North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Understanding this form

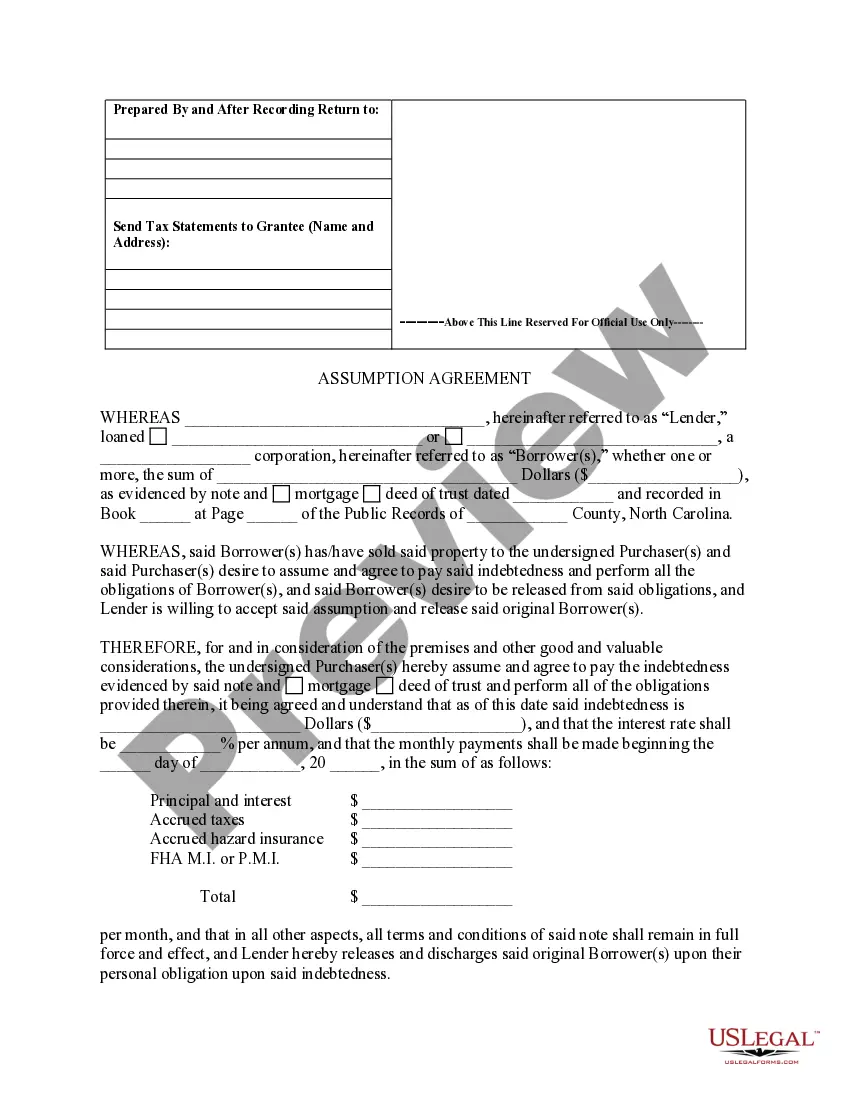

The Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that allows a new purchaser of a property to assume the existing mortgage debt from the original mortgagors. This agreement releases the original mortgagors from future liability on the loan while confirming that the new purchaser will take on the responsibility for repaying the mortgage. This form is crucial when real estate ownership changes hands, and the new owners wish to retain the original mortgage terms without creating a new loan.

What’s included in this form

- Identification of the lender, original mortgagors, and new purchasers.

- Details of the existing mortgage debt including total amount and interest rate.

- Terms of the monthly payments and associated obligations.

- A statement releasing the original mortgagors from future liability.

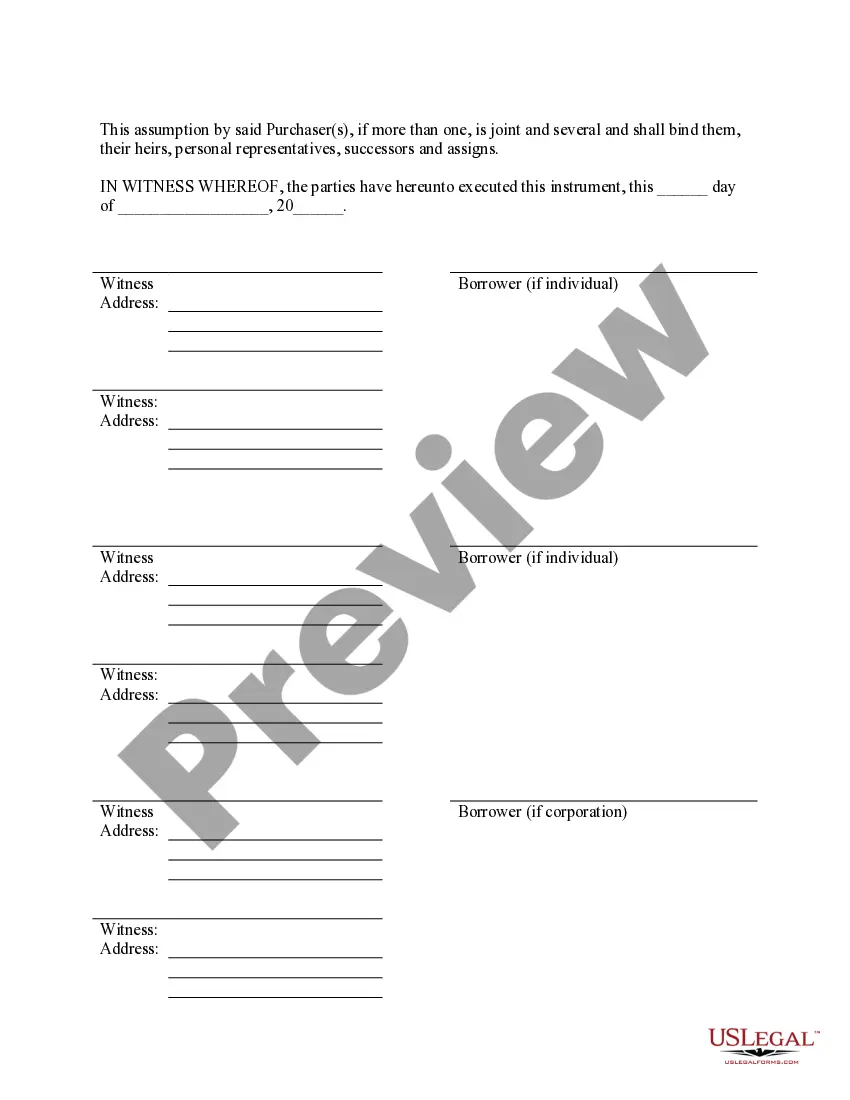

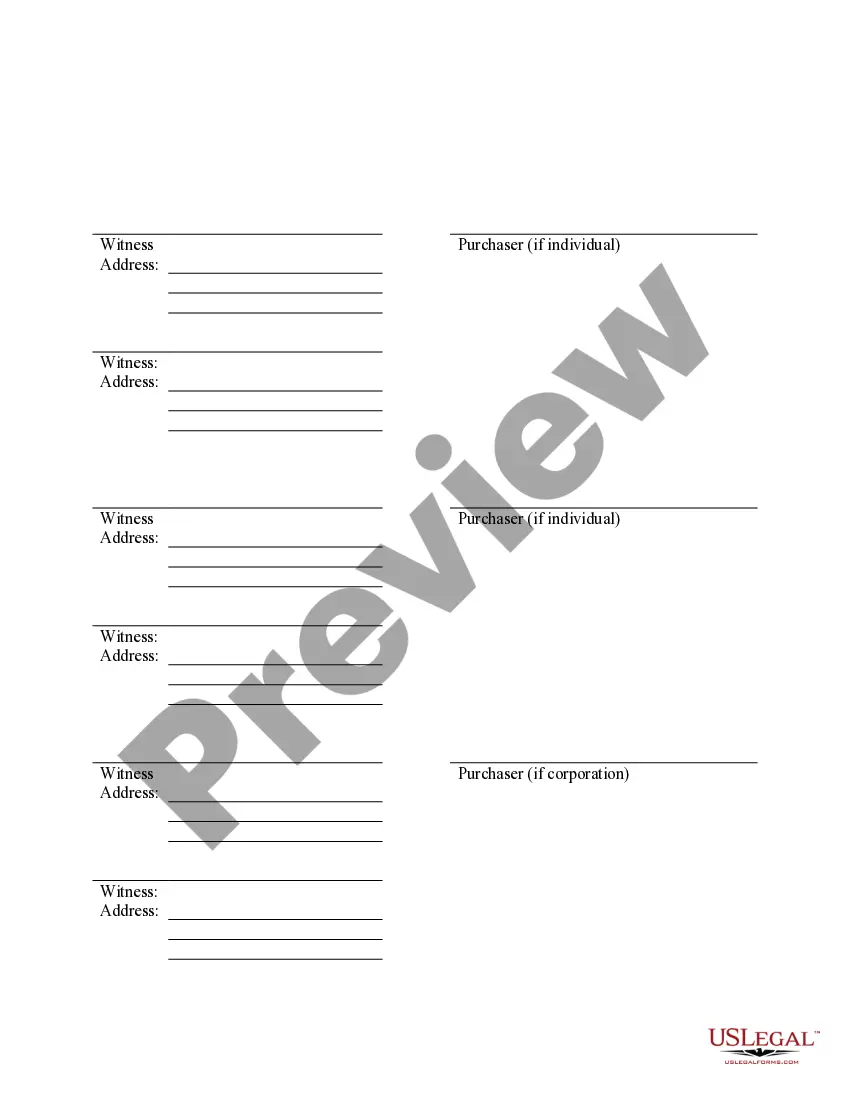

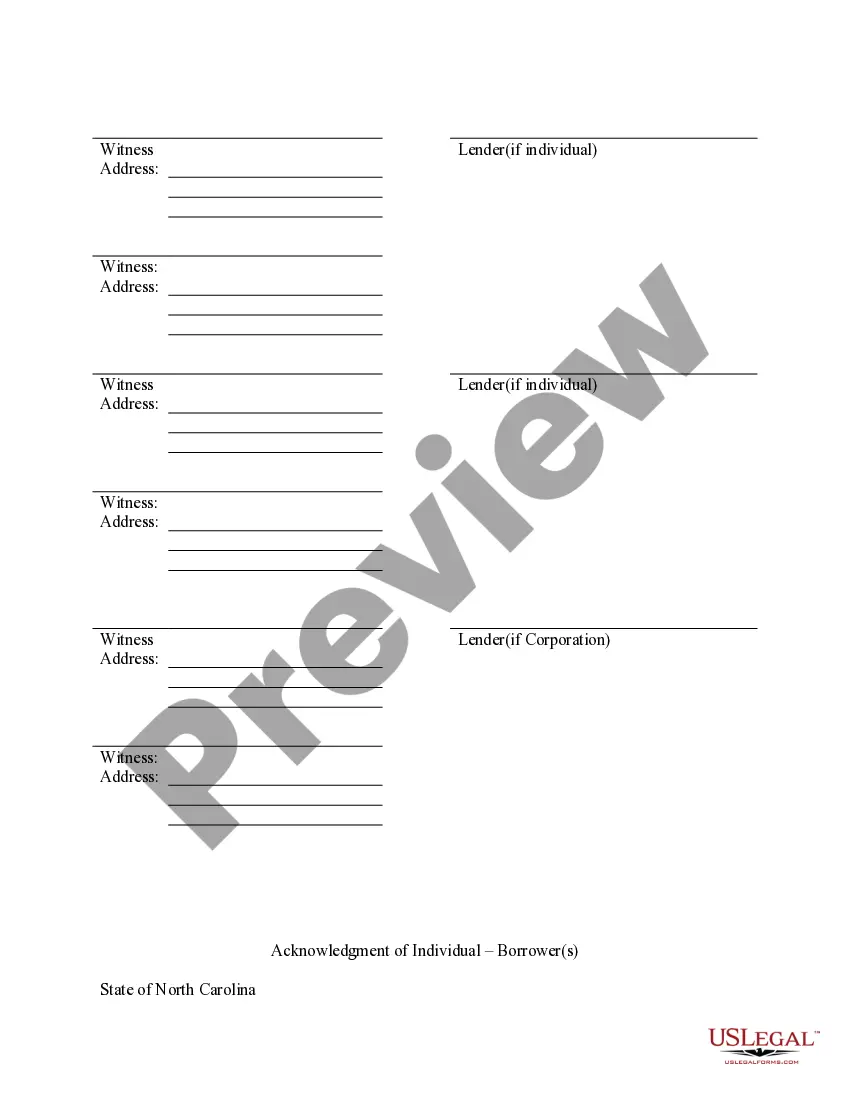

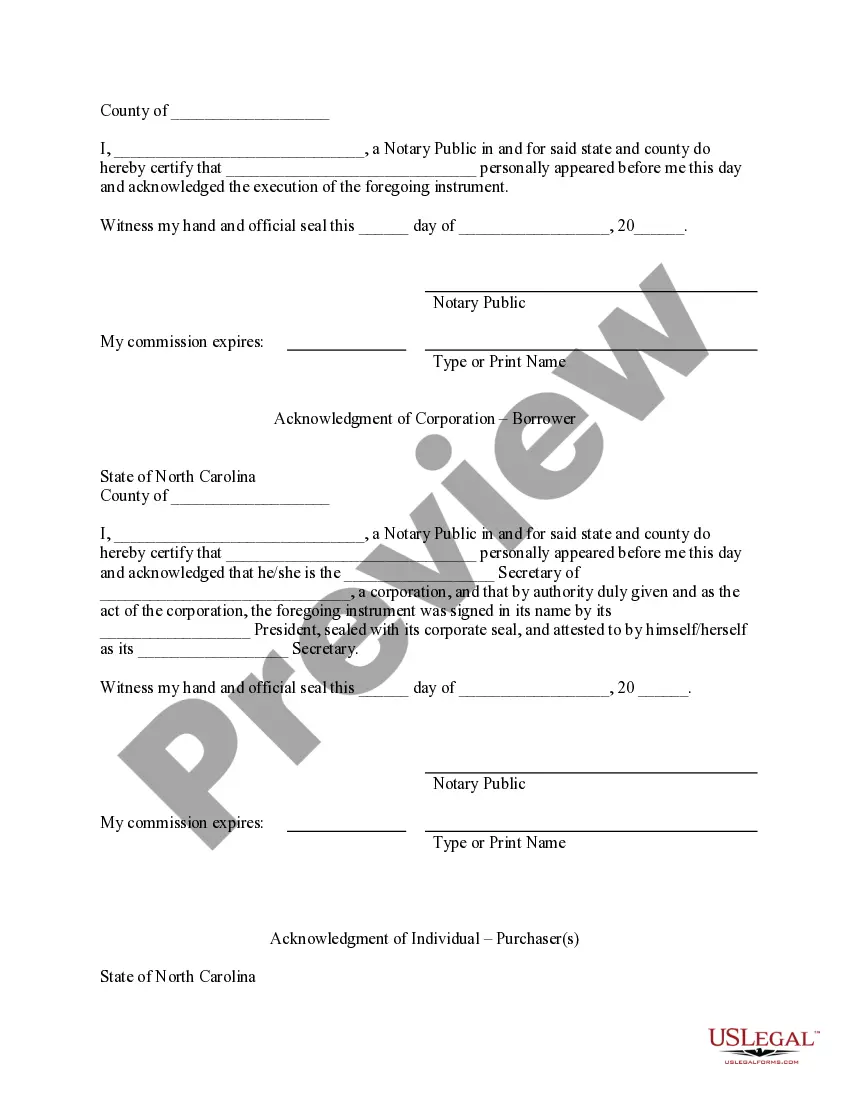

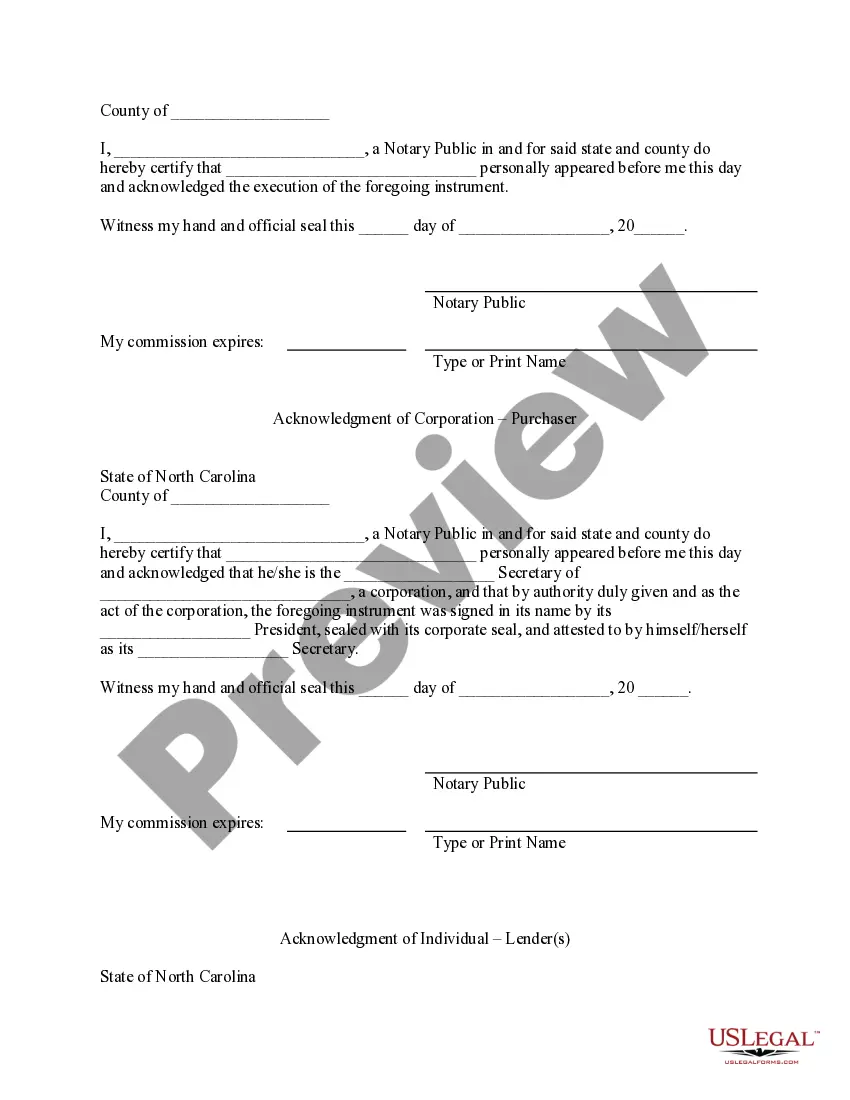

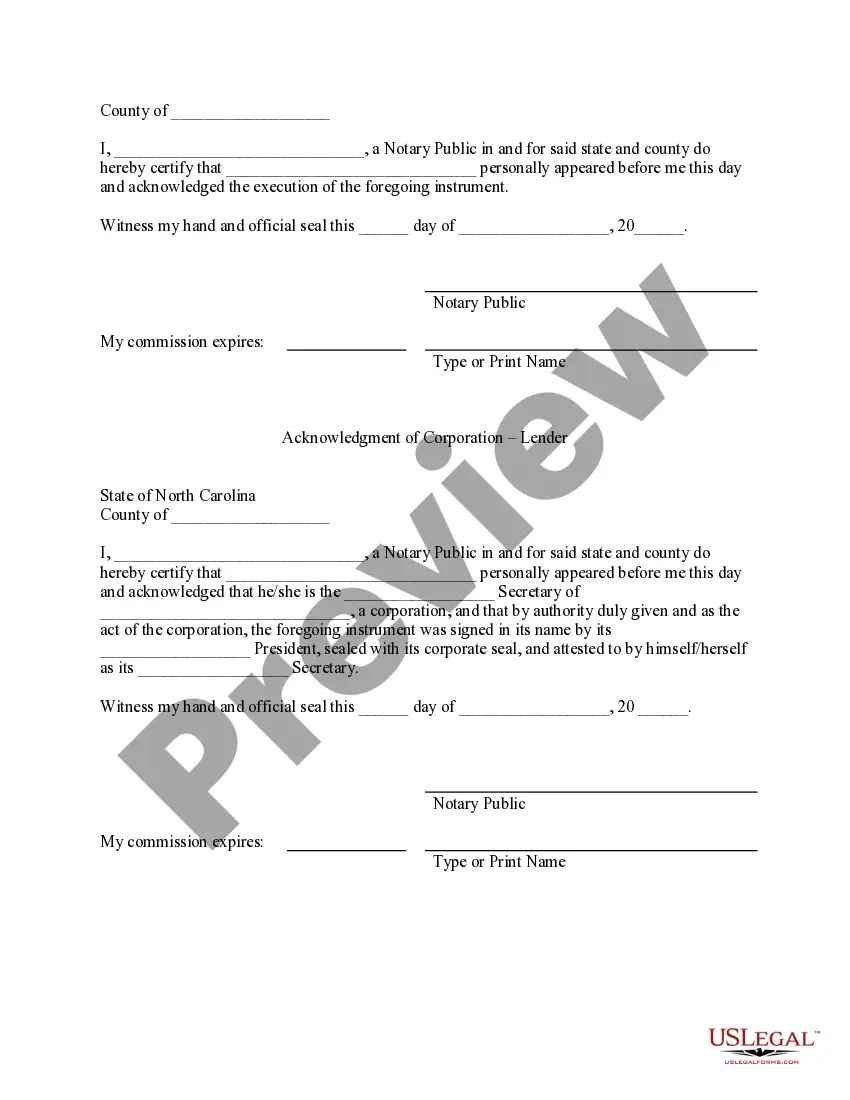

- Signature lines for all parties involved and notarization details.

Common use cases

This form is typically used when a property is sold, and the buyer wishes to assume the existing mortgage. It is suitable in scenarios such as transferring ownership between family members, selling a property while maintaining current financing terms, or when a buyer wants to avoid the costs and complexities of obtaining a new mortgage. By utilizing this agreement, all parties clarify their responsibilities and rights regarding the mortgage debt.

Who can use this document

Eligible users of this form typically include:

- New purchasers of property who wish to assume an existing mortgage.

- Original mortgagors looking to be released from their loan obligations.

- Lenders or mortgagees who need a formal agreement acknowledging the assumption of debt.

How to complete this form

- Identify all parties involved: the lender, original mortgagors, and new purchasers.

- Enter the total mortgage amount and the applicable interest rate.

- Specify the details of the monthly payments, including principal and interest.

- Ensure all parties sign the agreement to indicate their consent.

- Have the document notarized to ensure legal compliance.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all parties' names and signatures.

- Leaving the financial details incomplete or incorrect.

- Not having the form notarized when required.

- Assuming all obligations without clearly stating them in the agreement.

Benefits of completing this form online

- Convenient access for immediate download and use.

- Edit and fill out the form directly on your computer for accuracy.

- Reliable templates drafted by licensed attorneys to ensure compliance with state laws.

Looking for another form?

Form popularity

FAQ

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.The assignee must agree to accept, or "assume," those contractual rights and duties.

Most states that use deeds of trust to secure home loans are title theory states.A few deed of trust states include West Virginia, Alaska, Virginia, Arizona, Texas, California, North Carolina, Colorado, New Mexico, Idaho, Montana, Illinois, Missouri and Mississippi.

Release of the Debtor. In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

An assumption of contract occurs when one party, the assignee, accepts the benefits and obligations of an existing contract from one of the contract's original parties, known as the assignor. A corporate assumption of contract just means that either the assignee or the assignor, or both parties are corporations.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.