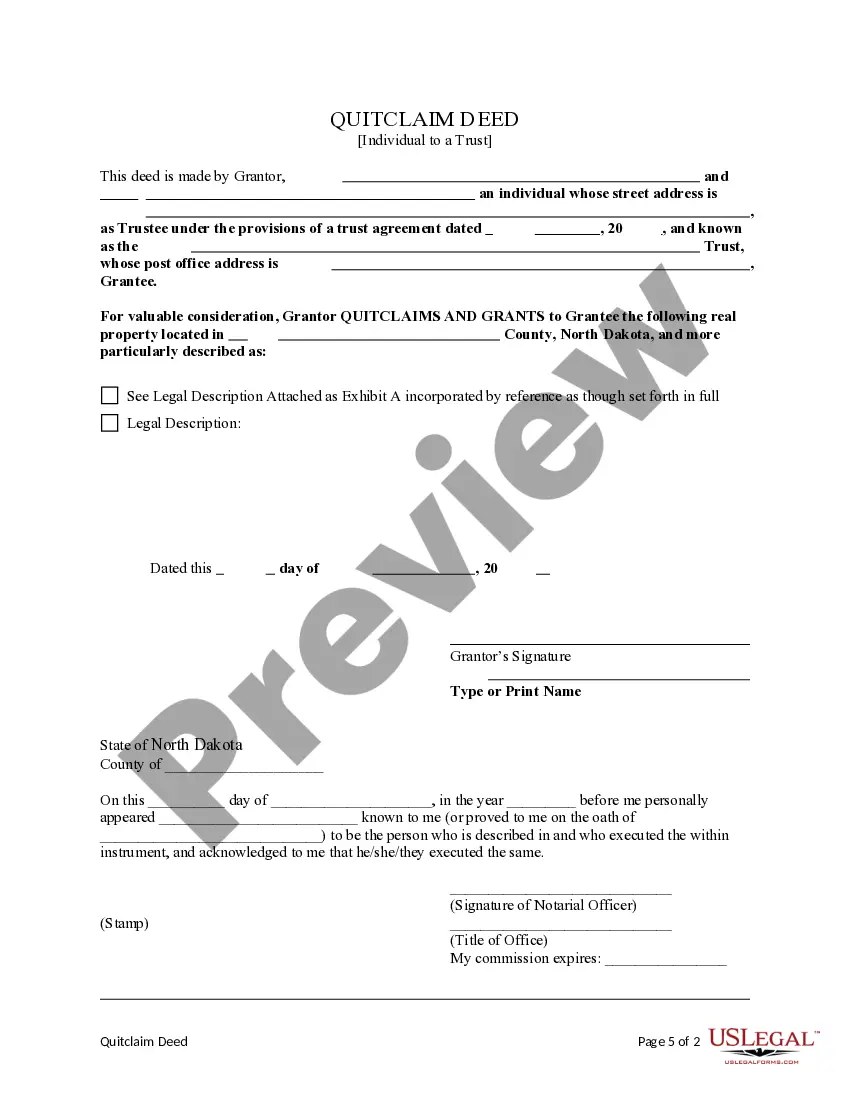

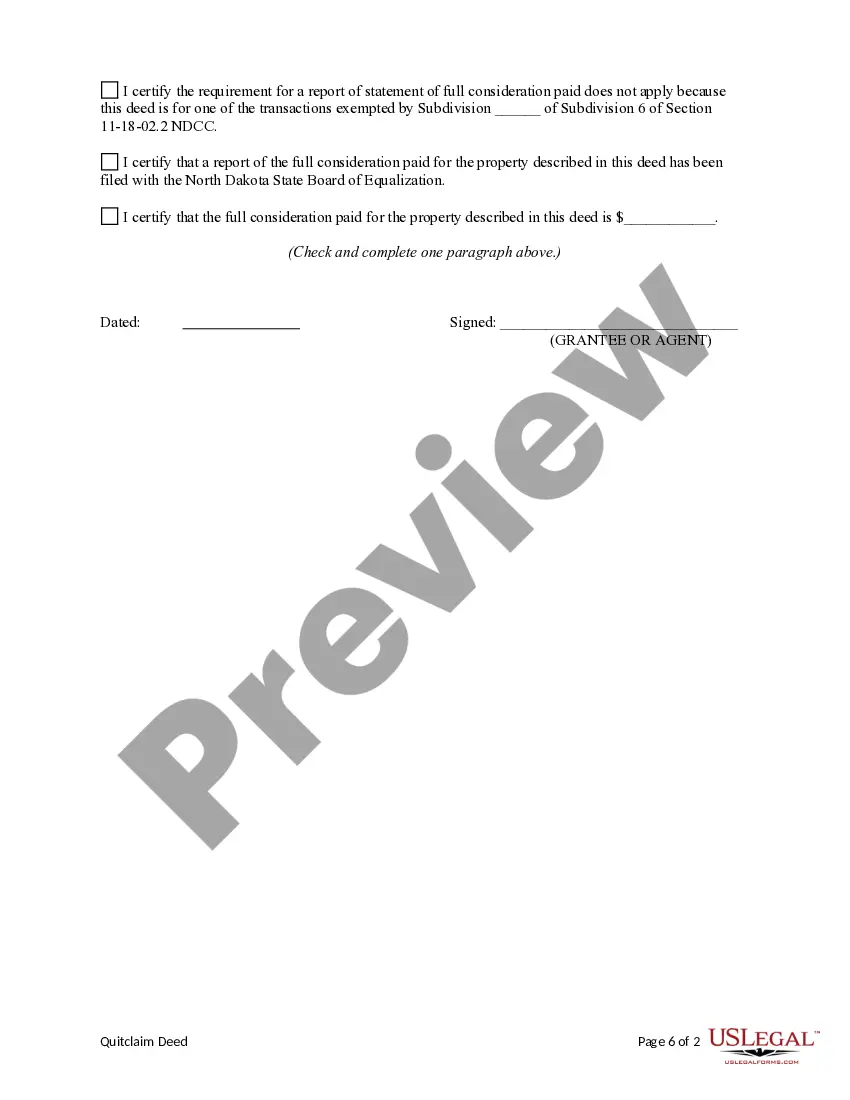

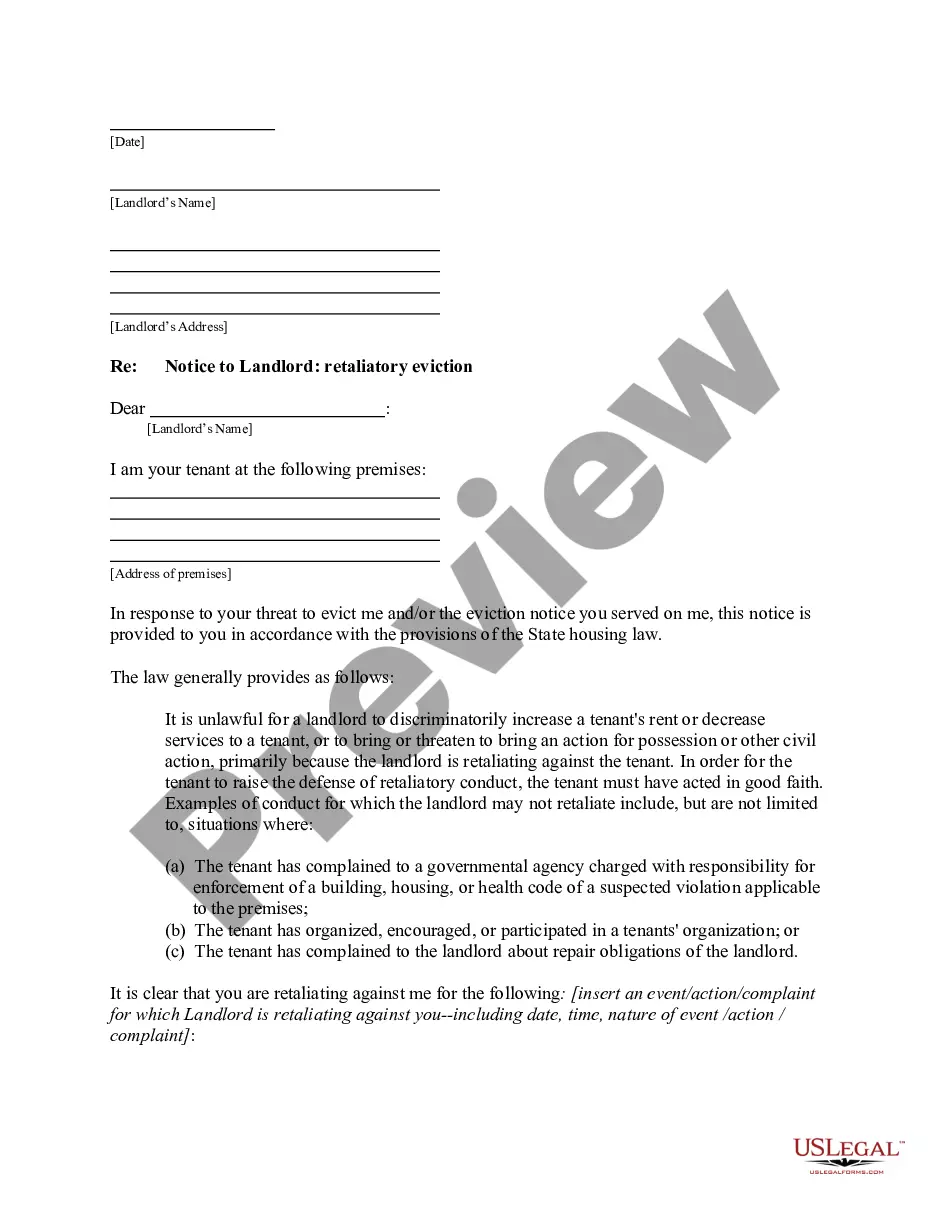

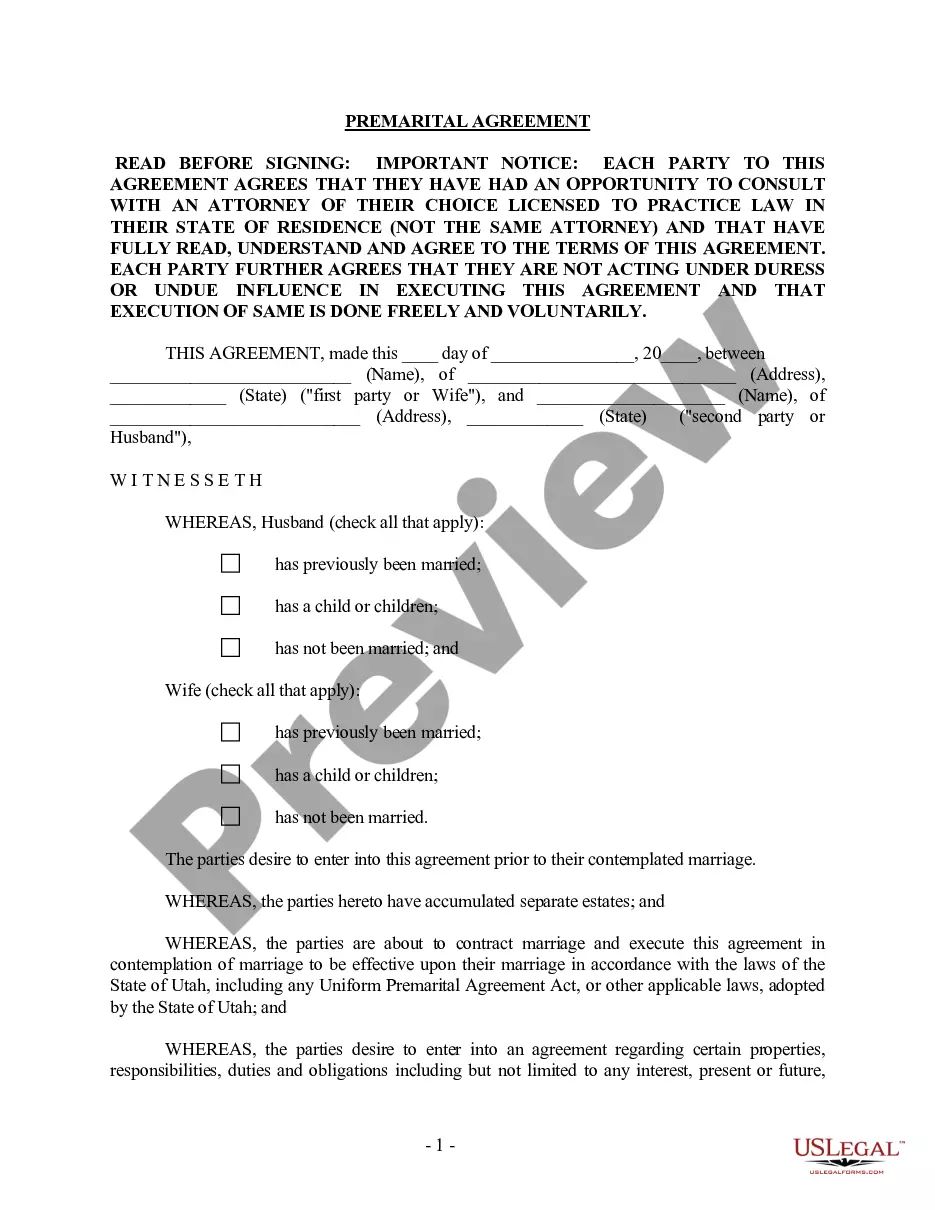

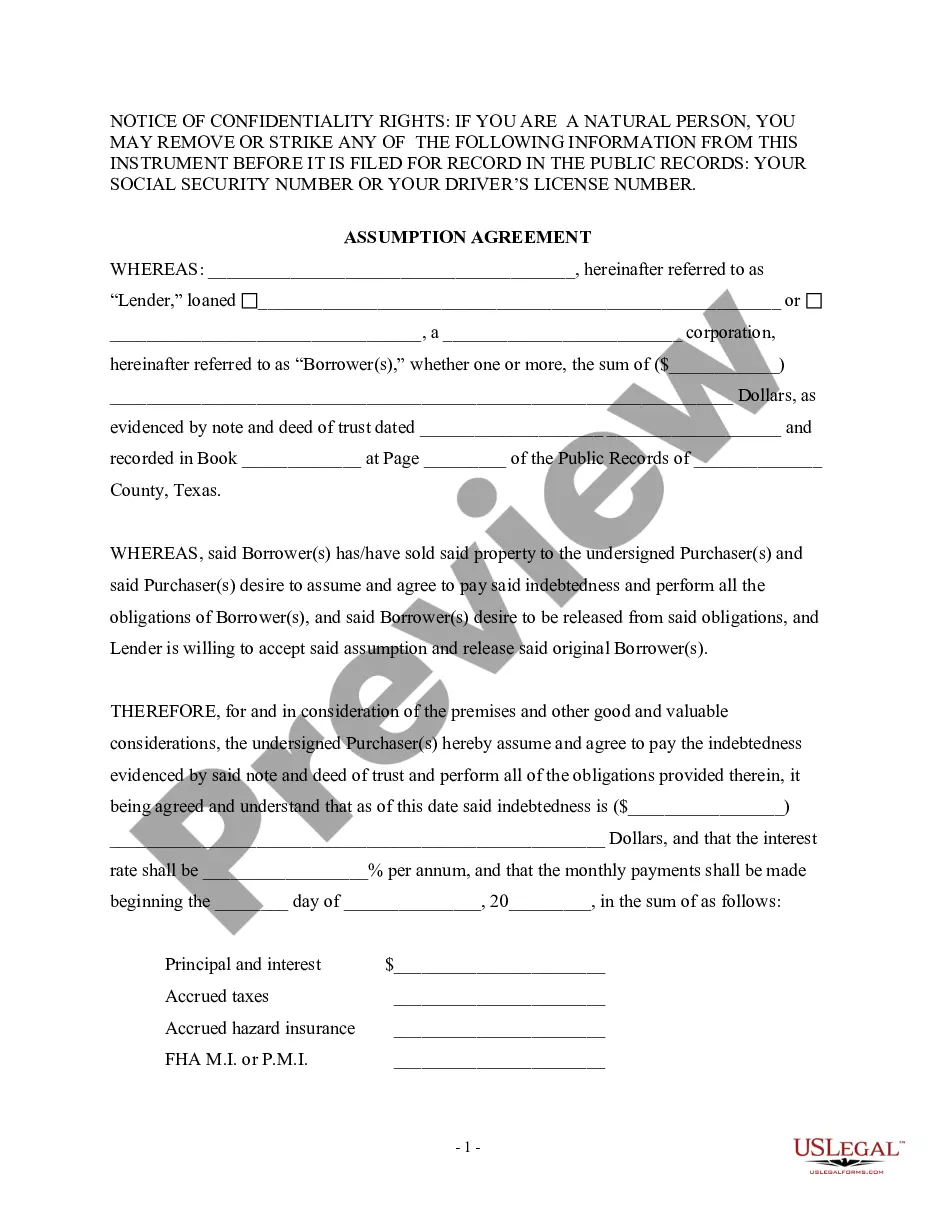

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

North Dakota Quitclaim Deed from an Individual to a Trust

Description

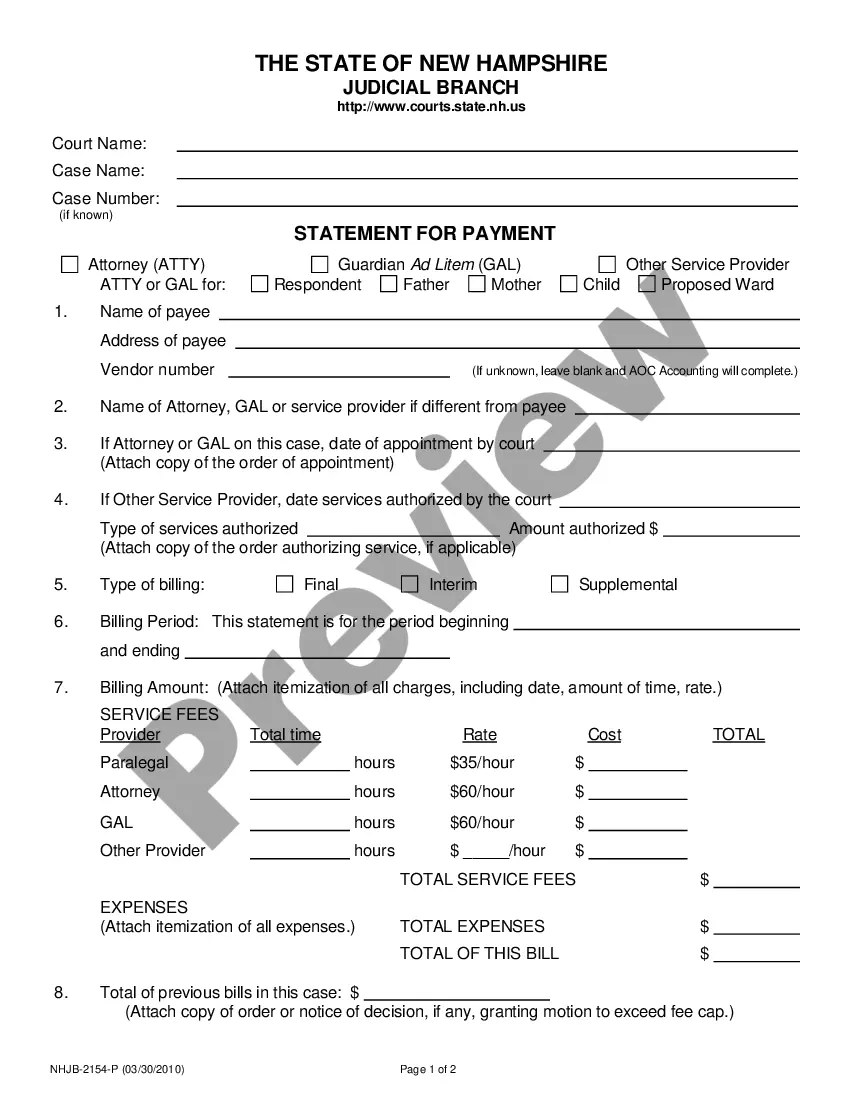

How to fill out North Dakota Quitclaim Deed From An Individual To A Trust?

Steer clear of pricey lawyers and locate the North Dakota Quitclaim Deed from an Individual to a Trust that you require at an affordable cost on the US Legal Forms site.

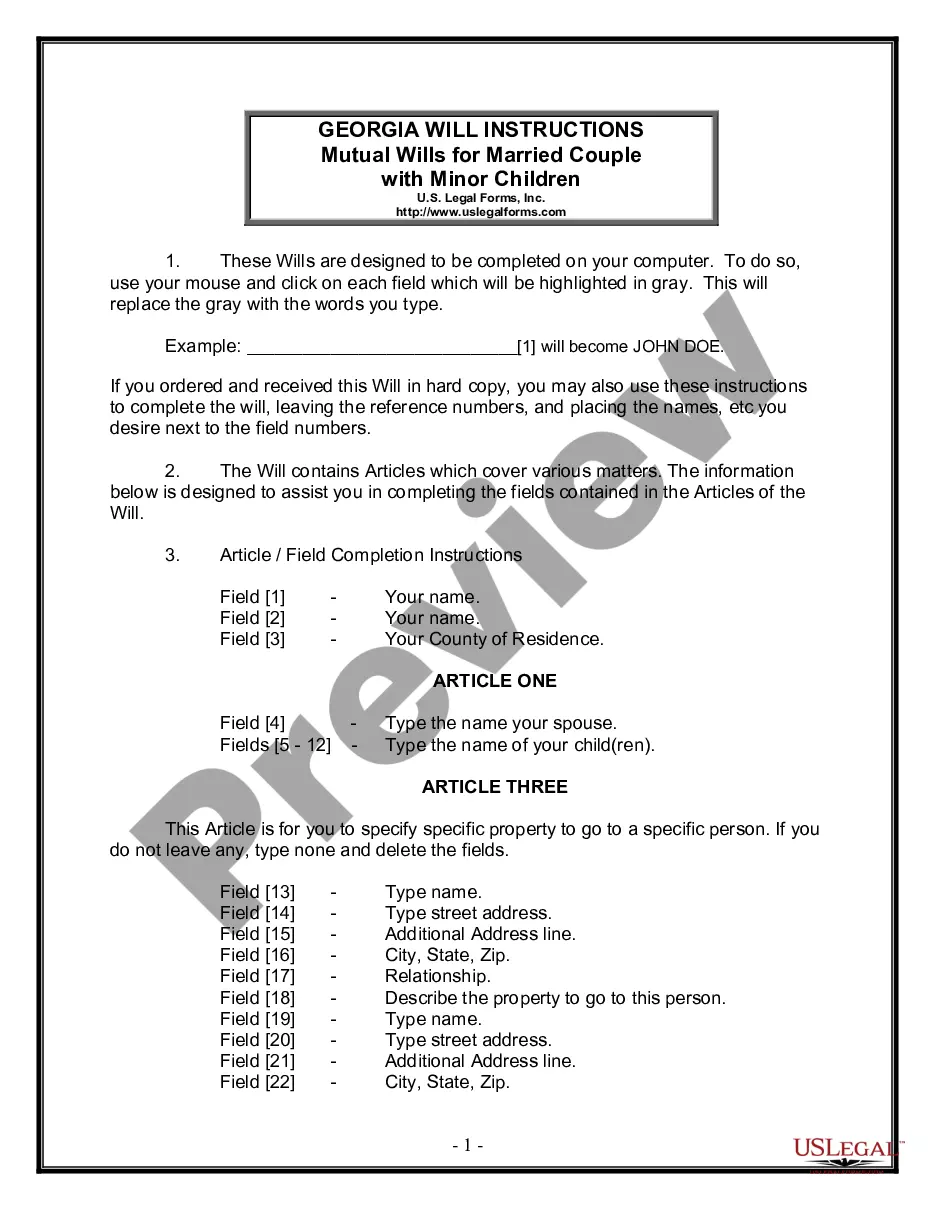

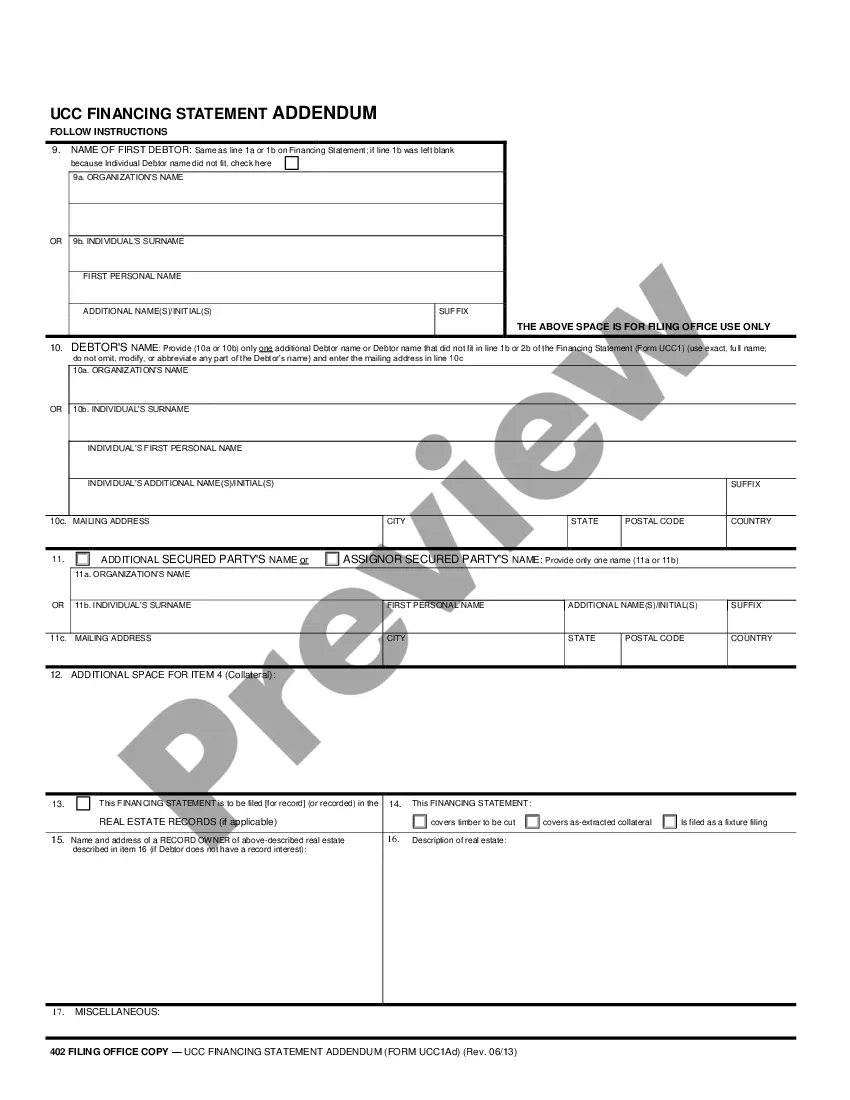

Utilize our straightforward categories feature to discover and acquire legal and tax documents. Review their explanations and preview them thoroughly before downloading.

Choose to download the form in PDF or DOCX format. Click Download and locate your template in the My documents section. You can save the form to your device or print it out. After downloading, you may fill out the North Dakota Quitclaim Deed from an Individual to a Trust by hand or using editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Furthermore, US Legal Forms provides users with detailed instructions on how to download and fill out each template.

- US Legal Forms clients essentially need to Log In and retrieve the particular form they require to their My documents section.

- Those who haven’t subscribed yet should adhere to the guidelines below.

- Confirm the North Dakota Quitclaim Deed from an Individual to a Trust is suitable for use in your area.

- If possible, review the description and utilize the Preview function just prior to downloading the documents.

- If you’re certain that the template meets your requirements, click Buy Now.

- If the form is incorrect, use the search tool to find the correct one.

- Then, establish your account and select a subscription option.

- Pay using a credit card or PayPal.

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

It is a legal document, hence should be short and precise. The letter must be addressed to the concerned authority. The letter must contain all the required details. You must mention your contact details for any queries or doubts.

A quitclaim deed is sometimes used to avoid probate court by transferring an interest in real property before someone's death. The property is transferred by deed during their life, instead of being transferred by a will after the grantor's death.