Nevada Living Trust for Husband and Wife with No Children

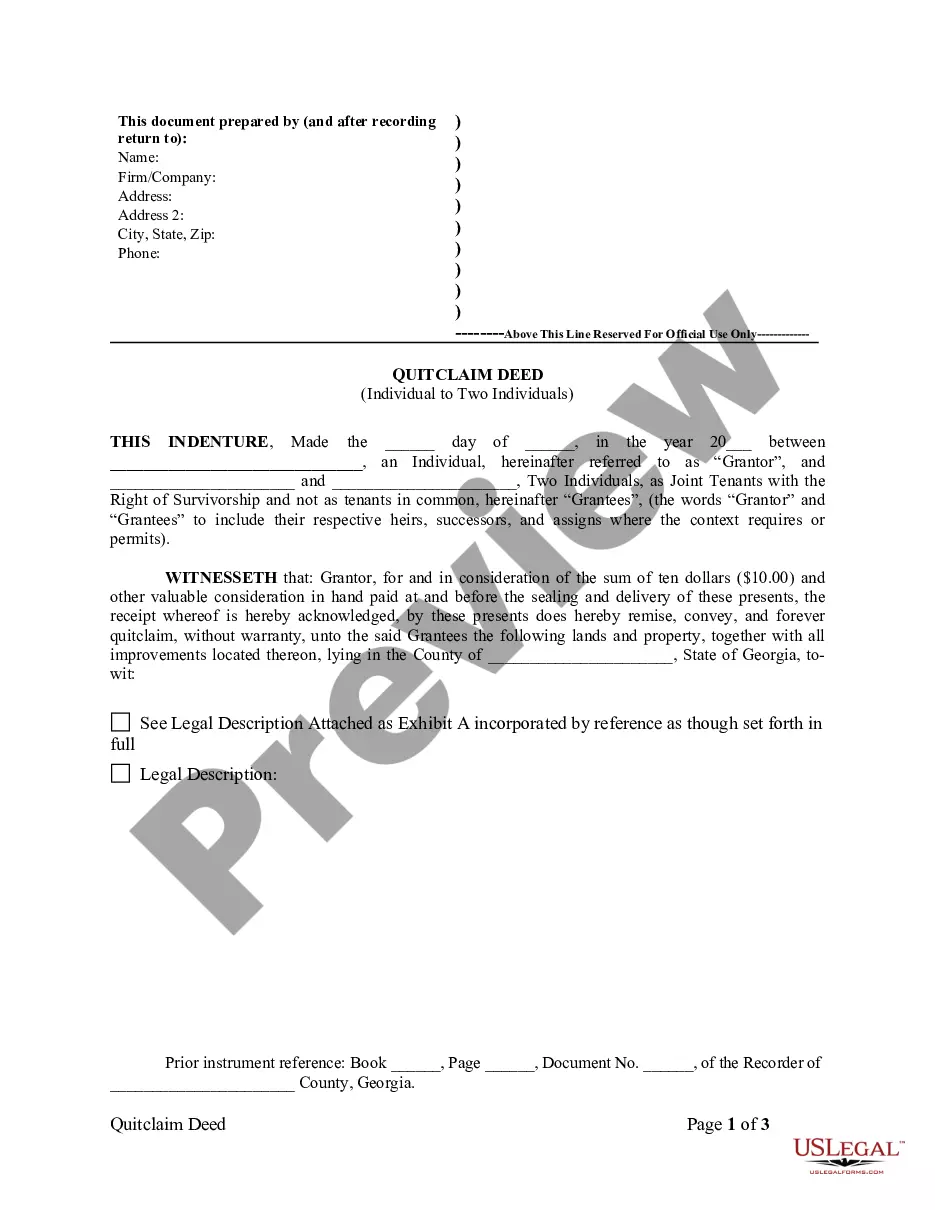

What this document covers

This Living Trust for Husband and Wife with No Children is a legal document designed to allow a married couple without children to manage and protect their assets during their lifetimes and after death. Unlike a will, a living trust avoids probate, streamlining the process of asset distribution upon the death of the trustor. This trust empowers the creators to maintain full control over their assets while providing a clear plan for their distribution after death, differentiating it from a standard will or estate plan.

Key components of this form

- Trustor identification: Includes the names and addresses of the husband and wife creating the trust.

- Trustee appointment: Designation of the husband and wife as trustees for their trust.

- Assets of the trust: Lists all real and personal property to be placed in the trust and procedures for additional property.

- Trustee powers: Details the powers granted to the trustee for managing and distributing trust assets.

- Provisions for health and maintenance: Guidelines for accessing funds for the health and living expenses of the trustors during their lifetimes.

- Distribution upon death: Instructions on how to distribute trust assets after the death of one or both trustors.

Common use cases

This form is appropriate for married couples who do not have children and want a structured, clear plan for managing their assets. It is ideal when the couple wishes to simplify the distribution of their property upon death and avoid the lengthy probate process. A living trust is beneficial if the couple wants to ensure their assets are managed according to their wishes during their lifetimes and to facilitate seamless asset transfer upon their passing.

Who can use this document

This form is intended for:

- Married couples without children who want to establish a living trust.

- Individuals seeking to manage and control their assets while minimizing probate involvement.

- Couples looking for a straightforward estate planning tool to ensure their wishes are executed after death.

How to complete this form

- Identify the trustors by providing full names and addresses of both spouses.

- Designate the primary and any successor trustees, usually the husband and wife.

- List all assets to be included in the trust, detailing any real or personal property.

- Clearly outline the trust provisions, including trustee powers and instructions for asset management.

- Enter signatures and date the document to finalize the trust formation.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to clearly identify and list all assets intended for the trust.

- Not appointing successor trustees, leading to complications if the primary trustee cannot serve.

- Leaving vague instructions for asset distribution, which could lead to disputes later.

- Not signing the trust document or failing to have the trust duly witnessed or notarized as required.

Advantages of online completion

- Convenience of creating and customizing the document from home.

- Immediate access to downloadable forms that can be completed at your own pace.

- Guidance through the legal requirements tailored for your state.

- Peace of mind knowing that the form is drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

Under Hindu Law: the wife has a right to inherit the property of her husband only after his death if he dies intestate. Hindu Succession Act, 1956 describes legal heirs of a male dying intestate and the wife is included in the Class I heirs, and she inherits equally with other legal heirs.

Wives : A wife is entitled to an equal share of her husband's property like other entitled heirs. If there are no sharers, she has full right to the entire property.She is also entitled to maintenance, support and shelter from husband, and if staying in a joint family, from the family.

Married partners and civil partners. Married partners or civil partners inherit under the rules of intestacy only if they are actually married or in a civil partnership at the time of death. So if you are divorced or if your civil partnership has been legally ended, you can't inherit under the rules of intestacy.

When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.Because the surviving spouse becomes the outright owner of the property, he or she will need a Will to direct its disposition at his or her subsequent death.

Community Property in California Inheritance LawsCalifornia is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.