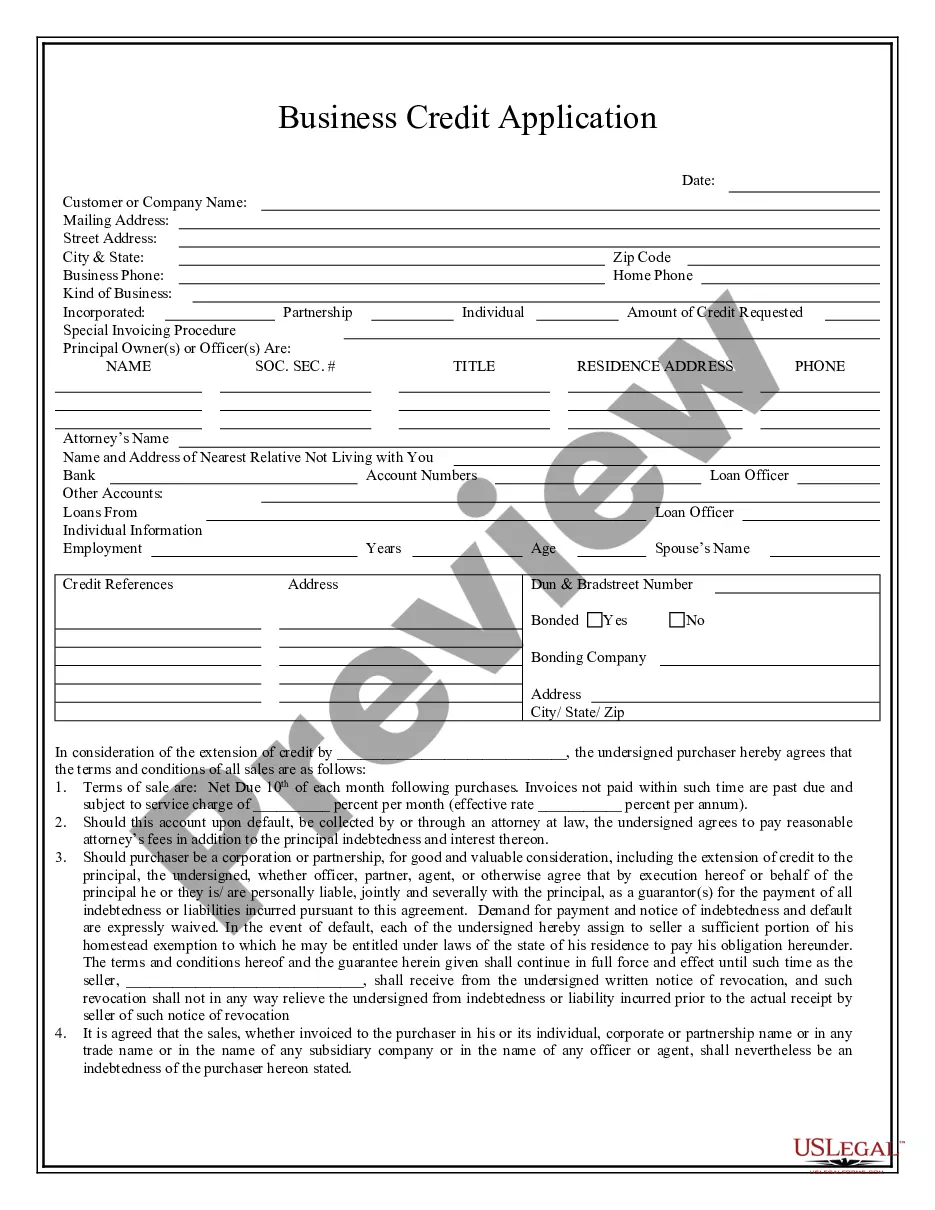

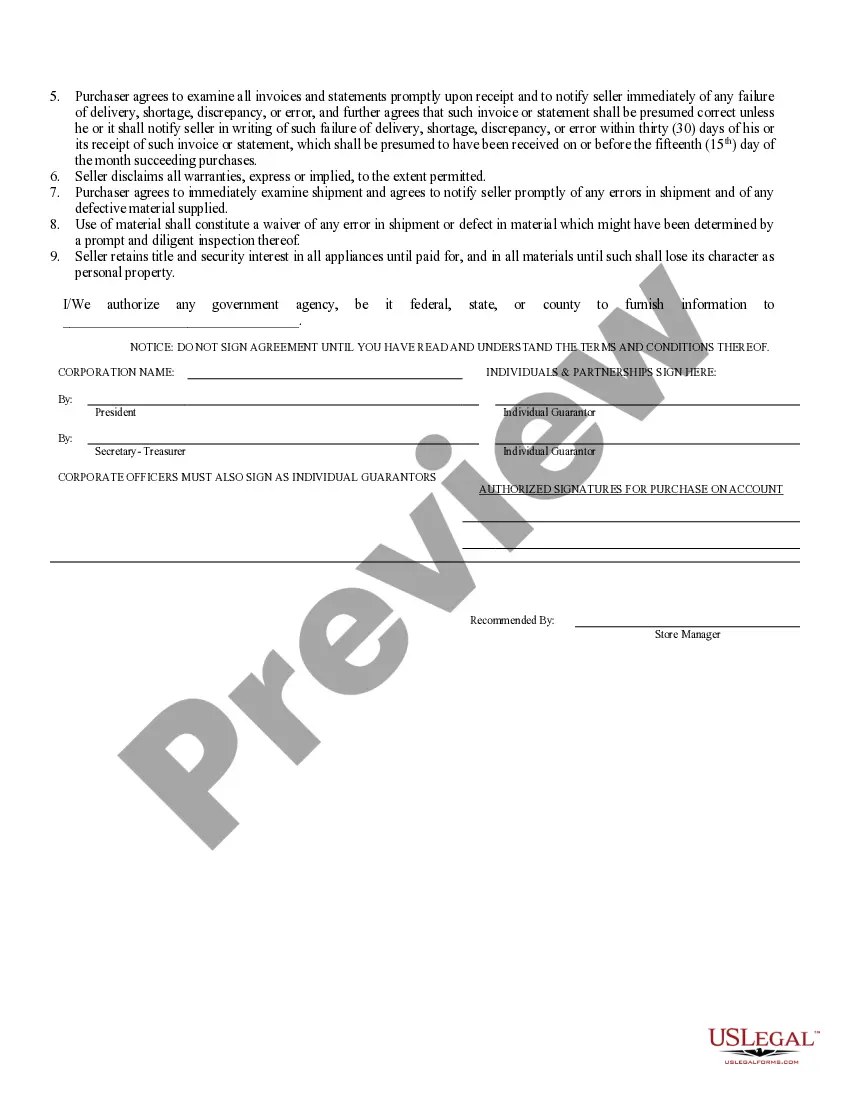

Rhode Island Business Credit Application

Description

How to fill out Rhode Island Business Credit Application?

The work with papers isn't the most easy task, especially for people who rarely deal with legal papers. That's why we recommend utilizing correct Rhode Island Business Credit Application templates made by professional attorneys. It gives you the ability to eliminate difficulties when in court or handling official institutions. Find the samples you want on our website for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can quickly get an account. Use this brief step-by-step help guide to get the Rhode Island Business Credit Application:

- Be sure that the sample you found is eligible for use in the state it is required in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this sample is what you need or utilize the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After doing these straightforward steps, you can complete the form in your favorite editor. Double-check filled in info and consider requesting a lawyer to examine your Rhode Island Business Credit Application for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

Decide on a name for your business. Assign a registered agent for service of process. Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. File for pass-through withholding tax.

Choose a business name. File an assumed business name with the city or town clerk. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Name Your Rhode Island LLC. Choose Your Registered Agent. Prepare and File Articles of Organization. Receive a Certificate From the State. Create an Operating Agreement. Get an Employer Identification Number.

How much does it cost to form an LLC in Rhode Island? The Rhode Island Secretary of State charges $150 to file the Articles of Organization. You can reserve your LLC name with the Rhode Island Secretary of State for $50.

Gather required information. Name of Company. Get proof of good standing or legal existence. Register your business. Register with the RI Division of Taxation. Confirm your filing.

Step 1: Choose a Business Idea. Step 2: Write a Business Plan. Step 3: Select a Business Entity. Step 4: Register a Business Name. Step 5: Get an EIN. Step 6: Open a Business Bank Account. Step 7: Apply for Business Licenses & Permits. Step 8: Find Financing.

Choose a business name. File an assumed business name with the city or town clerk. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.