IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

Among numerous free and paid examples which you get on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they’re competent enough to deal with what you need these people to. Keep calm and use US Legal Forms! Locate IRS 20 Quiz to Determine 1099 vs Employee Status samples created by professional lawyers and prevent the high-priced and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you’re searching for. You'll also be able to access all of your previously acquired templates in the My Forms menu.

If you’re utilizing our service the first time, follow the tips below to get your IRS 20 Quiz to Determine 1099 vs Employee Status with ease:

- Make sure that the file you discover applies where you live.

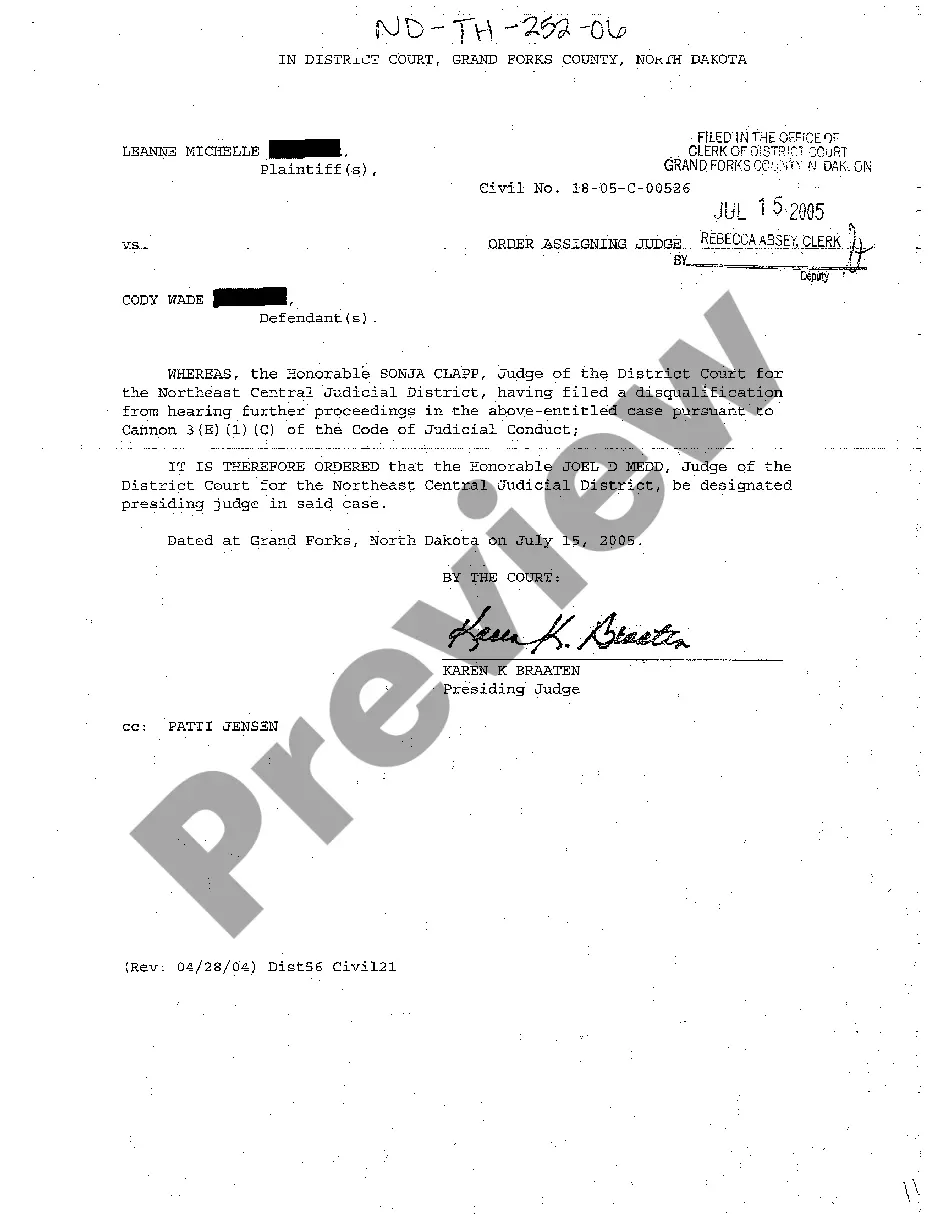

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another sample using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and purchased your subscription, you may use your IRS 20 Quiz to Determine 1099 vs Employee Status as many times as you need or for as long as it remains valid where you live. Edit it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

Anyone your business paid $600 or more in non-employee compensation over the year must be issued a Form 1099-MISC. According to IRS guidance, a form 1099-MISC may be required if a company makes the following types of payments: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work, not what will be done and how it will be done. Small businesses should consider all evidence of the degree of control and independence in the employer/worker relationship.

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. Profit and Loss Statement or Ledger Documentation. Bank Statements.

Income-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement. Contracts and agreements. Invoices. Bank statements and Pay stubs.

If you have a written contract to complete a specific task or project for a predetermined sum of money, you are probably a 1099 worker. However, if your employment is open-ended, without a contract and subject to a job description, you will typically be considered an employee.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.