New York Warranty Deed to Child Reserving a Life Estate in the Parents

Overview of this form

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer ownership of property to their child while retaining the right to live on and benefit from that property for the rest of their lives. This deed differs from standard property transfer forms as it ensures that while the child becomes the legal owner, the parents can continue to use the property during their lifetime.

Key parts of this document

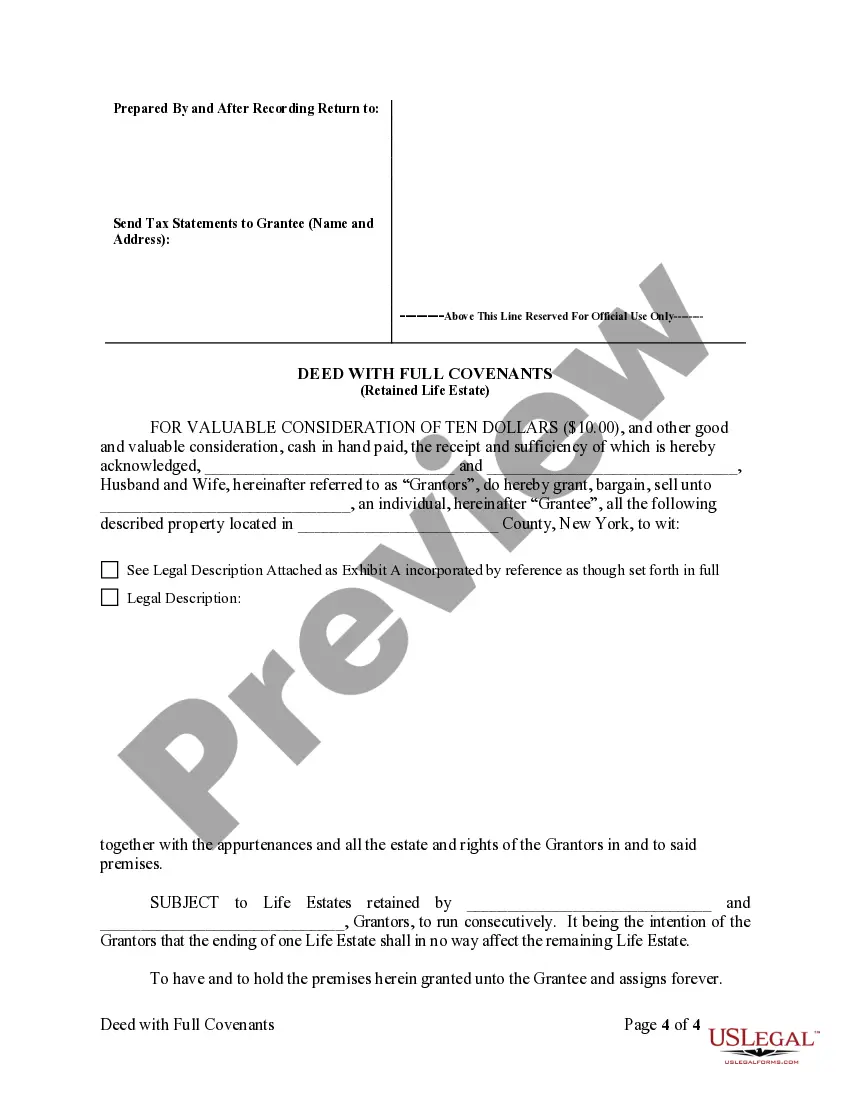

- Grantors and Grantee: Identifies the parents (grantors) and the child (grantee).

- Legal Description: Provides a detailed description of the property being transferred.

- Reservation Clause: Specifies that the parents reserve a life estate, allowing them to retain use of the property.

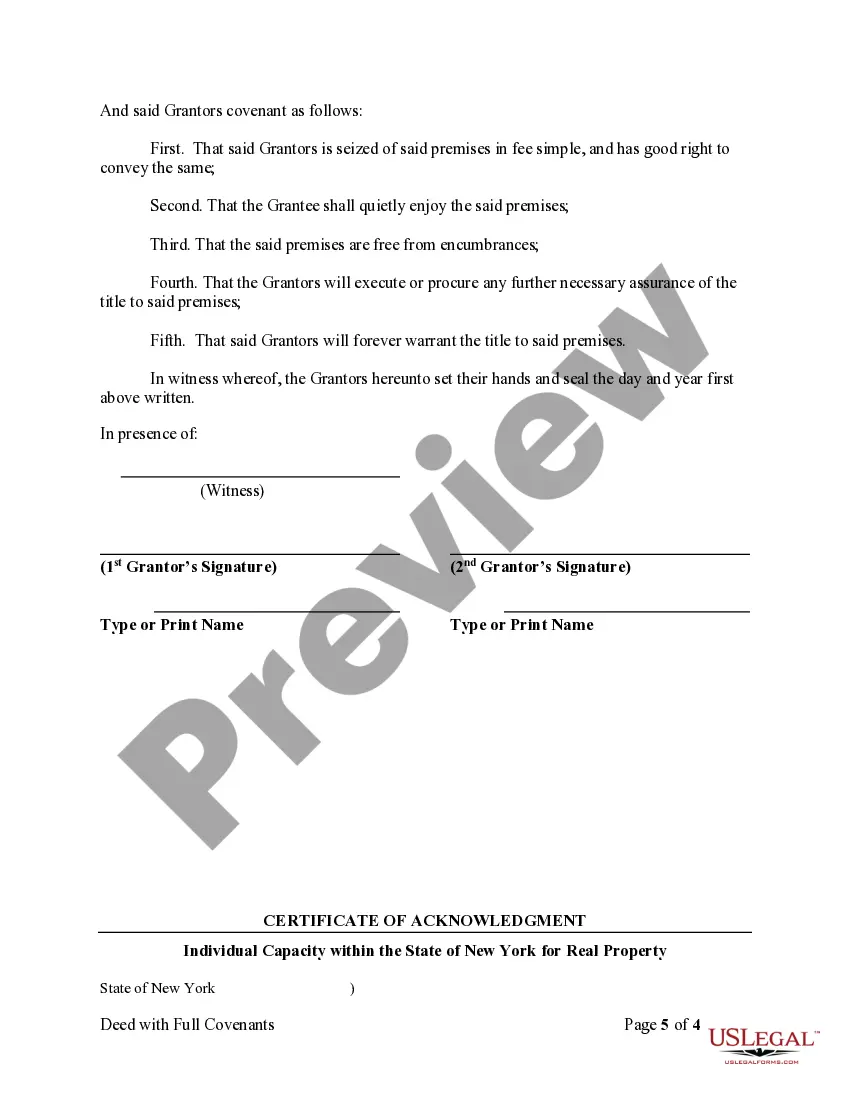

- Covenants: Includes promises made by the grantors regarding their right to convey the property and its condition.

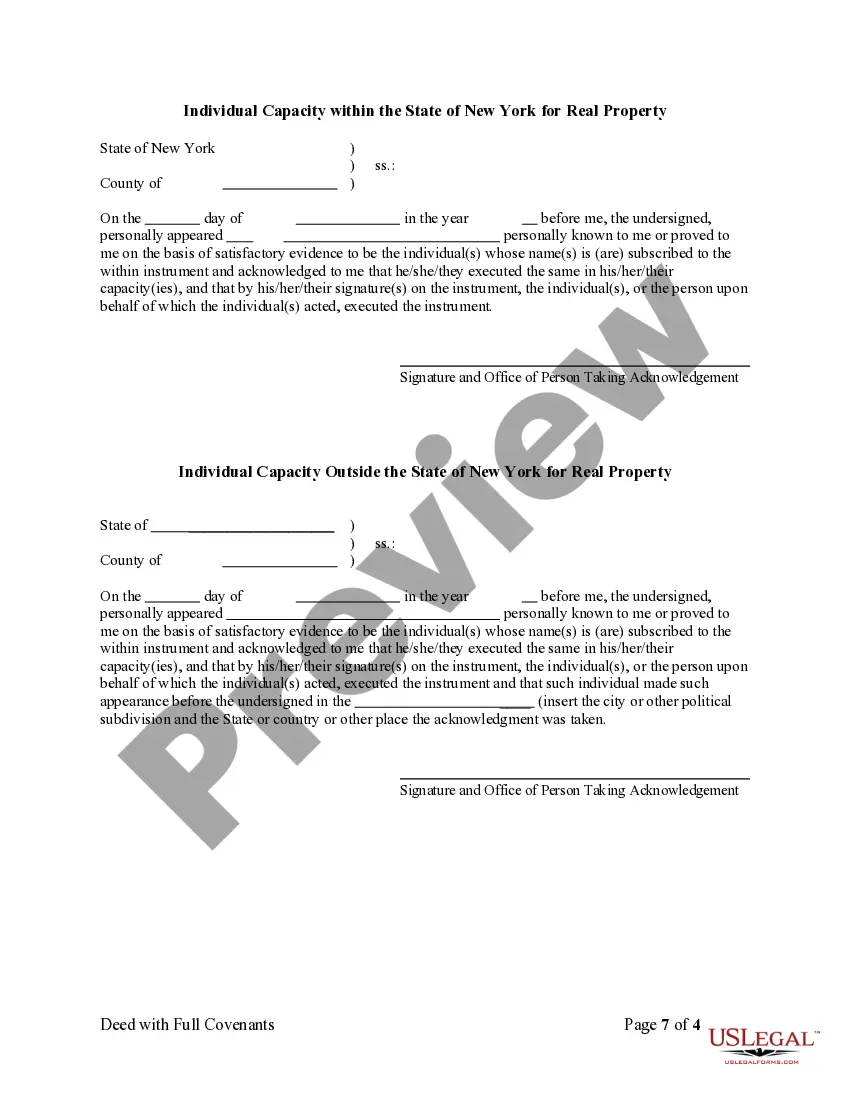

- Signatures: Requires signatures from the grantors and witnesses to validate the deed.

When to use this form

This form is useful when parents wish to transfer property to their child but want to maintain the right to live in and benefit from the property for their lifetime. This may be applicable in various scenarios, such as estate planning, tax considerations, or when parents want to simplify the transfer of property while retaining some control over it.

Who needs this form

This form is intended for:

- Parents looking to transfer property to their child while retaining a life estate.

- Individuals involved in estate planning seeking to manage inheritance while maintaining control over the property.

- Homeowners in New York who wish to create a legacy for their children.

Completing this form step by step

- Identify the parties involved: Enter the names of the grantors (parents) and grantee (child).

- Specify the property: Include the legal description of the property being transferred.

- Detail the reservation: Clearly indicate the reservation of the life estate for the grantors.

- Fill in consideration: State the amount of consideration (e.g., ten dollars) for the transfer.

- Sign the document: Ensure that all parties sign the deed in the presence of a witness.

Does this form need to be notarized?

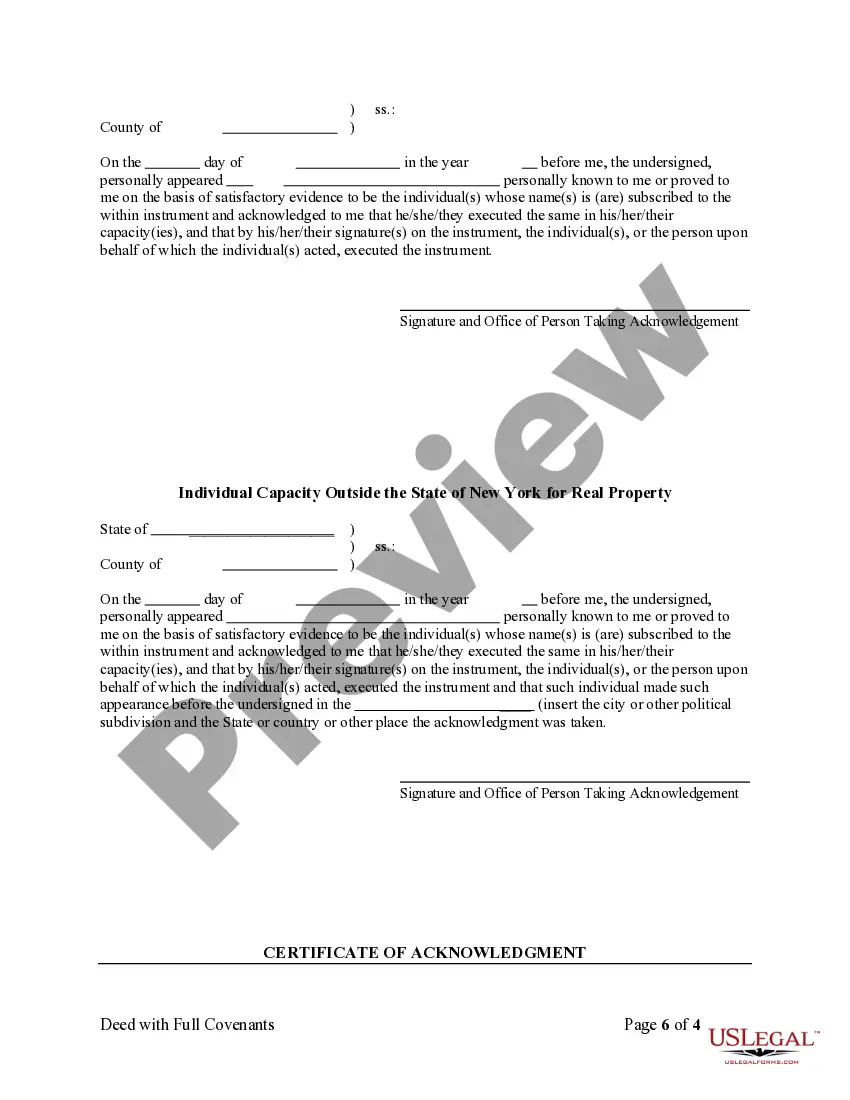

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the complete legal description of the property.

- Not having the document signed in the presence of a witness, which may invalidate the deed.

- Leaving the reservation clause unclear or unaddressed, leading to confusion about rights.

Advantages of online completion

- Convenience: Easily complete and download the form from anywhere at any time.

- Editability: Modify the form as necessary to fit personal situations.

- Quick access: Avoid the delays of traditional legal offices with immediate access to forms.

Looking for another form?

Form popularity

FAQ

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.