North Carolina Registration of Foreign Corporation

Description

How to fill out North Carolina Registration Of Foreign Corporation?

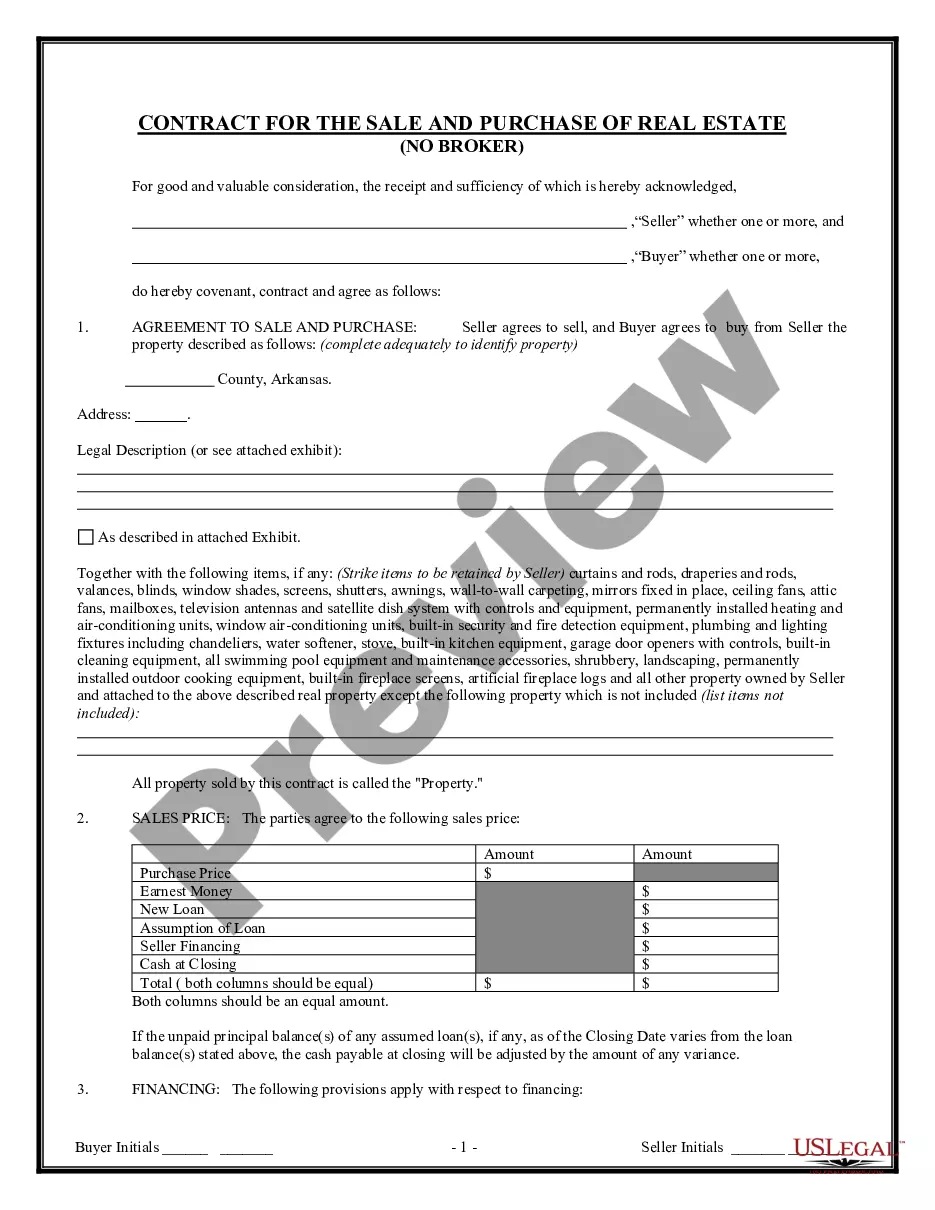

Steer clear of expensive lawyers and locate the North Carolina Registration of Foreign Corporation you seek at an affordable cost on the US Legal Forms website.

Utilize our straightforward groups feature to search for and acquire legal and tax documents. Review their descriptions and preview them before downloading.

Choose to download the document in PDF or DOCX format. Simply click Download and locate your form in the My documents section. You may save the template to your device or print it out. After downloading, you can fill out the North Carolina Registration of Foreign Corporation by hand or with editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Furthermore, US Legal Forms offers users detailed guidance on how to download and complete each form.

- Customers of US Legal Forms simply need to Log In and download the specific document they require to their My documents section.

- Those who haven’t yet purchased a subscription should follow the instructions listed below.

- Verify that the North Carolina Registration of Foreign Corporation is suitable for use in your state.

- If possible, review the description and utilize the Preview option before downloading the document.

- If you are confident that the document fits your needs, click Buy Now.

- If the template is incorrect, use the search bar to find the correct one.

- Then, create your account and choose a subscription plan.

- Pay using a credit card or PayPal.

Form popularity

FAQ

To foreign qualify an LLC in California, you file an Application to Register a Foreign LLC with the Secretary of State. You'll pay at least $90 in state fees (a $70 registration fee and the $20 Initial Statement of Information fee mentioned below).

To register your business in North Carolina, you must file an Application for Certificate of Authority for Limited Liability Company with the North Carolina Secretary of State (SOS). You can download a copy of the application form from the SOS website.

To register the foreign LLC, you will need the information from the Articles of Organization and you will need a copy of the official LLC document from the state. Next, determine if you are "doing business" in another state and are thus required to register as a foreign LLC in that state.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Business Corporations, Nonprofit Corporations, Limited Liability Companies (LLC), Limited Partnerships (LP), Limited Liability Partnerships(LLP or RLLP), and Limited Liability Limited Partnerships (LLLP) are required to register with the NC Secretary of State's Office prior to conducting business in North Carolina.

A Foreign LLC is not an LLC that is formed outside of the United States. The requirement to file for a Foreign LLC is usually to expand one's business operations or to open an additional retail or brick-and-mortar location in a new state.

You can register your business with the North Carolina Department of Revenue by completing and submitting Form NC-BR, or by registering online. When you register, you will be issued an account ID number for such tax purposes as income tax withholding, sales and use tax, and machinery and equipment tax.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

You can register your business with the North Carolina Department of Revenue by completing and submitting Form NC-BR, or by registering online. When you register, you will be issued an account ID number for such tax purposes as income tax withholding, sales and use tax, and machinery and equipment tax.