The Missouri Application For Authority To Self Insure (MOA-SSI) is a document used by employers in the state of Missouri to self-insure their employees or workers for workers compensation insurance. The application is used to provide the Missouri Department of Labor and Industrial Relations with the necessary information to determine the employer's eligibility for self-insurance. The MOA-SSI comprises two parts: Part A, which includes employer information and Part B, which includes employee/worker information. The application must be completed in its entirety and submitted to the Missouri Department of Labor and Industrial Relations. Upon approval of the application, the employer will be authorized to self-insure and will receive a Certificate of Authority. There are two types of Missouri Application For Authority To Self Insure: 1. The Standard Application For Authority To Self Insure: This is the standard application used by employers to self-insure their employees/workers. 2. The Alternative Application for Authority To Self Insure: This is an alternative application used by employers who have the ability to meet certain requirements that are not required for the standard application.

Missouri Application For Authority To Self Insure

Description

How to fill out Missouri Application For Authority To Self Insure?

Engaging with official documentation necessitates focus, precision, and the use of well-constructed templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Missouri Application For Authority To Self Insure template from our platform, you can rest assured it adheres to federal and state guidelines.

Utilizing our service is simple and swift. To obtain the required document, all you’ll need is an account with an active subscription. Here’s a brief guideline for you to locate your Missouri Application For Authority To Self Insure in just a few minutes.

All documents are prepared for multiple uses, like the Missouri Application For Authority To Self Insure you see on this page. If you need them again, you can complete them without repaying - simply access the My documents tab in your profile and finalize your document whenever necessary. Try US Legal Forms and complete your business and personal documentation quickly and in full legal compliance!

- Ensure to carefully review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative official blank if the one you opened does not meet your circumstances or state regulations (the tab for that is located at the top page corner).

- Log in to your account and download the Missouri Application For Authority To Self Insure in your preferred format. If this is your first experience with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you would like to save your form and click Download. Print the document or add it to a professional PDF editor for electronic preparation.

Form popularity

FAQ

Self-insurance involves acquiring a certificate of coverage from the Florida DMV and taking fiscal responsibility for all accident-related expenses for which the motorist is legally liable. Self-insurance can either be a cost-cutting measure or a risky gamble that could financially wipe out the self-insured party.

If you want to be self-insured in Florida, you have to meet the minimum unencumbered net worth of $40,000 to qualify. This would assure the state that you can be responsible for any expenses that need to get paid following a car accident. In addition, you have to maintain that balance.

Saving money may be the primary driver when companies decide to self-insure, but there are other benefits as well. Employers can eliminate costs for state insurance premium taxes. And they don't have to adhere to state-mandated coverage requirements.

If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money! And we're all about saving money where we can?especially on insurance premiums.

Being self-insured means that rather than paying an insurance company to pay medical, dental and vision claims, we pay the claims ourselves, using a third-party administrator to process the claims on our behalf.

insured group health plan (or a 'selffunded' plan as it is also called) is one in which the employer assumes the financial risk for providing health care benefits to its employees.

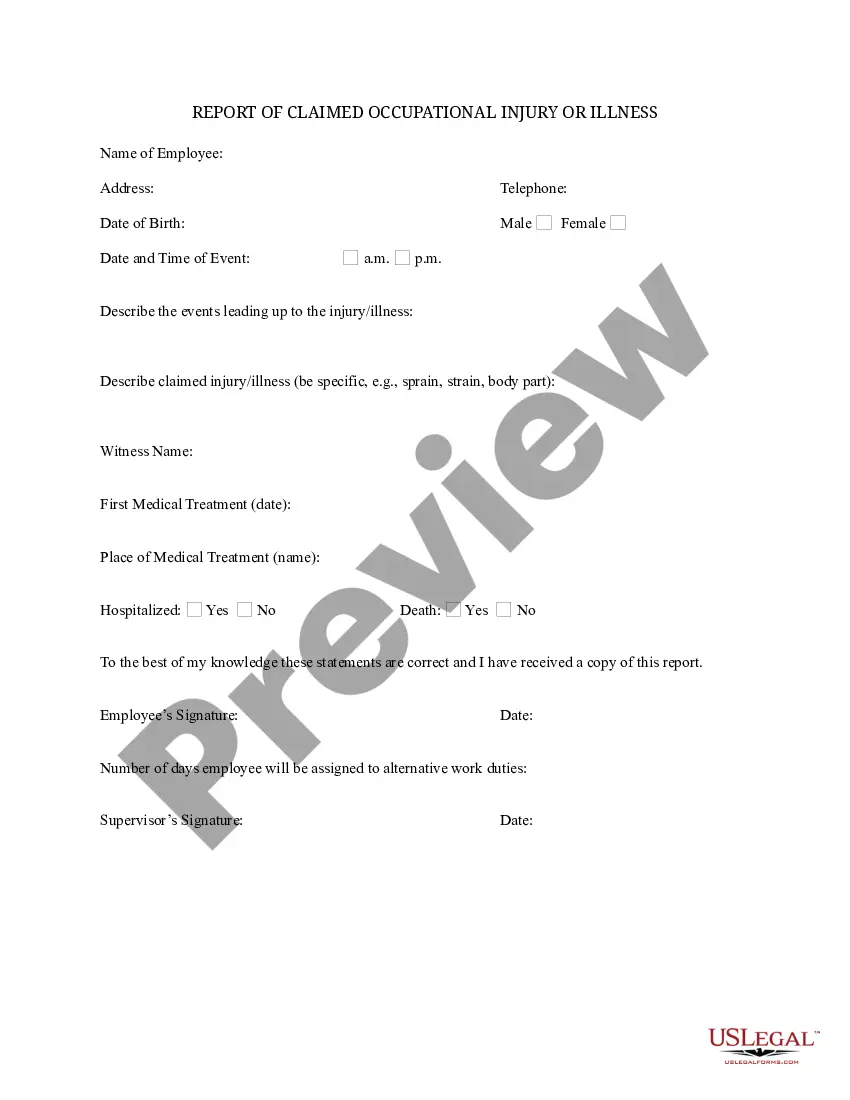

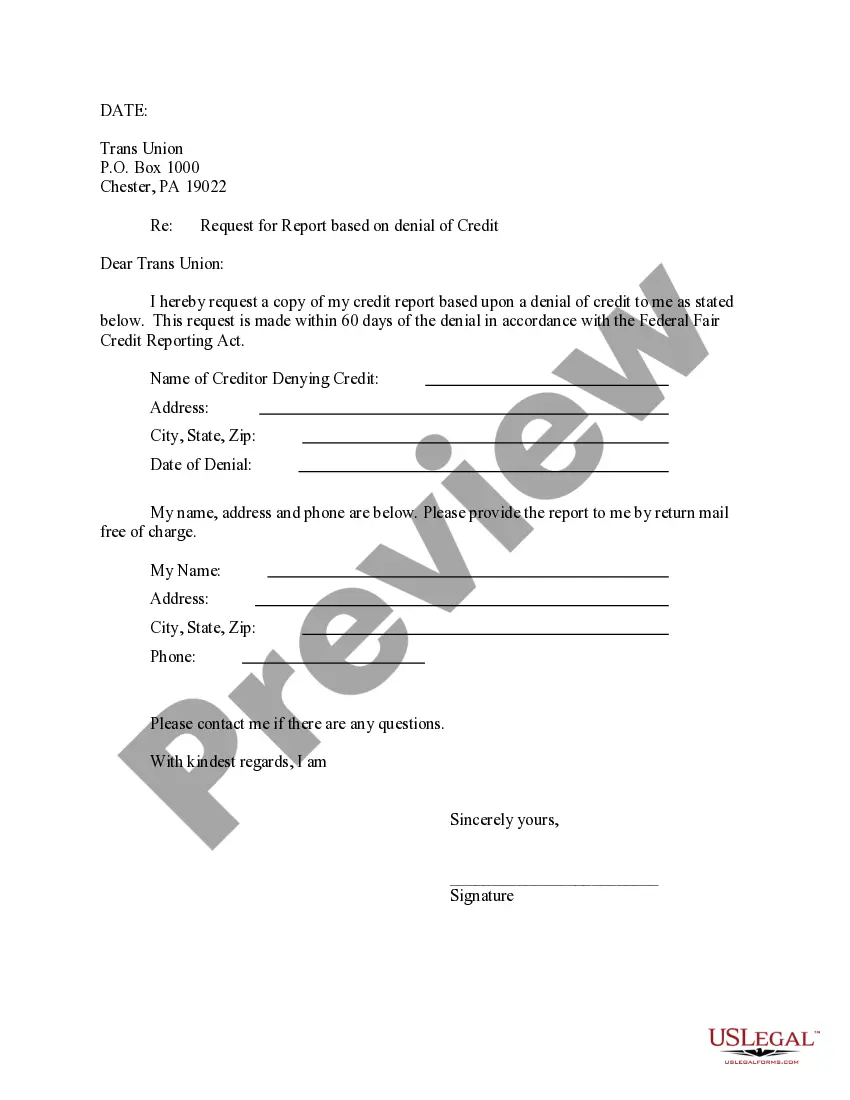

Each state regulates who may be self-insured for workers' compensation. Normally, a prospective self-insured submits a required application accompanied by audited financial data, prior workers' compensation loss history, and other information required by each state.

A model letter for use by executive branch federal agencies when responding to requests for proof of insurance or proposed contract clauses which require proof of insurance.