Texas Warranty Deed from Corporation to Individual

Understanding this form

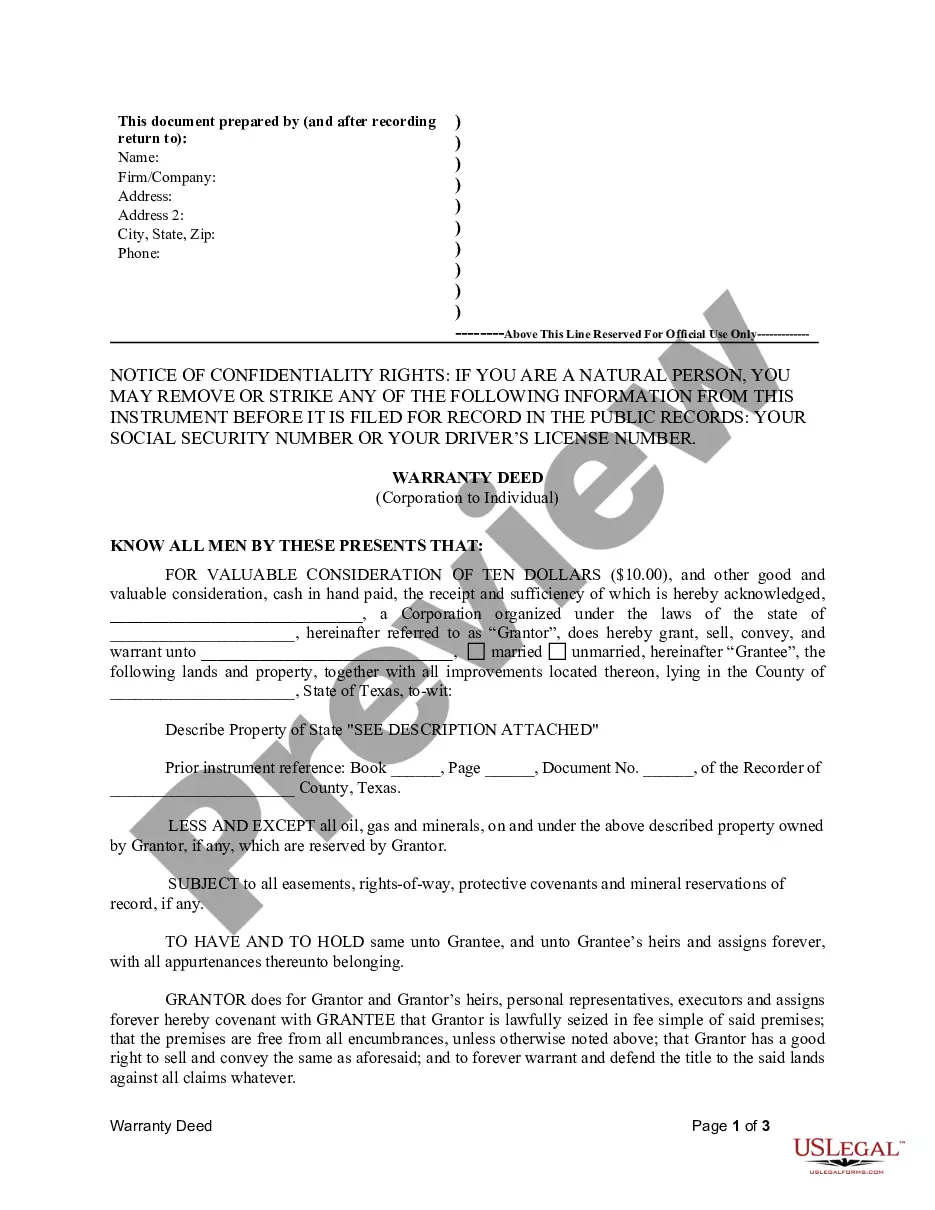

This Warranty Deed from Corporation to Individual is a legal document whereby a corporation (the Grantor) transfers ownership of real property to an individual (the Grantee). This form ensures that the property's title is conveyed without encumbrances, except for noted exclusions, such as mineral rights. It is distinct from other types of deeds, such as quitclaim deeds, as it includes guarantees about the property's title, providing greater security for the Grantee.

What’s included in this form

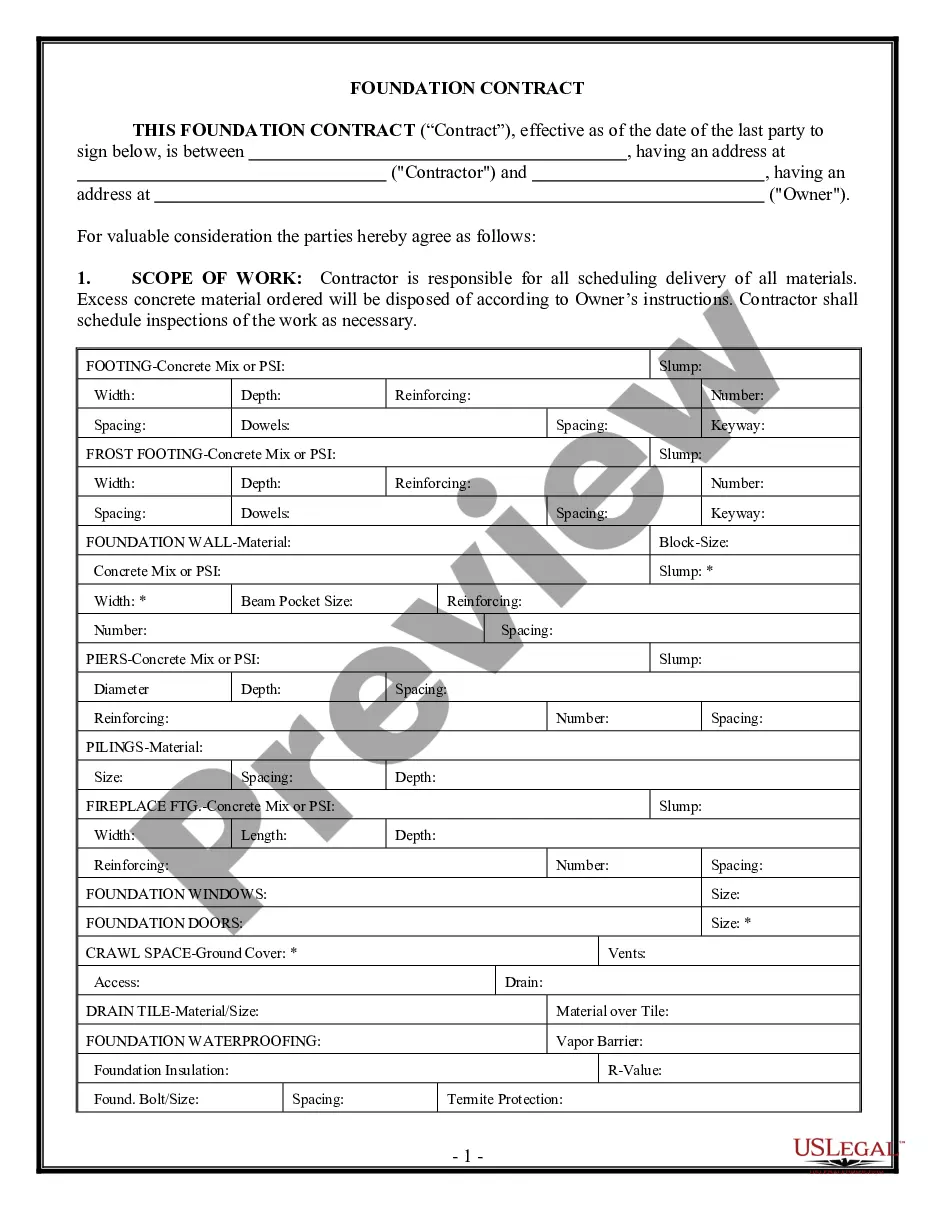

- Identification of the Grantor (corporation) and Grantee (individual).

- Description of the property being conveyed.

- Statement of the consideration amount for the transfer.

- Disclaimer regarding the reservation of oil, gas, and minerals, if applicable.

- Covenant by the Grantor regarding the title's validity and freedom from encumbrances.

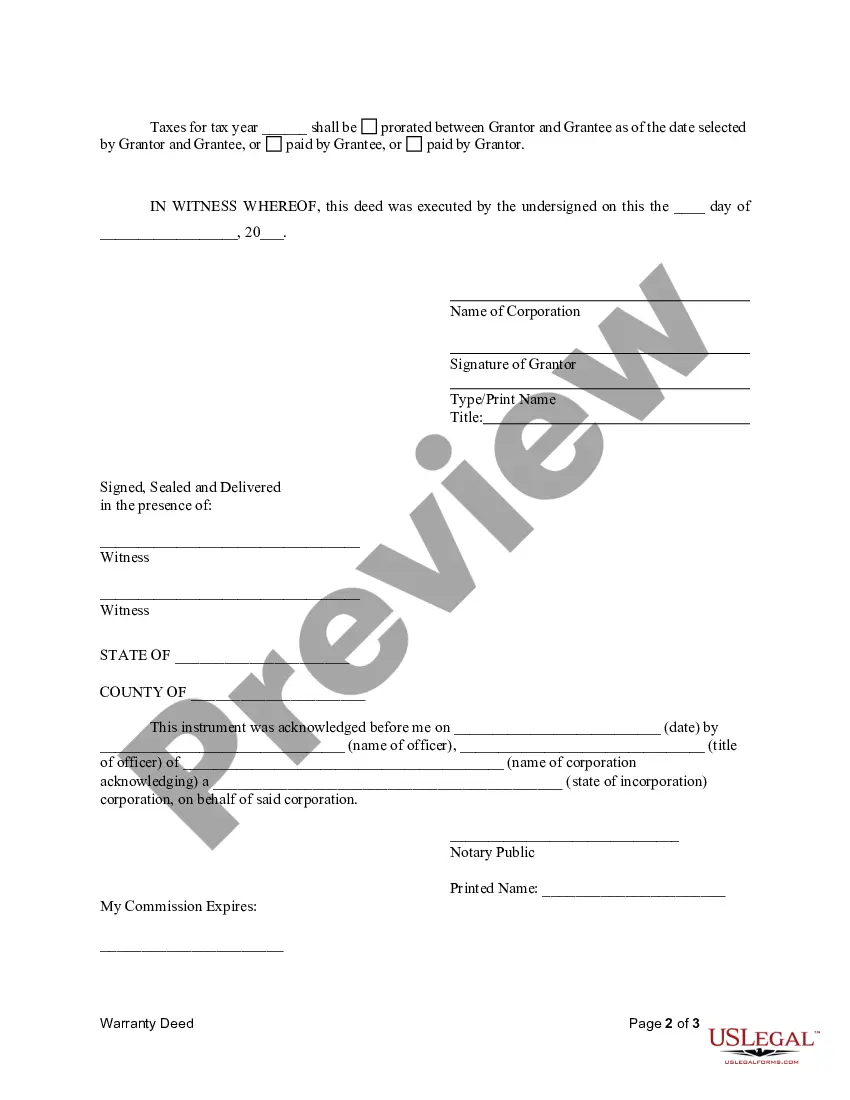

- Execution and acknowledgment clauses, including notary section.

When this form is needed

This form should be used when a corporation is transferring real estate to an individual. Situations may include enticing offers for property ownership, liquidating corporate assets, or facilitating estate planning for shareholders. Essentially, it provides legal documentation to establish the ownership transfer and protects the rights of the individual acquiring the property.

Who should use this form

This form is intended for:

- Corporations wishing to convey property to individuals.

- Individuals who are purchasing or receiving property from a corporation.

- Legal representatives or attorneys managing property transfers for corporations.

How to complete this form

- Identify the Grantor and Grantee by entering their full legal names.

- Describe the property in detail, including any attached descriptions or references.

- Enter the agreed consideration amount (e.g., ten dollars or another sum).

- Include any reservations or exceptions related to the property, such as mineral rights.

- Sign the document in the presence of a notary public to ensure legal validity.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete and accurate property description.

- Not specifying or incorrectly specifying any encumbrances or exceptions.

- Neglecting to have the form notarized when required.

- Omitting necessary signatures or acknowledgments.

Benefits of using this form online

- Easy access to legally vetted templates drafted by licensed attorneys.

- Convenience of completing and downloading the warranty deed from home.

- Editability allows users to tailor the form to their specific situation.

- Reliable format that complies with state requirements.

Looking for another form?

Form popularity

FAQ

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.Our title agents can help.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A property deed, or house deed, is a legal document that transfers ownership of real estate from the grantor (seller) to the grantee (buyer). Property deeds are the legal tool of defining ownership. When a property or house is sold, the buyer and seller sign the deed to transfer ownership.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

To officially prove ownership of a property, you will require Official Copies of the register and title plan; these are what people commonly refer to as title deeds because they are the irrefutable proof of ownership of a property. Note, this only applies to registered property.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.