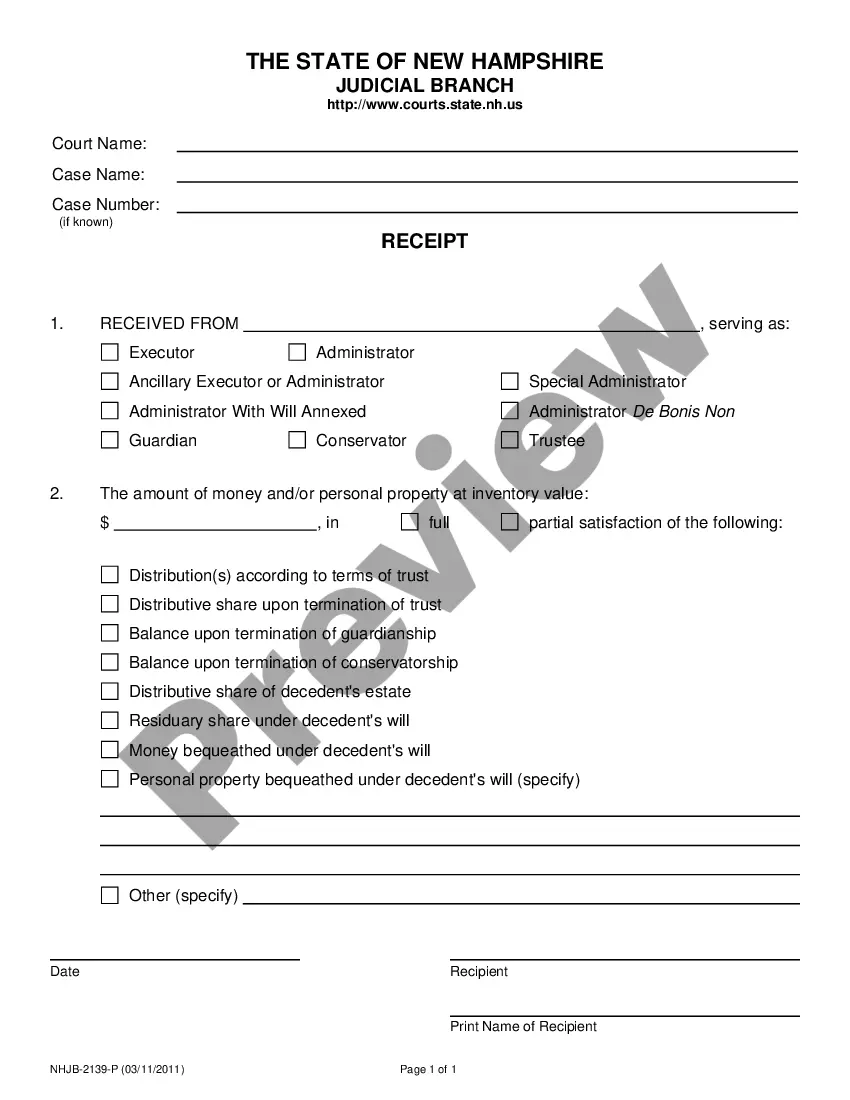

This is an official form from the New Hampshire Judicial Branch that is used by appointed attorneys, guardians ad litem and other service providers to summarize services provided and to be approved by the court for payment. It complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New Hampshire statutes and law.

New Hampshire Statement for Payment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Hampshire Statement For Payment?

US Legal Forms is a special system to find any legal or tax template for filling out, such as New Hampshire Statement for Payment. If you’re sick and tired of wasting time looking for perfect examples and paying money on file preparation/legal professional charges, then US Legal Forms is precisely what you’re trying to find.

To experience all of the service’s benefits, you don't have to install any software but simply select a subscription plan and sign up an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need New Hampshire Statement for Payment, have a look at the recommendations listed below:

- make sure that the form you’re considering is valid in the state you need it in.

- Preview the form and look at its description.

- Click Buy Now to get to the register page.

- Choose a pricing plan and keep on registering by entering some information.

- Select a payment method to complete the registration.

- Save the file by selecting your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you are uncertain about your New Hampshire Statement for Payment form, contact a legal professional to examine it before you decide to send out or file it. Get started hassle-free!

Form popularity

FAQ

The procedure is straightforward. A claim may be filed either in the district court where the plaintiff lives, where the defendant lives, or where the legal wrong arose. The small claim is filed with the district or municipal court clerk.

PA-33 STATEMENT OF QUALIFICATION FOR PROPERTY TAX CREDIT, EXEMPTION OR. TAX DEFERRAL UNDER RSA , V. (to be submitted with Form PA-29 or Form PA-30) USE THIS FORM IF YOUR PROPERTY IS HELD IN A TRUST, HAS EQUITABLE TITLE OR HAS A LIFE ESTATE. TYPE OR PRINT.

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends. The taxpayer can enter the date of residency during the New Hampshire Q&A.

In its simplest sense, fair market value (FMV) is the price that an asset would sell for on the open market.

Both spouses live in New Hampshire. The spouse initiating the separation has lived in New Hampshire for at least one year. The spouse initiating the separation lives in New Hampshire and their partner can be served in New Hampshire.

The procedure is straightforward. A claim may be filed either in the district court where the plaintiff lives, where the defendant lives, or where the legal wrong arose. The small claim is filed with the district or municipal court clerk.

What Is a Financial Affidavit? A financial affidavit, which has different names in each state, is a statement showing your income, expenses, debts and assets. It allows a court to figure out how much spousal support and child support it should award.

In New South Wales claims of less than $10,000 are heard in the Small Claims Division of the Local Court. The purpose of the small claims division is to deal with minor legal matters in a way that is more accessible to the ordinary person.