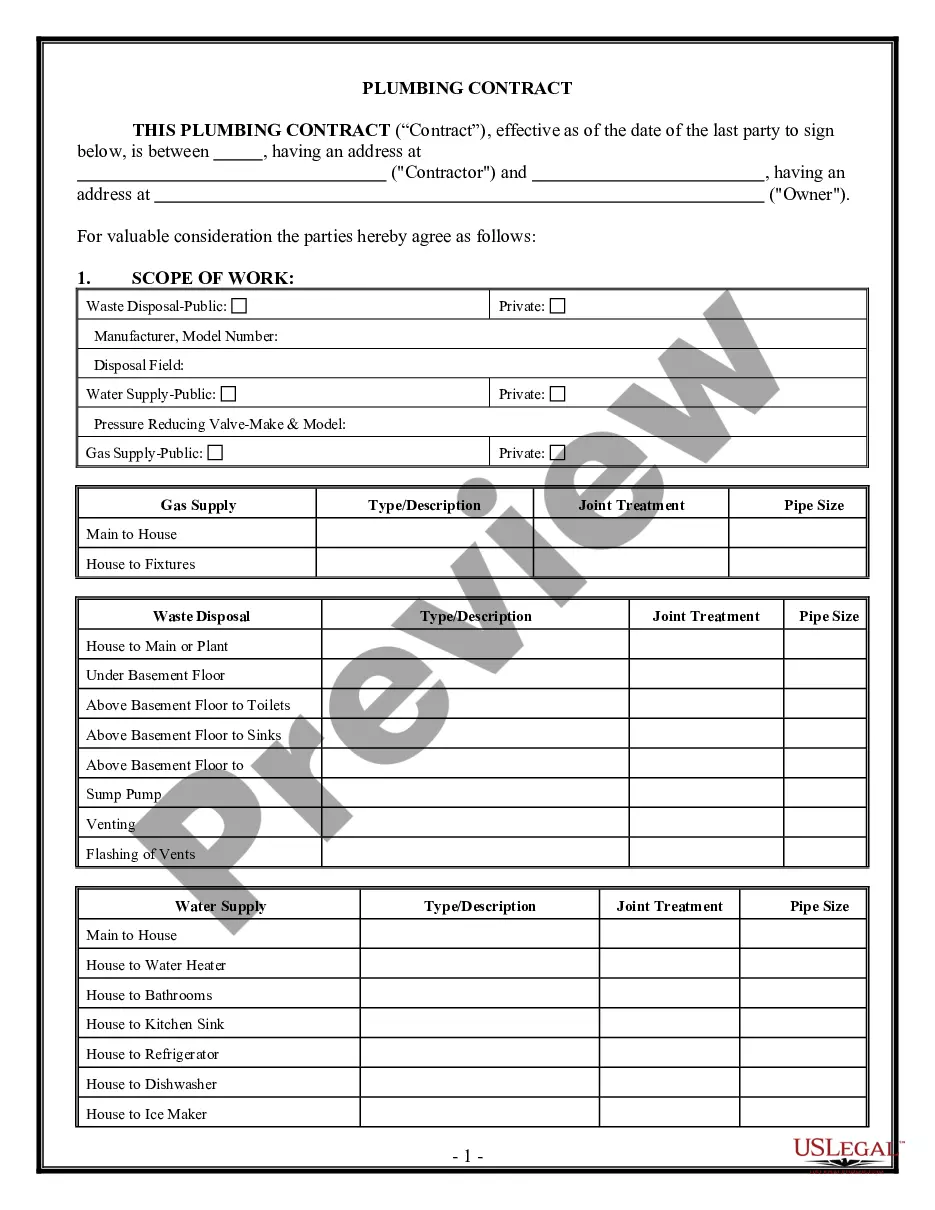

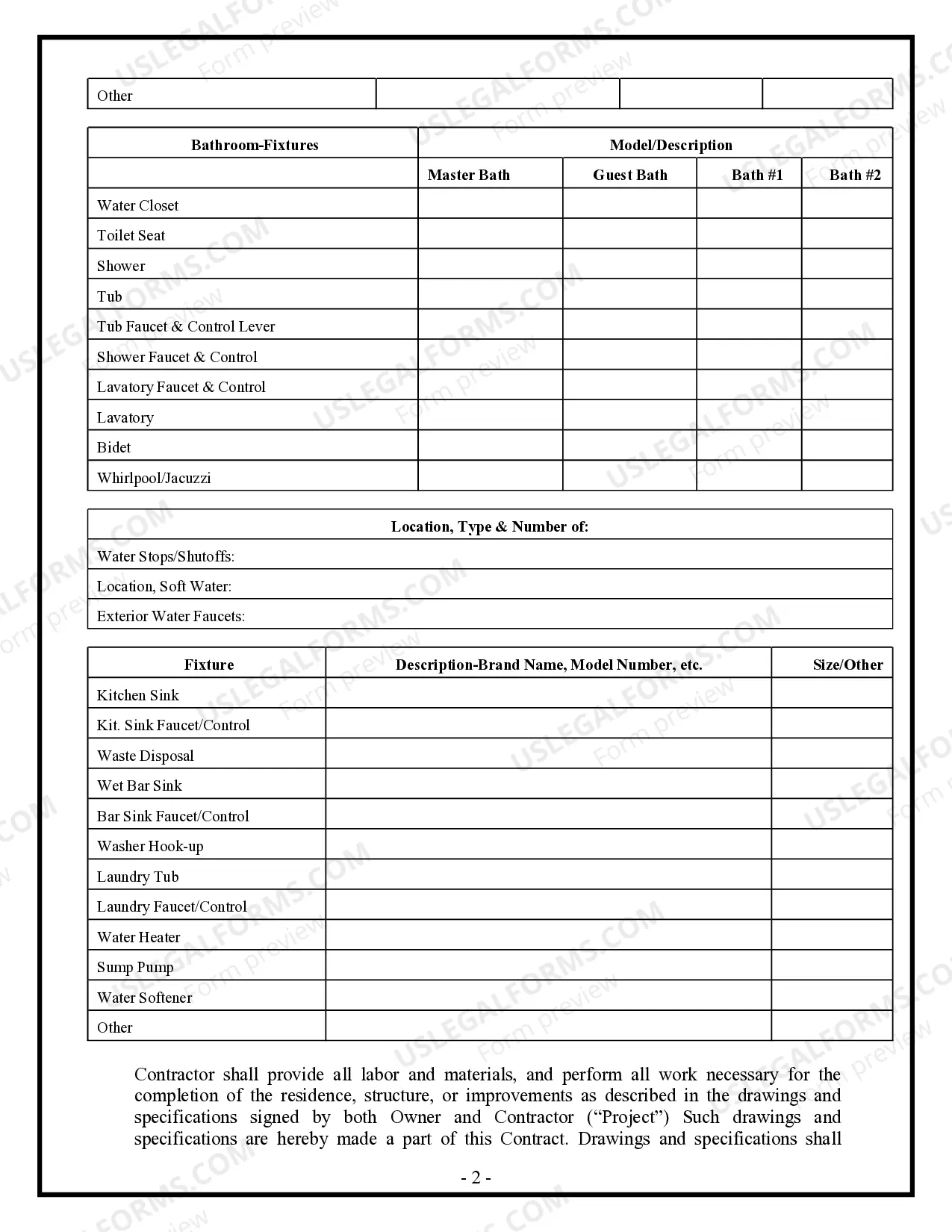

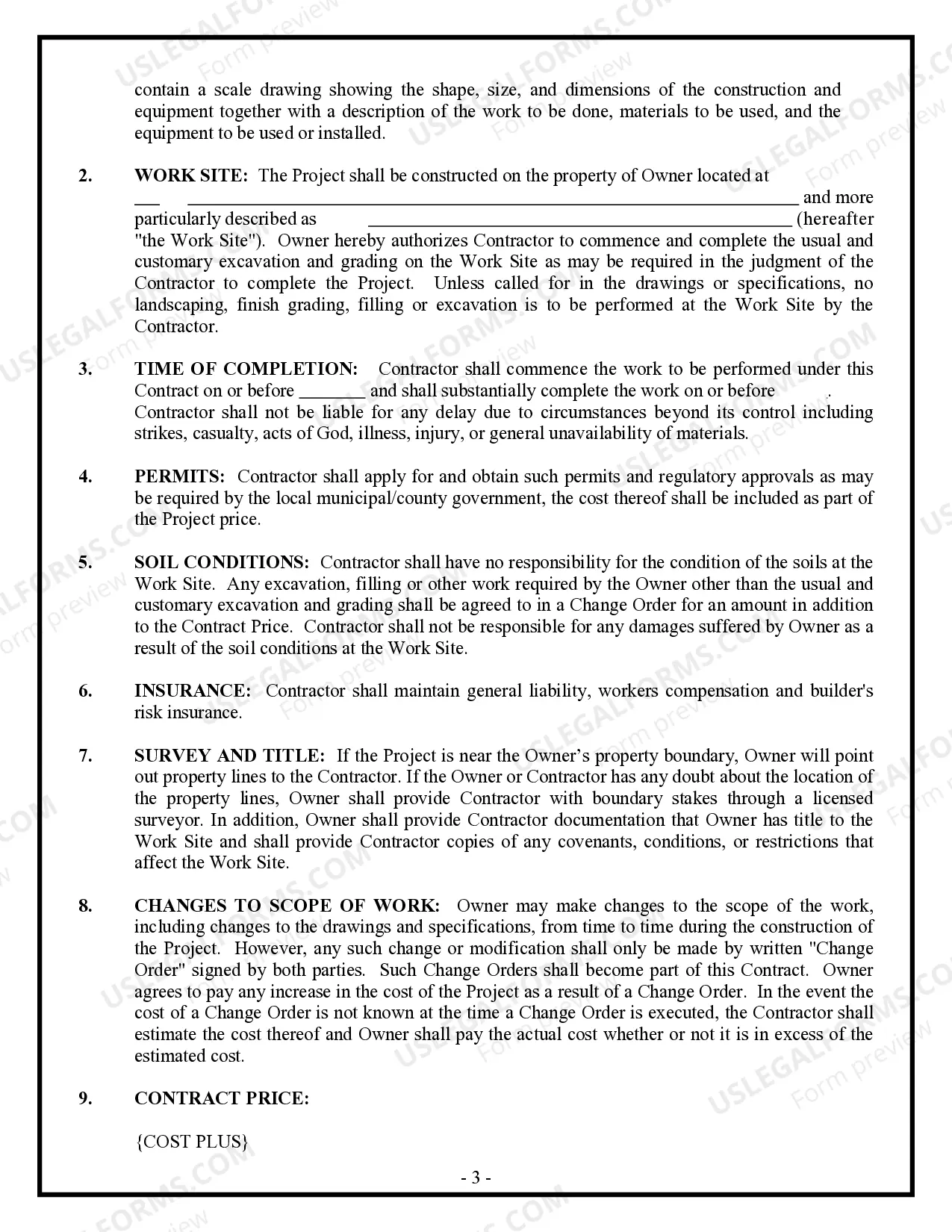

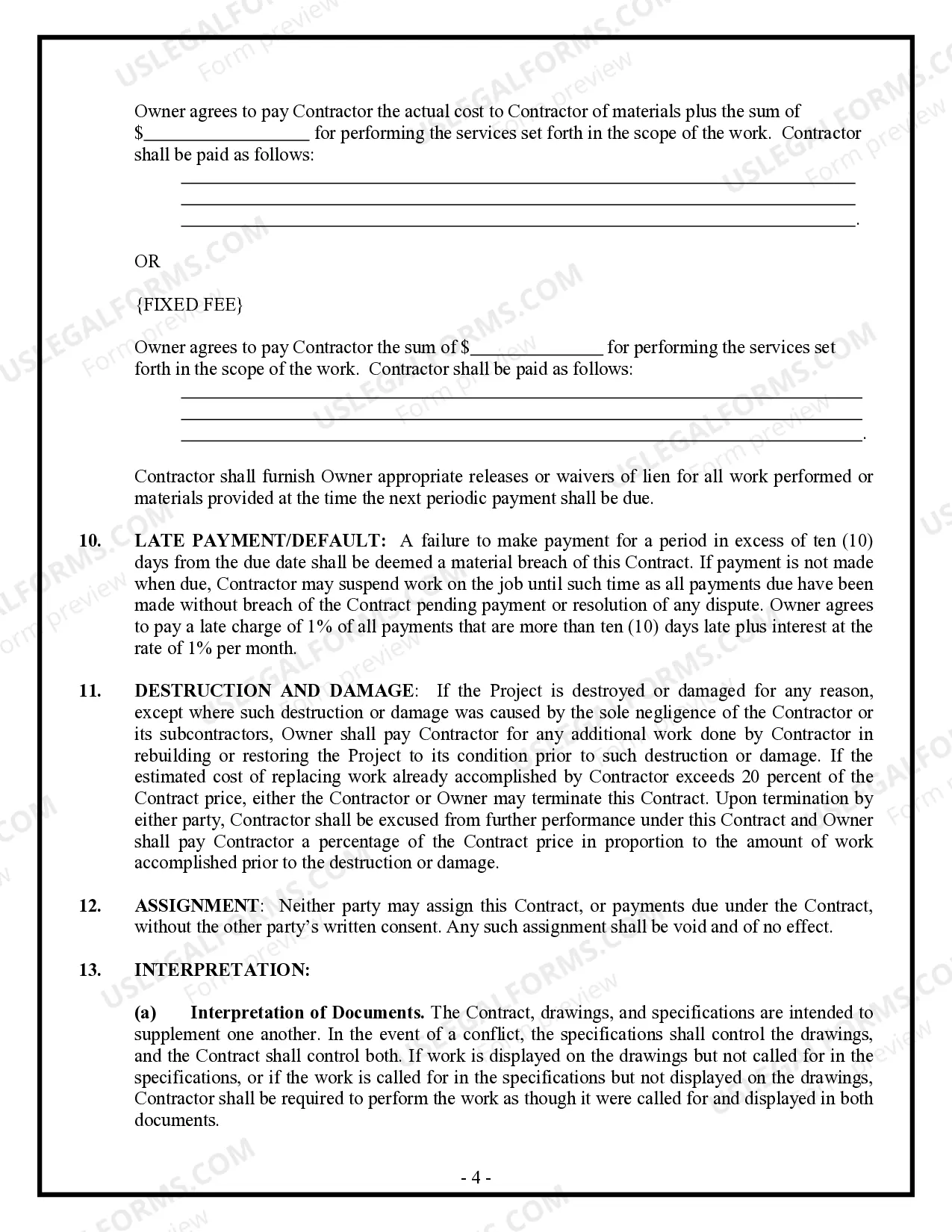

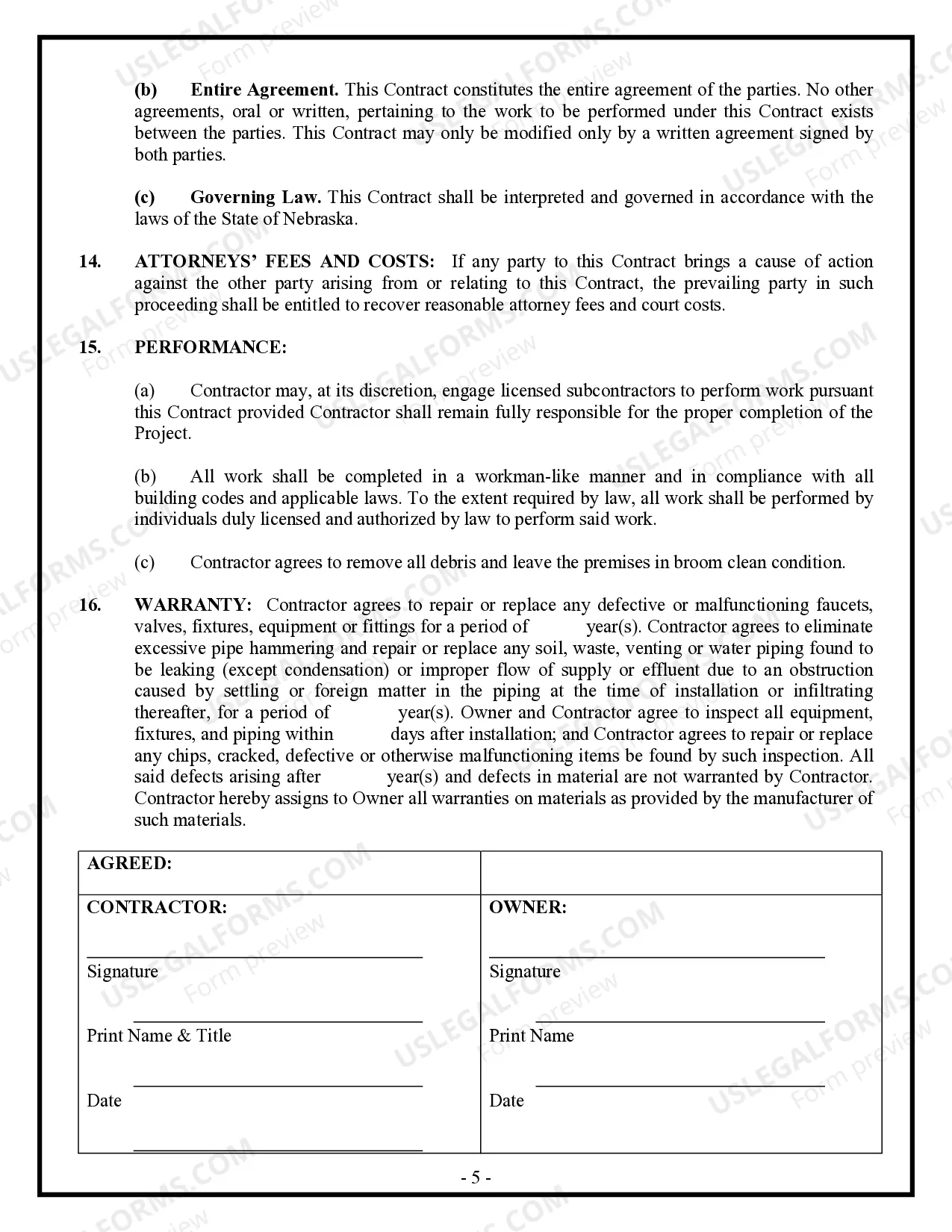

This form is designed for use between Plumbing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Nebraska.

Nebraska Plumbing Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nebraska Plumbing Contract For Contractor?

Avoid costly attorneys and find the Nebraska Plumbing Contract for Contractor you need at a reasonable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax files. Go through their descriptions and preview them before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to download and complete each template.

US Legal Forms subscribers basically have to log in and download the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet should follow the guidelines listed below:

- Ensure the Nebraska Plumbing Contract for Contractor is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you are sure the template suits you, click on Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you may complete the Nebraska Plumbing Contract for Contractor manually or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A certified contractor passed the state licensing examination. Certified contractors can work anywhere within the state in which they are licensed. A registered contractor is registered by a local county or municipality and receives a certificate of competency from the Electrical Contractors' Licensing Board.

To become a general contractor, you need at least a high school diploma, but there is an increase in a need for a bachelor's degree or at least an associate degree, plus years of construction industry experience. Regardless of education though, experience in the industry is the most important requirement.

Sales tax and surtax apply even when parts are provided at no charge. Labor Only for Repairs Charges for repairs of tangible personal property needing only labor or service are not subject to sales tax or surtax.

Deliveries into another state are not subject to Nebraska sales tax. Services are generally taxed at the location where the service is provided to the customer.

What Nebraska requires of contractors is relatively little, compared to other states. There is no required exam, but you are required to register with Nebraska's Department of Labor (DOL) via their website, providing specific business and identity information.

Nebraska Contractor Registration Information The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

On what labor charges must I collect tax?The labor charge is not subject to tax, provided it is separately stated on the invoice (an Option 1 contractor does not charge tax on contractor labor charges that are itemized separately). An Option 1 contractor is required to hold a Nebraska Sales Tax Permit.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.