Ohio Quitclaim Deed from Individual to Two Individuals in Joint Tenancy

Understanding this form

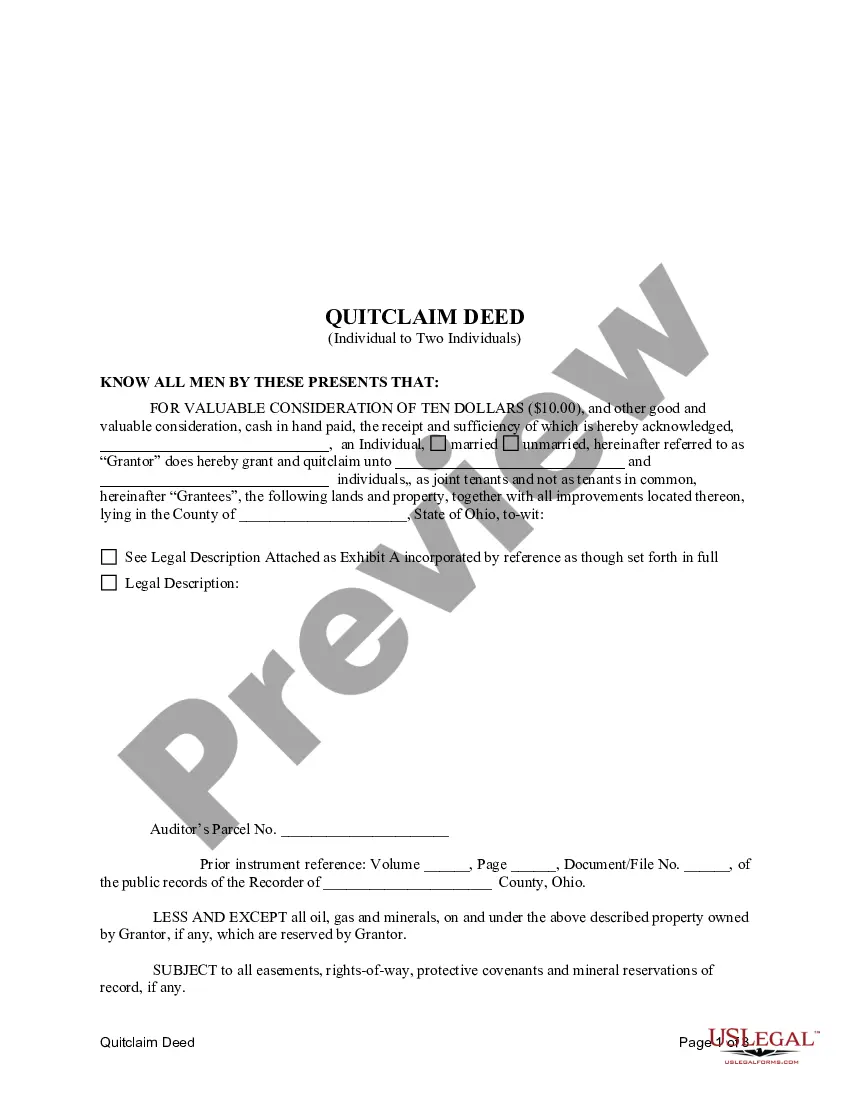

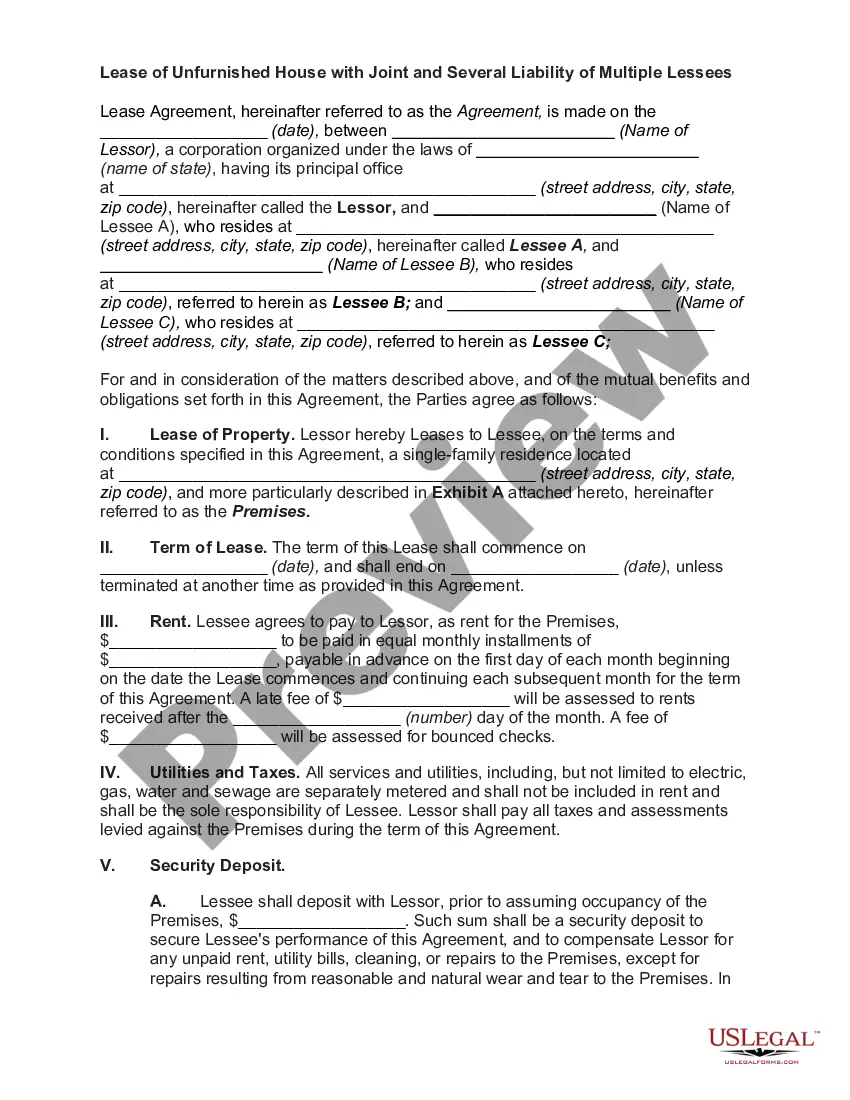

The Quitclaim Deed from Individual to Two Individuals in Joint Tenancy is a legal document that allows an individual (the Grantor) to transfer their property rights to two individuals (the Grantees) who will hold the property in joint tenancy. Unlike other property transfer methods, such as warranty deeds, a quitclaim deed does not guarantee that the Grantor has clear title to the property or that it is free of encumbrances. This deed is particularly useful for transferring property between family members or in situations where the Grantor is not concerned about title exceptions.

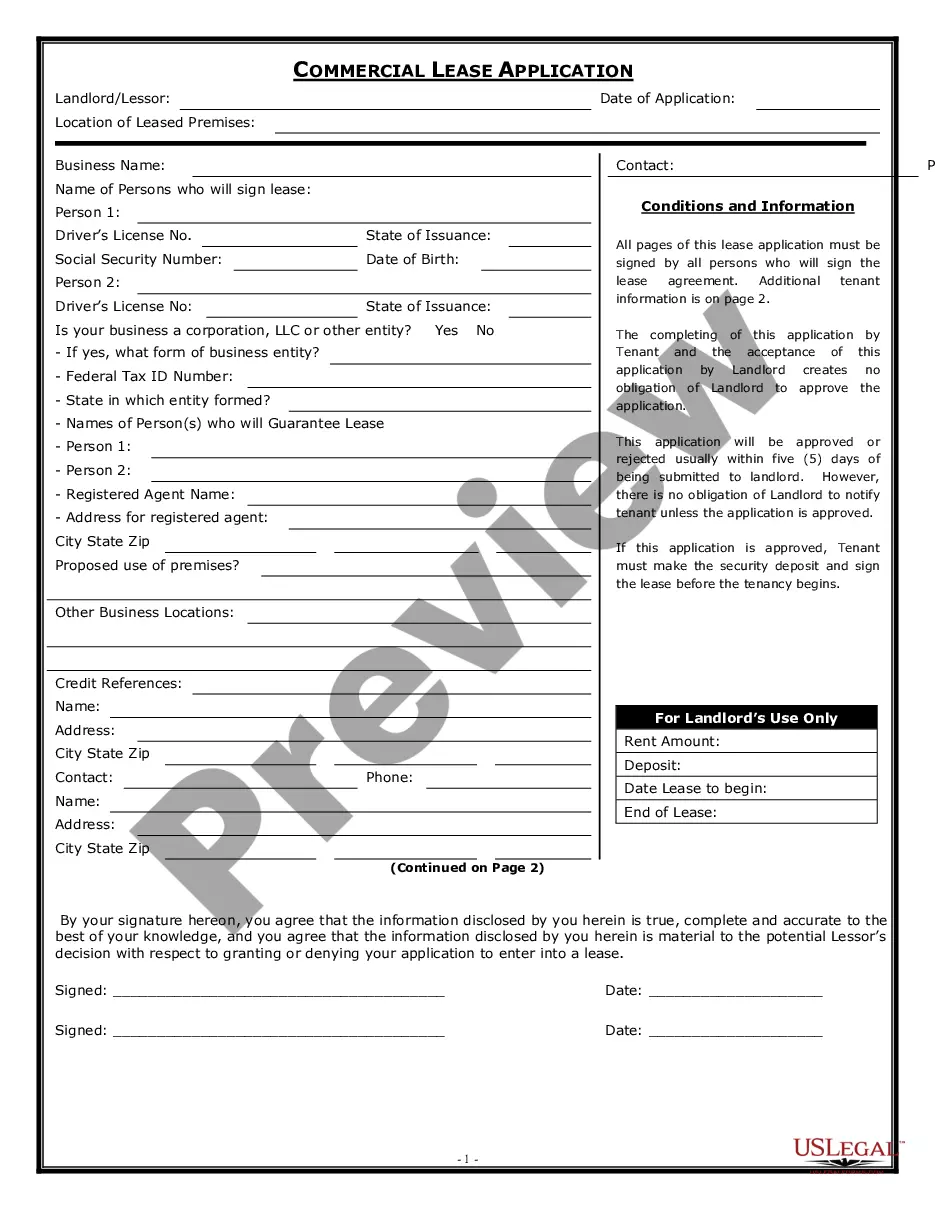

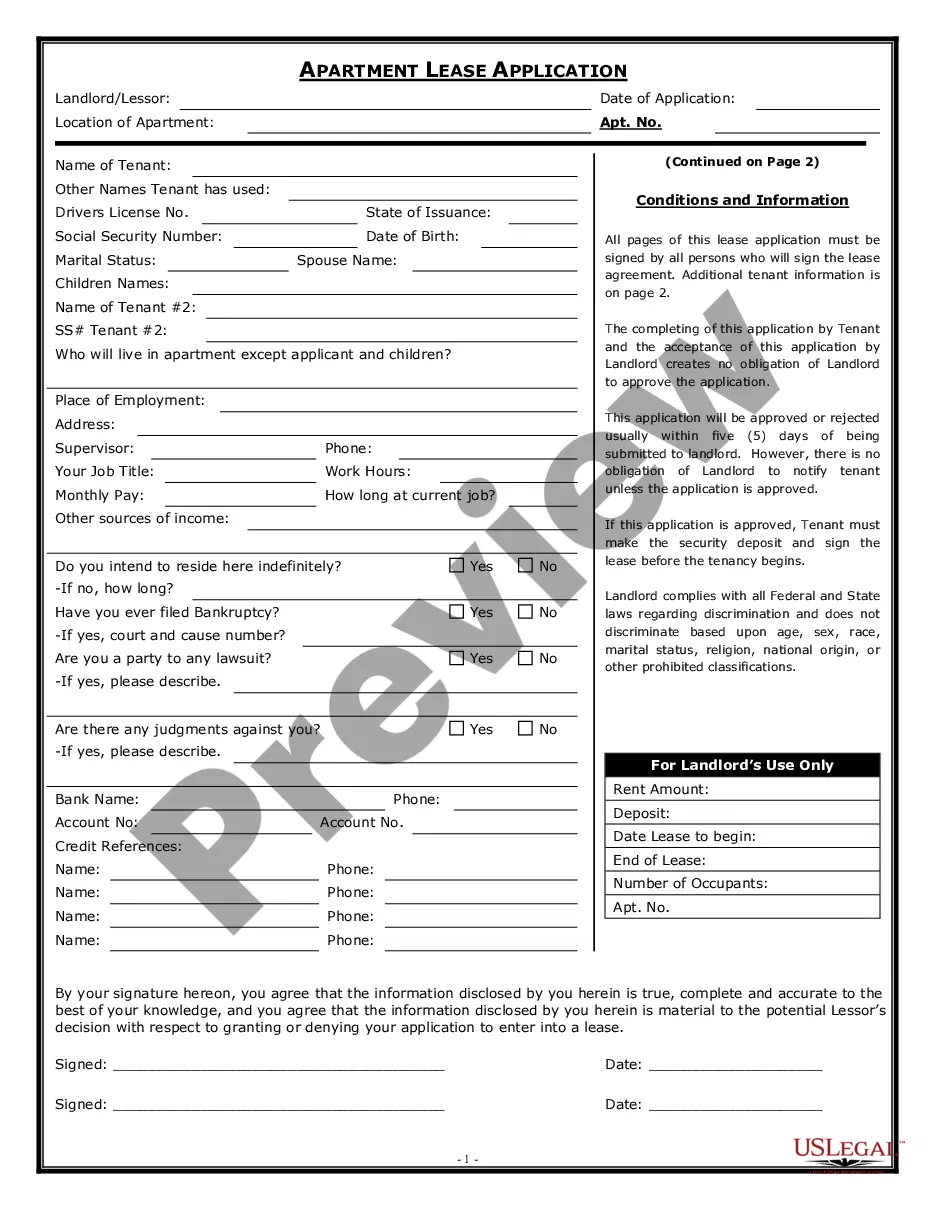

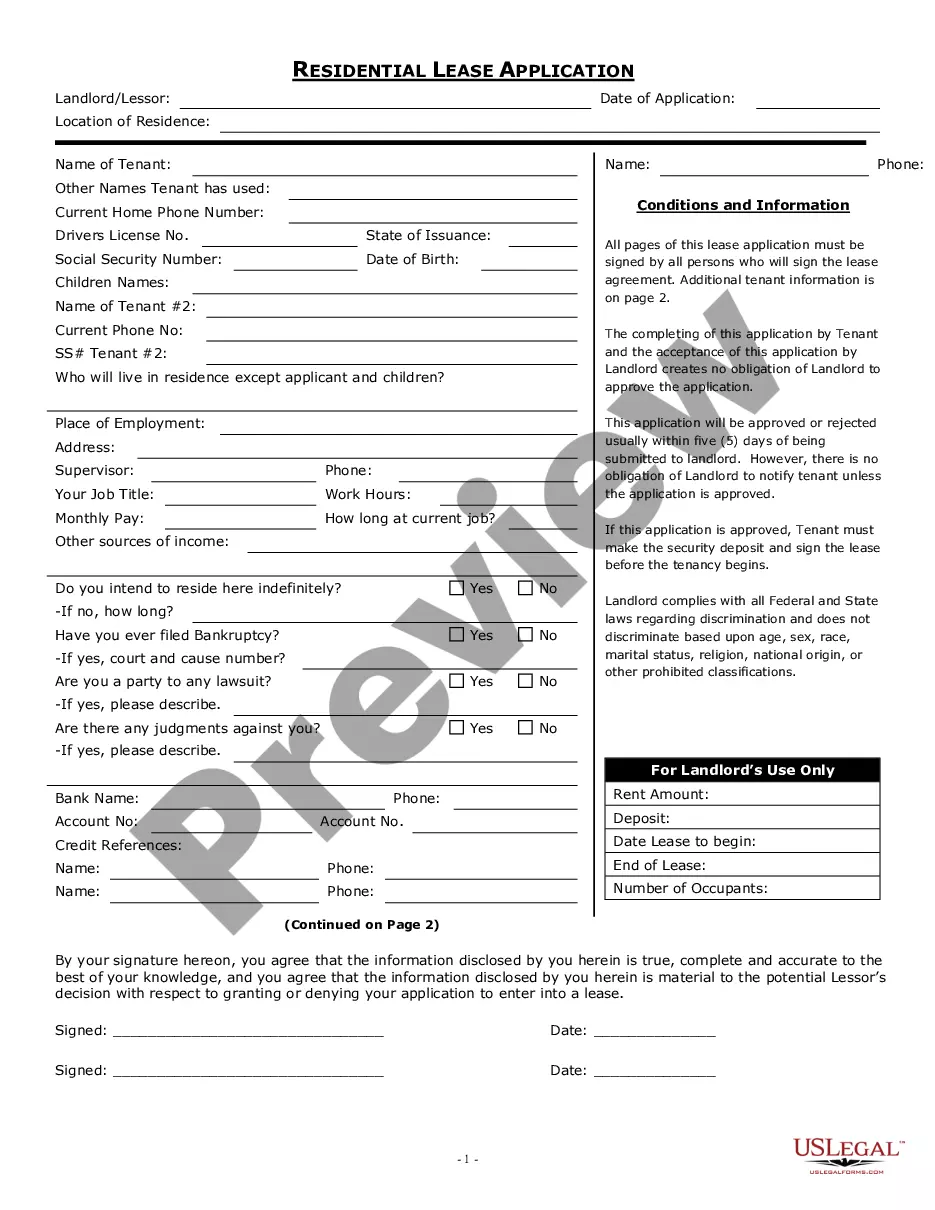

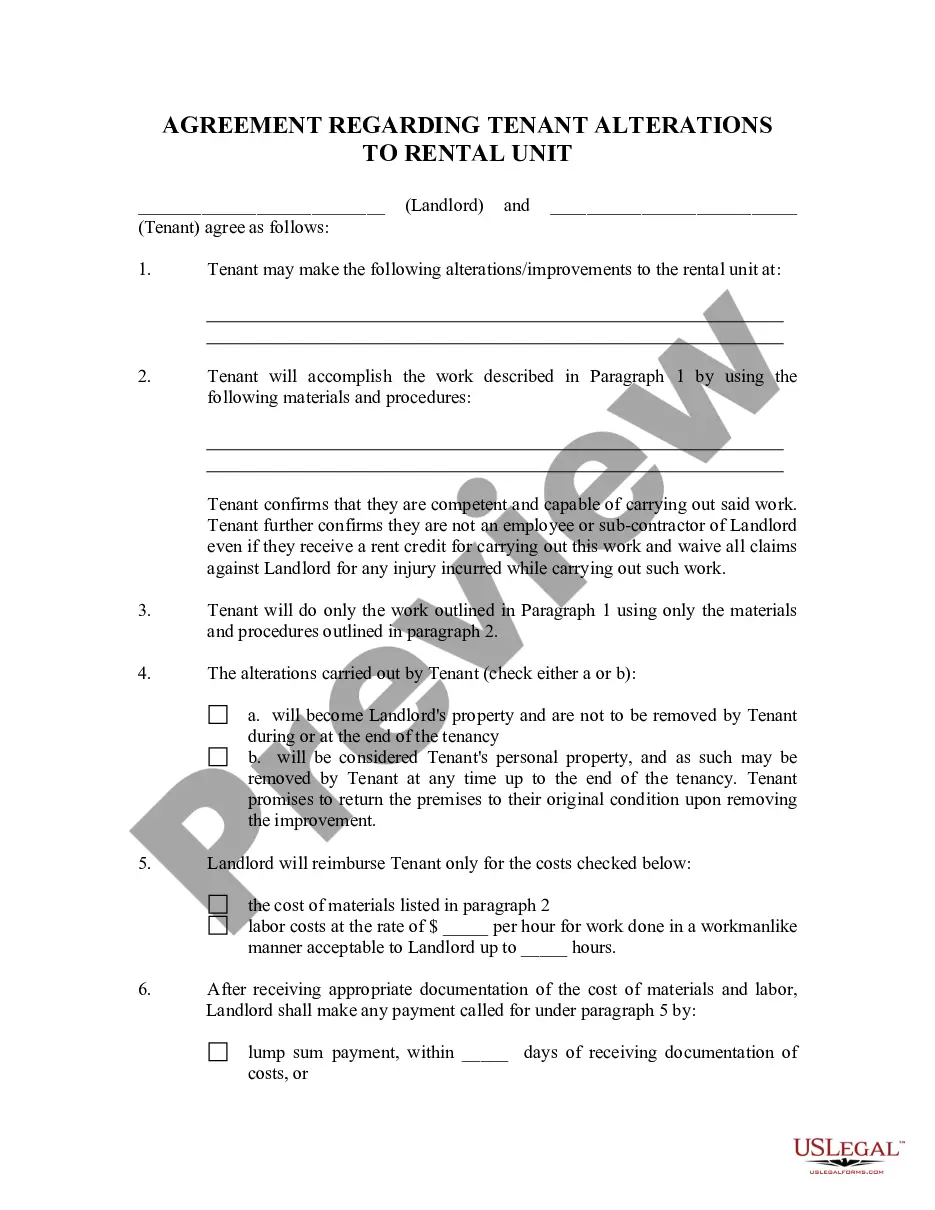

Form components explained

- Identification of Grantor and Grantees, including marital status.

- Property description detailing the specific land and any improvements.

- Indication of how Grantees hold the property, either as tenants in common or joint tenants with right of survivorship.

- Consideration clause acknowledging the value exchanged for the property.

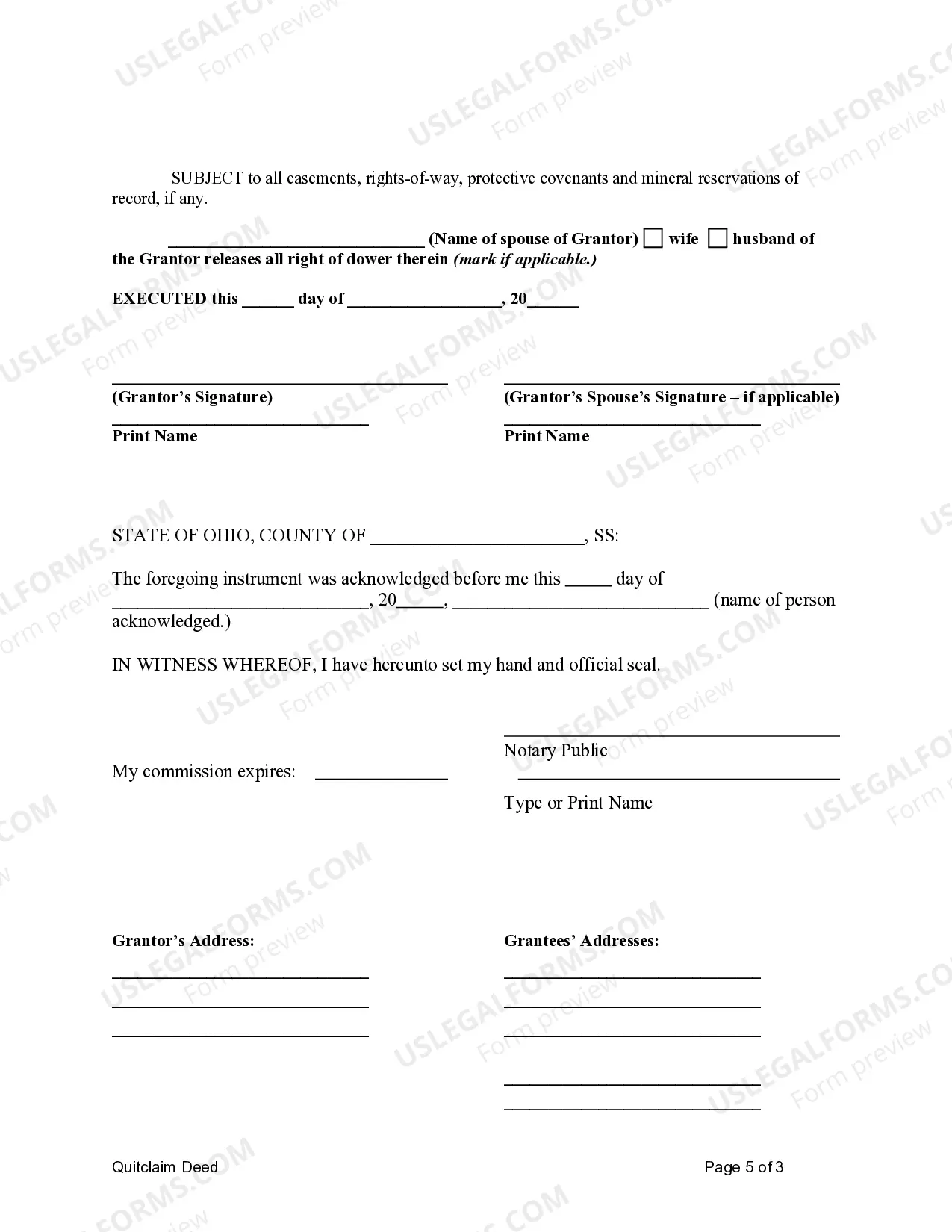

- Grantorâs signature and, if applicable, the signature of the Grantor's spouse.

Situations where this form applies

This form is used when an individual wishes to transfer ownership of property to two individuals, especially in cases where they want the Grantees to hold the property as joint tenants with the right of survivorship. Scenarios may include transferring family property, divesting assets prior to marriage, or reorganizing property ownership among friends or partners.

Who needs this form

- Individuals transferring property to two co-owners.

- Those seeking to define how two individuals will hold the property together.

- People not requiring guarantees of clear title from the Grantor.

How to prepare this document

- Identify the Grantor by entering their full legal name and marital status.

- Clearly state the names of the two Grantees who will receive the property.

- Provide a thorough description of the property, referencing any legal descriptions if available.

- Indicate how the Grantees will hold the property, selecting either tenants in common or joint tenants with right of survivorship.

- Obtain signatures from the Grantor and, if applicable, the Grantor's spouse.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide an accurate property description.

- Not specifying how the Grantees will hold the property.

- Overlooking the Grantor's spouse's signature when required.

- Neglecting to include any necessary disclosures related to the property.

Benefits of using this form online

- Convenience of completing the form remotely without the need for specific legal knowledge.

- Editability of the digital form, making it easy to correct errors or update information.

- Immediate access to properly vetted legal forms compliant with Ohio laws.

Looking for another form?

Form popularity

FAQ

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

An Ohio quit claim deed is a legal document that adheres to state law, and legally transfers the ownership interest of a property from one person to the next. This form of transfer comes with no warranties or guarantees that the property title is clear, and the seller has the authority to sell the property.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.