New York Quitclaim Deed from Husband to Himself and Wife

About this form

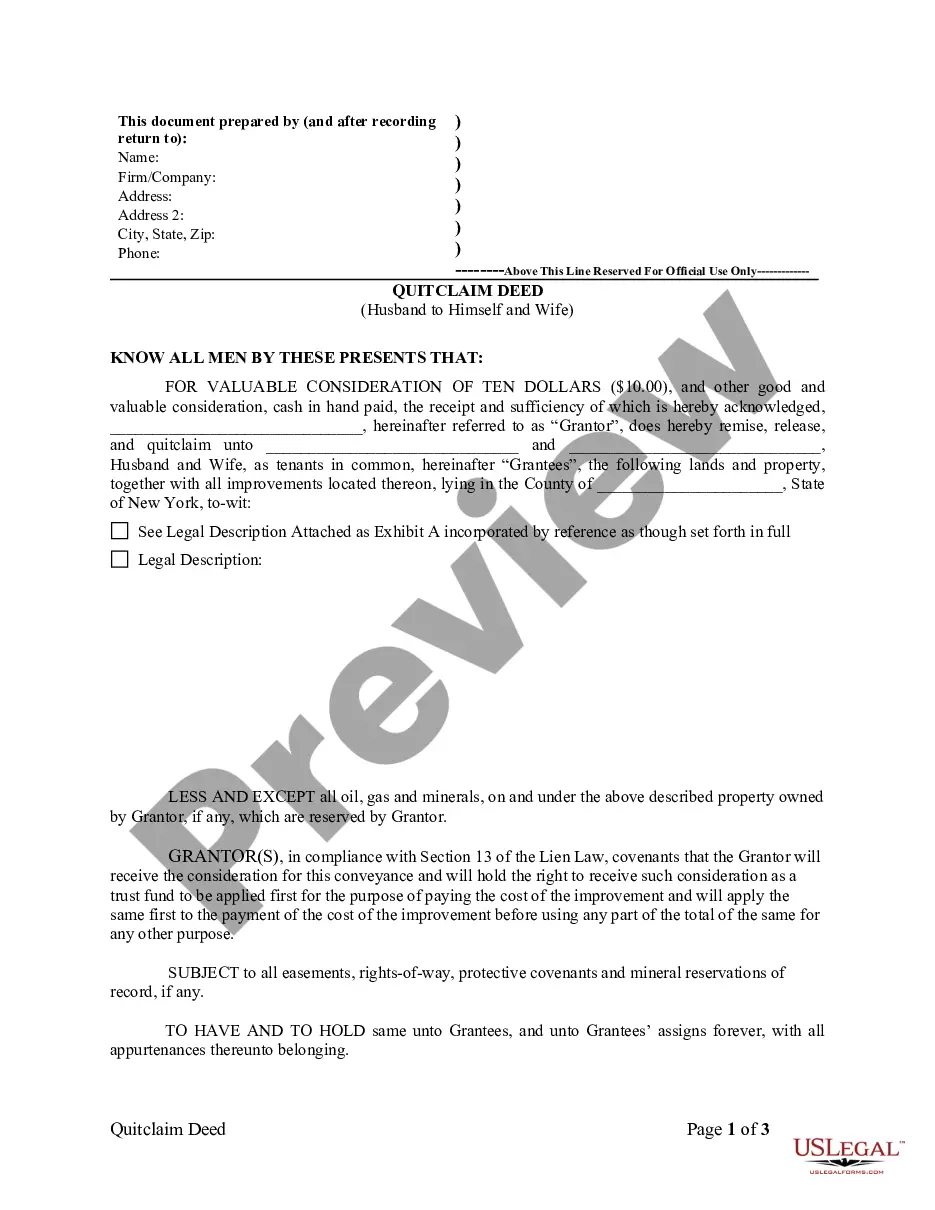

The Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer property ownership from one spouse to both spouses jointly. Unlike other deeds, a quitclaim deed does not guarantee that the property title is clear; it simply conveys any interest the Grantor may have. This type of deed is commonly used in situations where couples want to add or clarify ownership interests in property without involving a sale or refinancing process.

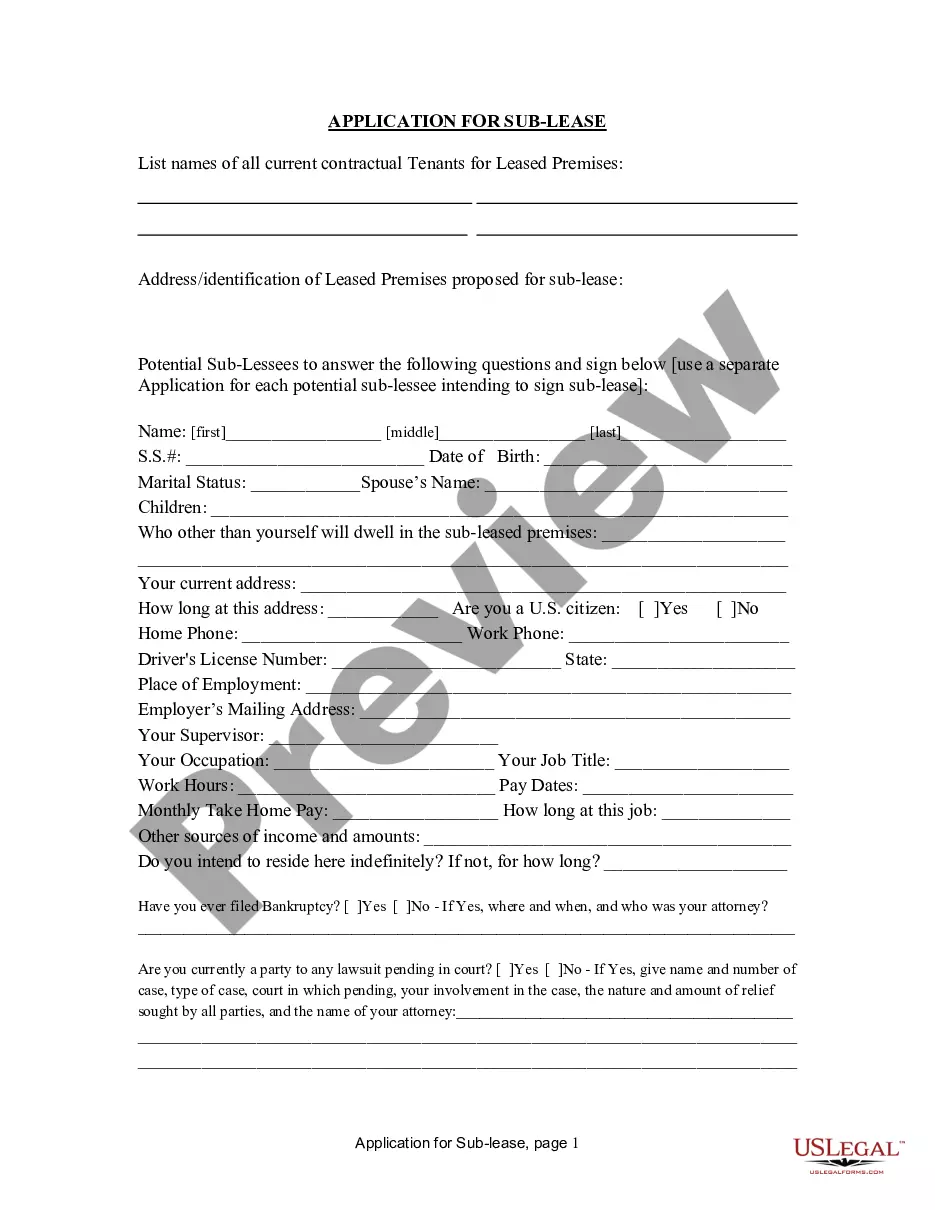

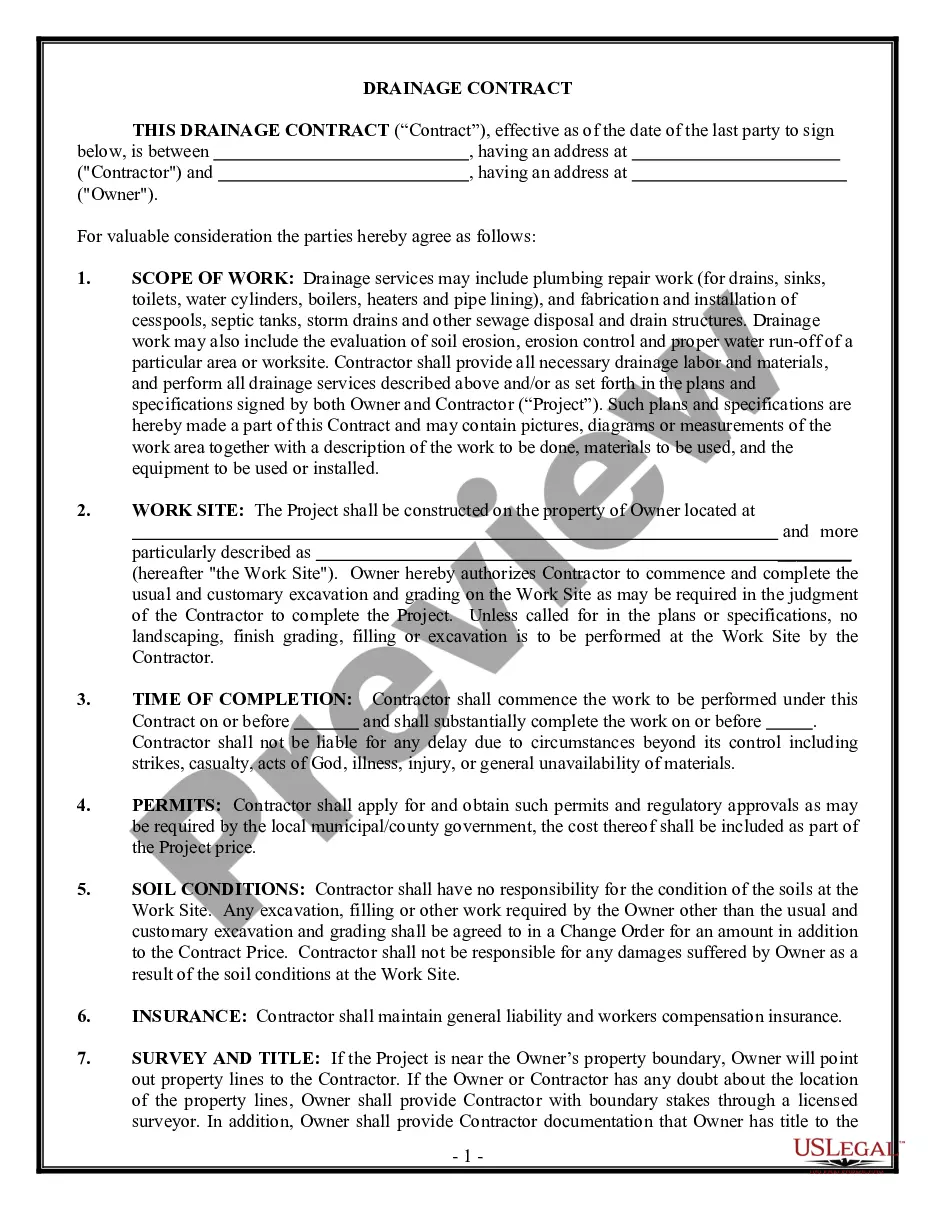

Main sections of this form

- Identification of the Grantor(s): The husband transferring the property and, in this case, also the Grantee.

- Identification of the Grantees: The husband and his wife receiving the property.

- Description of the property: Clear details of the property being transferred, including any reservations for minerals or resources.

- Consideration clause: Agreement that the Grantor received consideration for the transfer, which should be used to pay for property improvements.

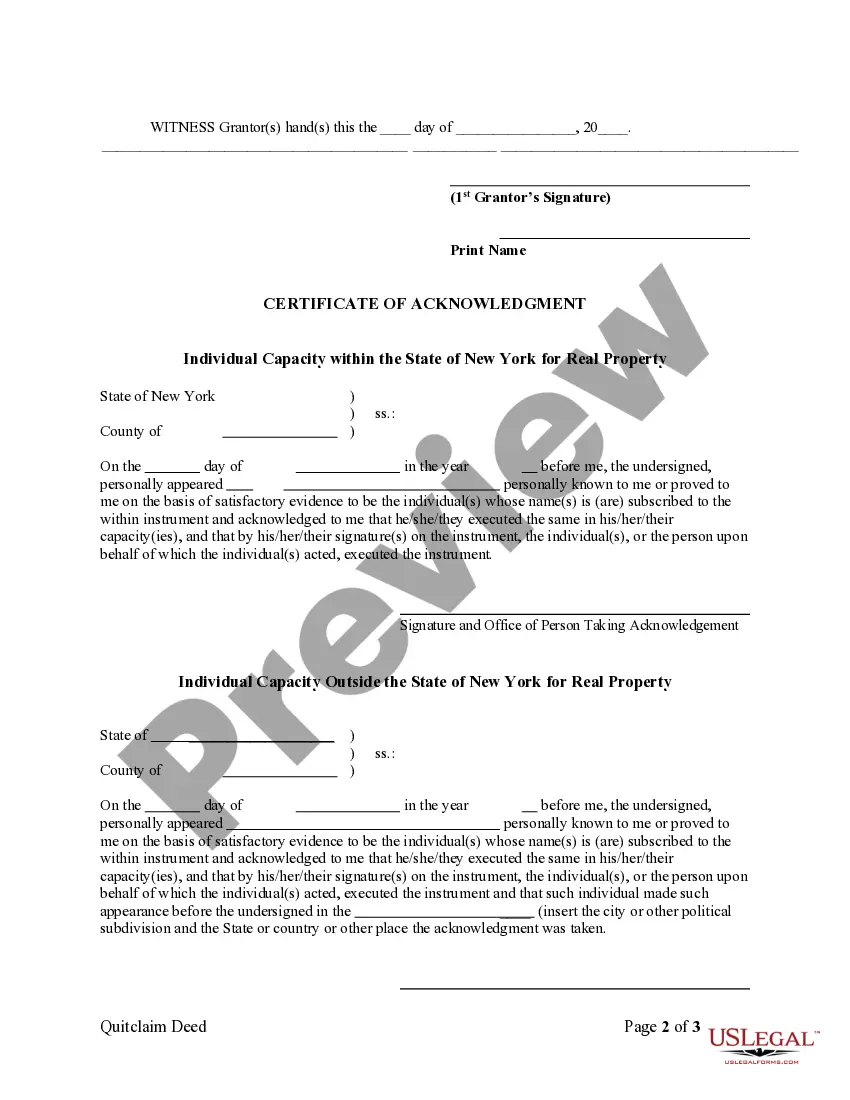

- Signatures: Spaces for the Grantor and a witness to provide signatures, validating the deed.

When to use this form

This form is useful in various situations, such as when a husband wants to establish joint ownership with his wife for security or estate planning purposes. It can also be relevant when transferring property ownership due to marriage or when intending to clarify the property ownership arrangement without transferring it to a third party.

Intended users of this form

- Married couples seeking to clarify or establish joint ownership of a property.

- Individuals who want to transfer property to themselves and their spouse.

- Homeowners looking to add a spouse to the title without a formal sale.

How to complete this form

- Identify the parties: Enter the names of the Grantor (husband) and the Grantees (husband and wife).

- Specify the property: Clearly describe the property being transferred, including its legal description if available.

- Include the consideration: State the consideration for the transfer, which is often a nominal amount.

- Provide signatures: Ensure that the Grantor signs the deed and that it is witnessed as required by law.

- File the deed: Submit the completed deed to the local recording office to make it official.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a complete property description, which can lead to disputes.

- Not obtaining a witness or notarization when required by local law.

- Leaving out the consideration clause, which may affect the validity of the deed.

- Not filing the deed with the appropriate county office after completion.

Benefits of using this form online

- Convenience: Easily complete and download the form from anywhere at any time.

- Editability: Customize the form according to your specific needs and information.

- Reliability: Forms are drafted by licensed attorneys, ensuring compliance with legal requirements.

Looking for another form?

Form popularity

FAQ

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Unlike a general warranty deed, there's no guarantee made as to the ownership. There's no title search completed and no title insurance issued. Lenders wouldn't accept a quitclaim deed being used to purchase a property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.