Texas Limited Power of Attorney where you Specify Powers with Sample Powers Included

Understanding this form

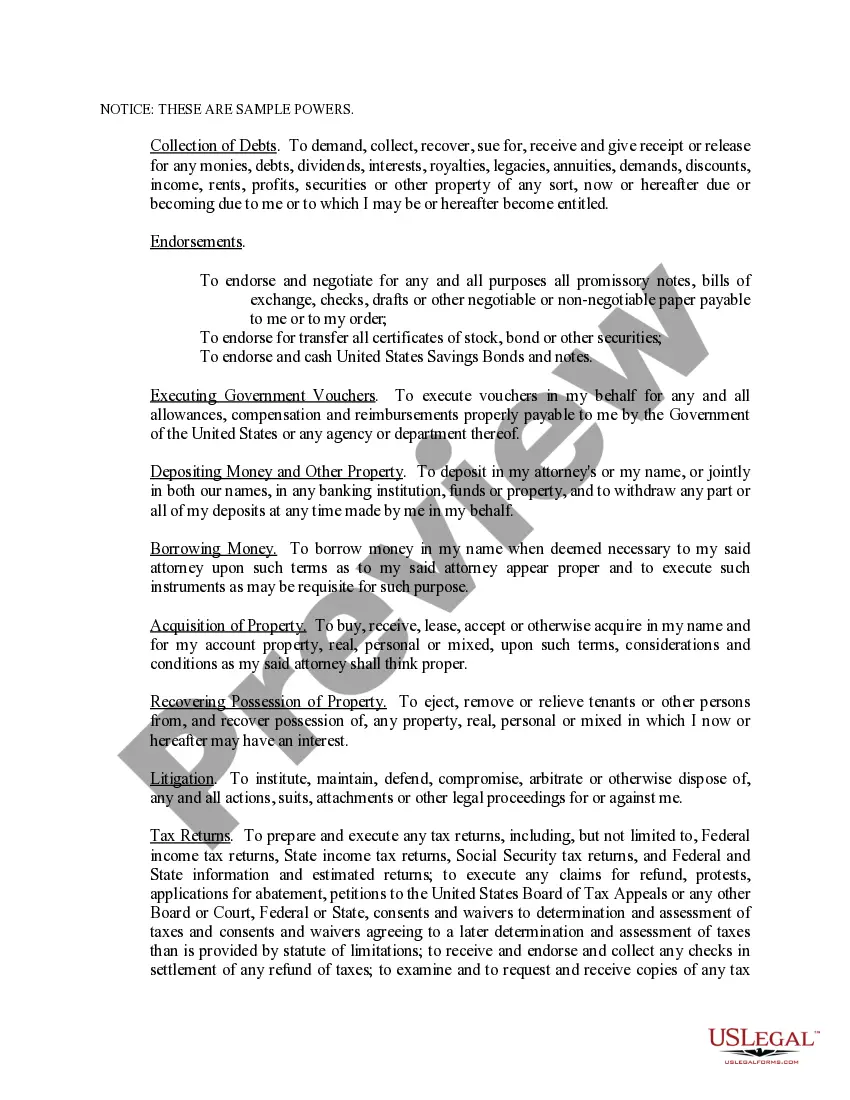

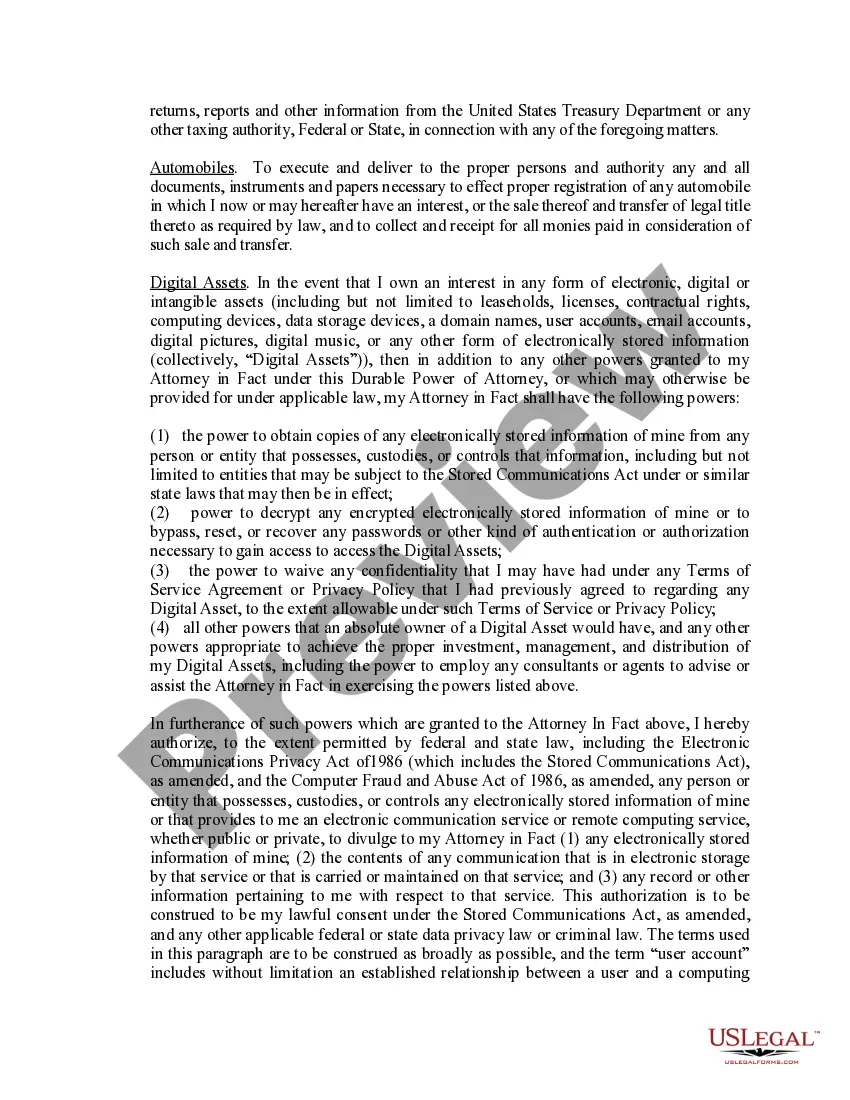

A Limited Power of Attorney is a legal document that allows you to grant specific powers to another person, known as your agent or attorney-in-fact, to act on your behalf in certain matters. Unlike a general power of attorney, which grants broad authority, this form enables you to limit the powers to specific tasks, such as managing finances or handling real estate transactions. This form provides sample powers that you can modify or delete as necessary.

Key components of this form

- Principal's information: The full name and address of the person granting the powers.

- Agent's information: The name and address of the authorized person who will act on behalf of the principal.

- Specified powers: A section where you list the specific authorities granted to your agent.

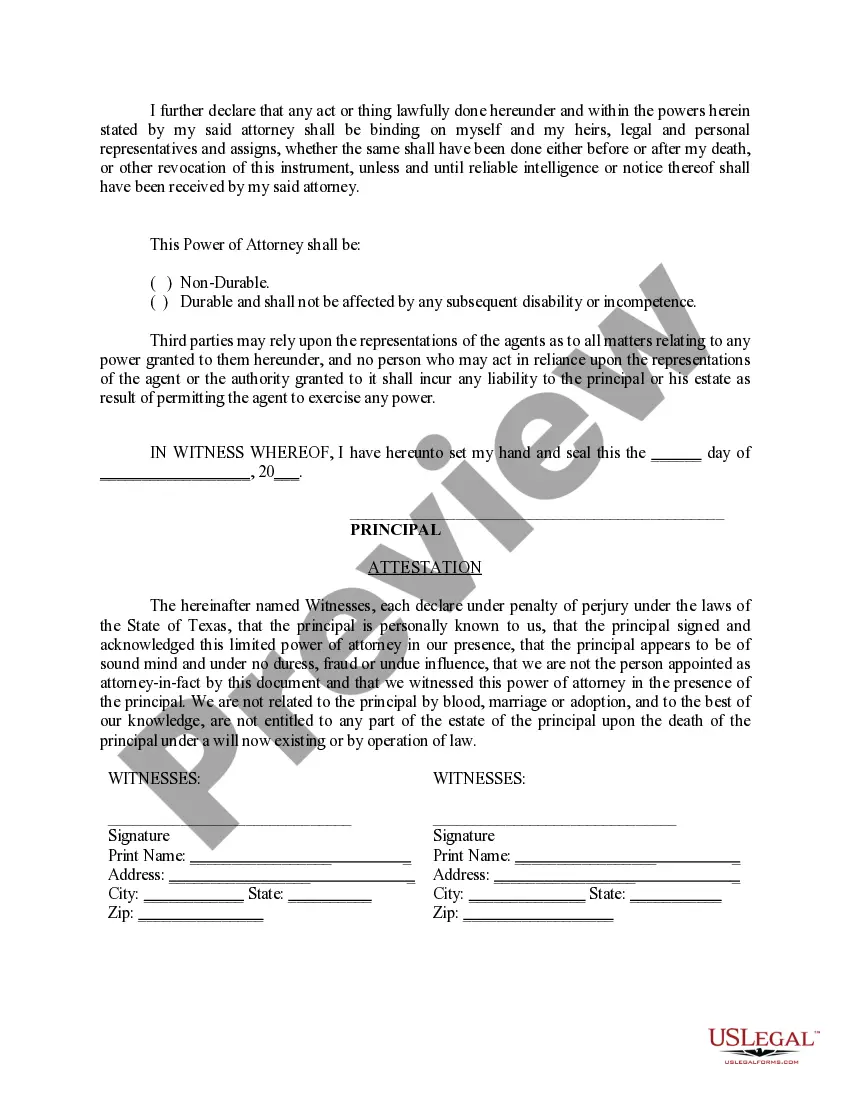

- Durability clause: An option to designate whether the power is non-durable or durable, affecting its validity in case of the principal's disability.

- Witnesses' signatures: Required signatures of two witnesses to validate the document.

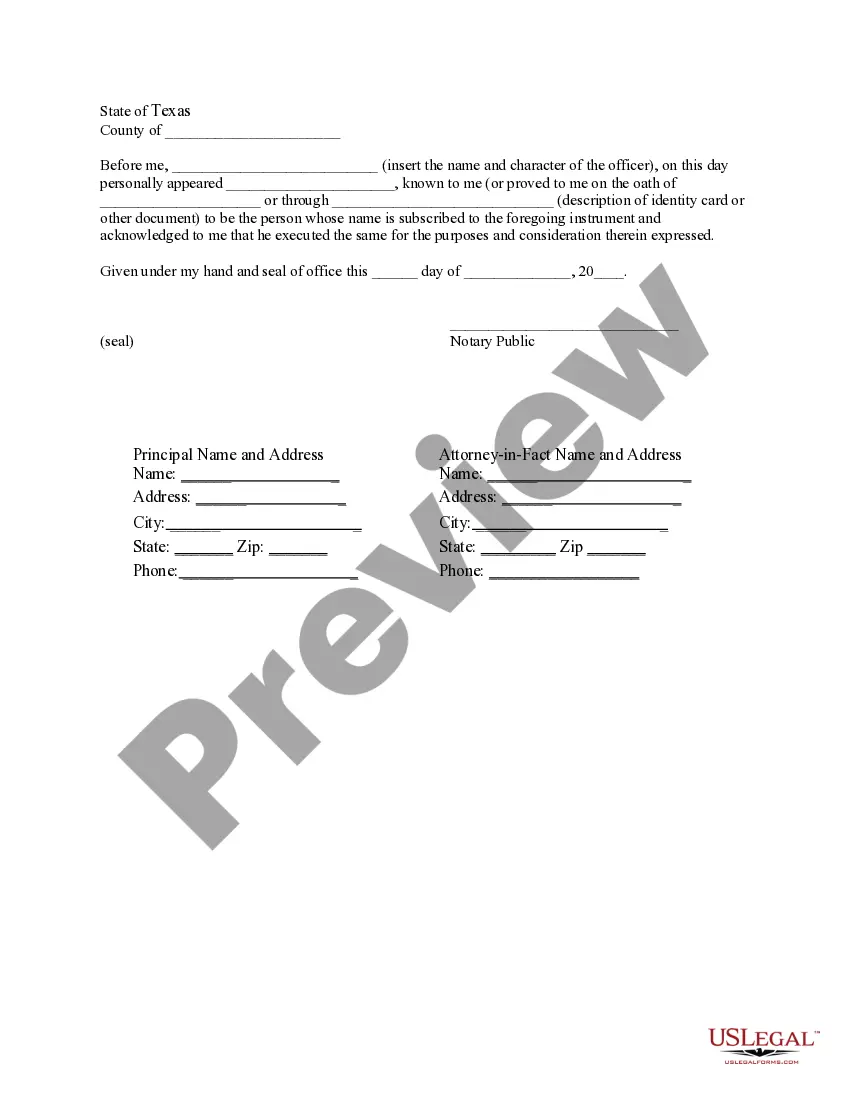

- Notarization section: Space for a notary public to certify the document, ensuring its legal standing.

When to use this document

This form is useful in situations where you need someone to manage specific tasks while you are unavailable or unable to act for yourself. Examples include appointing someone to handle real estate transactions, manage bank accounts, or deal with legal matters in your absence. It is particularly beneficial if you want to retain control over which powers are granted and ensure that they are limited to specific actions.

Who needs this form

- Individuals in Texas who need assistance with specific legal or financial matters.

- People planning for temporary absences, such as travel or hospitalization, where decision-making may be required.

- Those who desire to specify the powers given to their agent and limit the scope of authority.

How to prepare this document

- Enter your full name and address in the designated principal section.

- Provide the name and address of the person you are appointing as your agent.

- Specify the exact powers you want to grant in the area provided, referring to the included sample powers as a guide.

- Indicate whether this is a durable or non-durable power of attorney.

- Have two witnesses sign the document to confirm your identity and ensure you are of sound mind.

- If required, take the completed document to a notary public for certification.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly specify the powers granted, leading to confusion for the agent.

- Not having the required witness signatures, making the document invalid.

- Neglecting to complete the notarization if needed, which can affect enforceability.

- Using the form without understanding the implications of the granted powers.

Advantages of online completion

- Convenience: Access and complete the form from anywhere at any time.

- Editability: Customize the sample powers to fit your specific needs easily.

- Reliability: Ensure the form is correctly drafted with legal language validated by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

In Texas, all power of attorney forms need to be notarized.The current Texas statutory durable power of attorney forms do not provide for witnesses other than a notary public. Your agent is not required to sign any power of attorney forms.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.

Download the form. In just a few minutes, you can locate appropriate power of attorney forms from reputable sources. Appoint an agent. Your agent is the person you authorize to act on your behalf. Draft a statement of authority. Set time limits. Sign and date the form.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.Before signing an LPOA, the client should be aware of the specific functions they have delegated to the portfolio manager, as the client remains liable for the decisions.