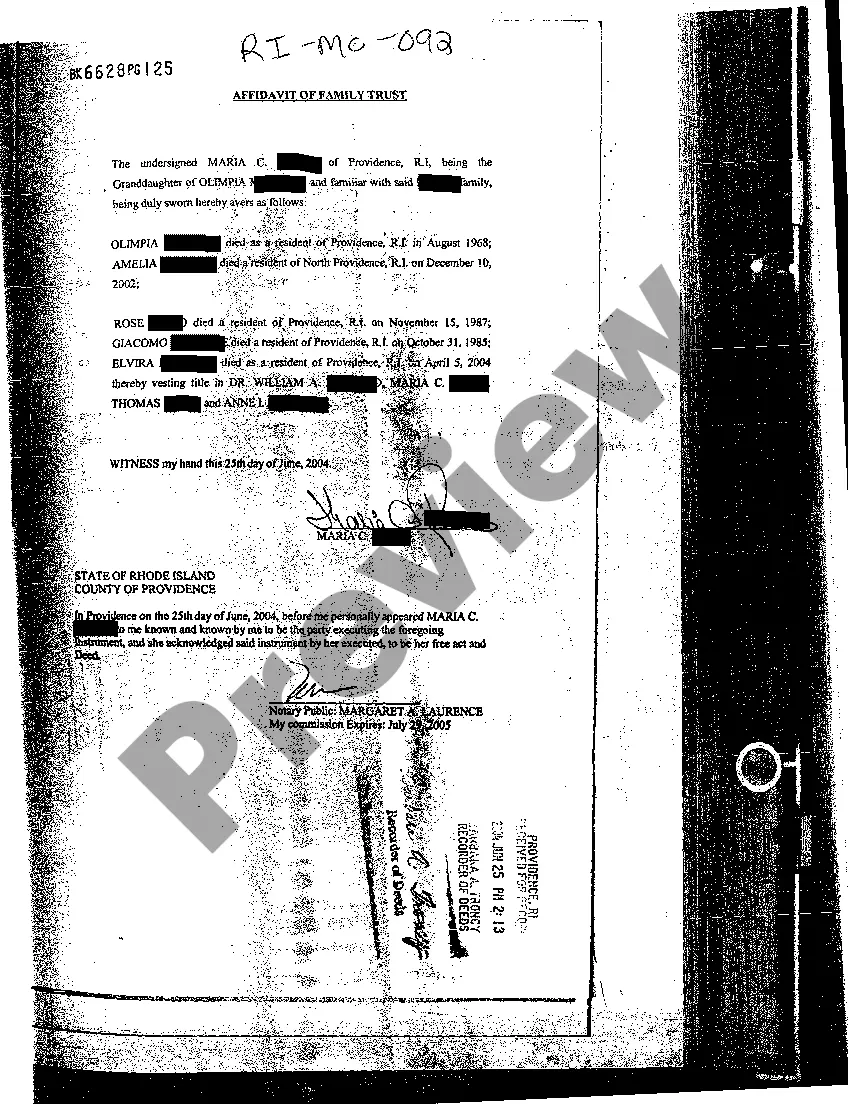

Rhode Island Affidavit of Family Trust

Description

How to fill out Rhode Island Affidavit Of Family Trust?

Among hundreds of paid and free examples that you can get on the net, you can't be certain about their accuracy and reliability. For example, who made them or if they are competent enough to take care of what you require these people to. Keep calm and use US Legal Forms! Locate Rhode Island Affidavit of Family Trust templates made by skilled attorneys and get away from the costly and time-consuming procedure of looking for an lawyer or attorney and after that paying them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access your earlier downloaded files in the My Forms menu.

If you’re making use of our website the first time, follow the instructions listed below to get your Rhode Island Affidavit of Family Trust quickly:

- Make certain that the document you see is valid in your state.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you’ve signed up and paid for your subscription, you can utilize your Rhode Island Affidavit of Family Trust as often as you need or for as long as it stays active where you live. Change it with your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Registration of a living trust doesn't give the court any power over the administration of the trust, unless there's a dispute.To register a revocable living trust, the trustee must file a statement with the court where the trustee resides or keeps trust records.

Trusts are private documents and they typically remain private even after someone dies. The only way to obtain a copy of the Trust is to demand a copy from the Trustee (or whoever has a copy of the documents, if not the Trustee).

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.

Generally, the administration involved in collecting straightforward Estate assets like bank account money will take between 3 to 6 weeks. However, there can be more complexities involved with shareholdings, property and some other assets, which can increase the amount time it takes before any inheritance is received.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private. The trustee maintains a record of all trust property in a trust portfolio.

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private.After the trust grantor dies, the trustee distributes all the trust's property to trust beneficiaries.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.