North Carolina Commercial Building or Space Lease

About this form

This Commercial Building or Space Lease is a legal document specifically designed for leasing a commercial property in North Carolina. It serves as a comprehensive agreement that outlines the terms and conditions between a landlord (lessor) and tenant (lessee). This lease covers various essential elements, such as lease duration, rent payment, utility responsibilities, property maintenance, and termination conditions, ensuring both parties understand their rights and obligations throughout the lease term.

Form components explained

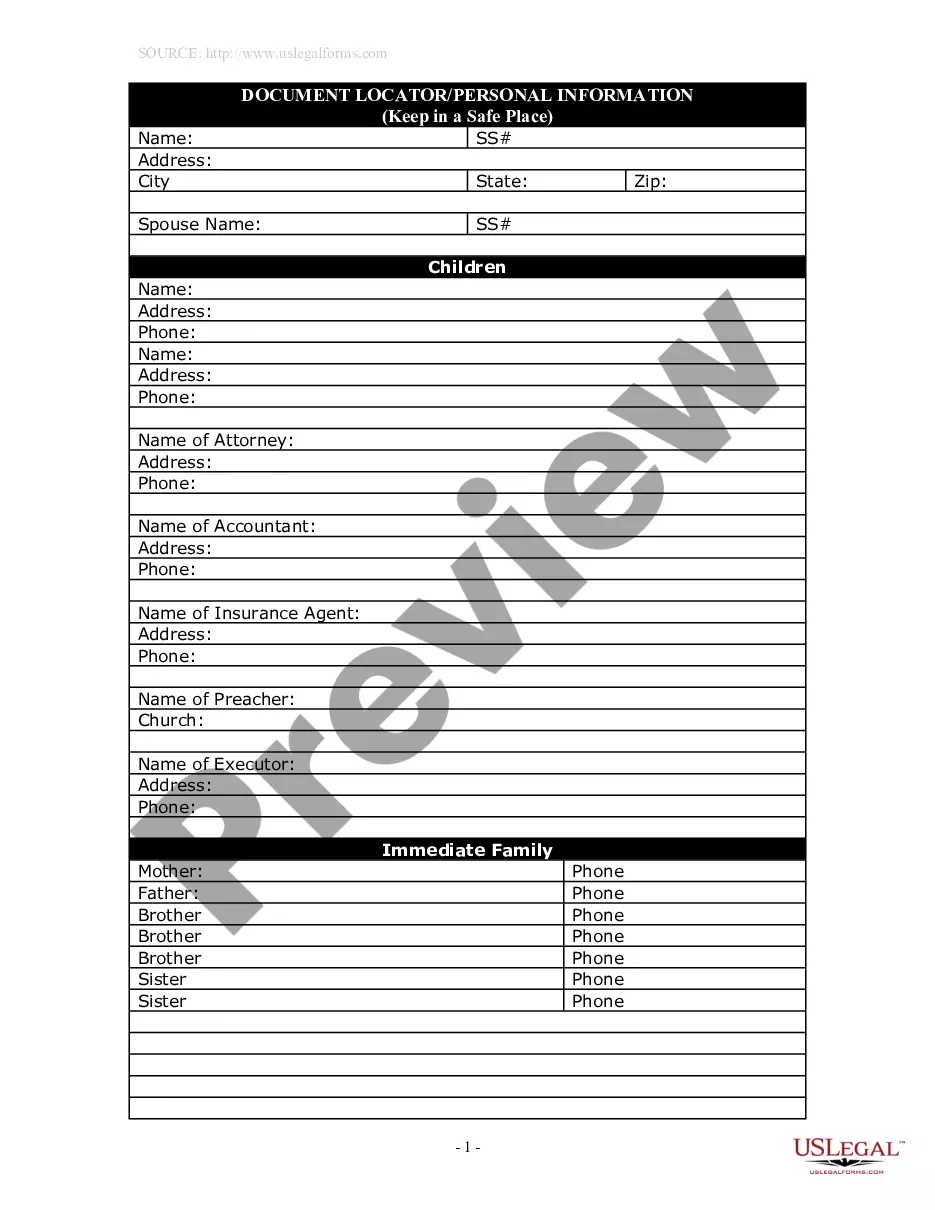

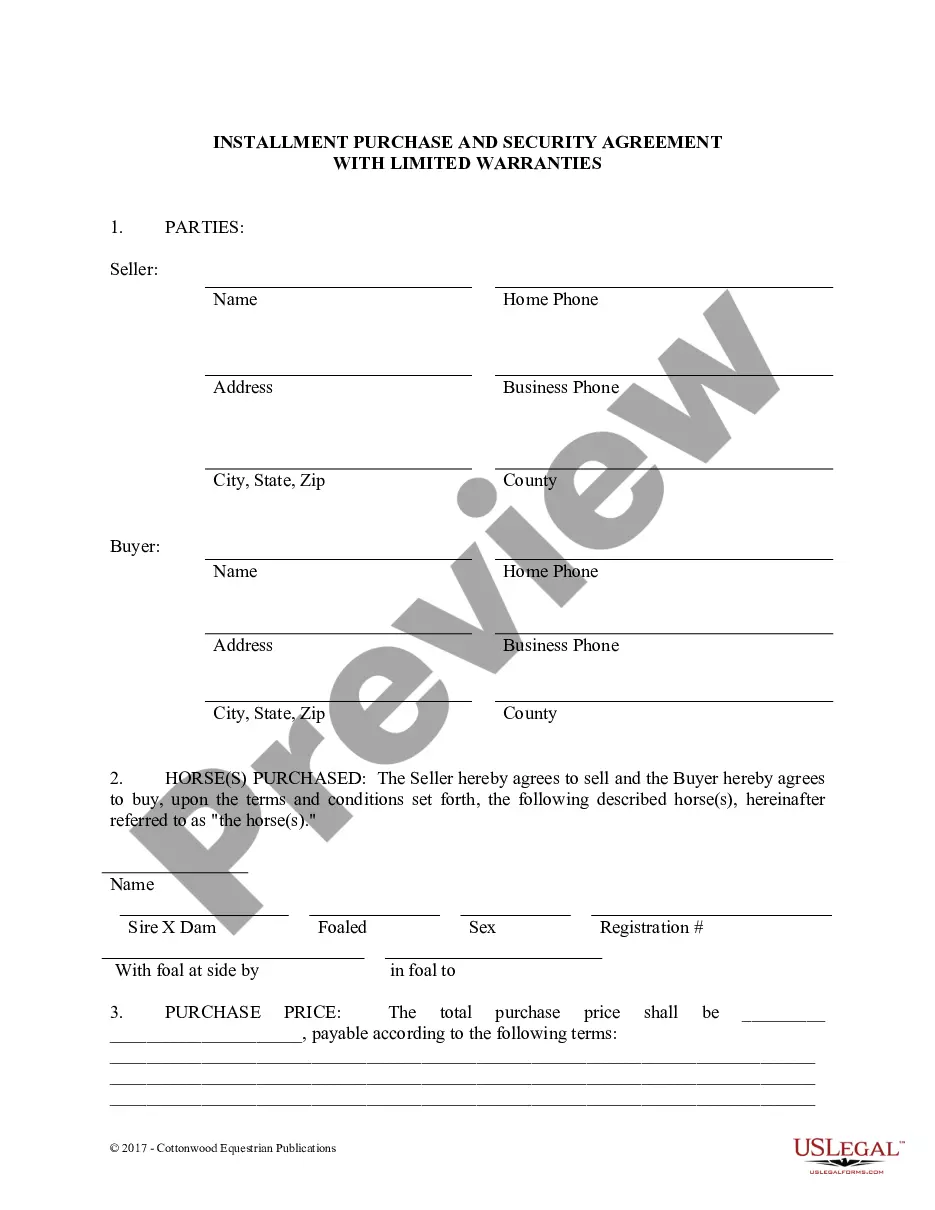

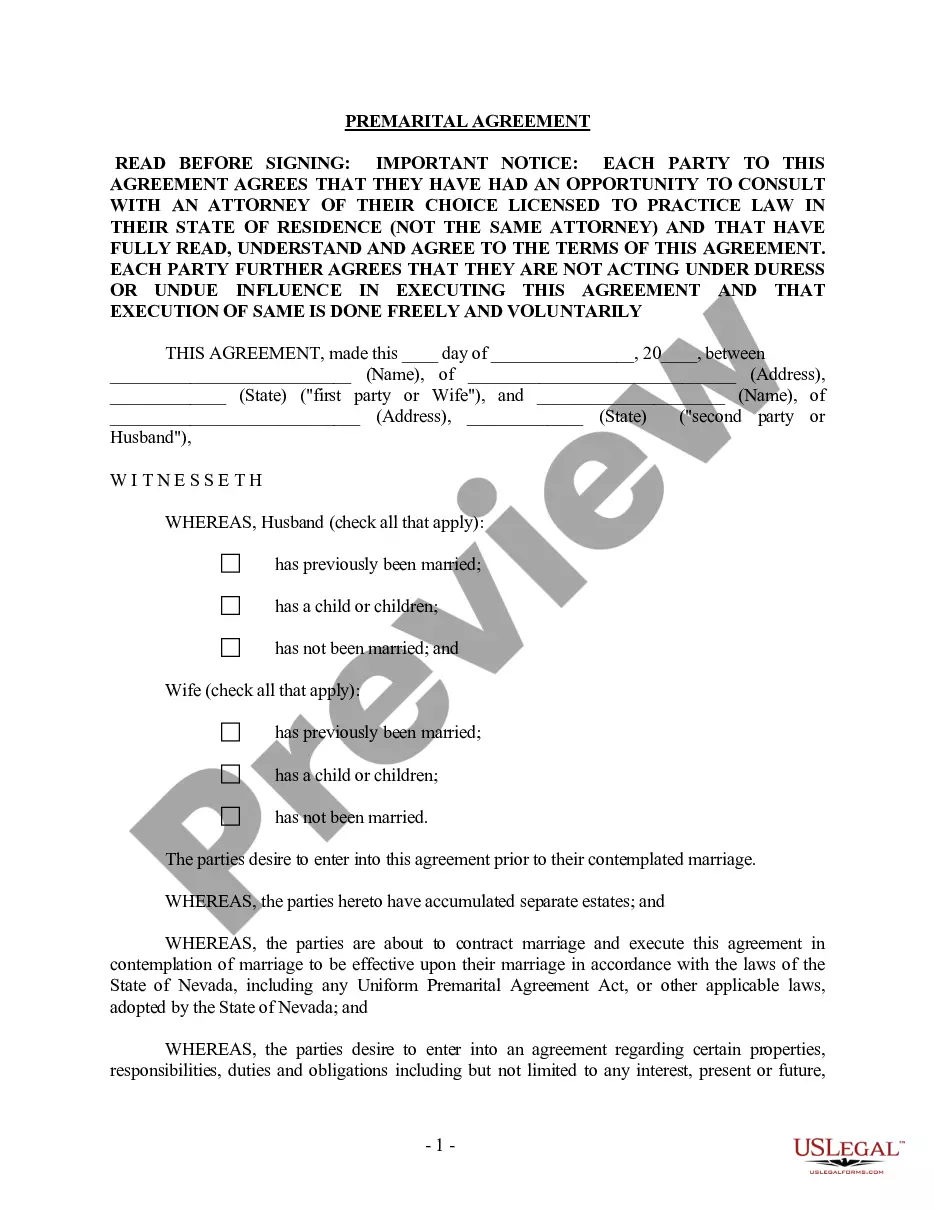

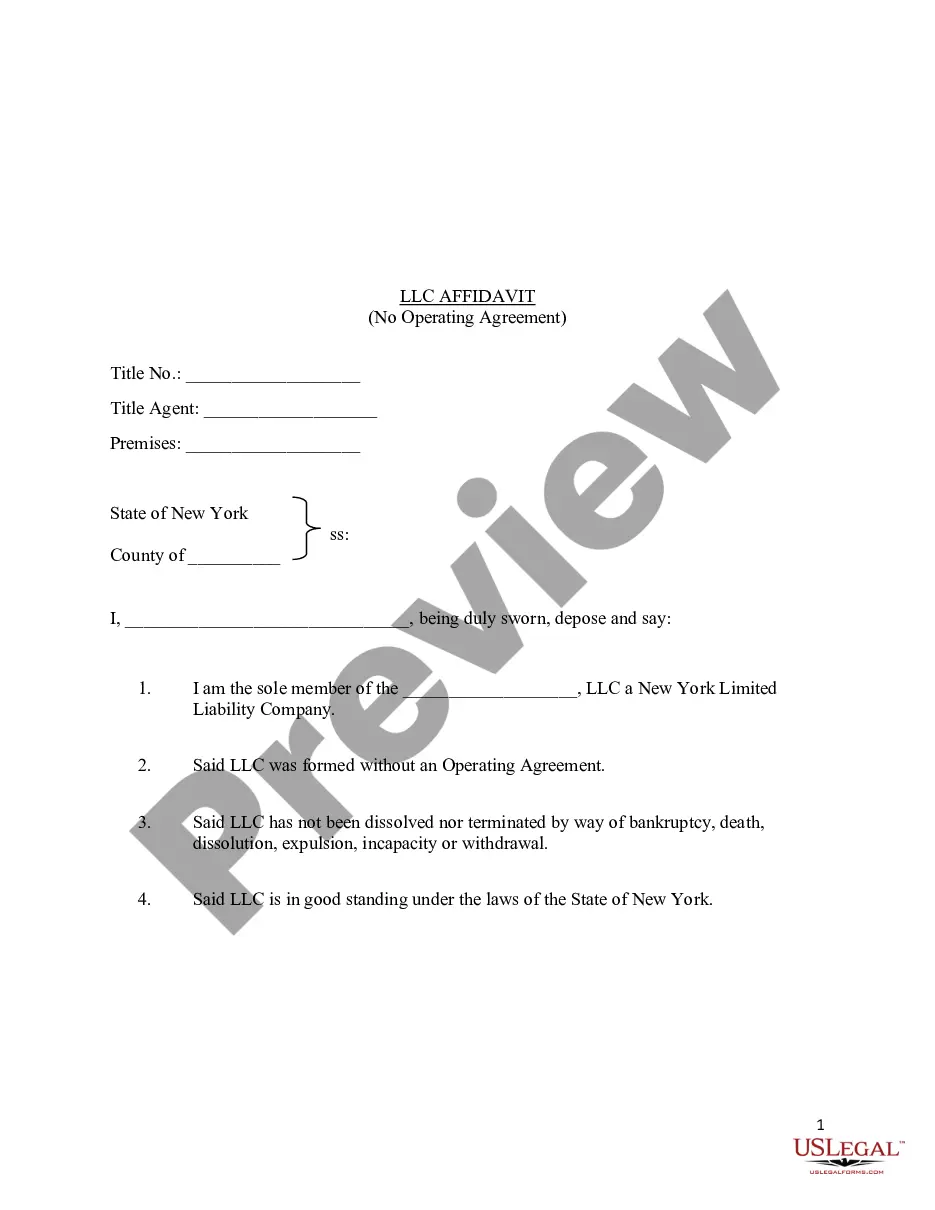

- Parties involved: Identification of lessor and lessee.

- Lease term: Start and end dates of the lease agreement.

- Rent details: Amount, due date, and late payment charges.

- Utilities: Responsibilities regarding utility payments.

- Property condition: Maintenance obligations and responsibilities for repairs.

- Security deposit: Amount and conditions for return.

- Default provisions: Rights and remedies for default by either party.

When this form is needed

This form is necessary when a property owner desires to lease commercial space to a tenant for business purposes. It is ideal for situations such as renting office buildings, retail spaces, or warehouses. Use this lease when you need to document the specifics of the rental arrangement, ensuring both parties have a clear understanding of their rights and responsibilities regarding the leased property.

Who needs this form

- Business owners seeking to lease commercial space for their operations.

- Property owners or landlords looking to rent out commercial properties.

- Individuals or entities needing a clear framework for their lease agreements in North Carolina.

- Real estate professionals involved in commercial leasing.

How to complete this form

- Identify the parties: Enter the names and contact information of the lessor and lessee.

- Specify the property: Clearly describe the leased premises, including the address and details.

- Define the lease term: Fill in the start and end dates of the lease agreement.

- Set rental payment details: Specify the monthly rent amount and any late fees applicable.

- Outline utility responsibilities: Decide which party is responsible for paying utilities.

- Document the security deposit: Indicate the amount of the security deposit and its conditions for return.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Not clearly defining the lease term, leading to confusion about the rental period.

- Failing to specify who is responsible for utilities, which can lead to disputes.

- Neglecting to set appropriate late fees for missed rent payments.

- Not addressing maintenance responsibilities, which can create issues during and at the end of the lease.

- Overlooking the necessity for both parties to sign the lease, making it legally binding.

Benefits of using this form online

- Convenience: Easy access to the form from anywhere at any time.

- Editability: Customize the lease to fit specific needs and circumstances.

- Legal compliance: Ensures the lease adheres to North Carolina laws and regulations.

- Cost-effective: Downloadable format that saves time and legal fees associated with drafting a lease from scratch.

Quick recap

- This Commercial Building or Space Lease is vital for both landlords and tenants in North Carolina.

- It delineates responsibilities for rent, utilities, and property maintenance.

- Clear definitions and terms can help prevent disputes during the lease period.

- Always make sure the lease is signed by both parties to ensure its validity.

Looking for another form?

Form popularity

FAQ

Rental yields of a residential property vary between 2.5 percent and 3.5 percent of the market value of the property. For instance, if the market value of your property is Rs 30 lakh, its rental value will range between Rs 7,5000 and Rs 10,5000 and monthly values will differ from Rs 6250 to Rs 8750.

As long as the contract spells out specific details and both parties have signed that they agree to the contract's terms, a handwritten contract is legally binding and enforceable in court.

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

Under California law, a lease does have to be in writing to be enforceable, but only when the lease is for a period of more than a year.There is, however, an additional legal doctrine called partial performance which does make oral contracts enforceable even if they are covered by the Statute of Frauds.

Typically, commercial space is evaluated at $X per square foot, and that rate times the rentable square feet for your space determines your monthly rent.You may have exactly what lease promised in rentable square feet.

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

Research is the key to signing the right business lease. Specifically, look at the building owner, landlord, zoning laws, environmental expectations and nuisance laws. Know how much you have to pay, what exactly you're covering and how much your rent will increase each year.

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.