New Jersey Dissolution Package to Dissolve Corporation

NEW JERSEY CORPORATE

DISSOLUTION

Statutory Reference:

NEW JERSEY PERMANENT STATUTES, 14A:12-1 through 14A:12-19

A New Jersey corporation may be dissolved:

By the filing of a certificate of dissolution upon expiration of any period

of duration stated in the corporation's certificate of incorporation;

By action of the incorporators or directors;

By action of the shareholders;

By action of the board and the shareholders;

By action of a shareholder or shareholders;

By a judgment of the Superior;

Automatically by a proclamation of the Secretary of State repealing or

revoking a certificate of incorporation for nonpayment of taxes or for

failure to file annual reports; or

By action of a corporation without assets.

Dissolution - Action of the Incorporators or Directors

A corporation may be dissolved by action of its incorporators when there

has been no organizational meeting of the board, or by the board if there

has been an organization meeting, if the corporation

Has not commenced business;

Has not issued any shares;

Has no debts or other liabilities;Â and

Has received no payments on subscriptions for its shares, or, if it has,

has returned them to those entitled thereto, less any part disbursed for

expenses.

The dissolution of a corporation under these circumstances is effected

in the following manner: the sole incorporator or director, if there is

only one, or both incorporators or directors, if there are only two, or

a majority of the incorporators or directors, if there are more than two,

must file a Certificate of Dissolution with the Secretary of State.

Dissolution - Action of the Shareholders

A corporation may be dissolved by the consent of all its shareholders

entitled to vote on the issue of dissolution. Notice of dissolution

must be provided to all shareholders not entitled to vote less than 10

nor more than 60 days before the filing of the certificate of dissolution.Â

Notice must be in the same manner as for the giving of notice of meetings

of shareholders. All shareholders entitled to vote must sign and

file a Certificate of Dissolution with the Secretary of State.

Dissolution - Action of Board and Shareholders;

A corporation may be dissolved by action of its board and its shareholders.Â

The board must recommend that the corporation be dissolved and direct that

the question of dissolution be submitted to a vote at a meeting of shareholders.

Written notice of the meeting must be given not less than 10 nor more

than 60 days before the meeting to each shareholder of record whether or

not entitled to vote at such meeting and notice must be in the same manner

as for the giving of notice of meetings of shareholders.

At the meeting, a vote of the shareholders must be taken on the proposed

dissolution. The dissolution is approved upon receiving the affirmative

vote of a majority of the votes cast by the holders of shares of the corporation

entitled to vote thereon. These voting requirements are subject to

such greater requirements as may be provided in the certificate of incorporation.

If dissolution is approved, a certificate of dissolution must be executed

on behalf of the corporation and filed with the Secretary of State.

Dissolution - Without Assets

A corporation which has ceased doing business and does not intend to

recommence doing business may be dissolved by action of its board and shareholders

or by a corporate officer if the corporation

Has no assets;

Has ceased doing business and does not intend to recommence doing business;

and

Has not made any distributions of cash or property to its shareholders

within the last 24 months and does not intend to make any distribution

following its dissolution.

The dissolution of the corporation without assets may be authorized by

the shareholders without a meeting or by action of a corporate officer

if the officer has given 30 days' prior written notice of his intention

to dissolve the corporation by mail or personal service to all known directors

and shareholders at their last known address and no director or shareholder

has objected to the proposed dissolution. The dissolution is effected by

filing with the Secretary of State a certificate of dissolution.

Dissolution - Provisions of Certificate of Incorporation

The certificate of incorporation may provide that any shareholder, or

any specified number of shareholders, or the holders of any specified number

or proportion of shares, or of any specified number or proportion of shares

of any class or series, may effect the dissolution of the corporation at

will or upon the occurrence of a specified event. In this event,

dissolution of the corporation is effected by the filing of a certificate

of dissolution with the Secretary of State, signed, as the certificate

of incorporation may provide, by a single shareholder, or the specified

number of shareholders, or the holders of any specified number or proportion

of shares, or of any specified number or proportion of shares of any class

or series.

Dissolution - Expiration of Period of Duration

A corporation is not dissolved when the period of duration stated in

its certificate of incorporation expires until a certificate of dissolution

has been filed in the office of the Secretary of State

Effective Time of Dissolution

A corporation is dissolved:

When the period of duration stated in the corporation's certificate of

incorporation expires and the corporation files a certificate of dissolution

in the office of the Secretary of State; or

Upon the proclamation of the Secretary of State; or

When a certificate of dissolution (voluntary) is filed in the office of

the Secretary of State, except when a later time not to exceed 90 days

after the date of filing is specified in the certificate of dissolution;

or

When a judgment of forfeiture of corporate franchises or of dissolution

is entered by a court of competent jurisdiction.

Effect of Dissolution

Except as a court may otherwise direct, a dissolved corporation continues

its corporate existence but cannot carry on any business except for the

purpose of winding up its affairs by:

collecting its assets;

conveying for cash or upon deferred payments, with or without security,Â

such of its assets as are not to be distributed in kind to its shareholders;

paying, satisfying and discharging its debts and other liabilities; and

doing all other acts required to liquidate its business and affairs.

When a corporation is dissolved, the corporation, its officers,

directors and shareholders continue to function in the same manner as if

dissolution had not occurred. In particular,

the directors of the corporation are not deemed to be trustees ofÂ

its assets and are held to no greater standard of conduct than that prescribed

by section 14A:6-14;

title to the corporation's assets remain in the corporation untilÂ

transferred by it in the corporate name;

the dissolution does not change quorum or voting requirements for theÂ

board or shareholders and it does not alter provisions regarding election,

appointment, resignation or removal of, or filling vacancies among, directors

or officers, or provisions regarding amendment or repeal of by-laws or

adoption of new by-laws;

shares may be transferred until the record date of the final liquidating

distribution or dividend to shareholders;

the corporation may sue and be sued in its corporate name and process may

issue by and against the corporation in the same manner as if dissolution

had not occurred;

no action brought against any corporation prior to its dissolution shall

abate by reason of a dissolution.

The right of the corporation to sell its assets and the right of a shareholder

to dissent from such a sale are governed by Chapters 10 and 11 in the same

manner as if dissolution had not occurred.

A dissolved corporation may condition the payment to its shareholders

of any partial liquidating distribution or dividend on the surrender toÂ

it of the share certificates on which the distribution or dividend is to

be paid for endorsement to reflect such payment; or

of the final liquidating distribution or dividend on the surrender to it

for cancellation of the share certificates on which the distribution or

dividend is to be paid.

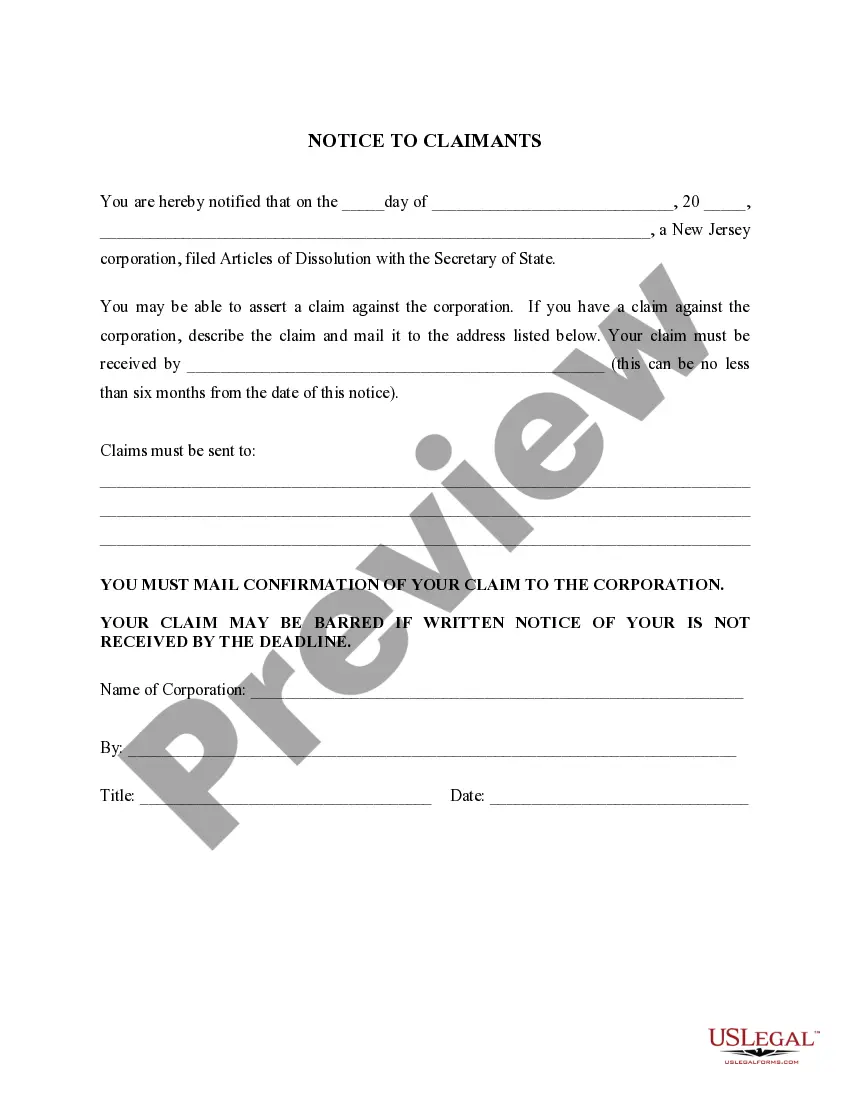

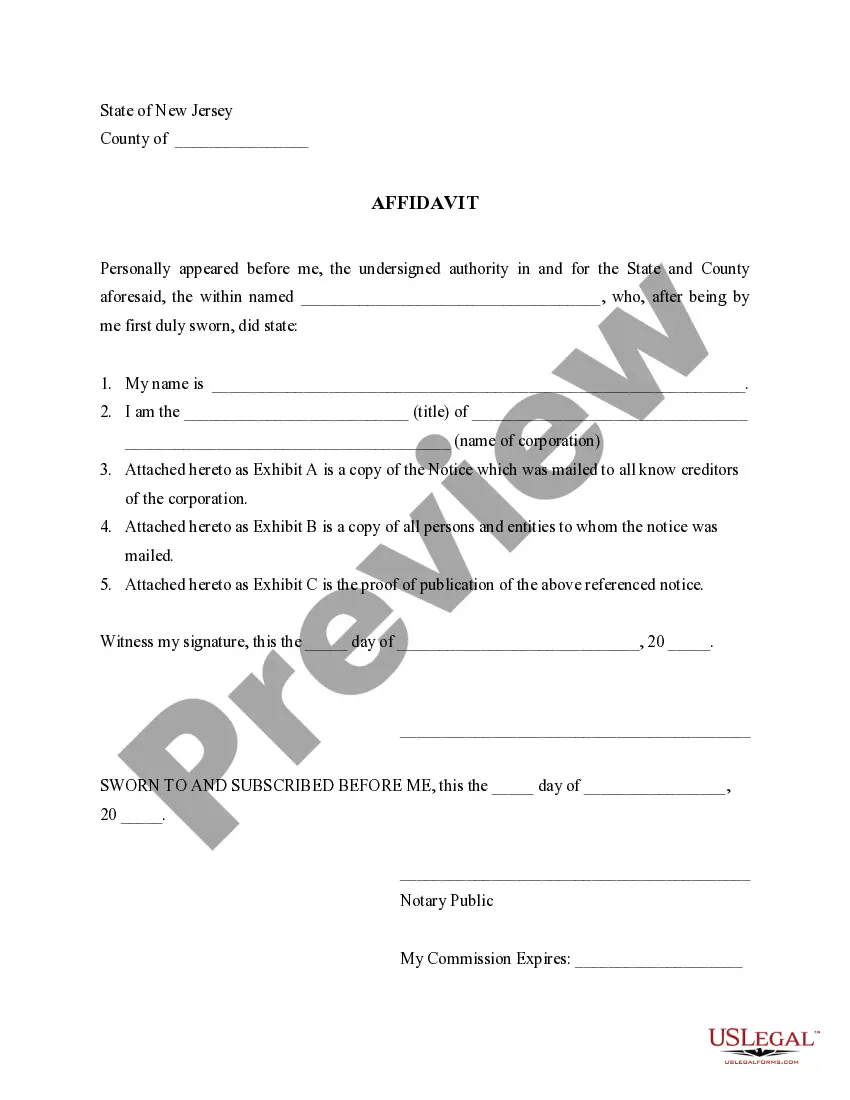

Notice to Creditors

At any time after a corporation has been dissolved, the corporation,

or a receiver appointed for the corporation pursuant to this chapter, may

give notice requiring all creditors to present their claims in writing.

The notice must be published once a week for three consecutive weeks in

a newspaper of general circulation in the county in which the registered

office of the corporation is located. The notice must state that

all persons who are creditors of the corporation must present written proof

of their claims to the corporation or the receiver at a place and on or

before a date named in the notice. The date must not be less than

6 months after the date of the first publication.

On or before the date of the first publication of this notice, the corporation

or the receiver must mail a copy of the notice to each known creditor of

the corporation.  The giving of such notice does not constitute

recognition that any person to whom a notice is directed is a creditor

of the corporation other than for the purpose of receipt of the notice.

A "creditor" is any person to whom the corporation is indebted, and

any other person(s) who have claims or rights against the corporation,

whether liquidated or unliquidated, matured or unmatured, direct or indirect,

absolute or contingent, secured or unsecured.

Proof of the publication and mailing of the notice must be made by an

affidavit filed in the office of the Secretary of State.

Barring of Creditors' Claims

Any creditor who does not file a claim as provided in the notice, and

all persons claiming through that creditor are forever barred from suing

on that claim or otherwise enforcing it except, in the case of a creditor

who shows good cause for not having previously filed his claim, to such

extent as the Superior Court may allow:

against the corporation to the extent of any undistributed assets; or

if the undistributed assets are not sufficient to satisfy a claim, against

a shareholder to the extent of his ratable part of such claim out ofÂ

the assets of the corporation distributed to him in liquidation or dissolution.

This restriction does not apply to claims which are in litigation on the

date of the first publication of the notice.

Disposition of Rejected Claims

If the corporation or the receiver of a corporation rejects in whole

or in part any claim filed by a creditor, the corporation or the receiver

must mail notice of the rejection to the creditor. If the creditor

does not bring suit upon the claim within 60 days from the time such notice

was mailed, the creditor and all those claiming through the creditor are

forever barred from suing on the claim. Proof of the mailing of a

notice of rejection of claim must be made by an affidavit filed in the

office of the Secretary of State.

Jurisdiction of the Superior Court

At any time after a corporation has been dissolved in any manner, a

or a shareholder of the corporation, or the corporation itself, may apply

to the Superior Court for a judgment that the affairs of the corporation

and the liquidation of its assets continue under the supervision of the

court.

Distribution to Shareholders

Any assets remaining after payment of or provision for claims against

the corporation are distributed among the shareholders according to their

respective rights and interests. Distribution may be made in either

or both cash and kind.

Disposition of Unclaimed Distributive Shares

The distributive shares payable to any person who is unknown or cannot

be found, or who is under a disability and for whom there is no legal representative,

are paid into the Superior Court to be held for the benefit of the owners,

subject to the order of the court.

Dissolution Upon Liquidation

No corporation is completely liquidated and all of its assets distributed

to its shareholders unless provision is made for the dissolution of the

corporation and the payment of all fees, taxes, and other expenses incidental

thereto.

Note: All Information and Previews are subject to the Disclaimer

located on the main forms page, and also linked at the bottom of all search

results.