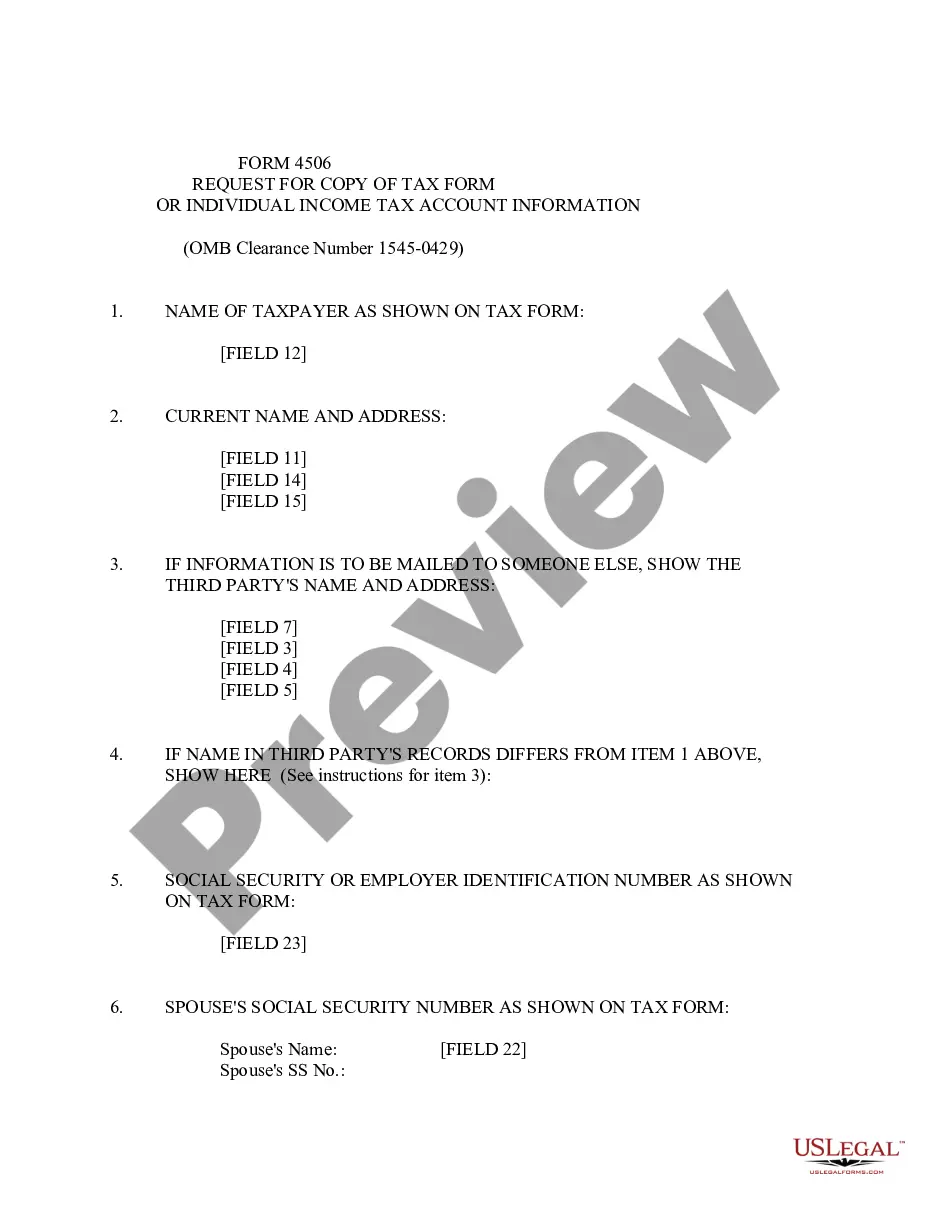

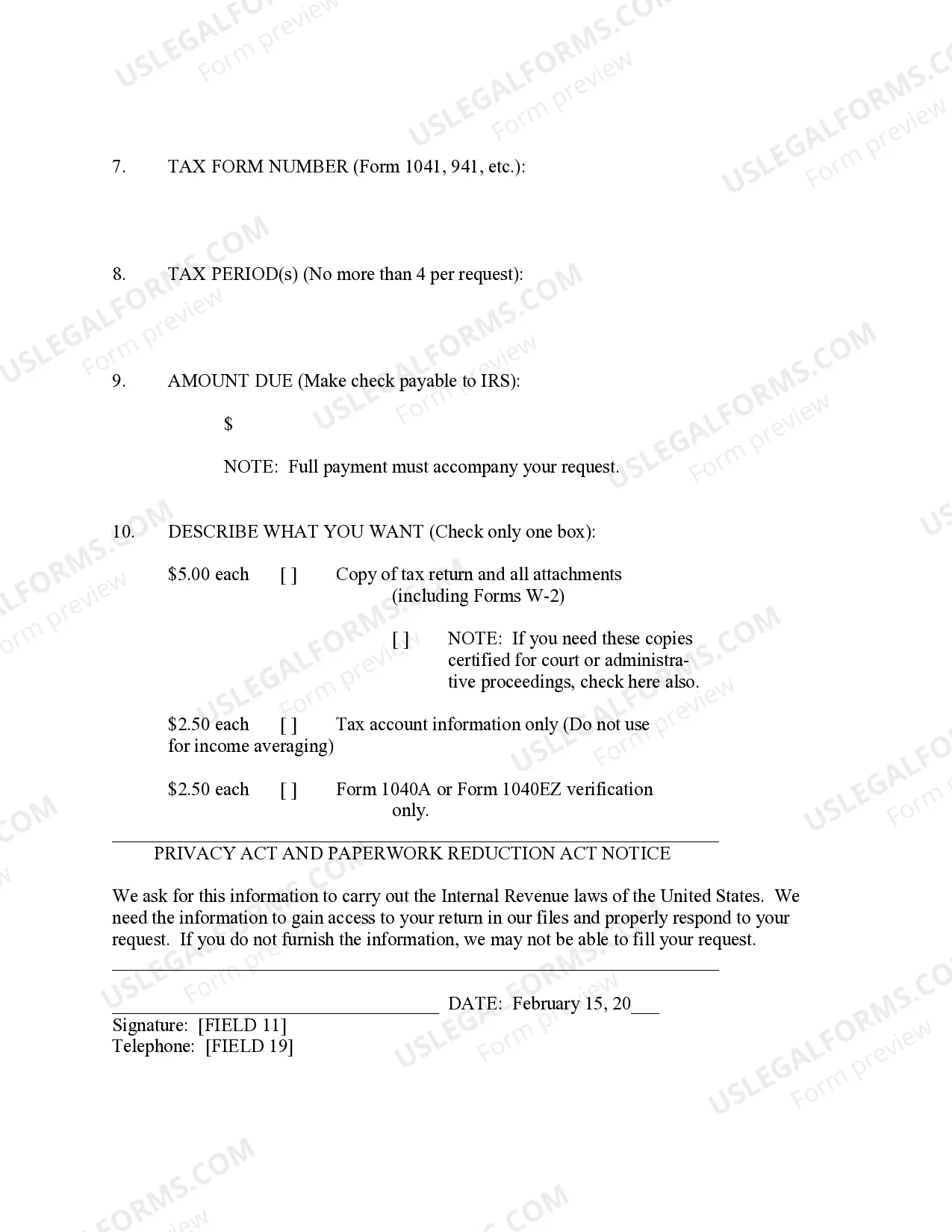

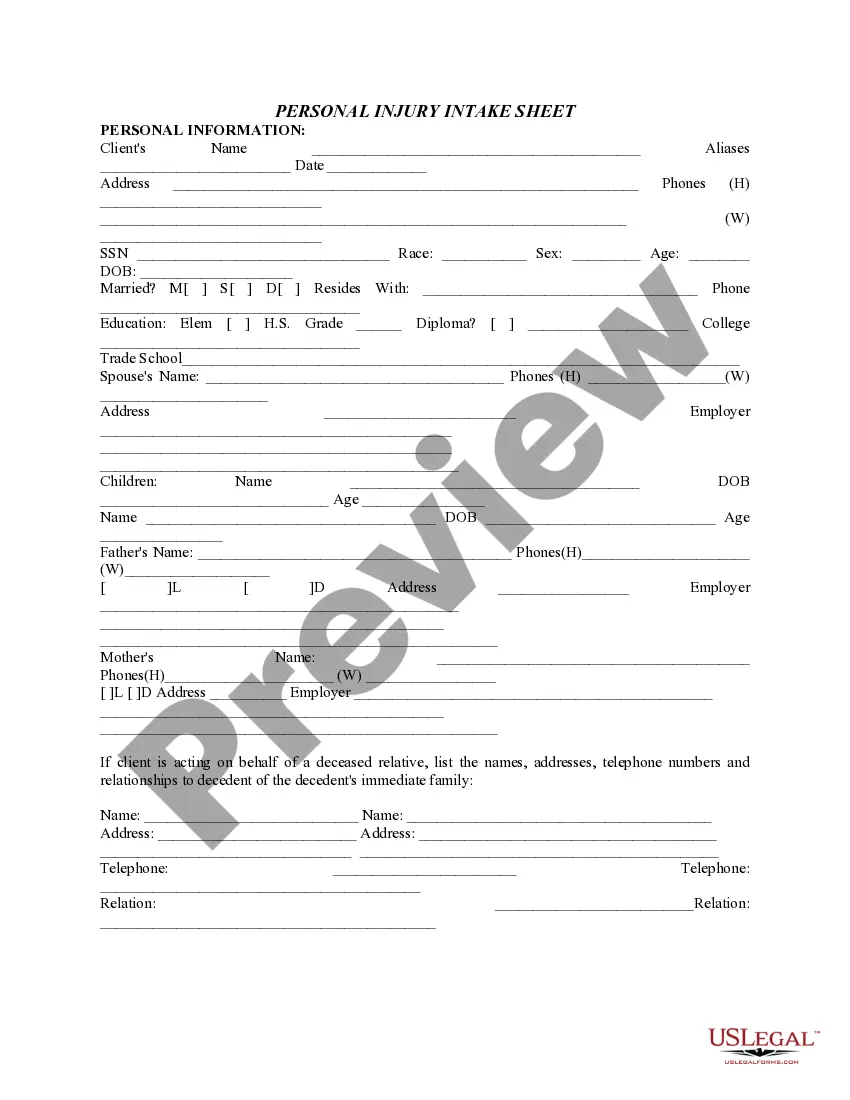

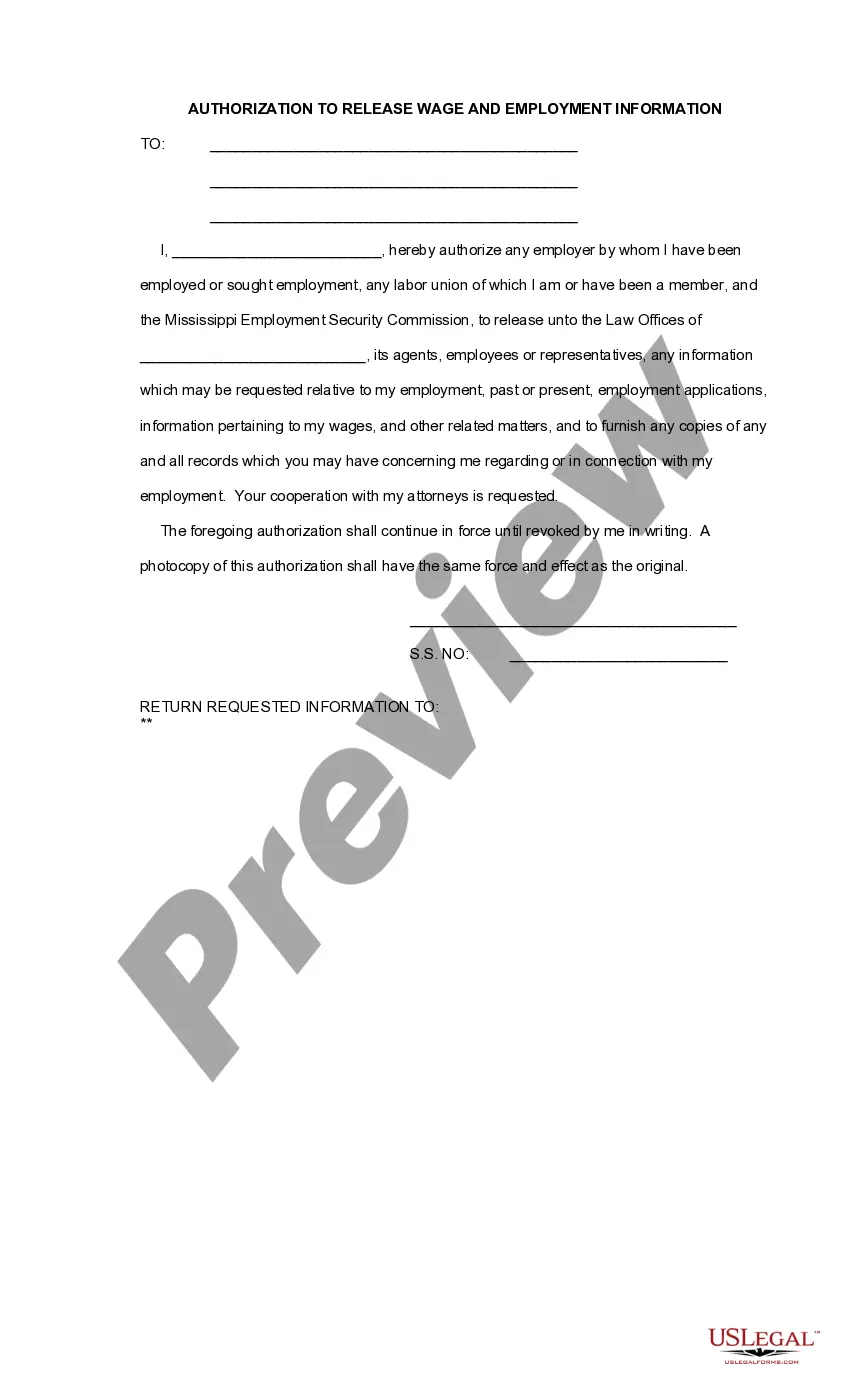

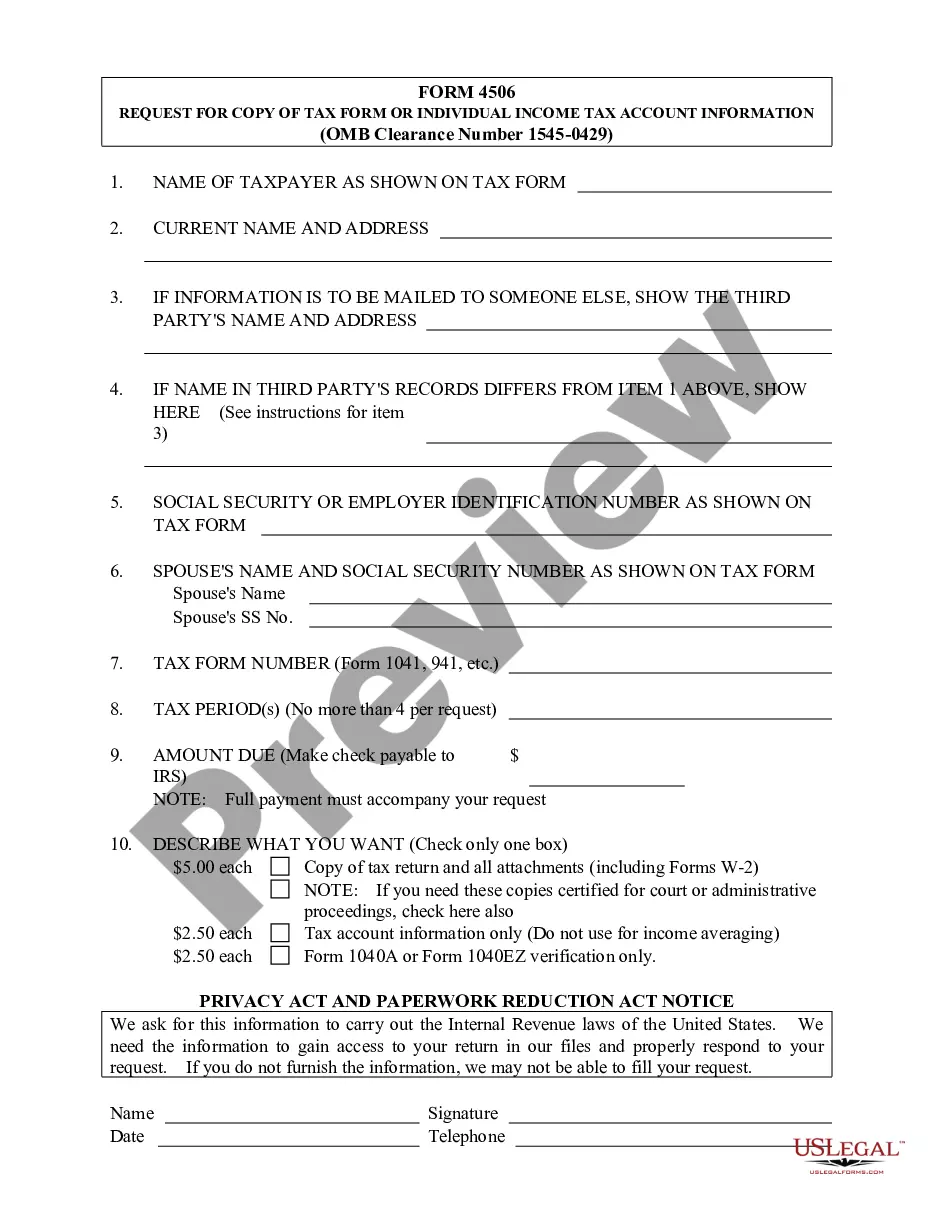

Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Mississippi Request For Copy Of Tax Form Or Individual Income Tax Account Information?

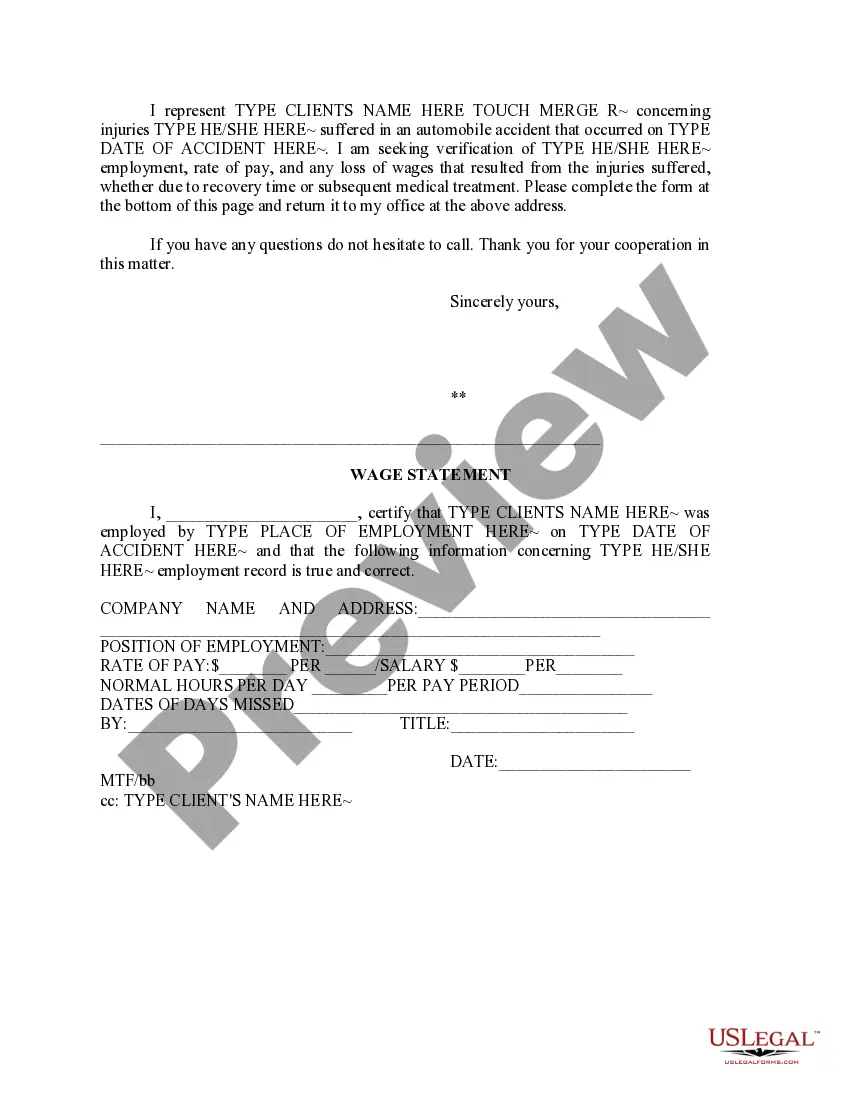

Acquire a printable Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information within just a few clicks from the largest collection of legal e-files.

Discover, download, and print out expertly prepared and verified samples on the US Legal Forms website. US Legal Forms has been the leading source of affordable legal and tax templates for US citizens and residents online since 1997.

After downloading your Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information, you can complete it in any online editor or print it and fill it out by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Users who already possess a subscription need to Log In directly to their US Legal Forms account, download the Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information and find it saved in the My documents section.

- Users without a subscription must adhere to the following guidelines.

- Ensure your template aligns with your state's criteria.

- If available, read through the form’s description for additional information.

- If accessible, examine the form to gather more content.

- Once you’re confident the form fulfills your needs, simply click Buy Now.

- Establish a personal account.

- Select a plan.

- Make payment via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

If you missed the e-file deadline, print and paper file your corrected tax return.Additionally, if you forgot to include documentation, such as a W-2 with a paper filed return, the IRS will request the documentation. How to File an Amended Return. If you need to file an amended return, you should use Form 1040X.

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center.

Yes. You can file them separately. Although state returns can be e-filed with your federal return (or after your federal return has already been accepted), it's no longer possible to e-file state returns before the federal. They are taking this measure to add an extra layer of security to all e-filed state returns.

Log in to Benefit Programs Online and select UI Online. Select Form 1099G. Select View next to the desired year. This link will only appear if you received benefits from the EDD for that year. Select Print to print your Form 1099G information. Select Request Duplicate to request an official paper copy.

Introduction. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well. While some states do not levy a state income tax, all states assess some form of tax, such as sales or use taxes. And some of these taxes will require you to submit a separate state tax form each year.

No, they aren't exactly the same. Most state tax laws are similar to federal tax law, but each state usually differs from the federal rules in some way.In addition, states often apply different rules than the Internal Revenue Service (IRS) for other types of income and have differing tax rates.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

The W-4 is a federal document, and several states but not all accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings.

TurboTax Online includes federal and state e-filing. About 75% of our customers choose this version.