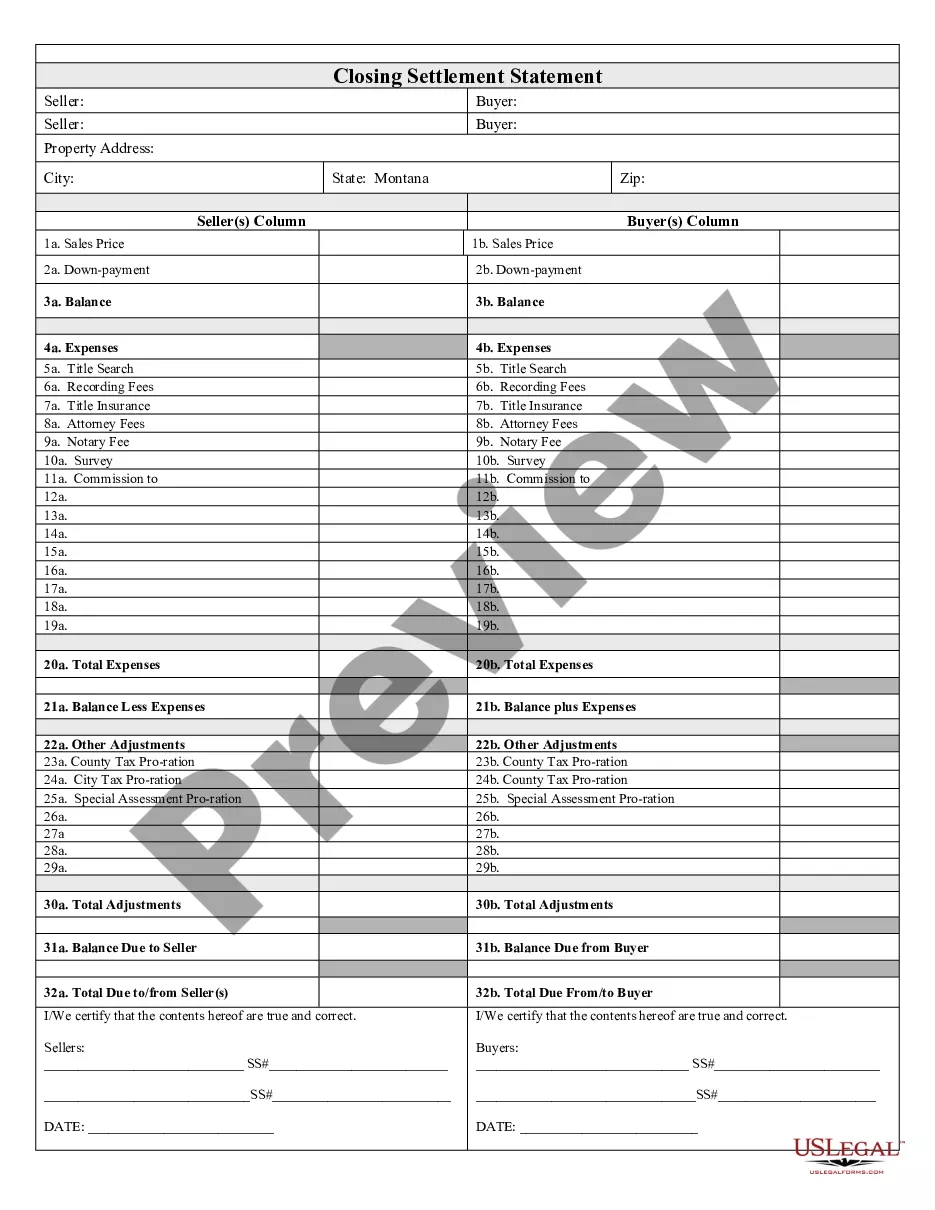

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Montana Closing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Closing Statement?

Obtain a printable Montana Closing Statement with just a few clicks in the most extensive collection of legal electronic documents.

Discover, download, and print expertly crafted and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of economical legal and tax templates for US citizens and residents online since 1997.

Once you’ve downloaded your Montana Closing Statement, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Clients who already have a subscription must Log In directly to their US Legal Forms account, retrieve the Montana Closing Statement, and find it saved in the My documents section.

- Individuals without a subscription need to adhere to the following steps.

- Ensure your template complies with your state’s regulations.

- If possible, examine the form’s description for additional information.

- If available, preview the document to learn more content.

- When you’re confident the template is suitable, click on Buy Now.

- Establish a personal account.

- Select a plan.

- Complete payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Closing Notice means a written notice duly executed by an authorized officer of Seller that is delivered by Seller to Buyer exercising its right to require the Closing of the transactions contemplated hereby in accordance with Article 6.

YOUR CLOSING STATEMENT IS "IMPORTANT": When your escrow has closed you will receive a closing statement which is a summary of the costs and financial settlement of your real estate transaction. This closing statement will be important for future tax needs and other possible considerations.

The Closing Disclosure is meant to help you understand your loan before you get to the closing table. In essence, it means your loan is clear to close, but it also means that you have time to go over the fees on your loan.

While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing.

Normally the seller purchases title insurance for the new buyer in the amount of the purchase price and the borrower purchases title insurance for the lender in the amount of the mortgage. When the mortgage is paid off, the lender's title insurance contract expires.

Estimated Escrow: Some lenders collect the money needed for recurring expenses (such things as property taxes, homeowners insurance and association fees) in advance and pay those bills on your behalf. To see which bills your lender escrows for, look at the Other Costs tab on Page 2 of the form.

Cleared to Close (3 days)Getting the all clear to close is the last step before your final loan documents can be drawn up and delivered to you for signing and notarizing. A final Closing Disclosure detailing all of the loan terms, costs and other details will be prepared by your lender and provided to you for review.

A closing statement is an accounting, in writing, prepared at the close of escrow which sets forth the charges and credits of your account.

A closing statement, also called a HUD-1 statement or settlement sheet, is a form used in real estate transactions with an itemized list of all the costs to the buyer and seller.