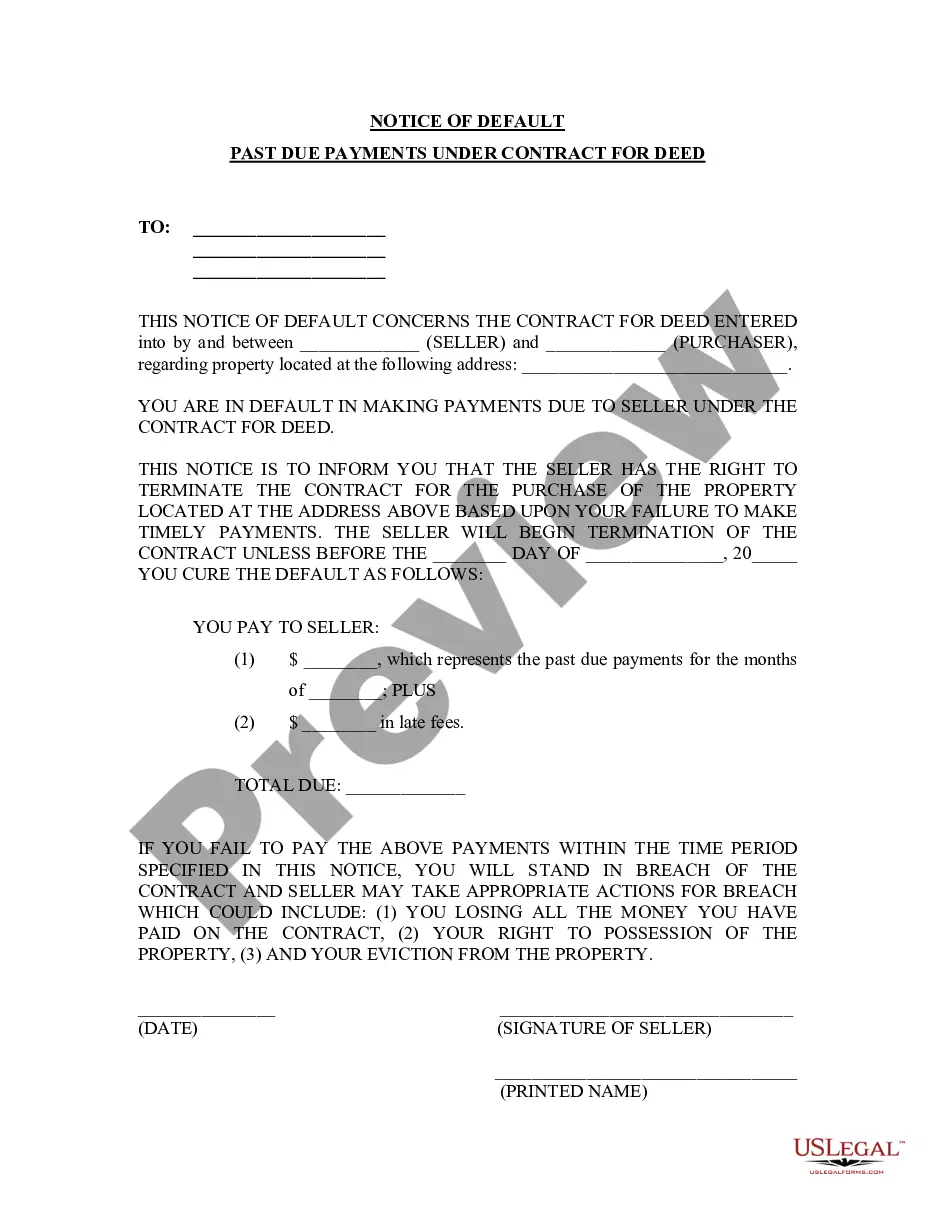

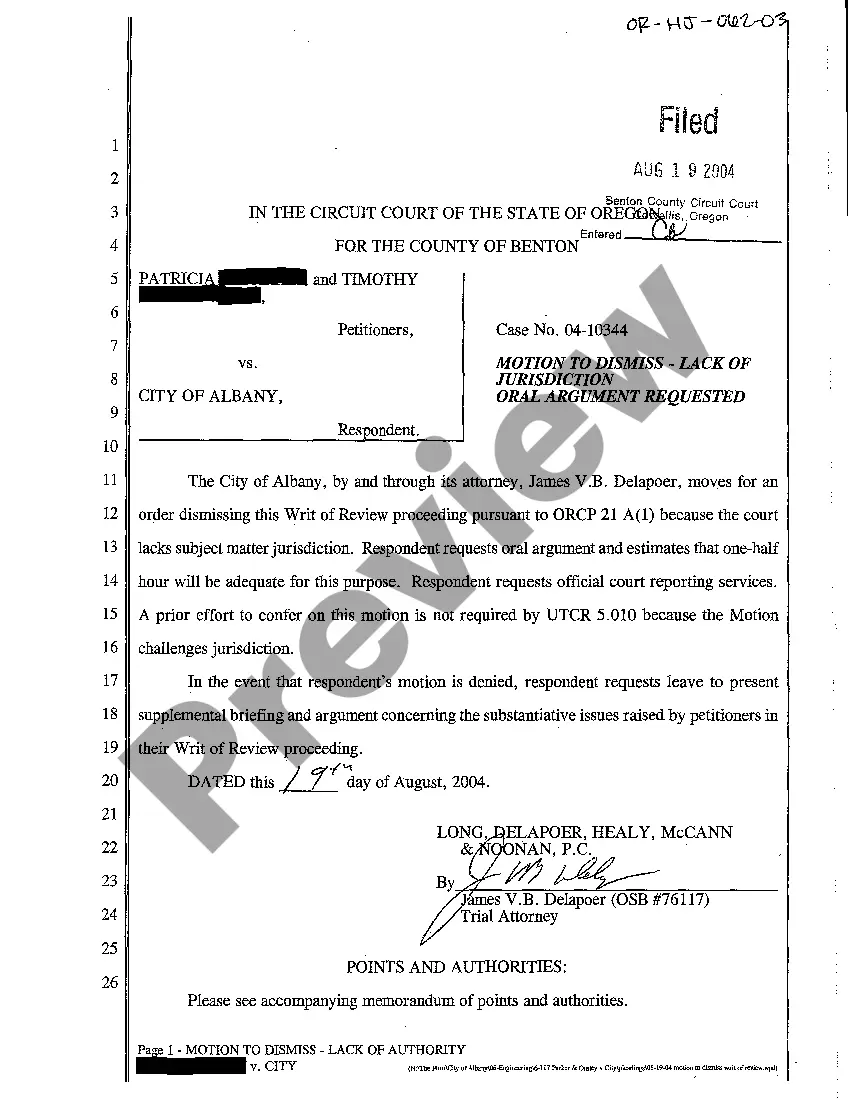

This form is a Warranty Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

South Dakota Warranty Deed from Individual to LLC

Description

How to fill out South Dakota Warranty Deed From Individual To LLC?

Creating documents isn't the most easy task, especially for people who almost never work with legal paperwork. That's why we advise utilizing accurate South Dakota Warranty Deed from Individual to LLC templates made by professional lawyers. It allows you to stay away from troubles when in court or working with official organizations. Find the files you require on our website for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the file webpage. Right after downloading the sample, it will be saved in the My Forms menu.

Customers with no a subscription can quickly create an account. Utilize this brief step-by-step help guide to get your South Dakota Warranty Deed from Individual to LLC:

- Make sure that the document you found is eligible for use in the state it’s required in.

- Confirm the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this file is what you need or utilize the Search field to get another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After doing these easy actions, it is possible to complete the sample in your favorite editor. Recheck filled in info and consider asking an attorney to review your South Dakota Warranty Deed from Individual to LLC for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

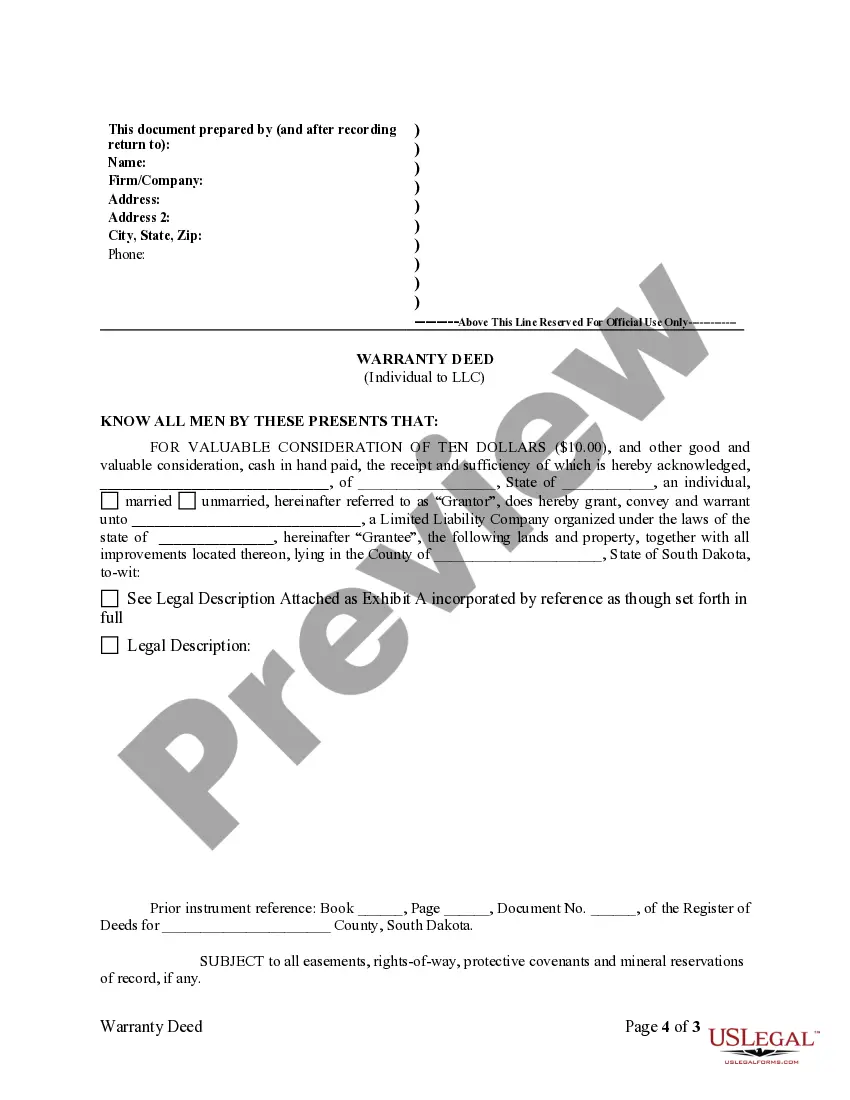

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

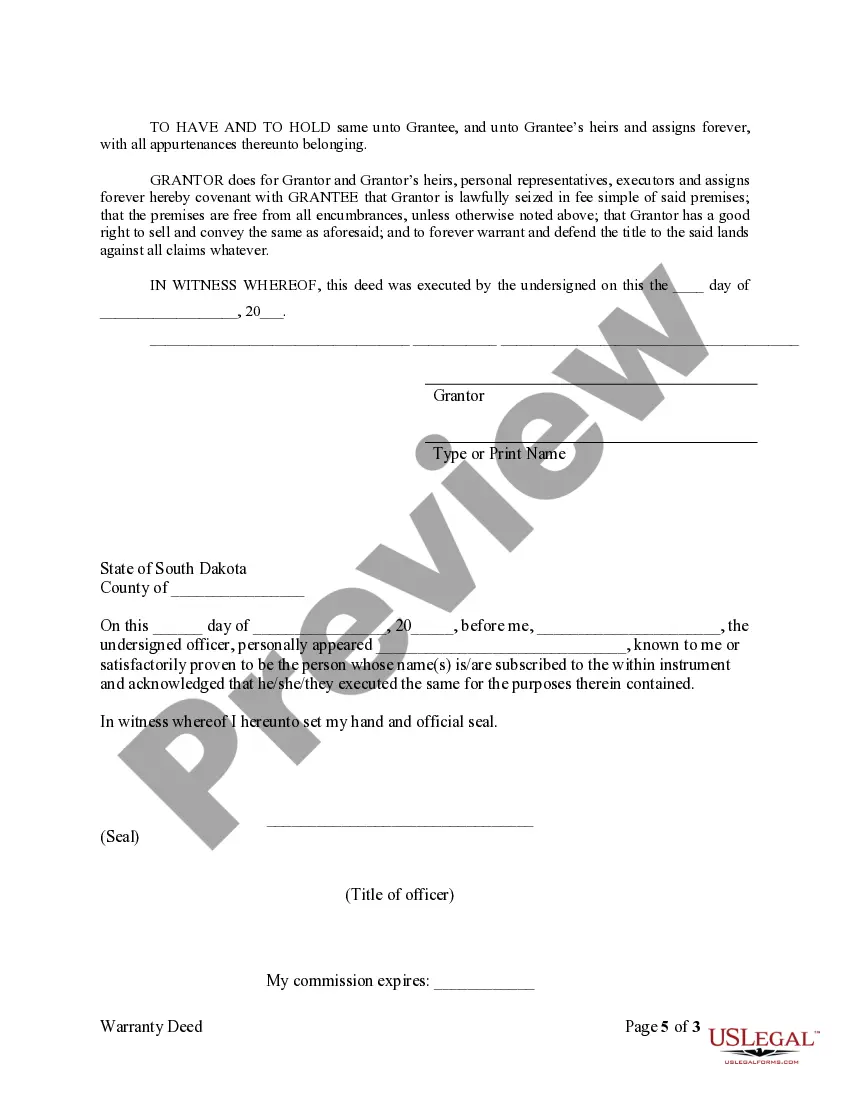

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

The deed did not meet the written requirements (such as if it failed to accurately describe the property); The deed was forged; The deed was induced by fraud, misrepresentation, coercion, duress, or undue influence; The deed was not delivered, or not delivered properly, and there was no acceptance by the grantee.