Oregon Notice of Intent to Foreclose - Individual

Overview of this form

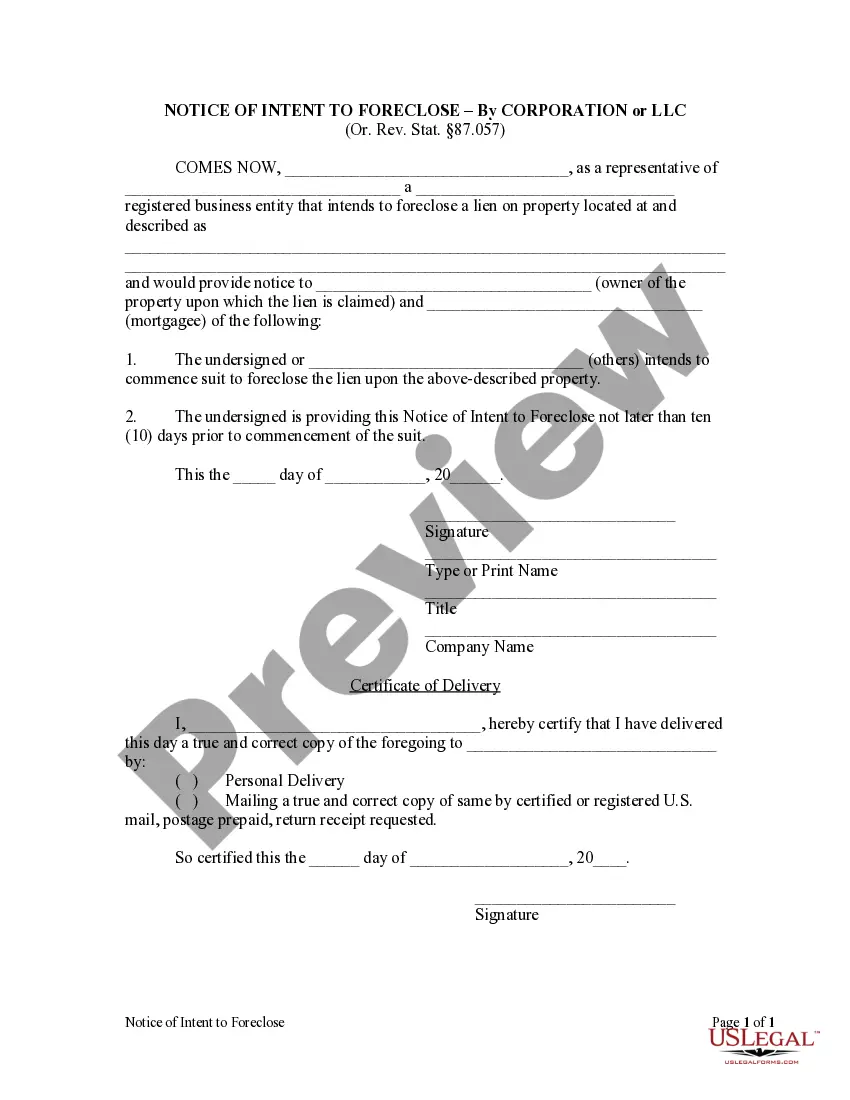

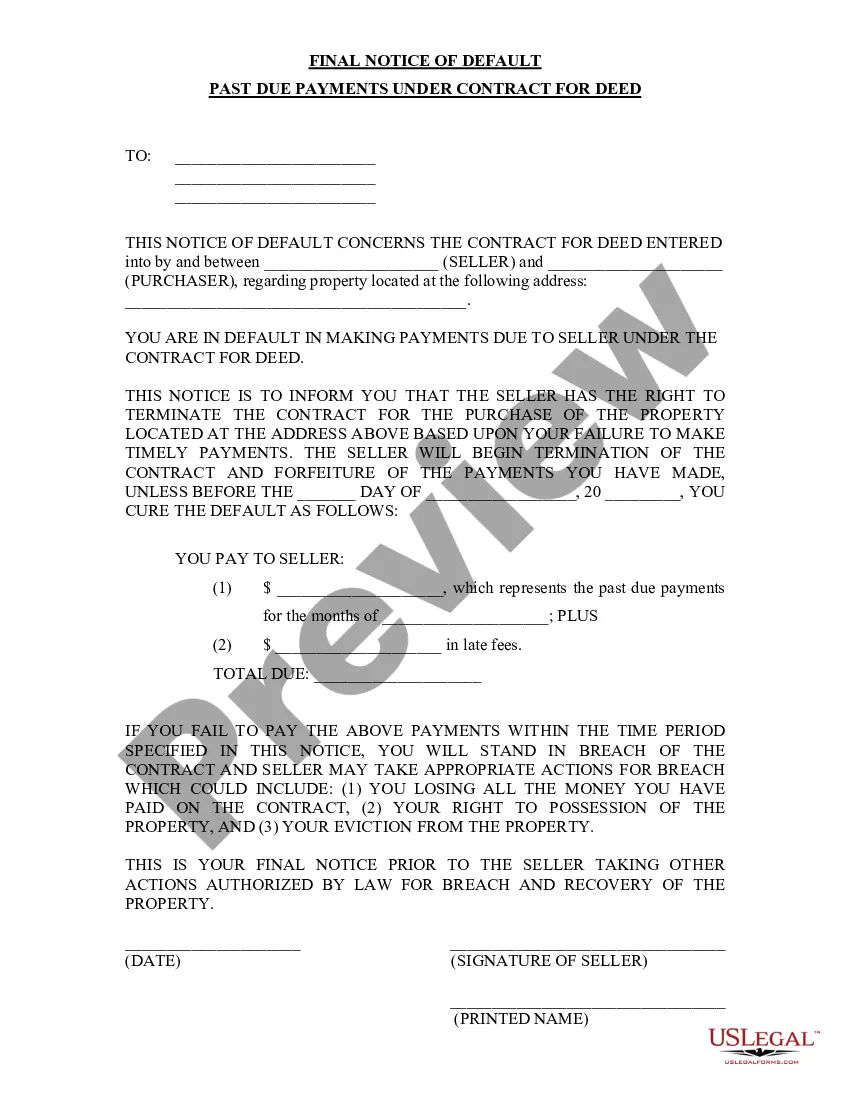

The Notice of Intent to Foreclose is a legal document used by an individual who plans to initiate a foreclosure action on a property lien. This form serves as official notice to the property owner and the mortgagee, informing them of the intent to start a foreclosure suit within ten days. It is distinct from other foreclosure-related forms as it specifically addresses the preliminary notice requirement before commencing legal action.

What’s included in this form

- Identifies the individual intending to foreclose and the specific property involved.

- Clearly states the intent to initiate foreclosure proceedings.

- Includes verification that notice is provided within ten days before filing the suit.

- Requires signatures from the notifying individual and a certificate of delivery to confirm receipt by the owner and mortgagee.

Common use cases

This form should be used when an individual has a lien on a property and intends to foreclose on that lien. It is typically necessary when the property owner has not fulfilled their obligations, prompting the lienholder to take legal action to recover the owed amount by taking possession of the property. Using this notification helps comply with legal requirements before officially filing a lawsuit.

Who needs this form

- Individuals holding a lien on a property who wish to foreclose.

- Property owners facing potential foreclosure and needing to be informed of impending legal action.

- Mortgages or lenders involved in disputes over property liens.

How to prepare this document

- Identify and enter your name as the individual intending to foreclose.

- Provide a detailed description of the property subject to the lien.

- Fill in the names of the property owner and mortgagee who will be notified.

- State the date when the notice is being provided.

- Sign the form and provide your printed name.

- Complete the Certificate of Delivery, noting how you delivered the notice (e.g., personal delivery or via mail).

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Common mistakes to avoid

- Failing to provide the notice within the required ten-day timeframe.

- Not including complete property descriptions, which can delay proceedings.

- Neglecting to sign the form or provide your printed name.

- Incorrectly filling out the Certificate of Delivery.

Why use this form online

- Easy to download and customize to your specific needs.

- Reduces time spent on paperwork compared to traditional methods.

- Access to templates drafted by licensed attorneys, ensuring legal correctness.

- Available anytime, allowing users to complete the form at their convenience.

Form popularity

FAQ

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

A Notice of Intent to Lien (NOI) is a document sent to notify certain parties on a construction project of the consequences of non-payment. An NOI is a warning that if payment isn't made, the claimant intends to file a mechanics lien. It works a lot like a demand letter.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

California requires preliminary notice in order to preserve your right to file a mechanics lien. Sending notice late will reduce the amount that you can claim in a lien. For example, sending preliminary notice today will allow you to file a claim for any work or materials you provided in the last 20 days.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

Serving a mechanics lien, or providing a copy of the lien to interested parties, ensures that they receive notice and can promptly recognize and pay your claim. In most states, mechanics liens lien may be served through the mail, usually by sending it via certified mail sometimes with return receipt requested.