to your state and situation.

- Use the Search field on top of the webpage if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a needed format to complete, print, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always be able to log in and download whatever file you require for whatever state you need it in. With US Legal Forms, completing Agreement of Shareholders of a Close Corporation with Management by Shareholders samples or other official paperwork is simple. Begin now, and don't forget to recheck your samples with certified lawyers!

Form popularity

FAQ

A corporation is owned by its shareholders and as a group they potentially possess a great amount of control over corporate operations. However, in most cases, shareholders do not exercise control over day-to-day operations or over any but the most important types of decisions.

Introduction. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up. Further information and documents.

Is a shareholders agreement legally binding? Once a shareholders agreement has been signed it should be legally binding, provided that it complies with the usual 4 aspects of a contract: offer, acceptance, consideration and an intention to create legal relations.

Introduction. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up. Further information and documents.

Is a shareholders agreement legally binding? Once a shareholders agreement has been signed it should be legally binding, provided that it complies with the usual 4 aspects of a contract: offer, acceptance, consideration and an intention to create legal relations.

Each shareholder must sign the Shareholders' Agreement.If there was ever a conflict in the future concerning the Agreement and you suspect that one or more shareholders may deny ever having seen or signed the Shareholder Agreement then maybe all signatures should be notarized.

The essential topics to agree on in a start-up or small business shareholder relationship include: the business strategy, financing, controlling interest rights, minority interests' rights, directorships and shares.