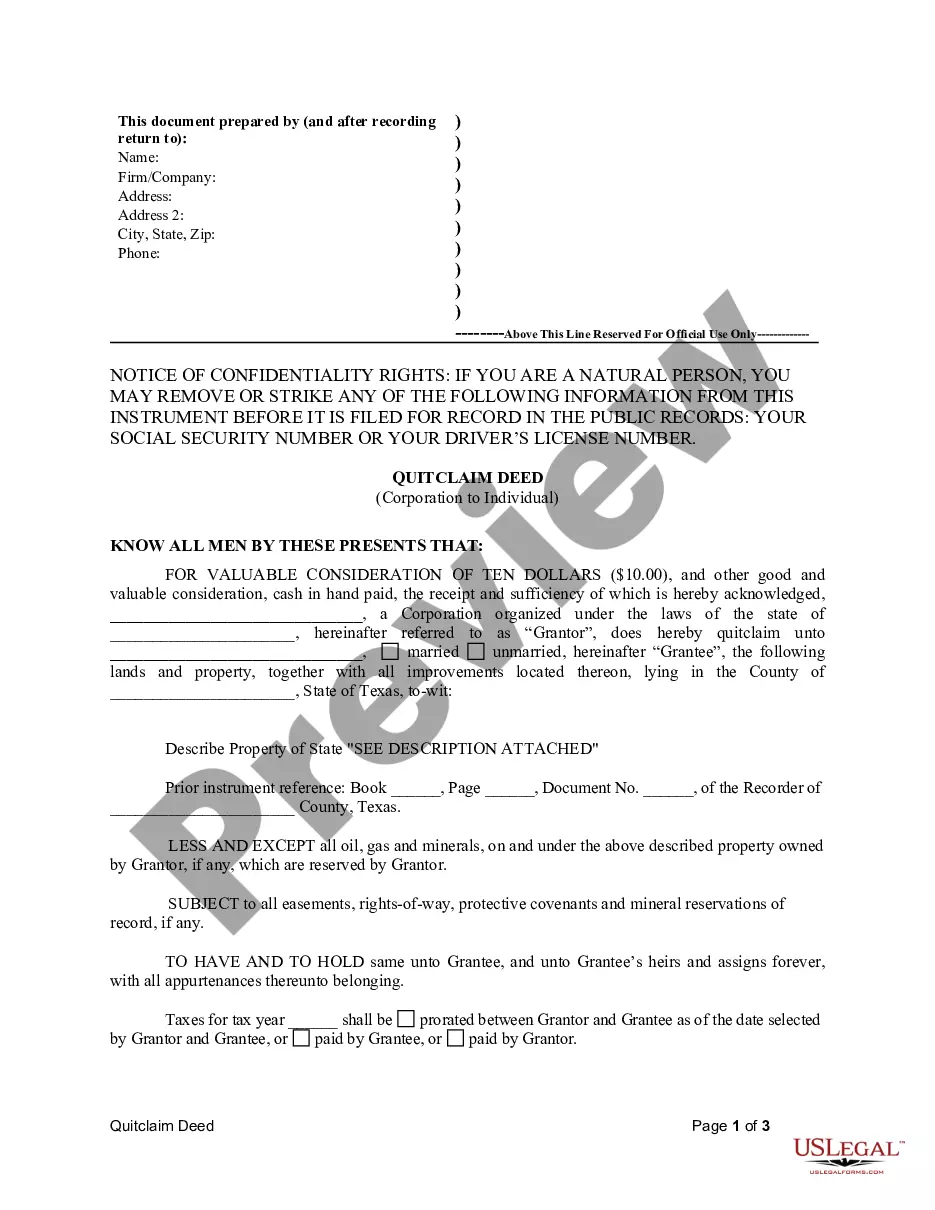

Texas Quitclaim Deed from Corporation to Individual

About this form

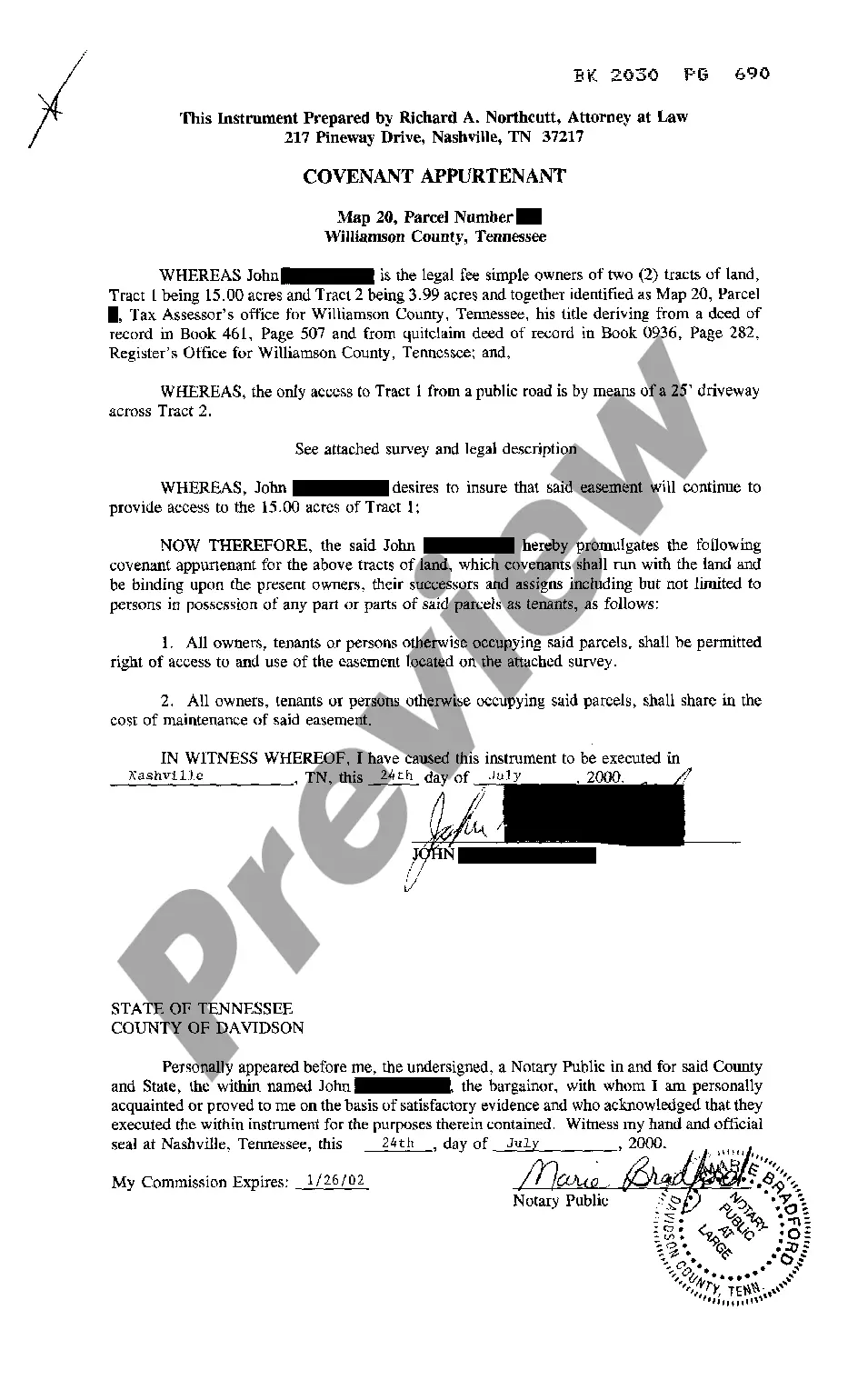

The Quitclaim Deed from Corporation to Individual is a legal document that allows a corporation (the Grantor) to transfer its property rights to an individual (the Grantee). This type of deed is primarily used when the Grantor wants to relinquish any claim to the property without making any warranties about the title. It is important to note that this deed specifically excludes oil, gas, and minerals beneath the property, which are retained by the Grantor. This form is essential for ensuring a clear transfer of property ownership while adhering to state statutory laws.

What’s included in this form

- Parties Involved: Identifies the Grantor (corporation) and Grantee (individual).

- Consideration: States the payment amount (typically ten dollars) for the transfer of property.

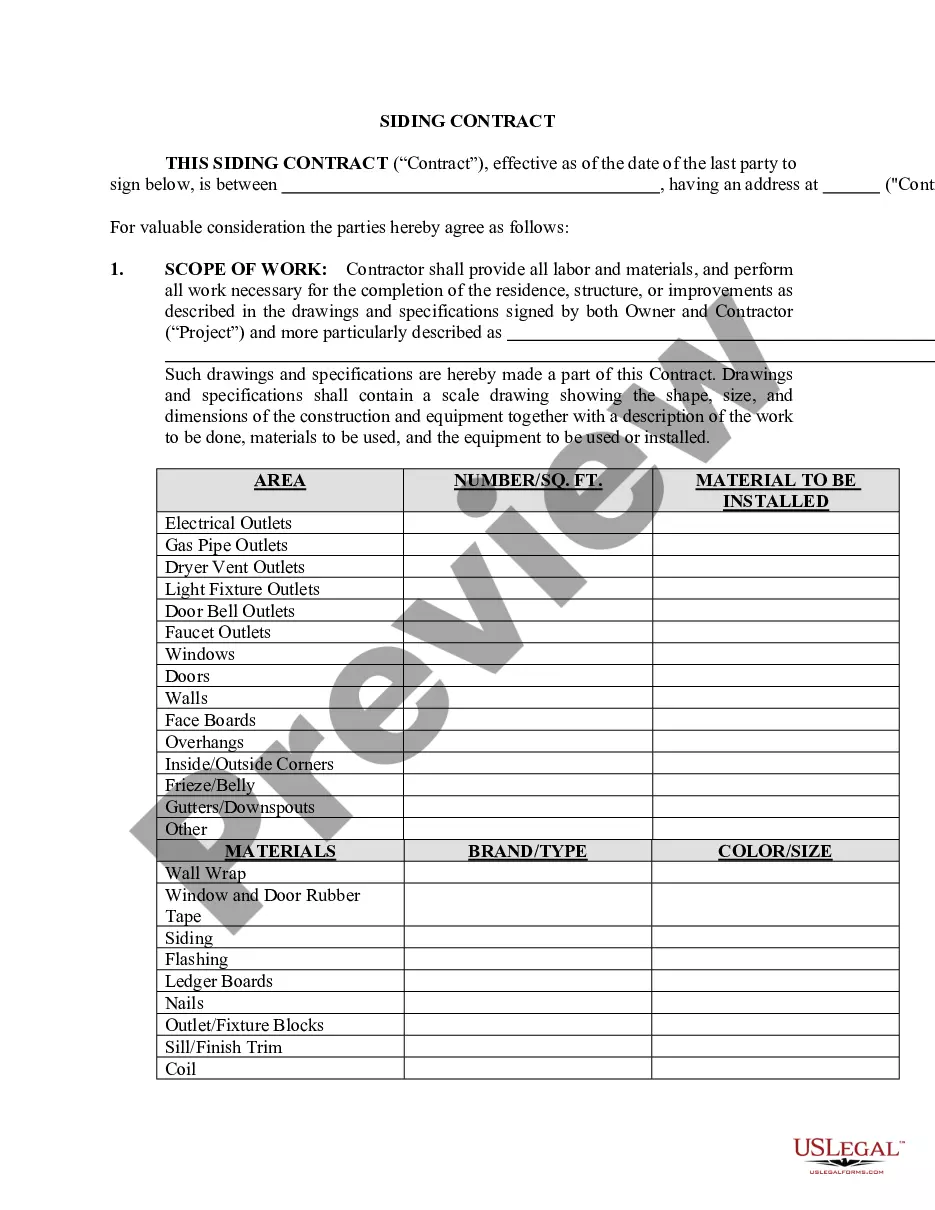

- Property Description: Clearly describes the land and property being transferred.

- Reservation of Rights: Specifies any reserved rights by the Grantor, including oil, gas, and minerals.

- Tax Proration: Outlines how taxes will be handled between Grantor and Grantee.

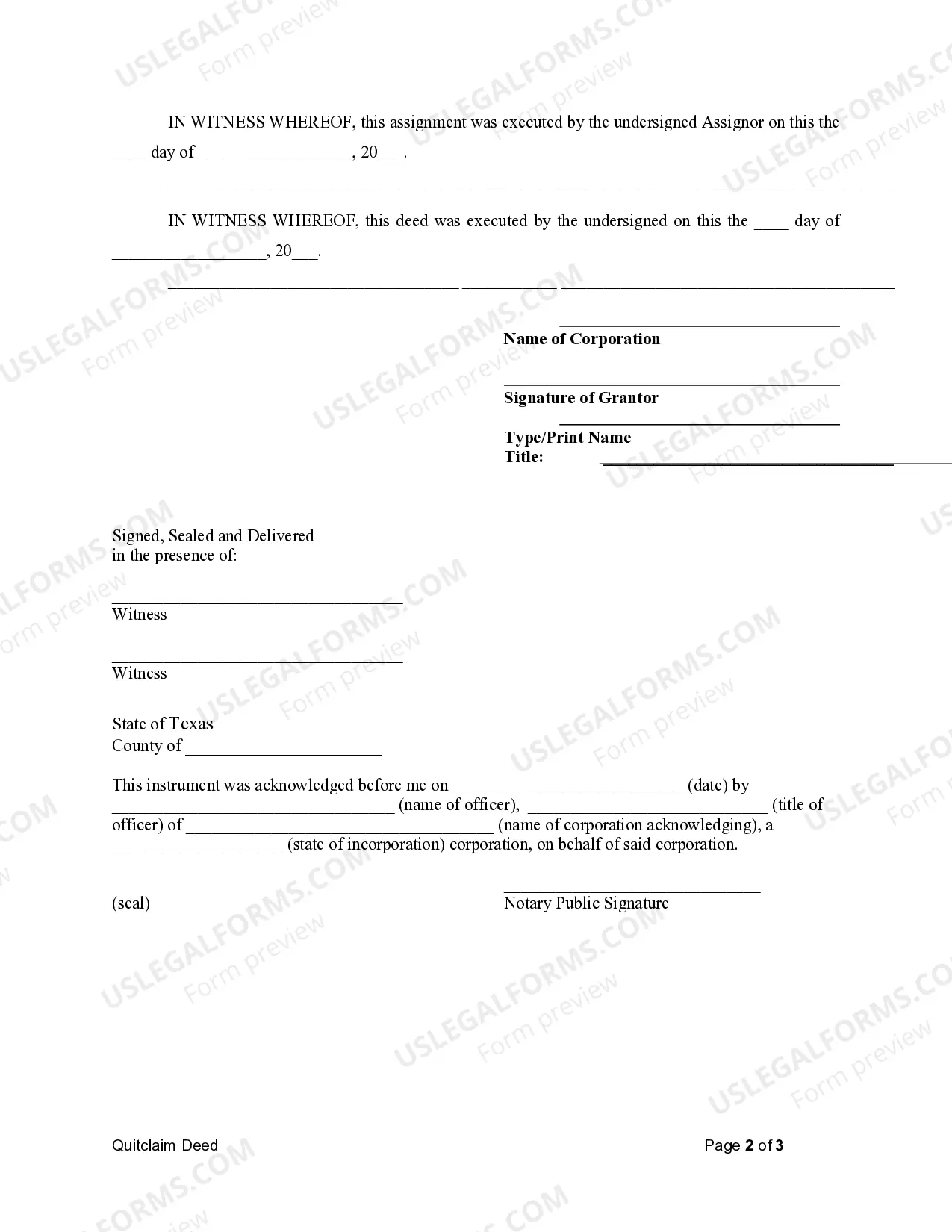

- Execution and Acknowledgment: Requires signatures and notarization to validate the deed.

When to use this document

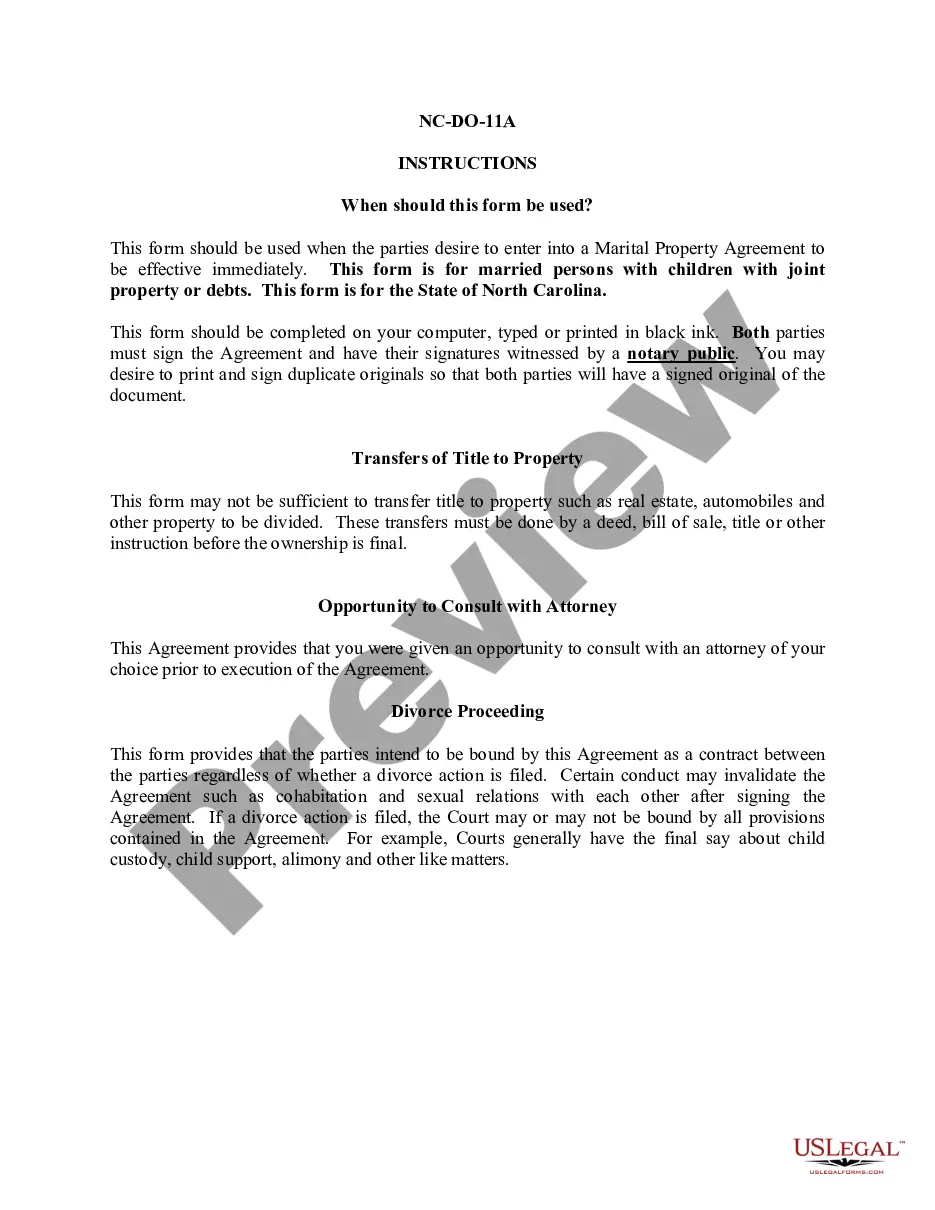

This form is most commonly used when a corporation wants to transfer property ownership to an individual without guaranteeing the property's title. It is often utilized in situations like transferring property for estate planning purposes, selling property to a family member or friend, or simplifying property ownership among business stakeholders. It is also helpful when the parties involved have a trusting relationship and are aware of existing property issues.

Who this form is for

This Quitclaim Deed should be used by:

- Corporations looking to transfer property ownership to individuals.

- Individuals receiving property from a corporation, such as in estate or family transactions.

- Real estate professionals who need a straightforward deed for property transfers.

Steps to complete this form

- Identify the Grantor: Enter the corporation's name and its state of incorporation.

- Identify the Grantee: Provide the individual's name and marital status.

- Describe the Property: Include a clear description of the property being transferred.

- Note the Reservation: Indicate any oil, gas, or mineral rights that the Grantor is retaining.

- Sign and Date: Ensure all parties sign the document and include the date of execution.

- Notarize the Document: Have the deed notarized to confirm the identities of the signatories.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Mistakes to watch out for

- Failing to provide a complete property description, which can lead to legal disputes.

- Not including the required signatures, which invalidates the deed.

- Forgetting to notarize the document, especially if required by state law.

- Leaving out essential tax proration instructions, leading to confusion later.

Benefits of completing this form online

- Convenience: Download and complete the form from anywhere at any time.

- Editability: Easily fill in the details relevant to your specific transaction.

- Legal Assurance: Forms are drafted by licensed attorneys to ensure compliance with state laws.

- Time-saving: Streamlined process eliminates delays in obtaining legal paperwork.

Form popularity

FAQ

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Unlike a general warranty deed, there's no guarantee made as to the ownership. There's no title search completed and no title insurance issued. Lenders wouldn't accept a quitclaim deed being used to purchase a property.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

Transfer property quickly and easily using this simple legal form. You can use a quitclaim deed to:transfer property you own by yourself into co-ownership with someone else. change the way owners hold title to the property.

It does not convey muniment of title. Instead, unlike a warranty deed, which conveys property, a quitclaim deed only conveys whatever interest the grantor has at the time of the transfer.Despite all of this, quitclaim deeds are still a valid, if unreliable, means of transferring title to real property in Texas.

Laws Section 13.002. Recording This form must be filed at the Recorder's Office in the County Clerk's Office. Signing (Section 11.002(c)) The Grantor(s) has the choice of authorizing this form in the presence of Two (2) Witnesses or a Notary Public.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.