Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

About this form

The Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor with Annuity is a legal document designed to manage and distribute the assets of a trustor during and after their lifetime. This type of irrevocable trust allows the trustor to receive income from the trust while also ensuring that their spouse will have financial support following their death. It differs from other trusts by specifically incorporating annuity payments, which provide regular distributions to beneficiaries, making it a practical option for ongoing financial needs.

Main sections of this form

- Trust Agreement: Details the parties involved, including the Trustor and Trustee.

- Trust Estate: Specifies the property included in the trust and its management.

- Disposition of Principal and Income: Outlines how the trust assets will be distributed during and after the trustor's life.

- Invasion of Principal: Allows the trustee to access the principal for the surviving spouse's needs.

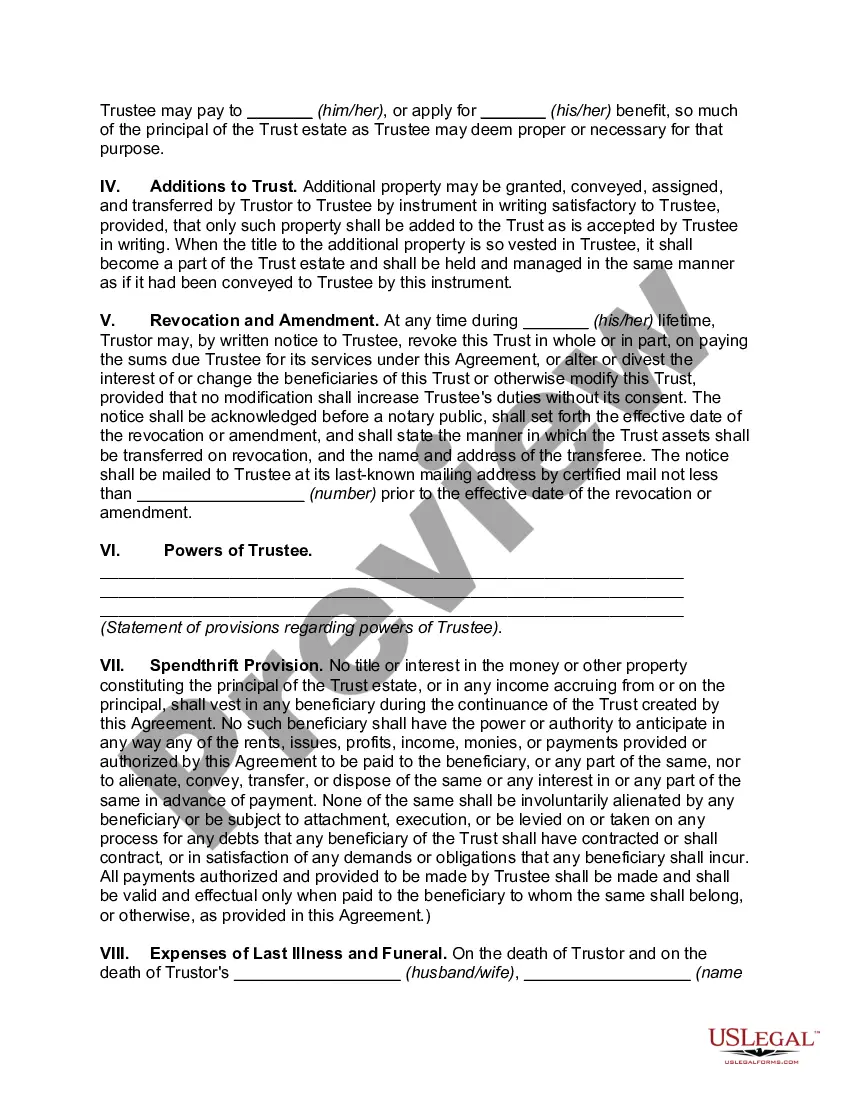

- Revocation and Amendment: Describes the terms under which the trust can be revoked or modified.

- Successor Trustee: Identifies who will take over management of the trust if the trustee can no longer act.

Jurisdiction-specific notes

This form is suitable for use across multiple states but may need changes to align with your state’s laws. Review and adapt it before final use.

When to use this form

This form is useful in scenarios where an individual wants to set up a trust that benefits them during their lifetime and ensures ongoing financial support for their surviving spouse after their death. It is particularly beneficial for individuals with significant assets or those who want to avoid probate, as it provides clear instructions on the distribution of trust assets and can help manage complex financial situations.

Intended users of this form

- Individuals looking to secure their financial future and that of their spouse.

- Those who wish to manage their assets through a trust while benefiting from annuity payments.

- People who want to minimize probate complexities and ensure a smooth transition of assets after death.

Steps to complete this form

- Identify the parties: Fill in the names of the Trustor and Trustee, along with their addresses.

- Specify the property: Itemize the property that will be included in the trust estate in Exhibit A.

- Enter income details: Determine the annuity payment amounts and the dates for distribution to the Trustor and surviving spouse.

- Designate the successor trustee: Name a successor trustee in case the original trustee is unable to fulfill their duties.

- Review legal requirements: Ensure compliance with your state's laws for validity and execution of the trust.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Typical mistakes to avoid

- Failing to adequately itemize the property included in the trust.

- Not specifying conditions for the distribution of assets clearly.

- Neglecting to name a successor trustee, which can lead to management issues.

- Forgetting to review state-specific laws that may affect the trust's validity.

Why use this form online

- Convenience of downloading the form anytime, anywhere.

- Editability allows you to customize the trust according to your unique needs.

- Reliability of having a legally drafted document that complies with state laws.

Form popularity

FAQ

A revocable trust becomes irrevocable at the death of the person that created the trust.The Trust becomes its own entity and needs a tax identification number for filing of returns. 2. The Grantor (also called the Trustor) of the Trust becomes incapacitated.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

When the maker of a revocable trust, also known as the grantor or settlor, dies, the assets become property of the trust. If the grantor acted as trustee while he was alive, the named co-trustee or successor trustee will take over upon the grantor's death.

Assets in a revocable living trust will avoid probate at the death of the grantor, because the successor trustee named in the trust document has immediate legal authority to act on behalf of the trust (the trust doesn't die at the death of the grantor).

The procedure for settling a trust after death entails: Step 1: Get death certificate copies. Step 2: Inventory the assets in the estate. Step 3: Work with a trust attorney to understand the grantor's distribution wishes, timelines, and fiduciary responsibilities. Step 4: Asset appraisal. Step 5: Pay taxes.

For capital gains purposes, the value of the assets would be equal to their value when you inherited them. Assets that have been conveyed into a revocable living trust do get a step-up in basis when they are distributed to the beneficiaries after the passing of the grantor.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

The Revocable Trust tax implications, following the death of the Grantor, impact both the Grantor's Estate and the Beneficiaries'.However, any income earned by the Trust assets or principal after the date of the Grantor's death is reported in a separate tax return for the Trust.