Idaho Workers Compensation Complaint Against the Industrial Special Indemnity Fund (ISIF)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

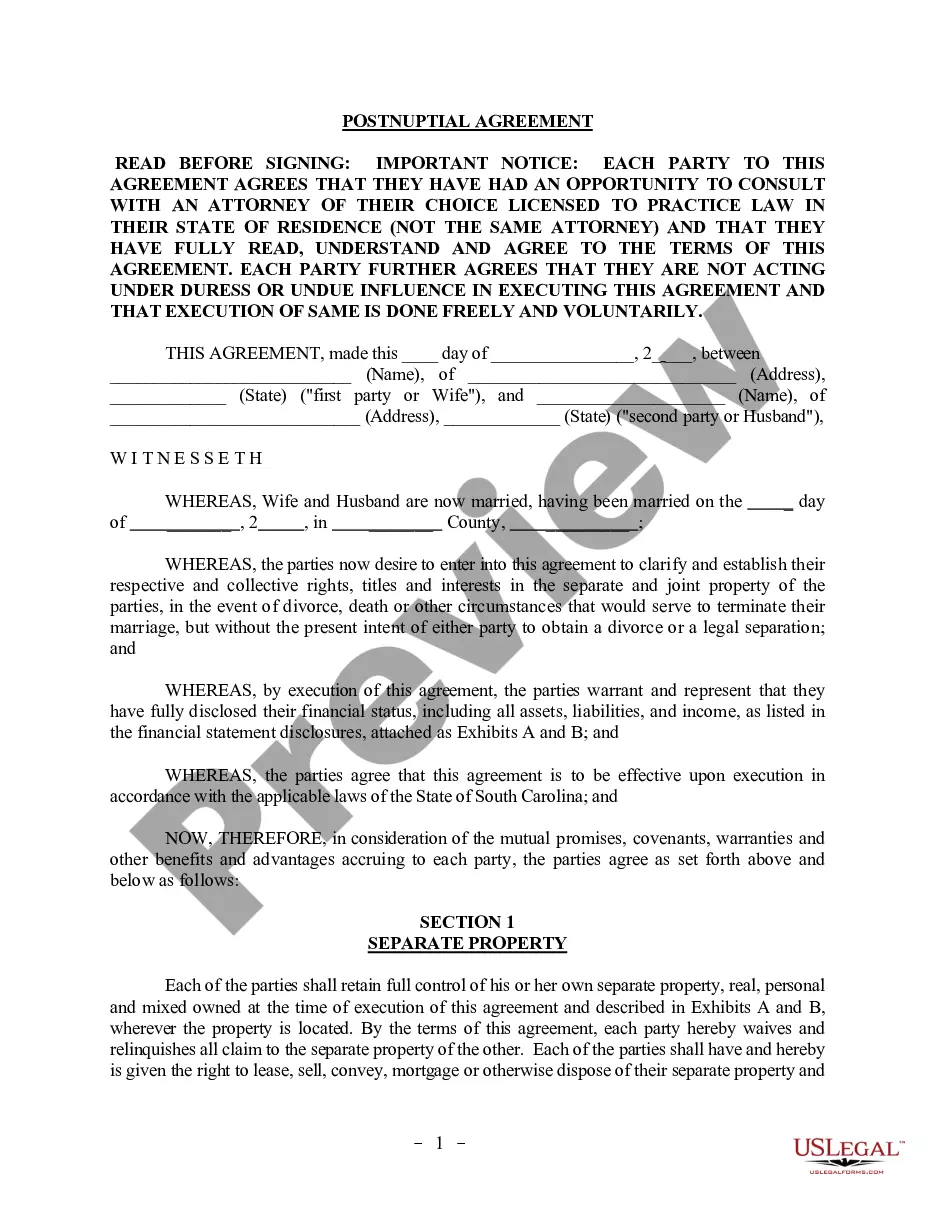

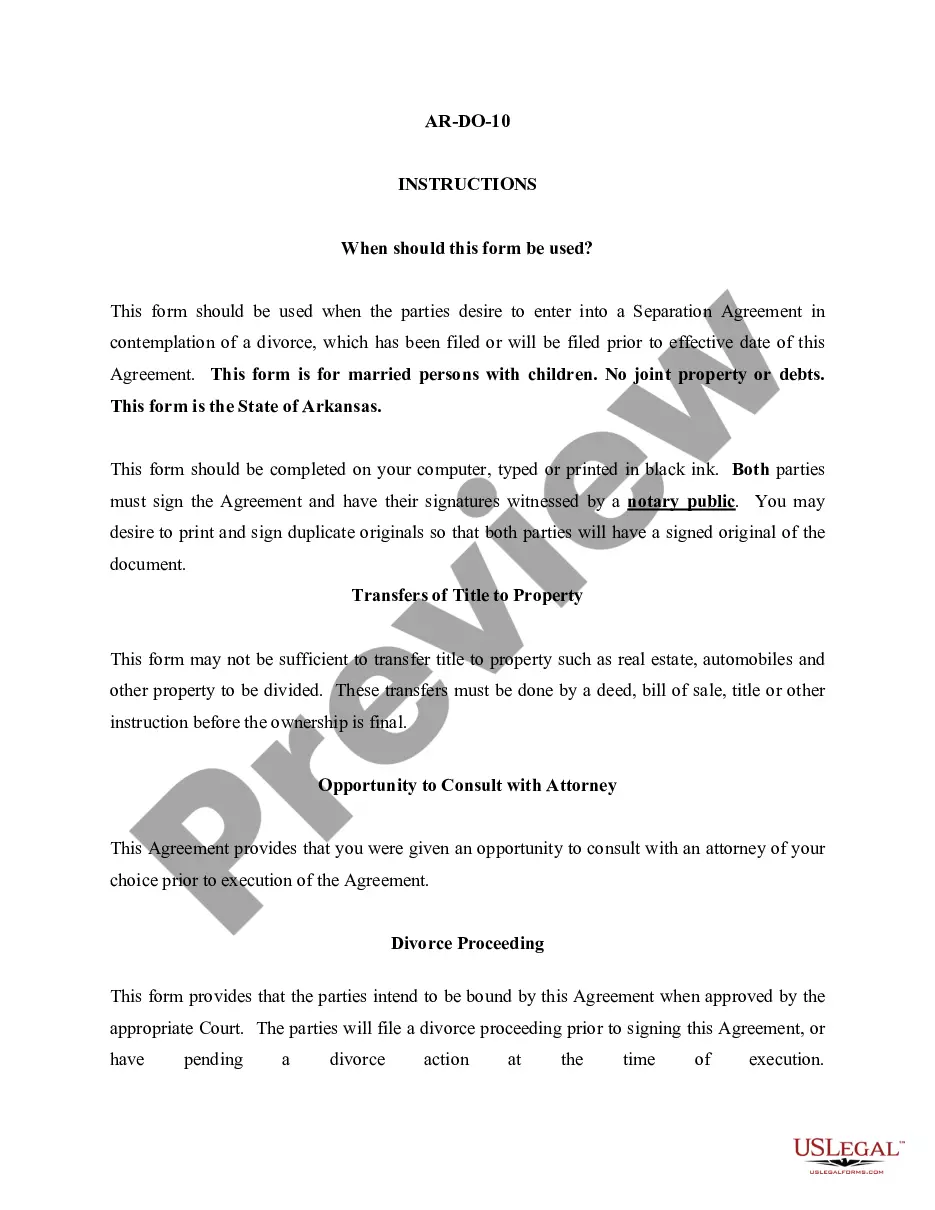

Looking for another form?

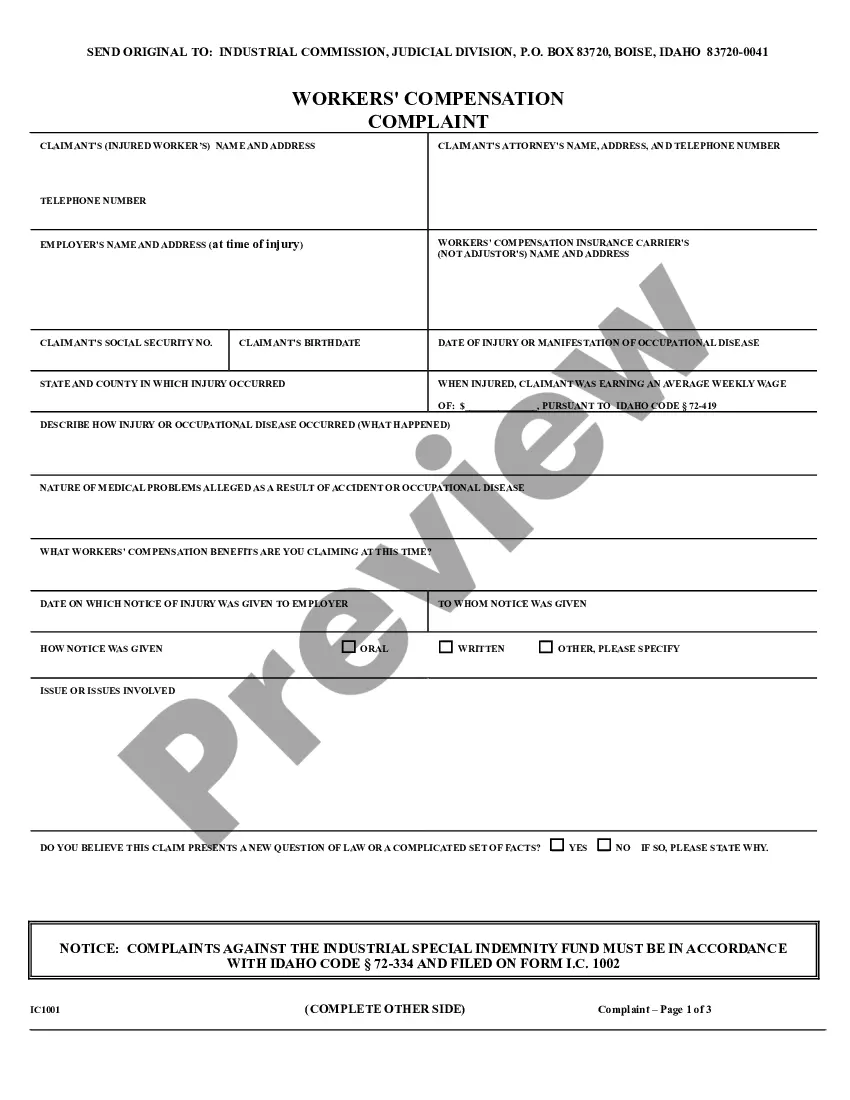

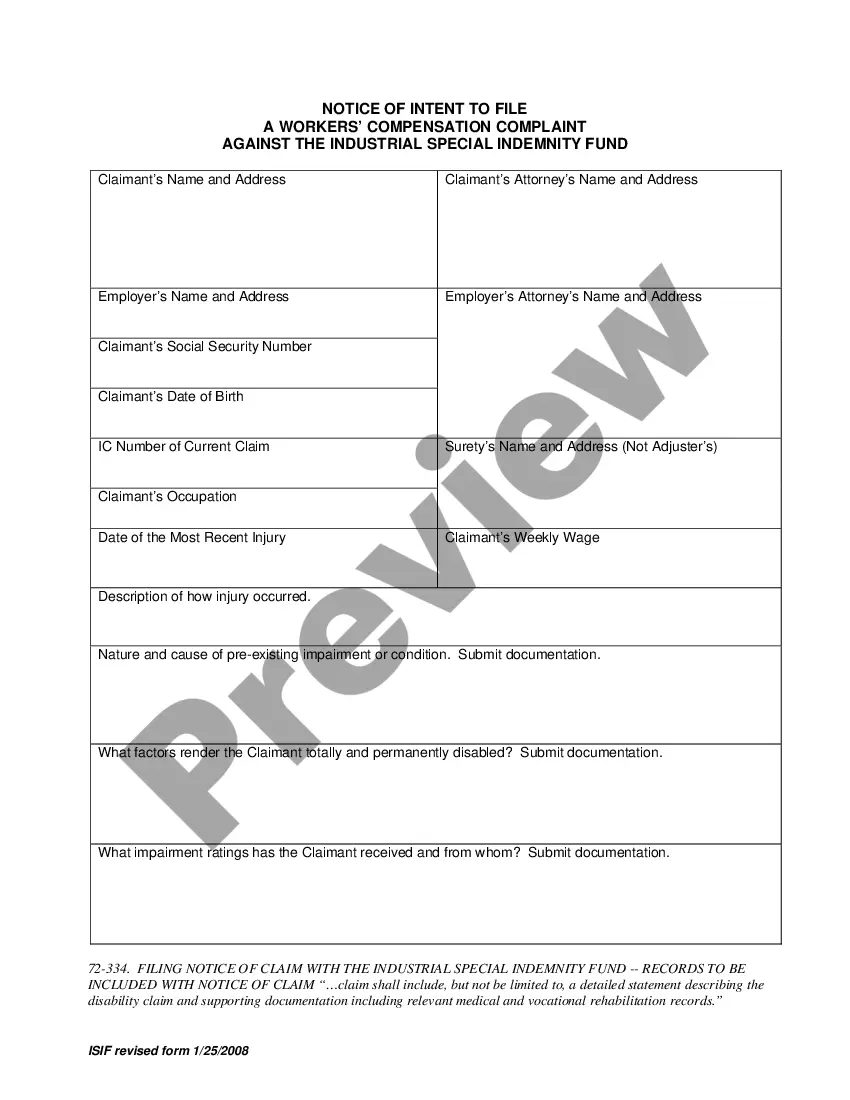

How to fill out Idaho Workers Compensation Complaint Against The Industrial Special Indemnity Fund (ISIF)?

Searching for Idaho Workers Compensation Grievance Regarding the Industrial Special Indemnity Fund (ISIF) forms and completing them might be challenging.

To conserve time, money, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state in only a few clicks. Our lawyers prepare every document, so you merely need to fill them out. It's truly that simple.

Log in to your account and return to the form's webpage to save the document. All your saved templates are stored in My documents and are accessible anytime for future use. If you haven’t signed up yet, you should create an account.

Download the Idaho Workers Compensation Grievance Regarding the Industrial Special Indemnity Fund (ISIF) template in your chosen format. You can print the template or complete it using any online editor. There's no need to worry about making errors, as your sample can be utilized and submitted multiple times, and printed as often as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Review our comprehensive instructions on how to acquire the Idaho Workers Compensation Grievance Regarding the Industrial Special Indemnity Fund (ISIF) template within a few minutes.

- To obtain a valid sample, verify its compliance for your state.

- View the sample using the Preview feature (if available).

- If there’s a description, read it to understand the details.

- Click Buy Now if you found what you're looking for.

- Select your plan on the pricing page and establish your account.

- Indicate whether you wish to pay via a credit card or PayPal.

Form popularity

FAQ

In Idaho, the form used to report significant changes in a worker's medical or disability status is the 'Notice of Injury or Claim.' Filing this notice ensures that the Workers Compensation Board is updated on your condition, which can affect your benefits. If you encounter issues, such as an Idaho Workers Compensation Complaint Against the Industrial Special Indemnity Fund (ISIF), timely and accurate documentation becomes essential. This proactive approach can help safeguard your entitlements.

The term indemnity insurance refers to an insurance policy that compensates an insured party for certain unexpected damages or losses up to a certain limitusually the amount of the loss itself. Insurance companies provide coverage in exchange for premiums paid by the insured parties.

In its simplest form, indemnity means that one party in the contract is responsible for compensating another for loss, damages, and/or injury incurred as a result of that party's actions. In other words, indemnity provides a form of protection against a financial liability.

Indemnity insurance is a type of insurance policy where the insurance company guarantees compensation for losses or damages sustained by a policyholder. Indemnity insurance is designed to protect professionals and business owners when found to be at fault for a specific event such as misjudgment.

Indemnity is compensation paid by one party to another to cover damages, injury or losses.An example of an indemnity would be an insurance contract, where the insurer agrees to compensate for any damages that the entity protected by the insurer experiences.

An indemnity is a promise by one party to compensate another for the loss suffered as a consequence of a specific event, called the 'trigger event'. The trigger event can be anything defined by the parties, including: a breach of contract. a party's fault or negligence. a specific action.

What is an Indemnity Plan? Indemnity plans allow you to direct your own health care and visit almost any doctor or hospital you like. The insurance company then pays a set portion of your total charges. Indemnity plans are also referred to as "fee-for-service" plans.

Specific Indemnities means the indemnities set out in sub-clauses 8.1 and 8.2 (Covenant by the Sellers in respect of certain matters), sub-clause 15.5 (Excluded Company Assets, Excluded Company Contracts and Excluded Company Liabilities) and sub-clause 16.1 (Excluded Asset Sellers Liabilities);