Texas Conditional Waiver and Release of Lien on Final Payment by an Individual Claimaint

Description

How to fill out Texas Conditional Waiver And Release Of Lien On Final Payment By An Individual Claimaint?

How much time and resources do you usually spend on composing formal documentation? There’s a better option to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the leading online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Texas Conditional Waiver and Release of Lien on Final Payment by an Individual Claimaint.

To get and complete an appropriate Texas Conditional Waiver and Release of Lien on Final Payment by an Individual Claimaint blank, adhere to these simple instructions:

- Look through the form content to make sure it complies with your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Texas Conditional Waiver and Release of Lien on Final Payment by an Individual Claimaint. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Texas Conditional Waiver and Release of Lien on Final Payment by an Individual Claimaint on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

After the lien on a vehicle is paid off, the lienholder has 10 days after receipt of payment to release the lien.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

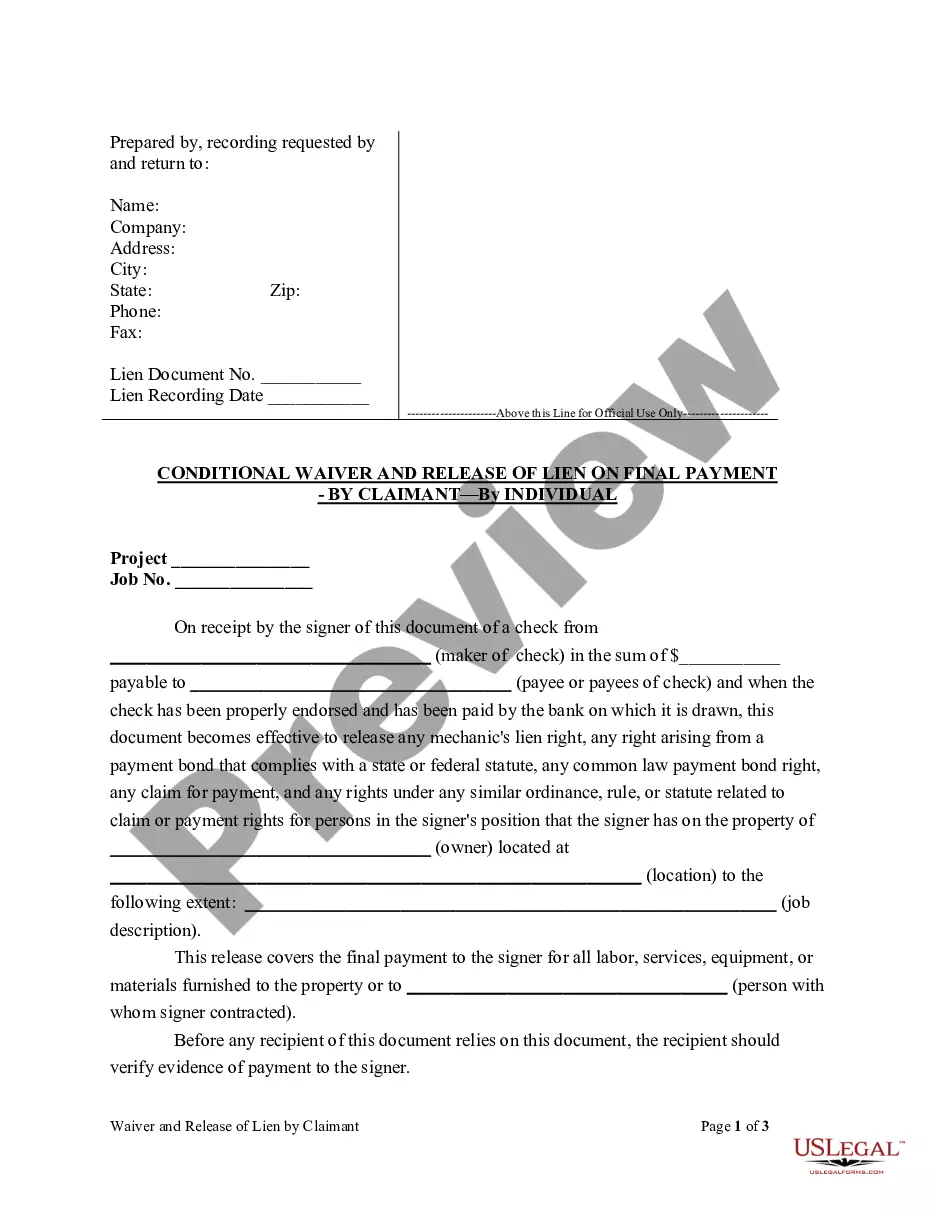

This Texas final conditional waiver (also called a final conditional lien release) should be used when the final payment for a project is expected, but has yet to be received on a project. Signing this waiver signifies that no further payments are expected following the payment described in the waiver.

Lien waivers act as a receipt for funds for the receiving party. They specify that the party waives their right to file a mechanics lien. As a result, they protect the property owner from lien claims on their property.

There are just 3 states where lien waivers must be notarized: Texas, Wyoming, and Mississippi. And of these three states, only Texas' law is explicitly clear on the matter.

Lien waivers act as a receipt for funds for the receiving party. They specify that the party waives their right to file a mechanics lien. As a result, they protect the property owner from lien claims on their property.

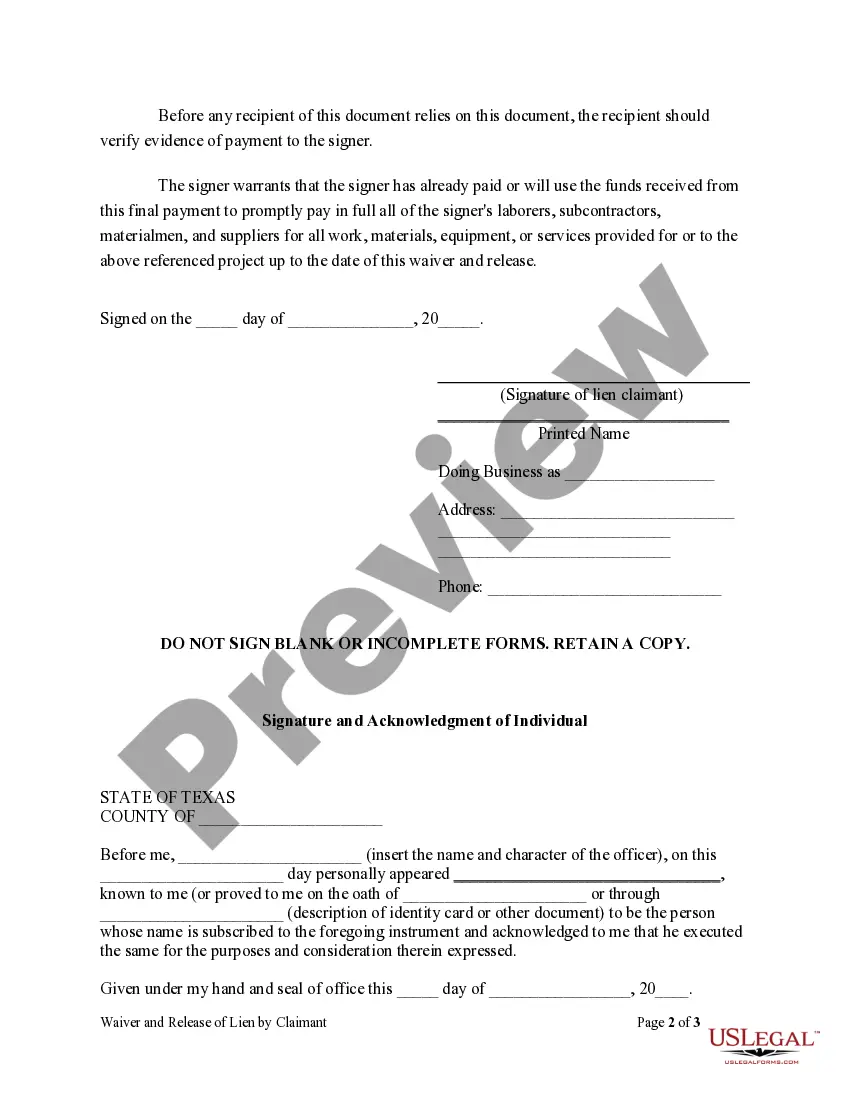

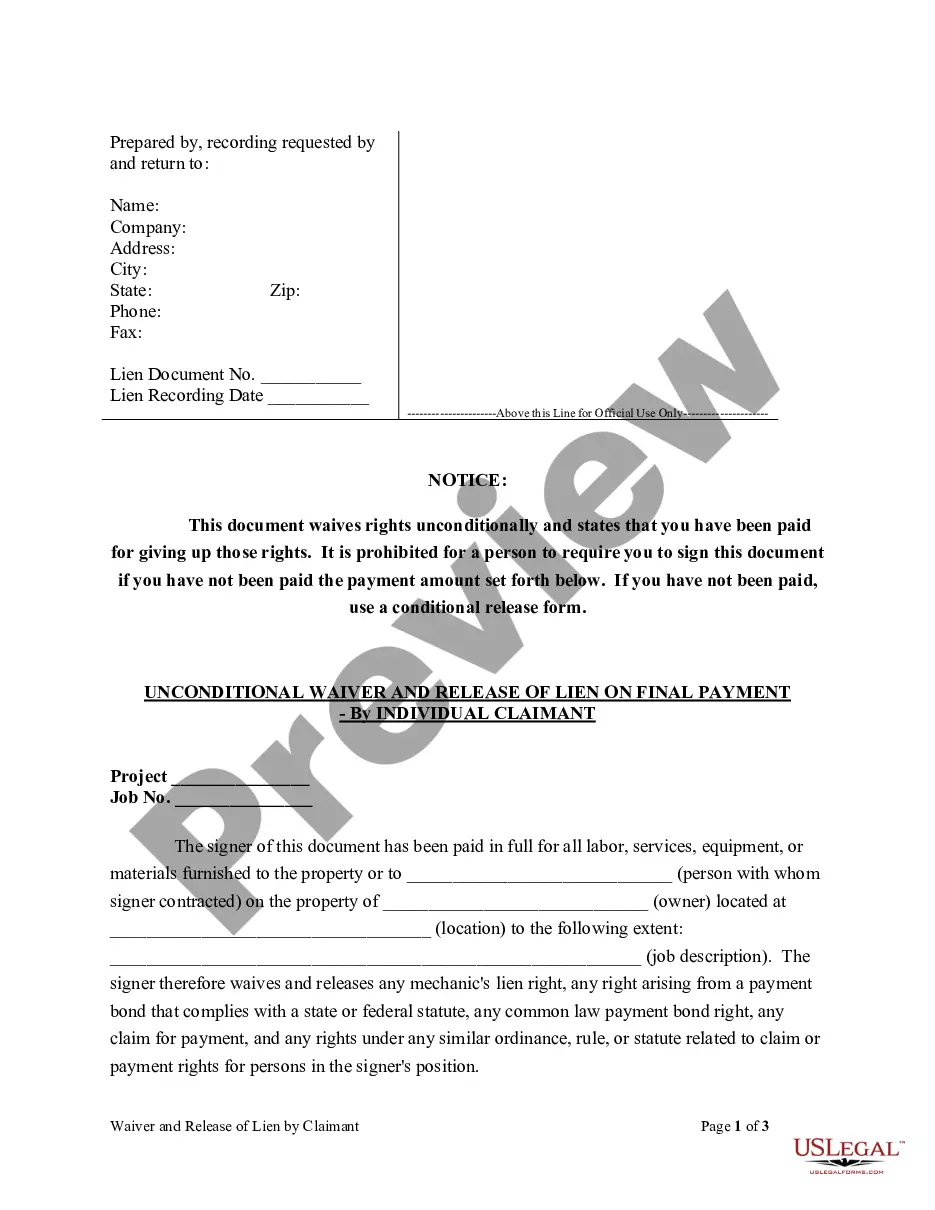

How to fill out a Texas Unconditional Waiver and Release on Final Payment Project. This is the official name of your project.Job No. This is your project number or contract number. Person with whom signer contracted.Owner.Location.Job description.Date.Company name, Signature, Title.

How to complete the Conditional Waiver and Release on Progress Payment form Name of Claimant. The claimant is the party receiving the payment ? in other words, the one waiving their lien rights.Name of Customer.Job Location.Owner.Through Date.Maker of the Check.Amount of the Check.Check Payable To.