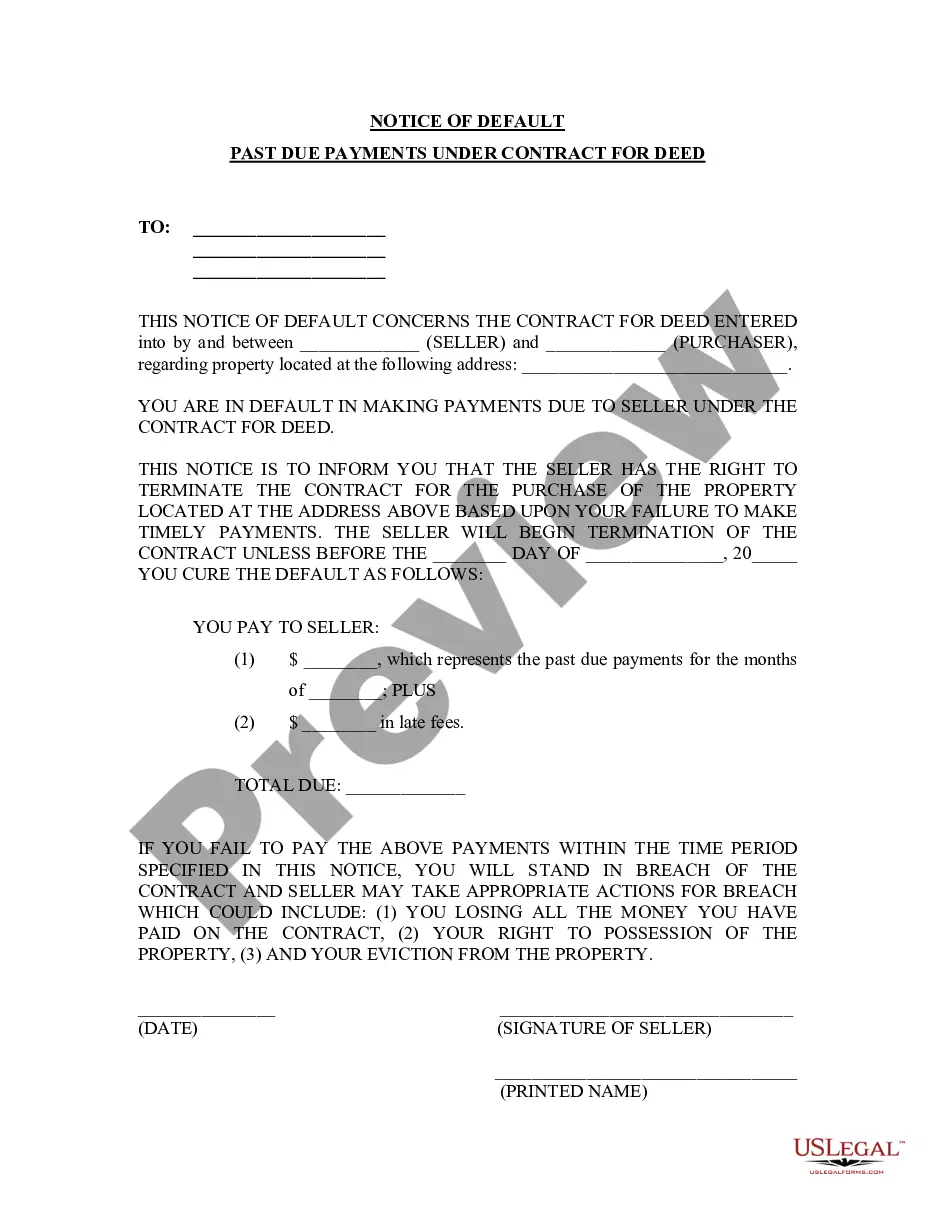

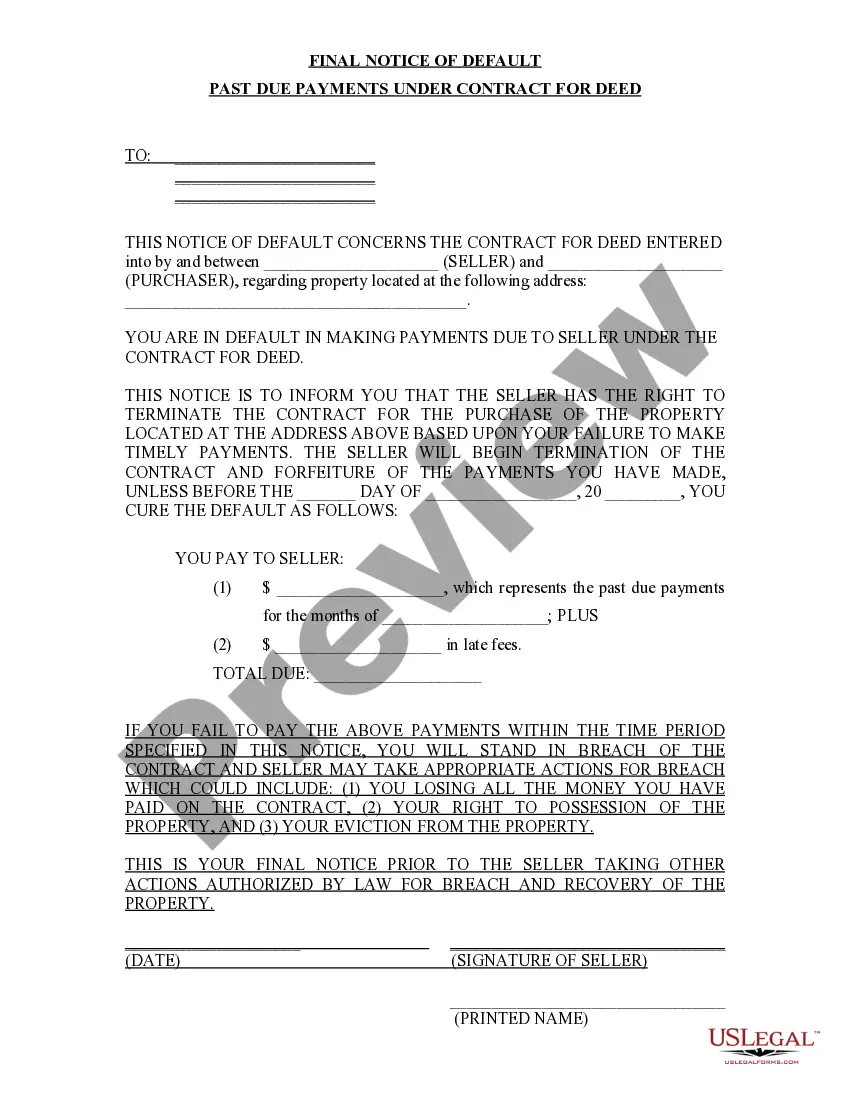

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Virginia Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Virginia Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Use US Legal Forms to get a printable Virginia Notice of Default for Past Due Payments in connection with Contract for Deed. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library on the web and offers cost-effective and accurate templates for customers and lawyers, and SMBs. The templates are grouped into state-based categories and many of them can be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Virginia Notice of Default for Past Due Payments in connection with Contract for Deed:

- Check out to ensure that you get the right template in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Virginia Notice of Default for Past Due Payments in connection with Contract for Deed. More than three million users have used our service successfully. Choose your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

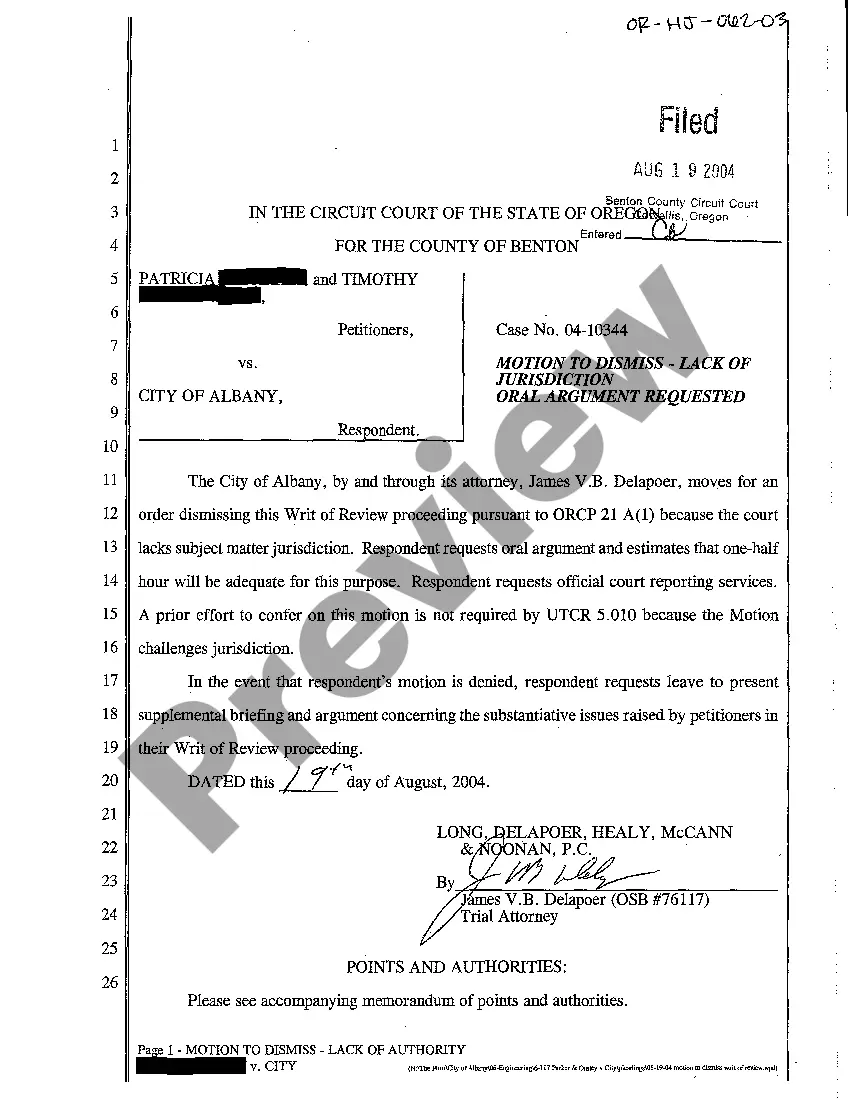

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

How long does it take to foreclose a property in Virginia? Depending on the timing of the various required notices, it usually takes approximately 60-90 days to effectuate an uncontested non-judicial foreclosure.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Redeeming the Property Before the Sale One way to stop a foreclosure is by redeeming the property.Virginia law, however, doesn't provide a post-sale redemption period after a nonjudicial foreclosure.

Generally, after the court declares a foreclosure, the property will be auctioned off to the highest bidder. The borrower has two hundred forty (240) days from the date of the sale to redeem the property by paying the amount for which the property was sold, plus six (6) percent interest.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

In a foreclosure by judicial sale, the redemption period is six months from the date of the foreclosure decree, unless the court orders a shorter time. Redemption is also available before the sale takes place, even if the initial redemption period expired.