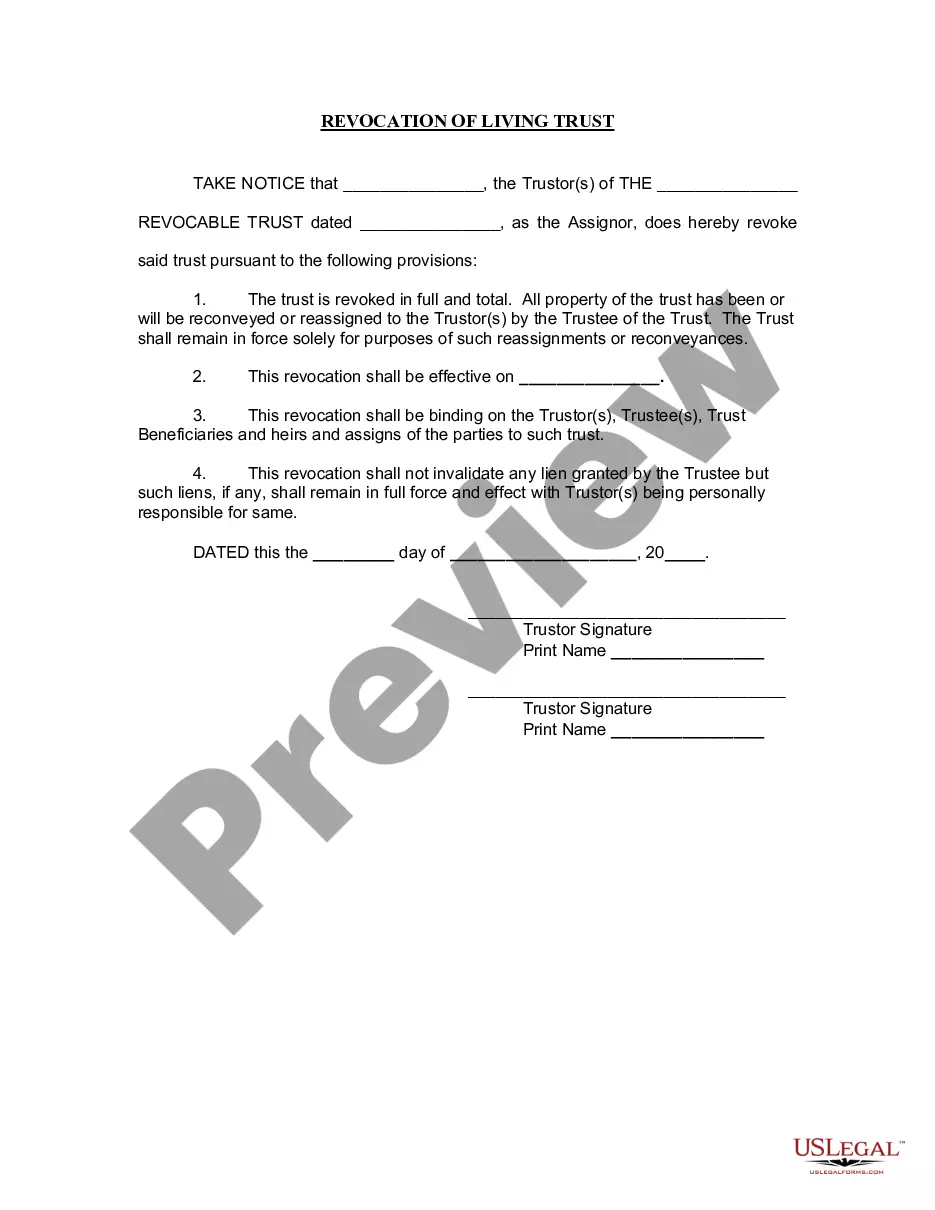

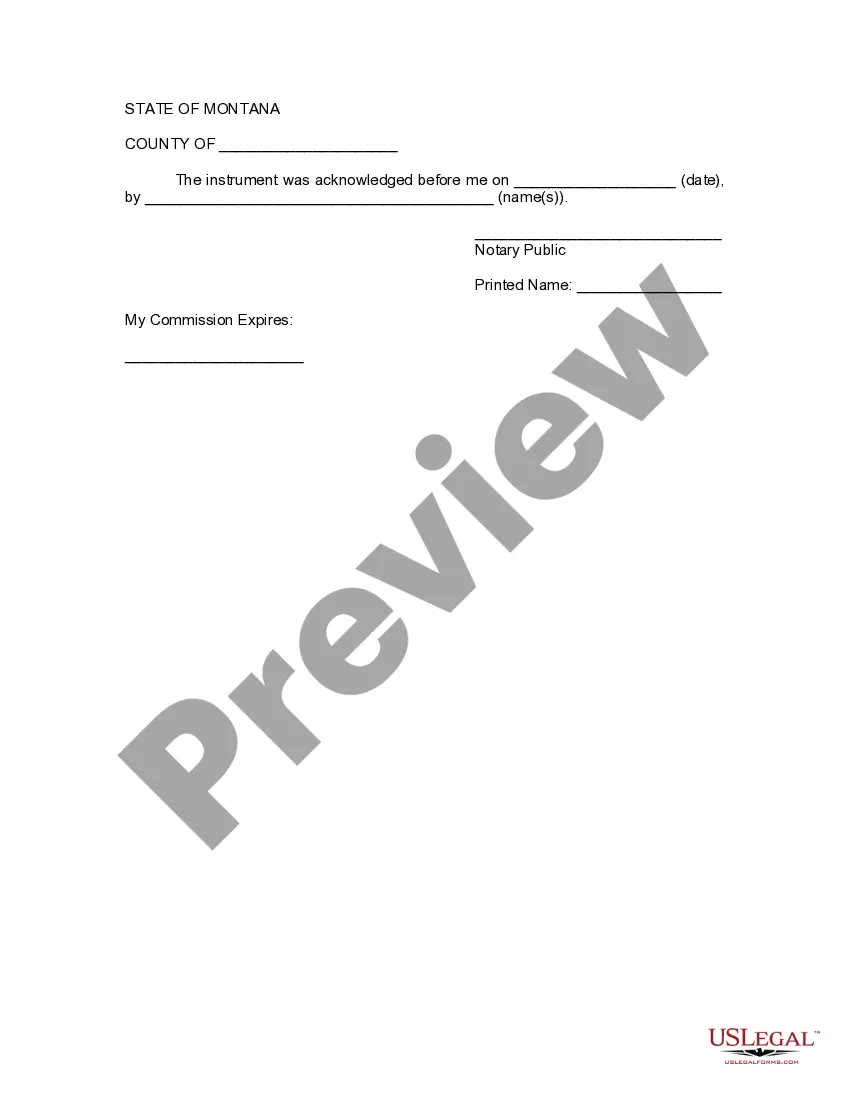

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Montana Revocation of Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Revocation Of Living Trust?

Acquire a printable Montana Revocation of Living Trust with just a few clicks in the most extensive collection of legal electronic documents.

Discover, download, and print professionally created and certified samples on the US Legal Forms platform. US Legal Forms has been the leading provider of affordable legal and tax forms for US citizens and residents online since 1997.

Download the template in Word or PDF format. After downloading your Montana Revocation of Living Trust, you can fill it out in any online editor or print it out and complete it manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific forms.

- Users who already possess a subscription must Log In directly to their US Legal Forms account and find the Montana Revocation of Living Trust saved in the My documents section.

- Users without a subscription need to follow the guidelines listed below.

- Confirm your form complies with your state's regulations.

- If available, browse the form's description for more information.

- If accessible, review the form to view additional content.

- Once you are certain the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or credit card.

Form popularity

FAQ

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.