North Carolina Financial Account Transfer to Living Trust

Description

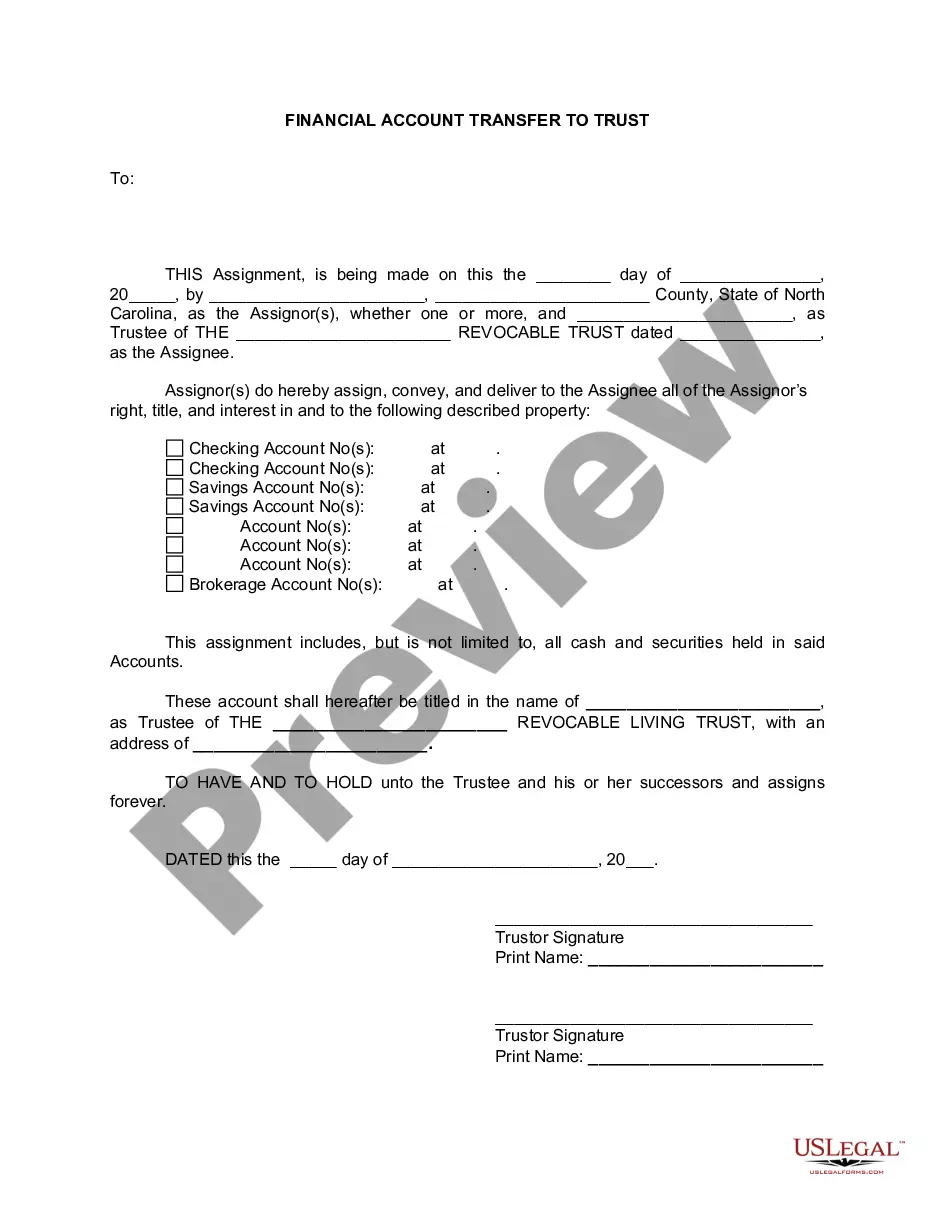

How to fill out North Carolina Financial Account Transfer To Living Trust?

Avoid costly lawyers and find the North Carolina Financial Account Transfer to Living Trust you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and obtain legal and tax files. Go through their descriptions and preview them prior to downloading. Moreover, US Legal Forms enables users with step-by-step tips on how to obtain and complete every form.

US Legal Forms subscribers simply must log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must follow the guidelines below:

- Ensure the North Carolina Financial Account Transfer to Living Trust is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the templates.

- If you are sure the document fits your needs, click on Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, you can complete the North Carolina Financial Account Transfer to Living Trust by hand or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

Transfer Real Estate. Transfer Titled Personal Property. Fund Untitled Personal Property. Transfer Bank Accounts. Fund Securities. Transfer Business Interests. Change Life Insurance Beneficiaries. Transfer Royalties, Copyrights, Patents, and Trademarks.

You can add property to your living trust at any time. And because you'll also be the trustee, you can always sell or give away property in the trust, or take it out of the living trust and put it back in your name as an individual. A living trust isn't the only way to save money on probate.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.