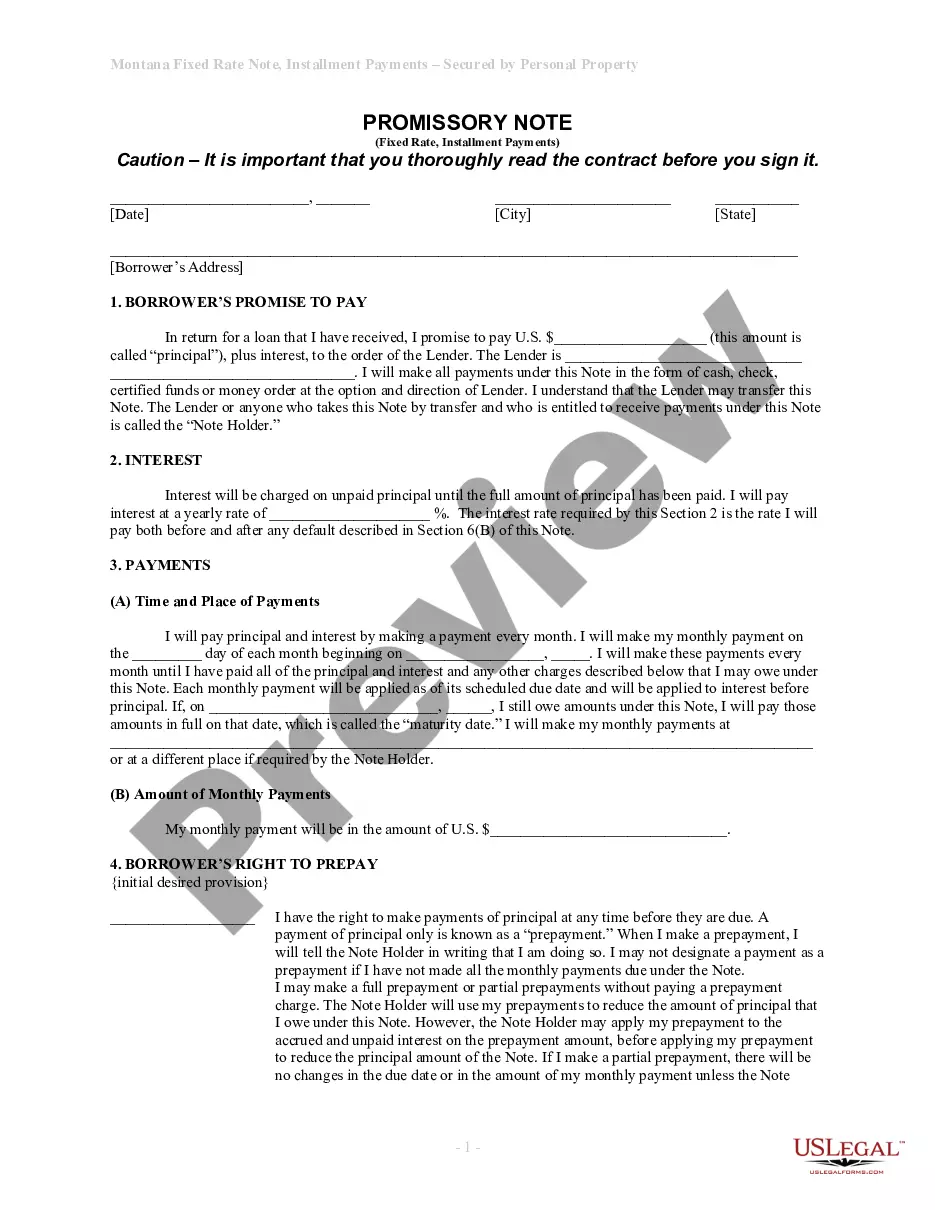

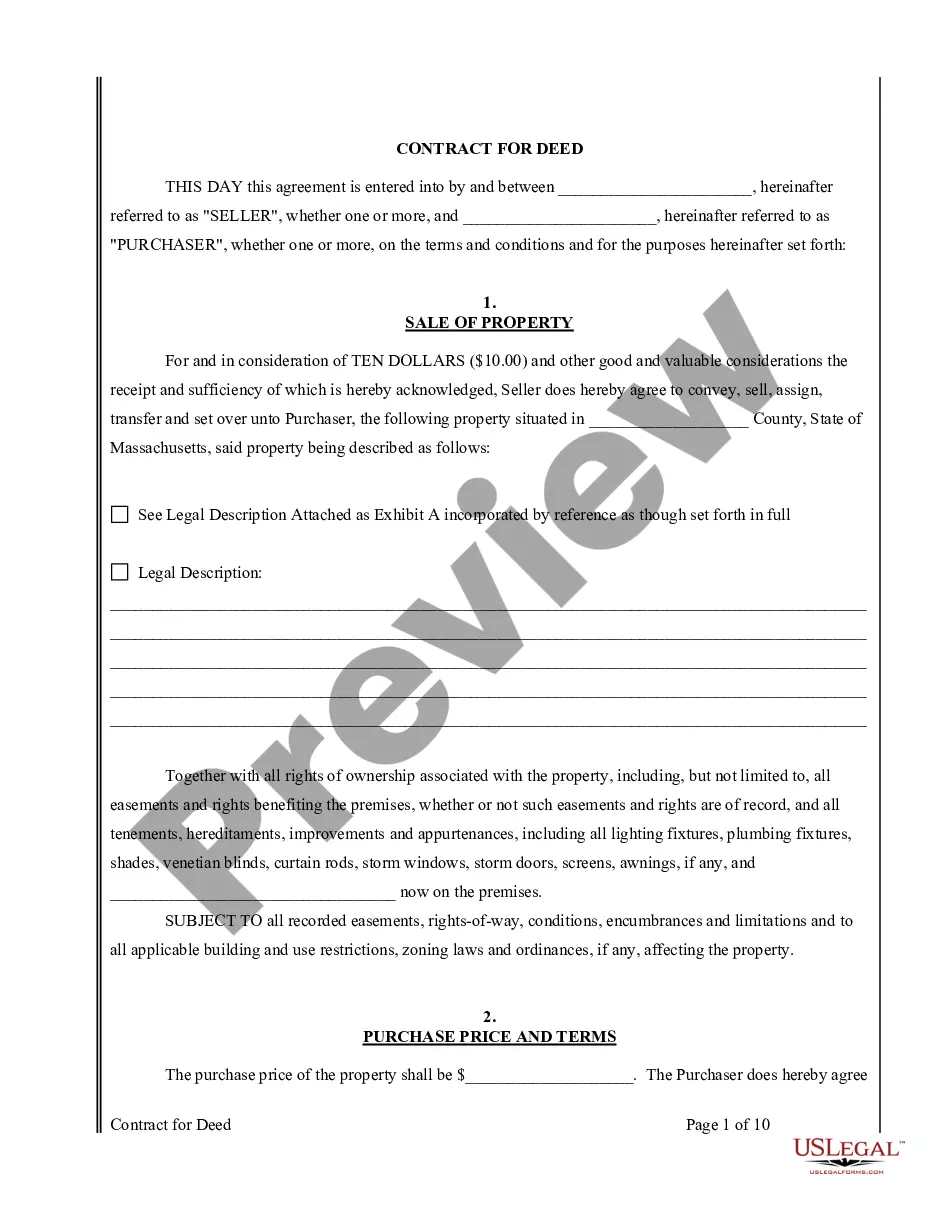

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

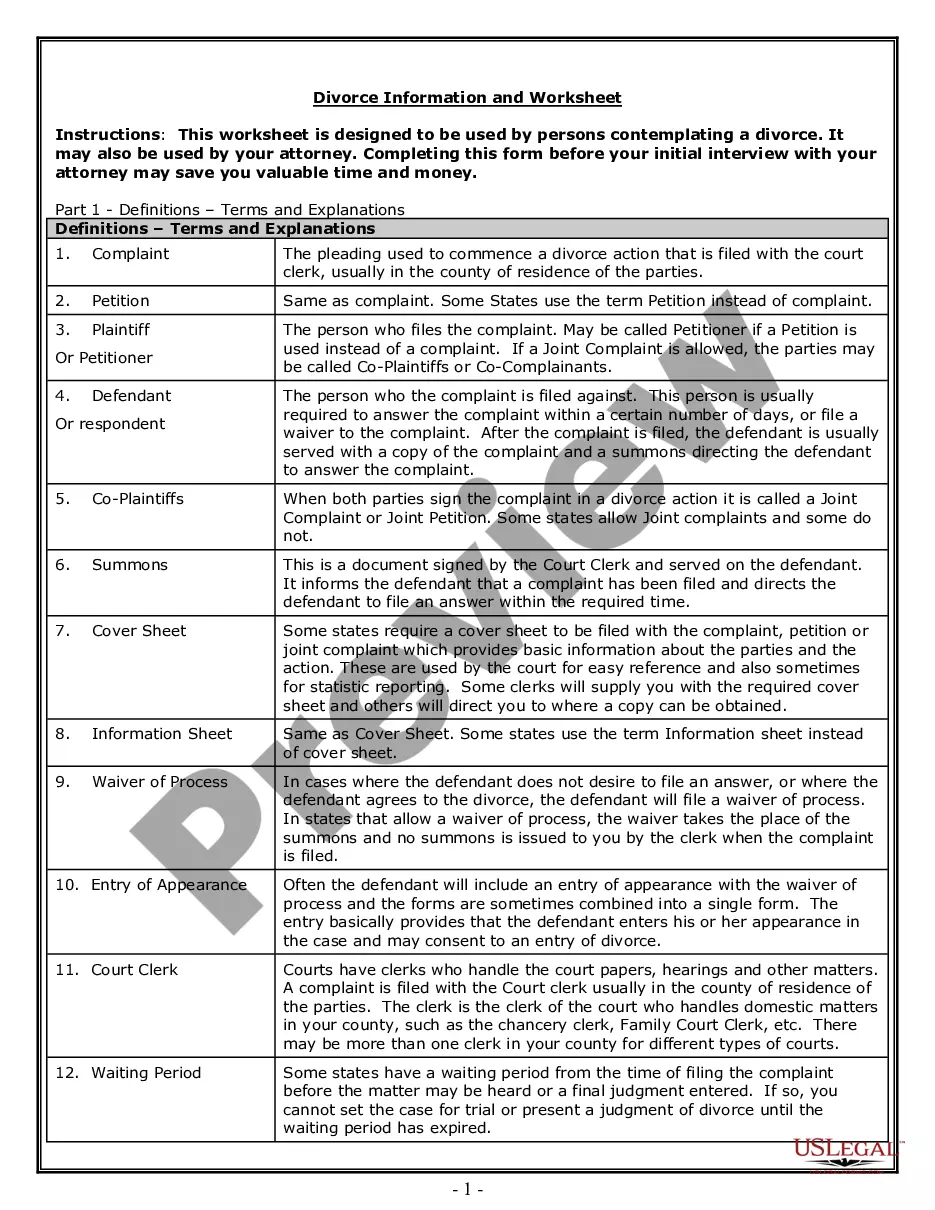

Key Concepts & Definitions

Texas Installments Fixed Rate Promissory Note: A legal document where a borrower agrees to repay a loan under specified conditions in Texas. This note includes fixed rate promissory terms, meaning the interest rate remains constant through the life of the loan, paid in installments.

Step-by-Step Guide

- Determine the Need: Evaluate if you need a promissory note for purposes such as real estate purchases or unsecured loans.

- Understand the Terms: Know the specifics about monthly repayments, interest rates, and the security of the note, whether it's secured with residential real property or not.

- Document Preparation: Prepare the promissory note ensuring it contains all required elements like borrower repayment commitments and terms of the loan.

- Legal Validation: Have the promissory note reviewed by a legal professional to ensure compliance with Texas state laws.

- Execution & Management: Sign the document as required and manage the repayment schedule as agreed in the terms.

Risk Analysis

- Interest Rate Risks: Fixed rates protect from market fluctuations but might result in higher costs if market rates decrease.

- Liquidity Risks: The duration and structure of installments may impact financial liquidity.

- Legal Compliance: Non-compliance with state laws may lead to legal repercussions.

- Default Risks: The borrower's failure to make scheduled repayments could lead to loss of secured assets or financial strain.

Best Practices

- Consult Legal Experts: Always consult with legal experts familiar with residential real transactions in Texas.

- Clear Terms: Define all terms clearly in the note to avoid ambiguities that could cause disputes.

- Regular Reviews: Regularly review the note's terms and conditions to accommodate any necessary amendments or updates.

- Maintain Records: Keep thorough records of all transactions and communications related to the promissory note.

Common Mistakes & How to Avoid Them

- Ignoring Legal Requirements: Ensure that the promissory note complies with all relevant Texas laws to avoid legal issues.

- Vague Repayment Terms: Specify exact dates and amounts for repayments to prevent misunderstandings.

- Inadequate Security: Secure the note adequately, preferably with collateral, to safeguard against borrower default.

- Failing to Document Changes: Any adjustments to the agreement should be documented and signed by all parties involved.

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Get access to top quality Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate templates online with US Legal Forms. Steer clear of days of misused time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific legal and tax forms that you could save and fill out in clicks in the Forms library.

To get the sample, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate you’re considering is suitable for your state.

- See the sample utilizing the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Pick a preferred format to download the file (.pdf or .docx).

You can now open the Texas Installments Fixed Rate Promissory Note Secured by Commercial Real Estate sample and fill it out online or print it and get it done by hand. Think about sending the papers to your legal counsel to ensure things are completed correctly. If you make a mistake, print and complete sample once again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

Texas promissory notes do not have to be notarized. However, to make them a legal document, they must be signed and dated by the borrower.

A buyer wanted to use a promissory note for consideration on the purchase of a property. Can he do this? Yes, this is acceptable as long as the seller agrees.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.