Montana Reconveyance - Satisfaction, Release or Cancellation of - Trust Indenture Deed of Trust by Individual Trustee

What this document covers

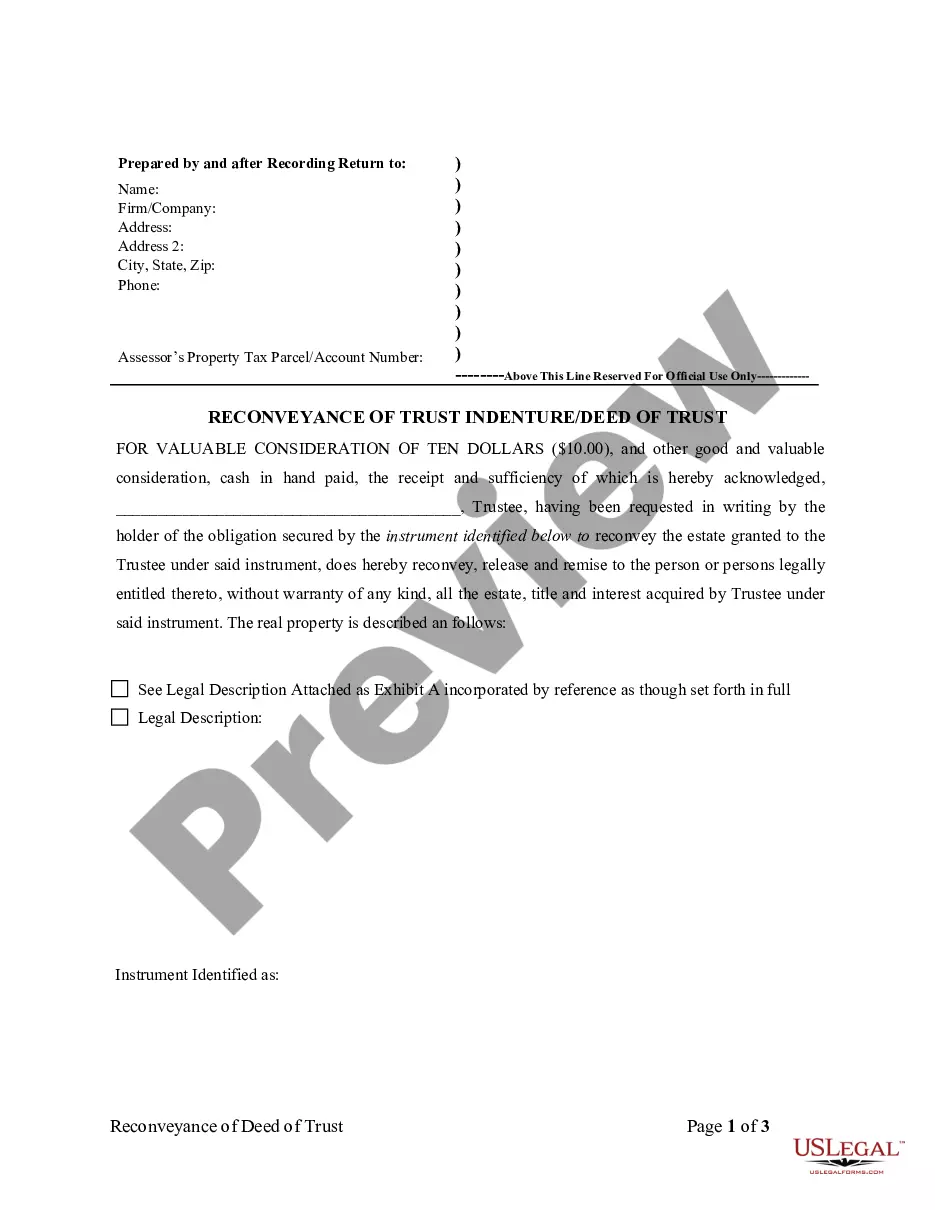

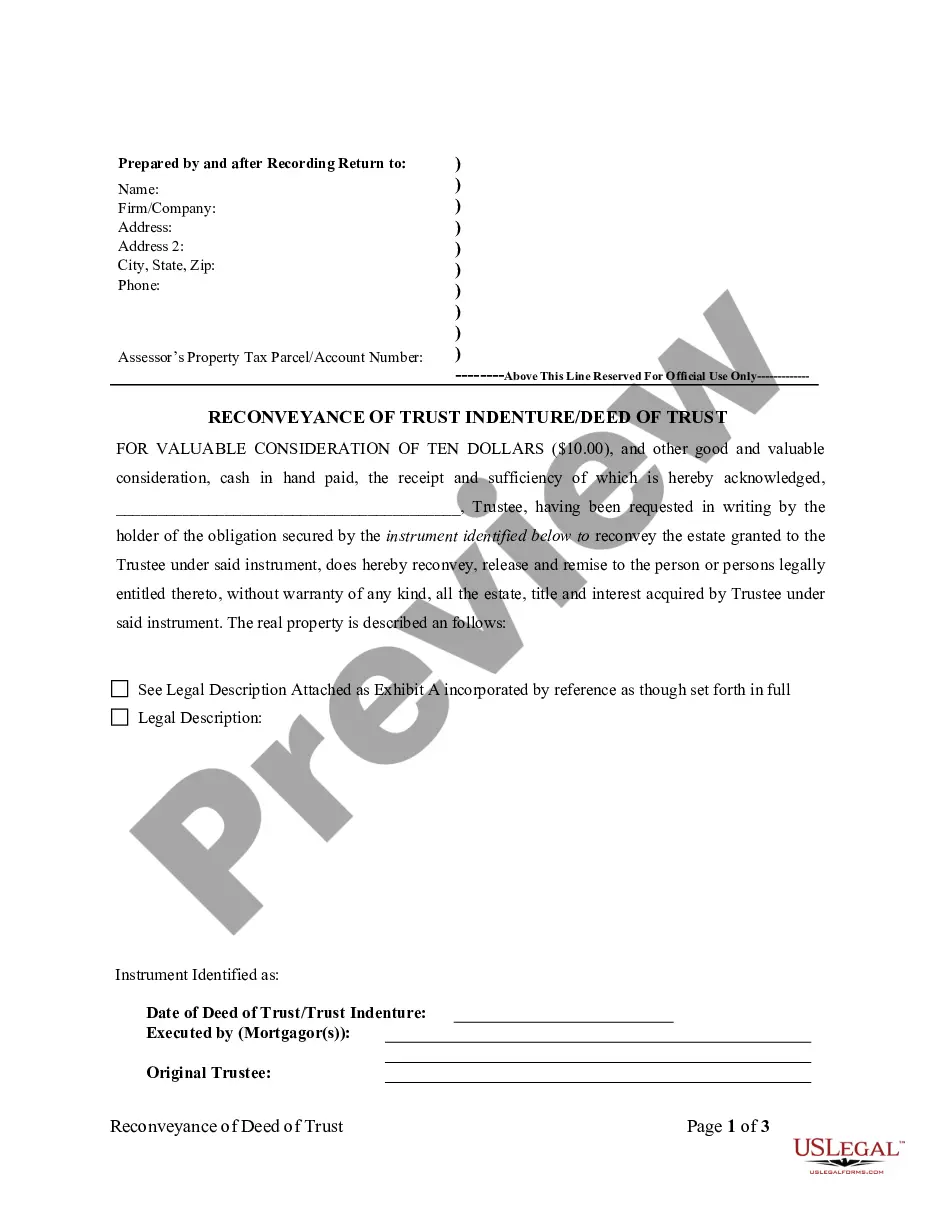

The Reconveyance - Satisfaction, Release or Cancellation of Trust Indenture Deed of Trust by Individual Trustee form is used to officially release a deed of trust on real estate in Montana. This form satisfies the legal requirements for releasing a mortgage on a property, ensuring that the described real estate is no longer encumbered by the mortgage. This form is specifically designed for situations where an individual trustee is involved, differentiating it from similar forms intended for corporate or multi-party contexts.

Key components of this form

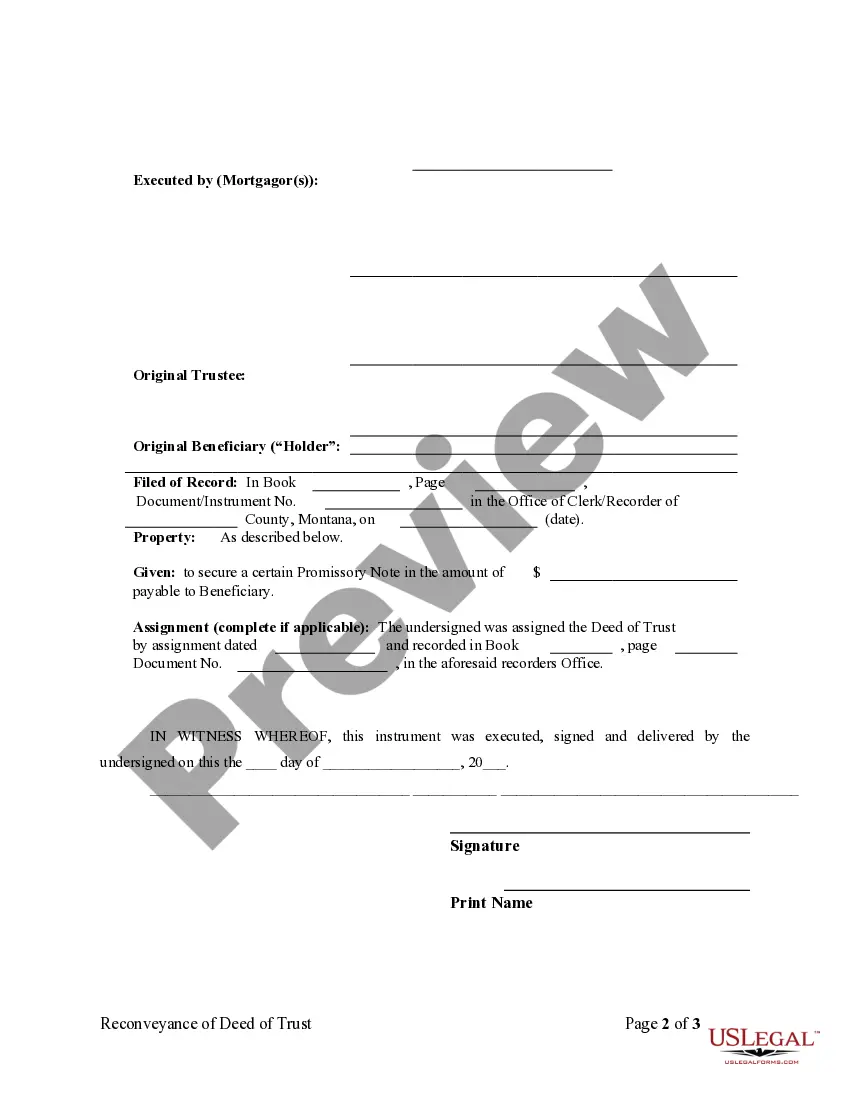

- Identification of the parties involved in the deed of trust.

- A legal description of the property being released, included as an exhibit.

- Details regarding the trustee's authority to convey the release.

- Spaces for signatures and dates, ensuring compliance with legal formalities.

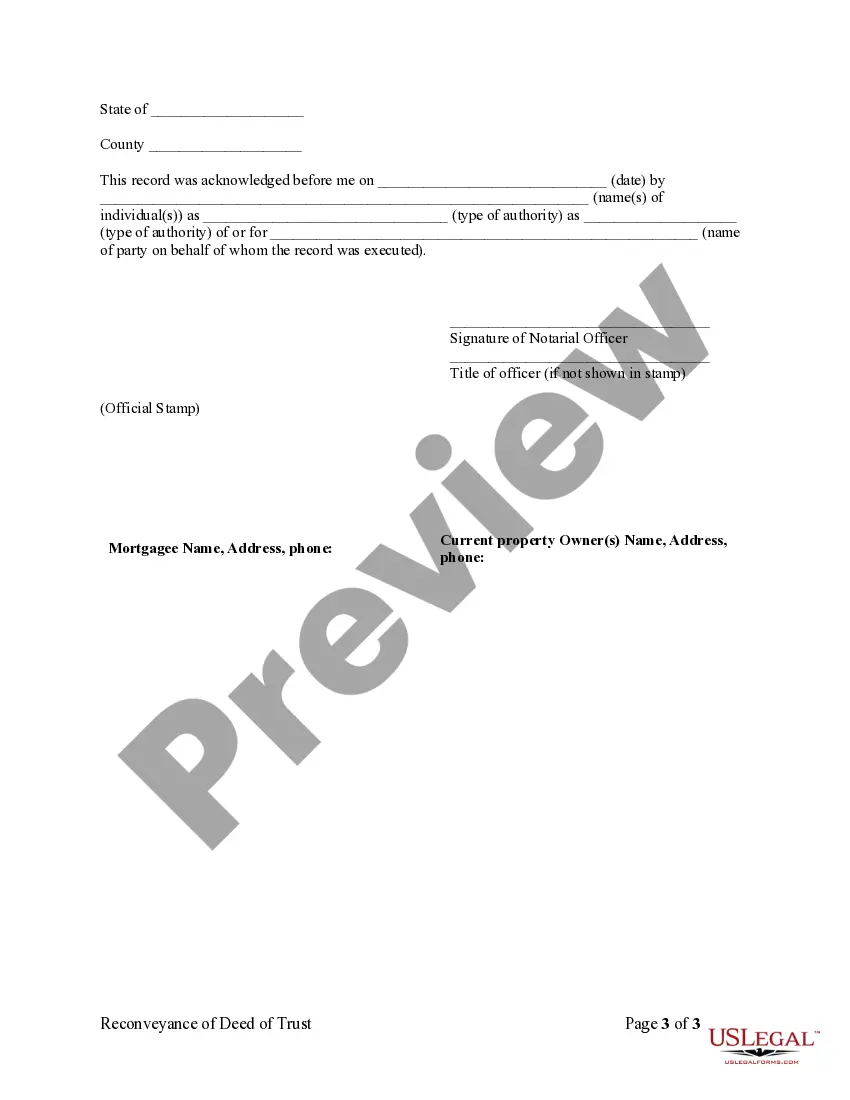

- Notary acknowledgment section to authenticate the document.

When to use this form

This form is essential in scenarios such as when a property owner has fully paid off their mortgage or when the mortgage has been satisfied for any other reason. It helps prevent any future claims or liens on the property, ensuring clear ownership. If you are an individual trustee responsible for releasing a property, this form is necessary to document the release officially.

Who should use this form

- Individual trustees who manage a deed of trust and need to release it.

- Property owners looking to document the release of their mortgage.

- Anyone involved in a real estate transaction who needs to verify clear title.

Instructions for completing this form

- Identify the parties involved by entering their names in the designated sections.

- Provide a complete legal description of the property as detailed in Exhibit A.

- Confirm the trustee's authority to sign on behalf of the mortgage holder.

- Sign and date the form where indicated.

- Have the form notarized to validate the document.

Notarization requirements for this form

Yes, this form must be notarized to be legally valid. All signatures must be acknowledged in front of a notary public, ensuring the authenticity of the document. US Legal Forms offers an integrated online notarization option, available 24/7, allowing for secure video calls and legal confirmation without the need for travel.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include a complete and accurate legal description of the property.

- Not obtaining a notarization, which is required for the document to be valid.

- Incorrectly identifying the parties involved in the release.

- Forgetting to sign and date the form before submission.

Why use this form online

- Convenient access to the form at any time, allowing users to complete it at their own pace.

- Editable templates let users fill in their specific information easily.

- Reliable forms drafted to comply with state law, reducing the risk of errors.

Quick recap

- This Reconveyance form is essential for releasing a property from a deed of trust in Montana.

- Always ensure notarization for legal validity.

- Provide complete and accurate information to avoid common mistakes.

- Utilizing this form online streamlines the process and reduces potential errors.

Looking for another form?

Form popularity

FAQ

1) Generally, any written agreement between two parties. 2) A real estate deed in which two parties agree to continuing obligations; for example, one party may agree to maintain the property and the other to make periodic payments.

Mortgage Trust Indenture (MTI) is a contractual agreement used to secure the obligations of the borrower with several lenders.A Mortgage Participation Certificate (MPC) is issued by the Trustee in favor of each lender as an evidence of the lender's participation in the MTI pool of assets.

In Montana, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. In judicial foreclosure, a court decrees the amount of the borrowers debt and gives him or her a short time to pay.

A trust indenture is an agreement in a bond contract made between a bond issuer and a trustee that represents the bondholder's interests by highlighting the rules and responsibilities that each party must adhere to. It may also indicate where the income stream for the bond is derived from.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

Trust indenture: means an indenture executed in conformity with this part and conveying real property to a trustee in trust to secure the performance of an obligation of the grantor or other person named in the indenture to a beneficiary. See Montana Code 71-1-303.