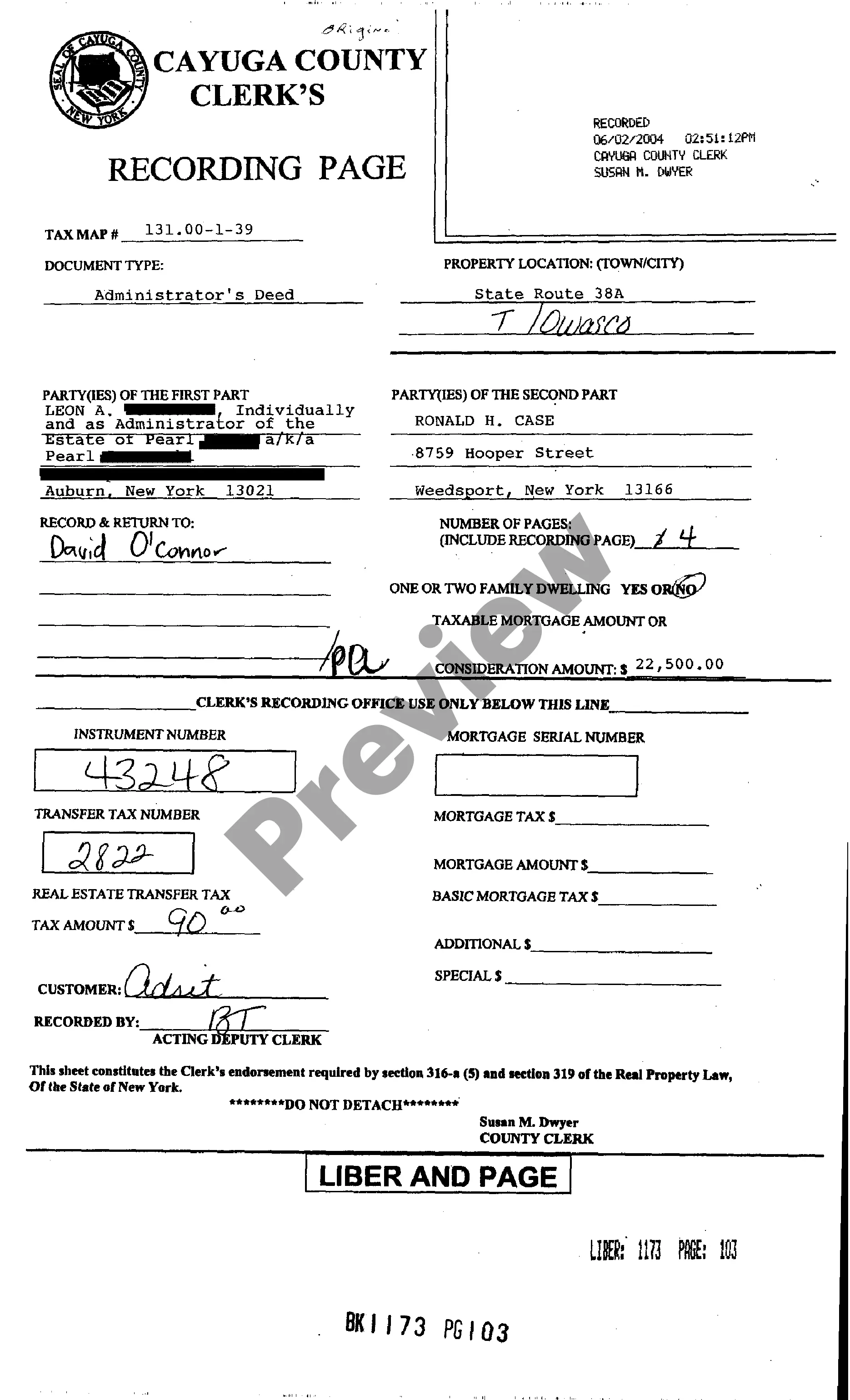

New York Administrator's Deed

About this form

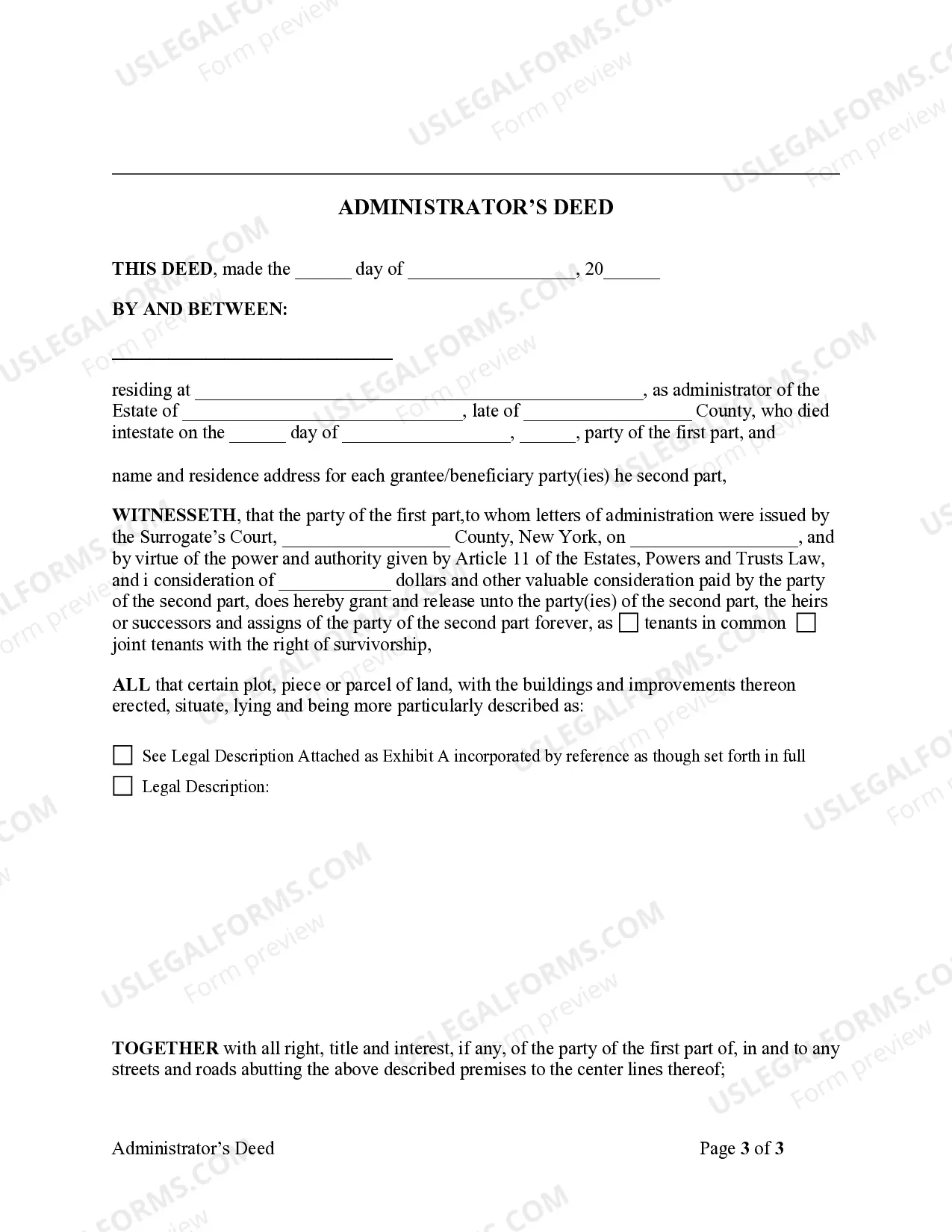

An Administrator's Deed is a legal document used to transfer property from an estate to its beneficiaries when the original owner has died without a will (intestate). This form outlines the powers granted to the administrator by the court, ensuring that the property transfer adheres to legal requirements. Unlike standard deeds, it specifically involves an administrator appointed to manage the estate, highlighting the legitimacy and court authorization associated with the transfer of property.

Form components explained

- Grantor and Grantee Details: Names and addresses of both the administrator (grantor) and the beneficiary or purchaser (grantee).

- Property Description: A clear description of the property being transferred, including its location and any improvements.

- Covenant Clause: A statement that the grantor has not encumbered the property in any way during their administration.

- Consideration Amount: The exchange value for the property, if any.

- Execution Date: The date when the deed is signed and executed by the grantor.

Common use cases

This form should be used when an individual has been appointed as the administrator for an estate that is being probated without a will. The Administrator's Deed is essential during property transfers to beneficiaries or when selling estate property. It legally formalizes the transition of property ownership and ensures compliance with intestate laws as determined by the court.

Who this form is for

- Individuals appointed as administrators of an intestate estate.

- Beneficiaries who are receiving property from the estate.

- Purchasers acquiring property from an estate under the administrator's management.

Completing this form step by step

- Identify the parties involved: enter your name as the administrator and the beneficiaries or purchasers' names.

- Specify the property: include a detailed description of the property being transferred.

- Fill in the consideration amount: indicate any payment involved in the transaction.

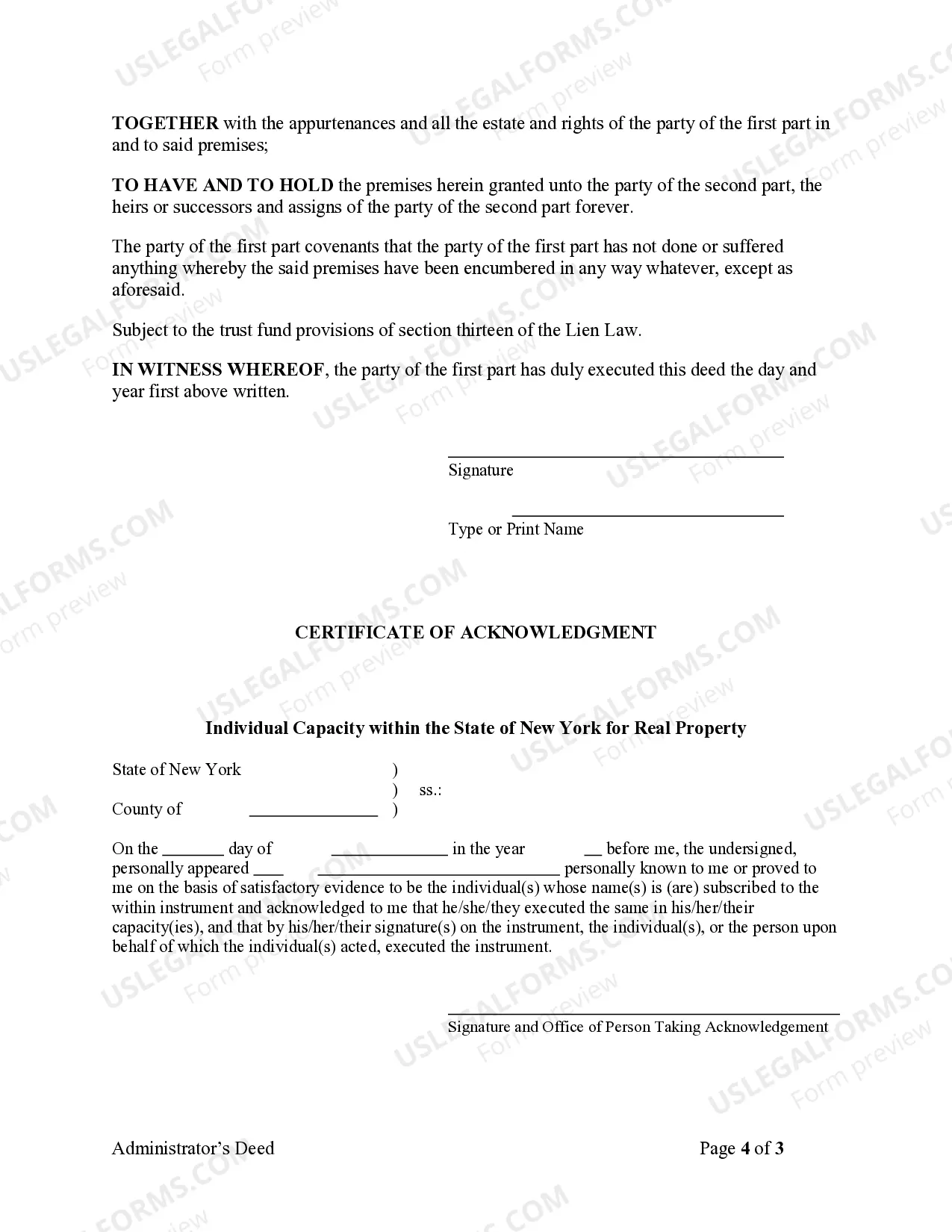

- Provide execution details: enter the date of signing and ensure the document is signed by the administrator.

- Finalize the form: check the form for completeness and accuracy before notarization.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Incorrectly listing grantor or grantee names, which can lead to issues in ownership.

- Failing to provide a complete property description, causing potential legal complications.

- Not including all required signatures or dates, which may invalidate the deed.

Benefits of completing this form online

- Convenience: Downloadable and printable, allowing you to complete the form at your own pace.

- Editability: You can personalize the document based on your specific needs before printing.

- Reliability: Forms are prepared based on state statutes and drafted by licensed attorneys, ensuring legal compliance.

Summary of main points

- An Administrator's Deed is crucial for transferring property from intestate estates.

- Ensure all information is accurately provided to avoid legal complications.

- Review local laws for any specific notarization requirements relevant to the deed.

Looking for another form?

Form popularity

FAQ

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

An administrator's deed is a legal document that transfers the property of an intestate individual, who is a person who passes away without a will. In such cases, the property is transferred to descendents or next-of-kin with the use of an administrator's deed since the deceased individual did not have a will.

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

Letters of Administration will need to be obtained which requires filing a petition and many other documents with the Court. The petition for Letters of Administration is filed in the Surrogate's Court in the county where the decedent lived.

California mainly uses two types of deeds: the grant deed and the quitclaim deed. Most other deeds you will see, such as the common interspousal transfer deed, are versions of grant or quitclaim deeds customized for specific circumstances.

To become appointed Executor or Administrator, you need to have standing to Petition. If there is a Will, then typically the nominated Executor, or successor Executor will file the Petition. If there are no executors willing and able to act, then a residuary beneficiary will file the Petition.

When you own a home, you own both the deed and title for that property. In real estate, title means you have ownership and a right to use the property.The deed is the physical legal document that transfers ownership. It shows who you bought your house from, and when you sell it, it shows who you sold it to.

Brothers or sisters; Any other distributee, aka heir, (preference given to the person entitled to the largest share in the estate. However, if the distributees are issue of grandparents, other than aunts or uncles, on only one side, then Letters of Administration will be granted to the Public Administrator.