Pennsylvania Warranty Deed to Child Reserving a Life Estate in the Parents

What this document covers

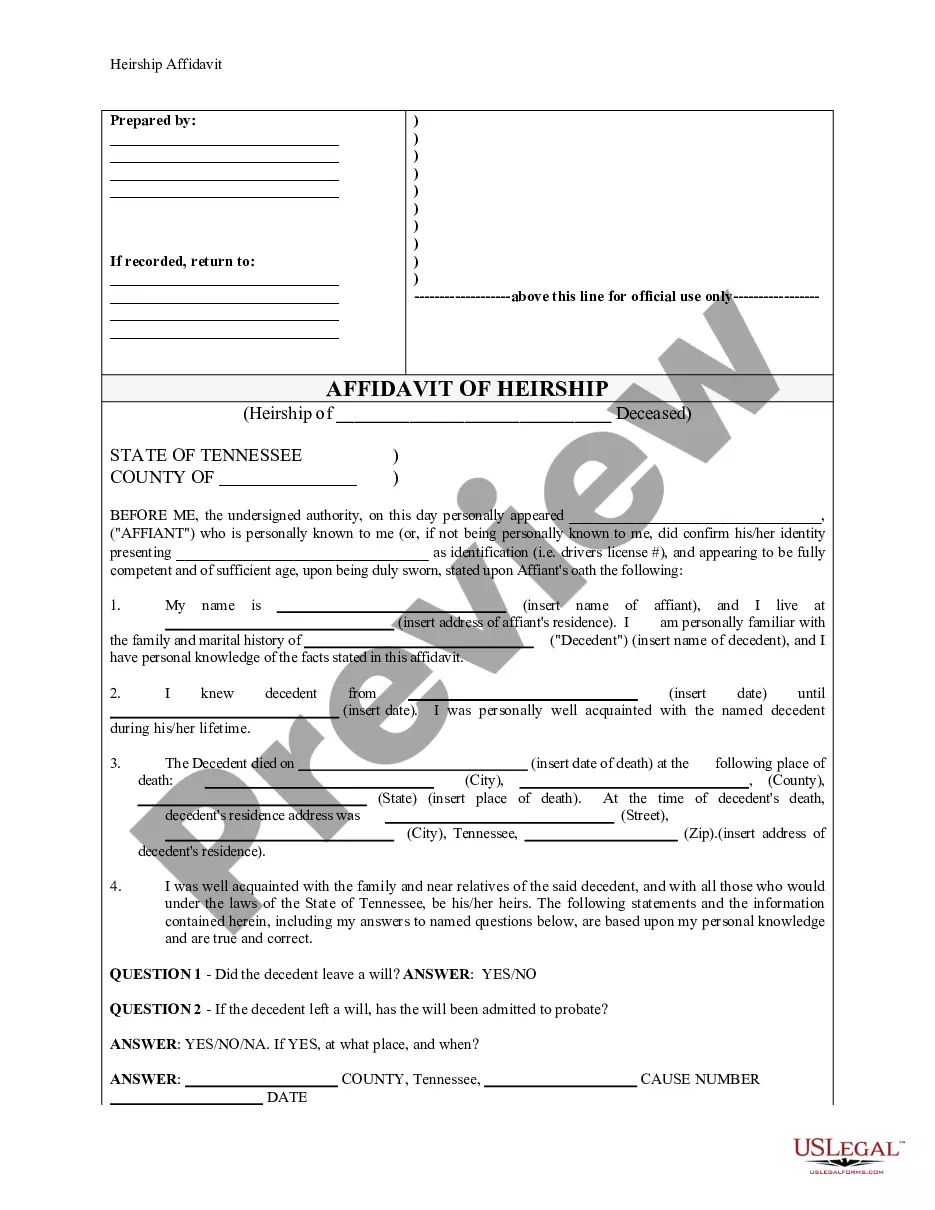

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer property to their child while retaining the right to use and enjoy the property during their lifetime. This form is distinct because it reserves a life estate, which means the parents will not lose their rights to the property until their passing. It is essential for individuals who wish to gift property to their children while ensuring they can continue to benefit from it until they die.

Form components explained

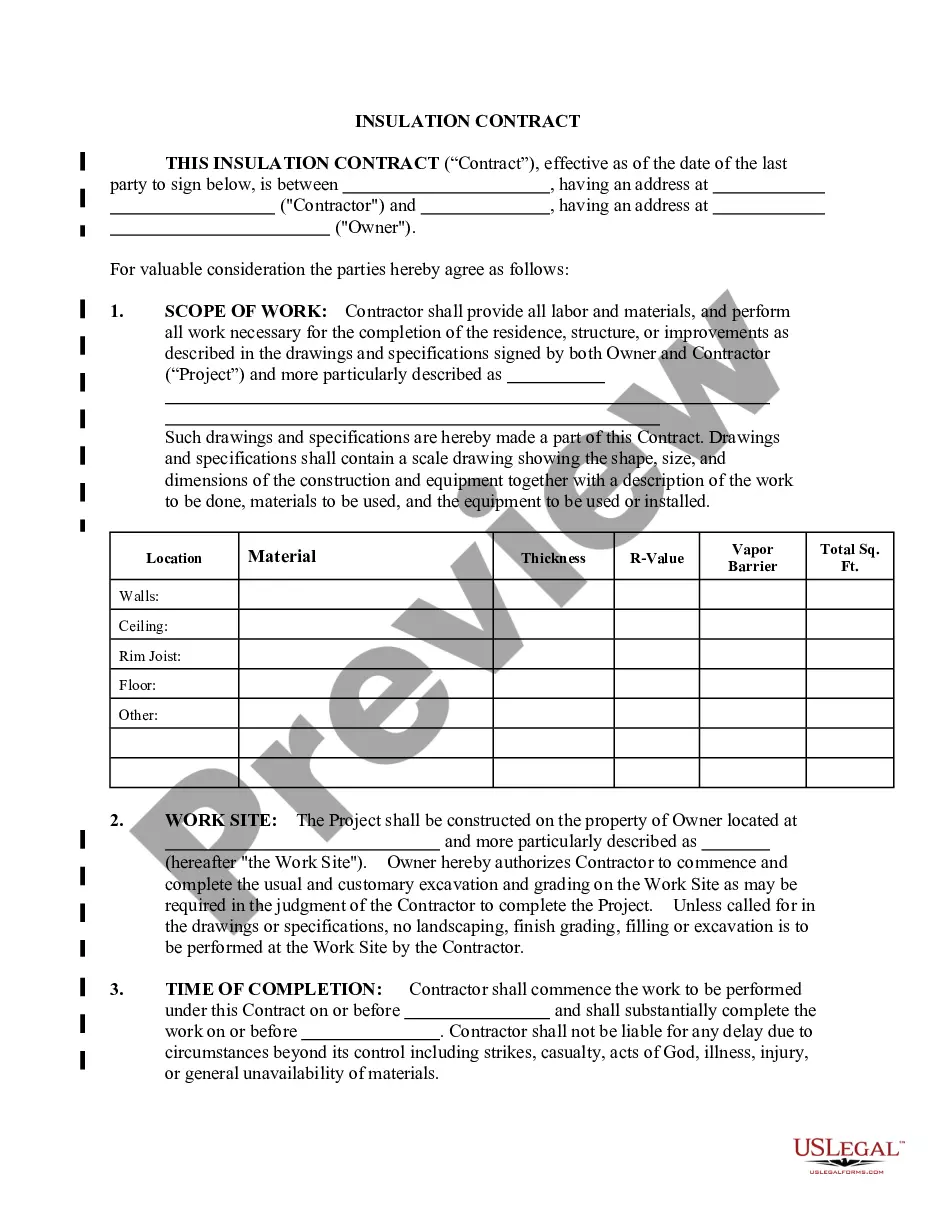

- Identification of grantors (parents) and grantee (child).

- Legal description of the property being transferred.

- Reservation of a life estate, specifying the rights retained by the grantors.

- Conditions under which the transfer takes place, including any financial considerations.

- Legal assurances from the grantors against future claims on the property.

When to use this document

This form is appropriate when parents want to transfer ownership of a property to their child while continuing to live in and control the property until their death. It is often used in estate planning to avoid probate and to ensure that the property passes directly to the child without further legal complications. Other circumstances may include the desire to provide a home for a child while safeguarding the parents' rights to the property.

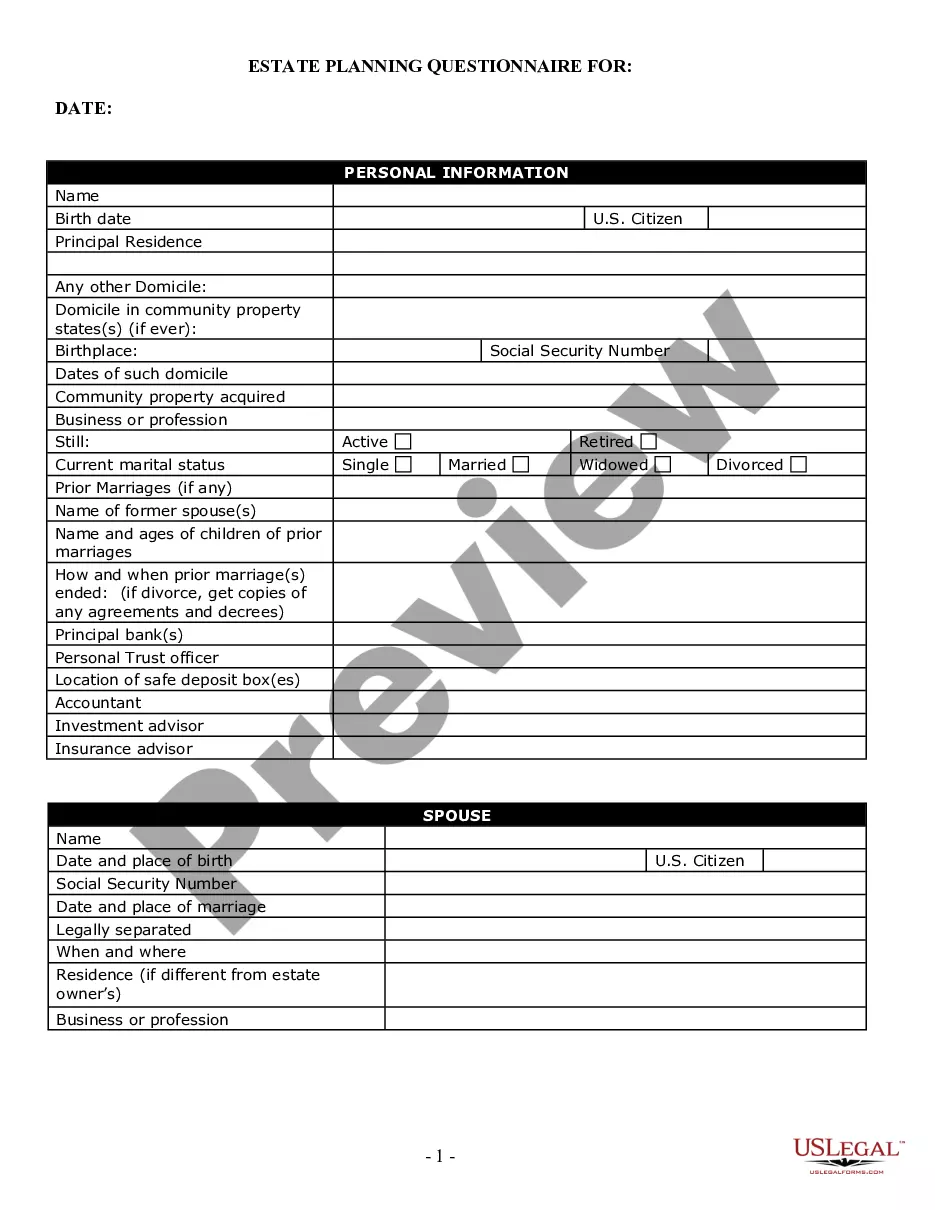

Intended users of this form

- Parents wishing to transfer their property to their child while retaining the right to use it.

- Individuals planning their estates to minimize tax implications or avoid probate.

- Anyone seeking to document the transfer of property clearly and formally.

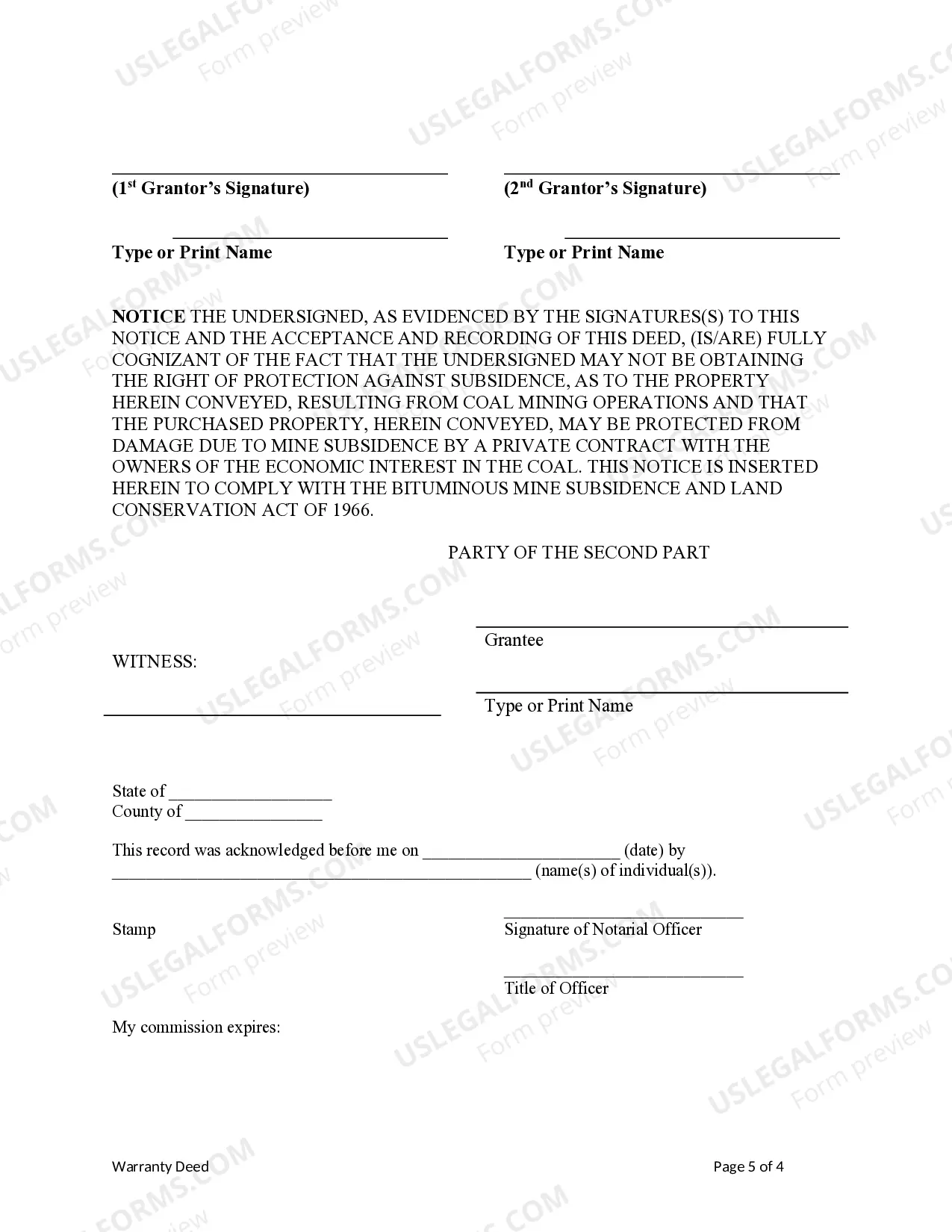

Instructions for completing this form

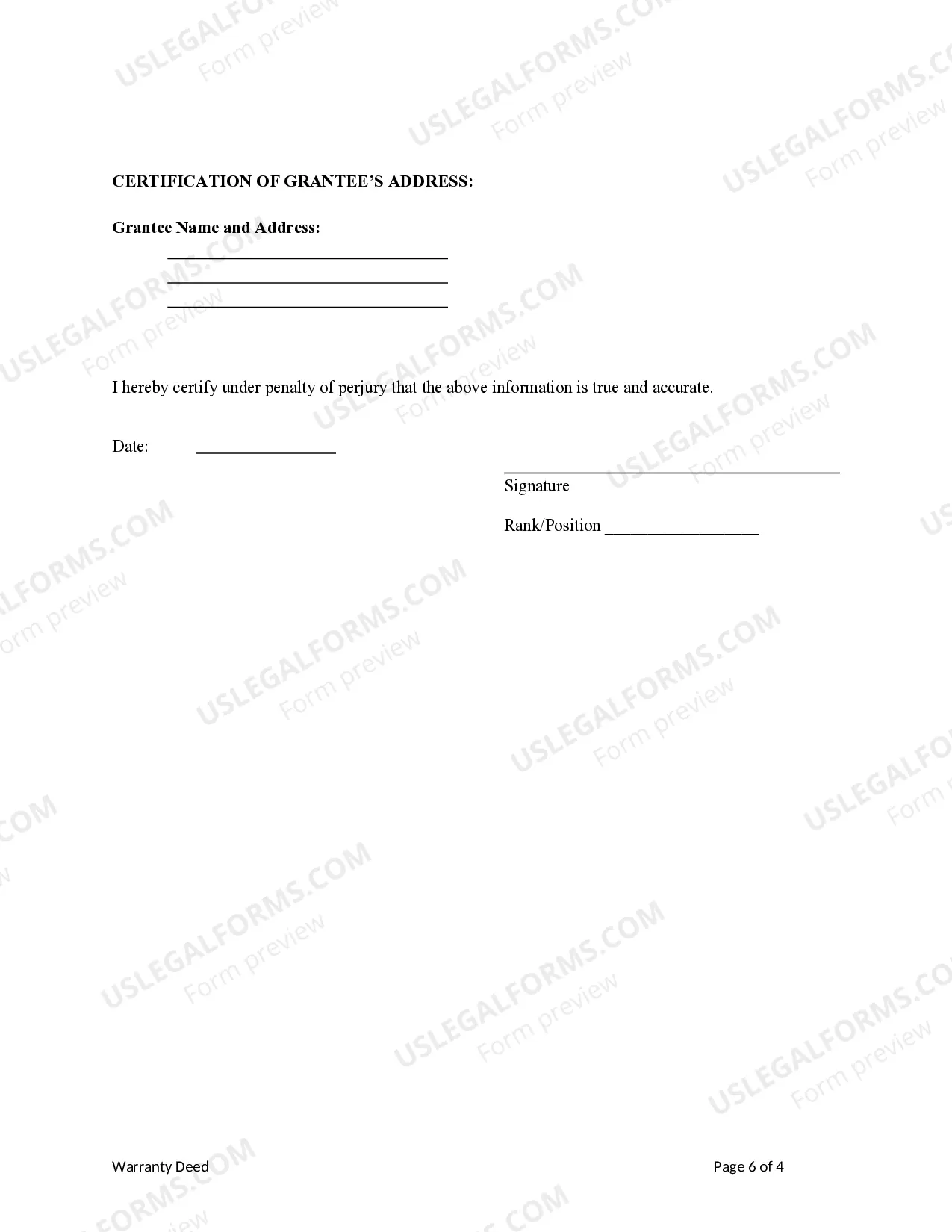

- Identify the parties involved: the grantors (parents) and grantee (child).

- Clearly describe the property being transferred, including the legal description.

- Indicate the reservation of life estate, specifying the grantors' rights.

- Prepare any necessary signatures and dates for the document.

- Consider whether notarization is required based on state laws.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not clearly specifying the reservation of life estate.

- Incomplete signatures or dates, rendering the document invalid.

- Neglecting to consult state-specific legal requirements.

Why use this form online

- Immediate access to downloadable legal forms without the need for physical appointments.

- Editability allows users to tailor the form to their specific circumstances.

- Reliability, as forms are drafted by licensed attorneys to ensure compliance with current laws.

Main things to remember

- The warranty deed allows parents to transfer property to their child while retaining living rights.

- Important components include property description, consideration, life estate reservation, and proper execution.

- Utilize this form for effective estate planning and to avoid probate complexities.

Form popularity

FAQ

Life Tenant Owner: The Life Tenant can be one individual or there can be joint Life Tenants. The Life Tenant remains responsible for real estate taxes, insurance, and ordinary maintenance costs related to the property and is still eligible for real estate tax abatements & exemptions.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.