The Massachusetts Chapter 13 Agreement Between Debtor and Counsel is a legal document outlining the terms and conditions of the relationship between the debtor and their attorney. This agreement is entered into when an individual seeks to file a Chapter 13 Bankruptcy in Massachusetts. The agreement outlines the roles and responsibilities of both parties, the cost of the services provided, and the timeline for the completion of the bankruptcy filing. Generally speaking, the debtor agrees to pay their attorney a fee for the services rendered, and the attorney agrees to represent the debtor throughout the bankruptcy process. The Massachusetts Chapter 13 Agreement Between Debtor and Counsel typically includes the following types of agreements: Fee Agreement, Retainer Agreement, Engagement Letter, and Motion to Compel Payment of Attorney Fees. The Fee Agreement outlines the fee structure that the debtor agrees to pay the attorney for their services. The Retainer Agreement outlines the amount of money that the debtor agrees to pay the attorney upfront to secure their services. The Engagement Letter outlines the terms of the attorney-client relationship and the services that the attorney will provide. The Motion to Compel Payment of Attorney Fees is a document filed by the attorney if the debtor fails to make payments on time. Overall, the Massachusetts Chapter 13 Agreement Between Debtor and Counsel is an important document for both parties to understand and agree to before any work begins. It outlines the roles and responsibilities of both the debtor and their attorney, and sets out the terms for the payment of fees.

Massachusetts Chapter 13 Agreement Between Debtor And Counsel

Description

How to fill out Massachusetts Chapter 13 Agreement Between Debtor And Counsel?

Engaging with official documentation necessitates carefulness, precision, and the utilization of accurately-prepared forms.

US Legal Forms has been assisting individuals across the country with this for 25 years, so when you select your Massachusetts Chapter 13 Agreement Between Debtor And Counsel template from our service, you can be assured it complies with federal and state laws.

All documents are crafted for multiple uses, such as the Massachusetts Chapter 13 Agreement Between Debtor And Counsel you see on this page. If you require them again in the future, you can complete them without additional payment - just navigate to the My documents tab in your profile and finalize your document whenever needed. Experience US Legal Forms and prepare your business and personal documents quickly and in full legal compliance!

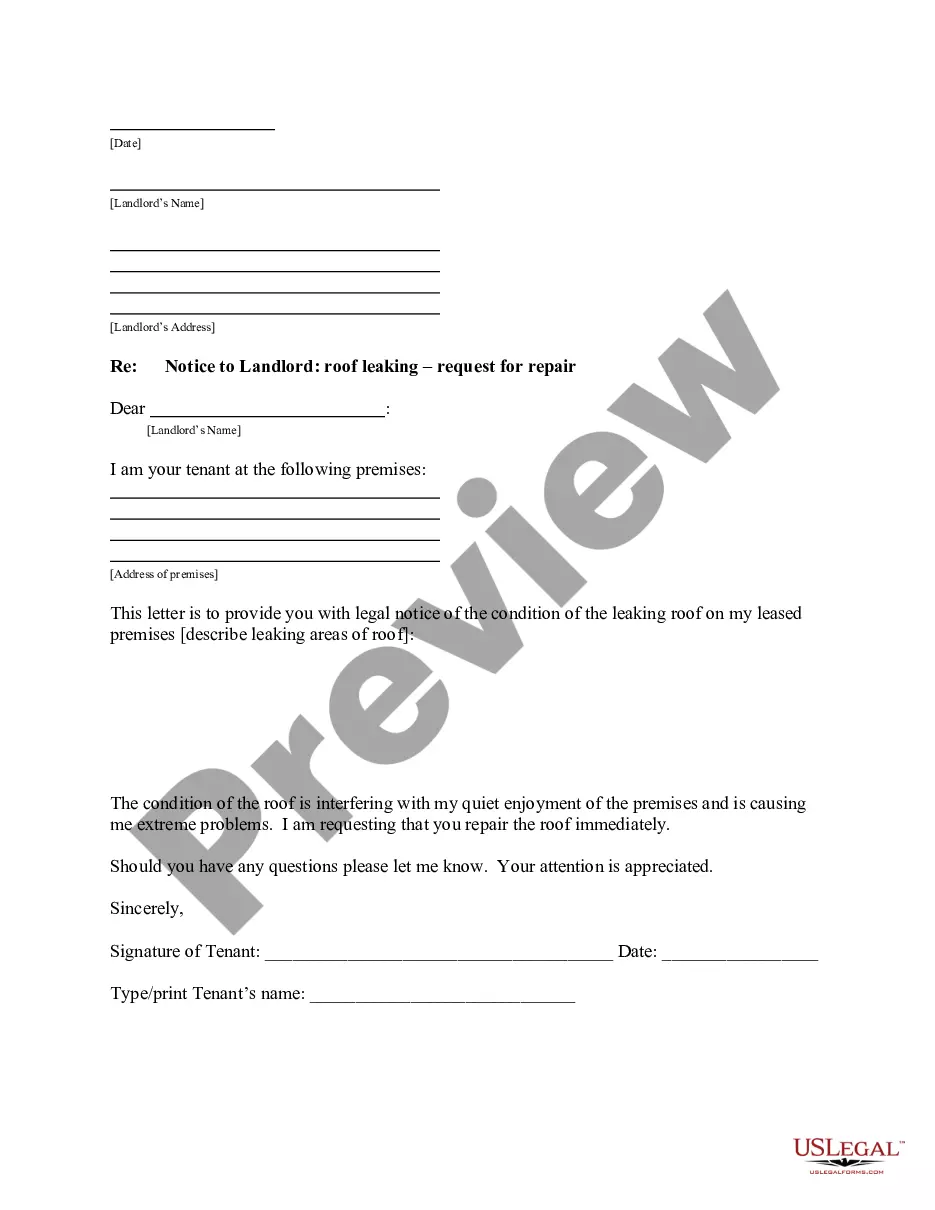

- Make sure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative formal document if the one you initially accessed does not fit your circumstances or state regulations (the option for that is in the top page corner).

- Log in to your account and download the Massachusetts Chapter 13 Agreement Between Debtor And Counsel in your desired format. If you're using our website for the first time, click Buy now to proceed.

- Establish an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you want to receive your document and click Download. Print the form or incorporate it into a professional PDF editor to complete it electronically.

Form popularity

FAQ

Yes, a court can dismiss a debtor's petition under Chapter 13 for bad faith, regardless of the reasons behind the filing. The Massachusetts Chapter 13 Agreement Between Debtor And Counsel provides a framework where the court examines whether the debtor is acting honestly in repaying debts. If the court finds evidence of bad faith, it can dismiss the case. Therefore, it’s essential to approach this process transparently and honestly.

The Chapter 13 Hardship Discharge After confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. In such situations, the debtor may ask the court to grant a "hardship discharge." 11 U.S.C. § 1328(b).

?Co-debtors? include co-borrowers and co-signors of consumer debts. Therefore, the ?co-debtor stay? extends the protections of the automatic stay (and the liability for violations of the stay) to co-borrowers and co-signors of consumer debts, even though the co-borrower or co-signor has not filed for bankruptcy.

If the Chapter 13 plan is dismissed, creditors may immediately initiate or continue with state court litigation pursuant to applicable state law to foreclose on the petitioner's property or garnish their income. If a bankruptcy case is dismissed, the legal affect is that the bankruptcy is deemed void.

The amount of time you need to wait to apply for a conventional loan after a Chapter 13 bankruptcy depends on how a court chooses to handle your bankruptcy. If the court dismisses your bankruptcy, you must wait at least 4 years from your dismissal date before you can apply.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

Your debts will not be discharged. Often creditors?especially unsecured creditors?don't bother to file claims with the bankruptcy court and their debts get discharged, but only if you complete the plan. When the case is dismissed, those creditors stay with you.

As a result, most Chapter 13 plans do not have to provide for the repayment of unsecured debts. The only instance when Chapter 13 plans must provide for payment of unsecured debts is when an unsecured creditor objects to the plan. If this happens, the debtor must pass a ?disposable income? test.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.