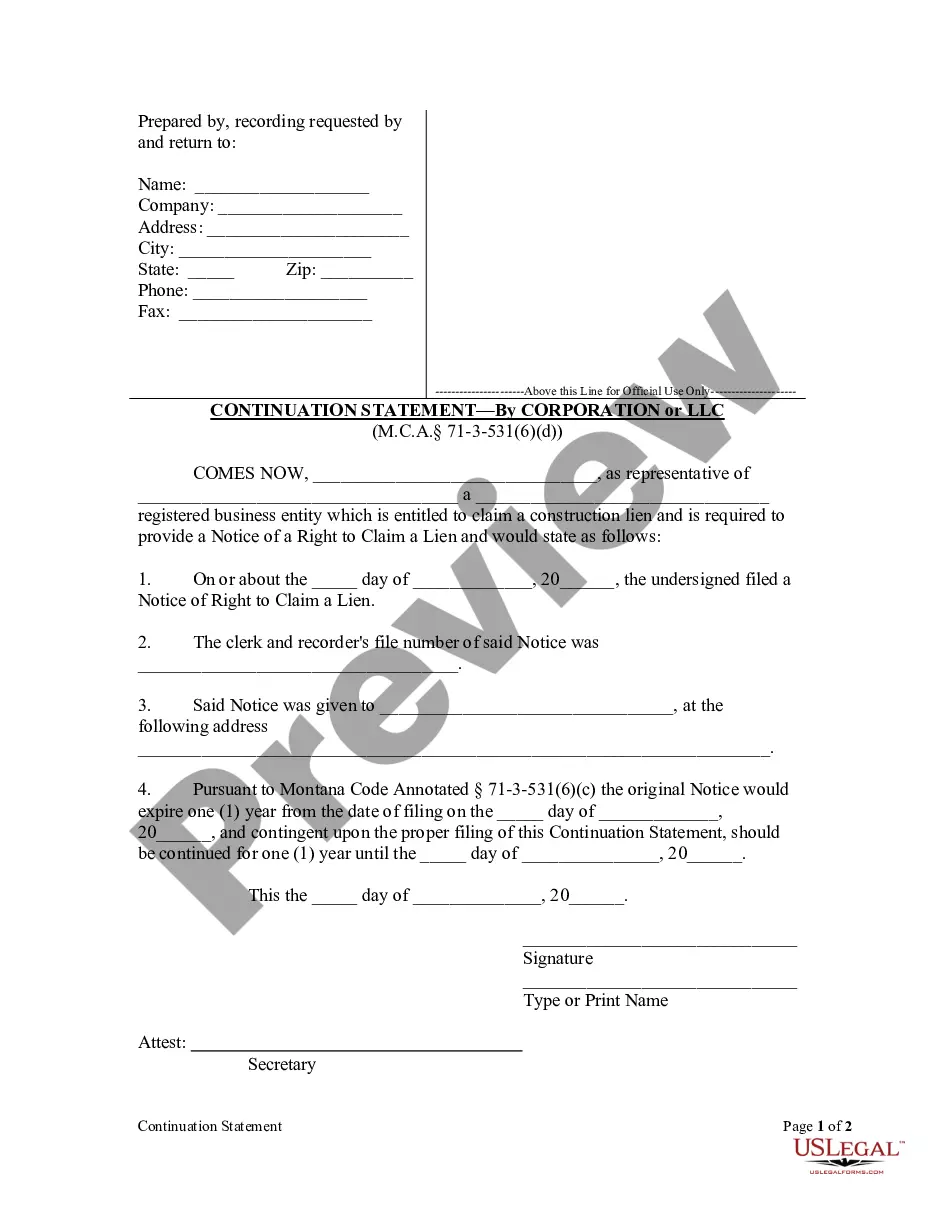

Generally, if required, a Notice of Right to Claim Lien must be filed within

twenty (20) days after the date that materials and services began to be

provided. These Notices are valid for one (1) year after filing,

but may be extended an additional (1) year after the filing of a Continuation

Notice. If a Notice of Right to Claim Lien is required, an unexpired

Notice of Right to Claim Lien or Continuation Notice is necessary before

a lien may be claimed. M.C.A. § 71-3-531

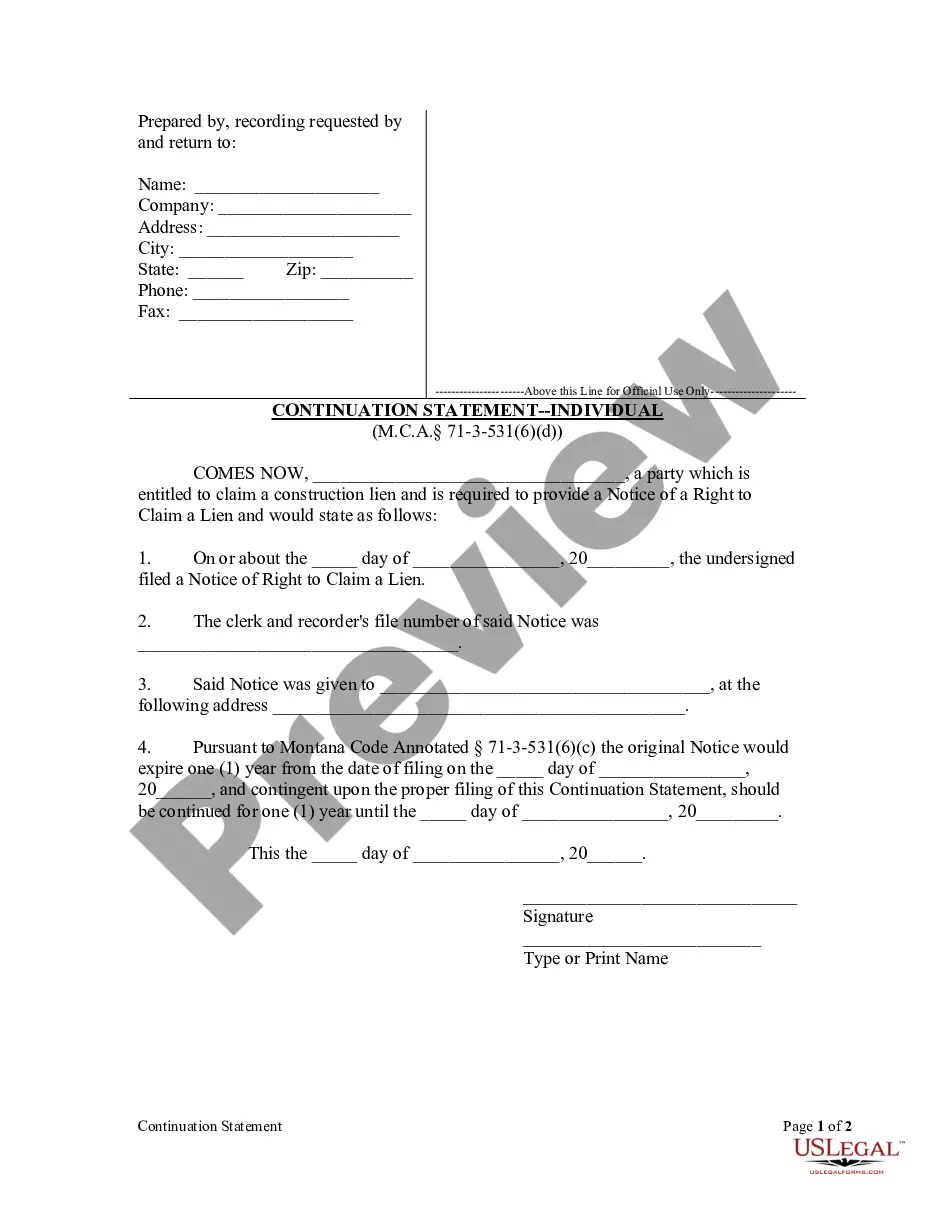

Montana Continuation Statement - Individual

Description

How to fill out Montana Continuation Statement - Individual?

Obtain a printable Montana Continuation Statement - Individual in just a few clicks from the most extensive collection of legal electronic files.

Discover, download, and print professionally prepared and certified samples on the US Legal Forms website. US Legal Forms has been the leading supplier of affordable legal and tax documents for US citizens and residents online since 1997.

After downloading your Montana Continuation Statement - Individual, you can fill it out in any online editor or print it and complete it by hand. Use US Legal Forms to access 85,000 professionally drafted, state-specific forms.

- Clients with a subscription must Log In to their US Legal Forms account, download the Montana Continuation Statement - Individual, and locate it in the My documents section.

- Individuals without a subscription should adhere to the following steps.

- Ensure your form complies with your state's regulations.

- If accessible, review the form’s description for additional information.

- If available, preview the form to discover more content.

- Once you are certain the template fulfills your needs, click Buy Now.

- Create a personal account.

- Choose a plan.

- Make a payment via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

Montana personal tax returns are due by April 15. If you cannot file by that date, you can get a state tax extension. A Montana extension will give you 6 more months to file, moving the deadline to October 15. NOTE: You do not need to file a Federal tax extension (IRS Form 4868) in order to get a Montana tax extension.

Montana Labor Department Announces Unemployment Benefits Extension. The Montana Department of Labor and Industry announced Tuesday that it has continued paying out unemployment insurance benefits through the latest federal stimulus package passed at the end of last year.

Montana Individual Income Tax Return (2020) You may use this form to file your Montana individual income tax return. This is the long form.

Tax Day has come and gone, but it's not too late to file your 2018 state income tax return.April 15 was the deadline for taxpayers who owed tax. But if you didn't get around to filing, remember that everyone gets an automatic, six-month filing extension to file until Oct. 15.

According to Montana Instructions for Form 2, you must file a Montana Individual Income tax return if your federal gross income meets the threshold and you lived or earned income in Montana during the tax year."

Montana State Income Taxes for Tax Year 2020 (January 1 - Dec. 31, 2020) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a MT state return). The Montana tax filing and tax payment deadline is April, 15, 2021.

When your home state has 46 (out of 56) counties with average populations of fewer than six people per square mile, every taxpayer counts! If you lived in or earned income in Big Sky Country, you'll likely need to file a Montana income tax return.

Taxpayers can e-file their returns for free on Montana Taxpayer Access Point (TAP) https://tap.dor.mt.gov/. Montana taxpayers can also e-file federal and state individual income tax returns using IRS software or an approved third-party software provider listed under Online Services at revenue.mt.gov.