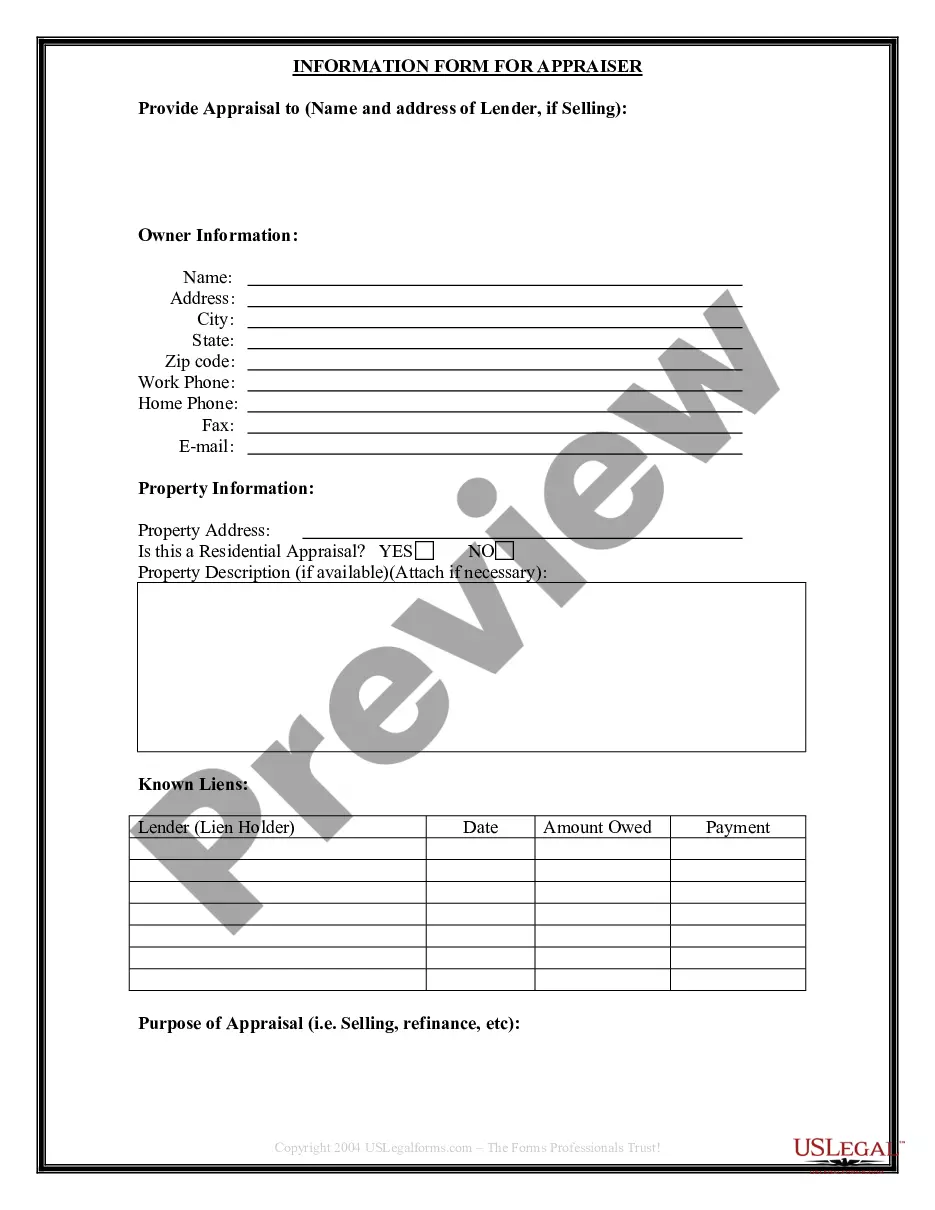

Mississippi Seller's Information for Appraiser provided to Buyer

Description

How to fill out Mississippi Seller's Information For Appraiser Provided To Buyer?

Among various paid and complimentary templates available online, you cannot be certain about their trustworthiness. For instance, who designed them or if they possess the expertise to handle your requirements.

Always remain calm and utilize US Legal Forms! Uncover Mississippi Seller's Information for Appraiser provided to Buyer templates crafted by proficient attorneys and steer clear of the costly and time-consuming effort of searching for a lawyer and subsequently having to compensate them to compose a document for you that you can easily locate on your own.

If you already hold a subscription, Log In to your account and locate the Download button adjacent to the form you’re looking for. You'll also be able to access your previously stored samples in the My documents section.

Download the form in the desired file format. After you have registered and bought your subscription, you can use your Mississippi Seller's Information for Appraiser provided to Buyer as frequently as you wish or for as long as it remains active in your state. Revise it in your chosen offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- If you’re visiting our website for the first time, follow the steps below to obtain your Mississippi Seller's Information for Appraiser provided to Buyer effortlessly.

- Ensure that the document you find is applicable in your state.

- Examine the file by reading the description using the Preview function.

- Click Buy Now to initiate the purchasing process or look for another example using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit card or Paypal.

Form popularity

FAQ

The seller often does not generally get a copy of the appraisal, but they can request one. The CRES Risk Management legal advice team noted that an appraisal is material to a transaction and like a property inspection report for a purchase, it needs to be provided to the seller, whether or not the sale closes.

Lender from Oakland, CA. If the appraisal comes in high, HELL NO you do not share it with the sellers!!! You have zero incentive to share something that they could use to negotiate the price upwards.If the appraisal comes in right at value, you do not share it with the sellers.

Property sellers are usually required to disclose information about a property's condition that might negatively affect its value. Even if the law doesn't require disclosure of a problem, it might be wise for a seller to disclose it anyway.

Home sellers aren't entitled to copies of the appraisals mortgage lenders conduct on behalf of their borrowers. If a home seller wants a copy of an appraisal, she should consider asking for a copy from the buyer.However, a copy may come in handy if the appraisal comes in low and price negotiations must ensue.

Generally, from the time the lender orders it, you can expect to see an appraisal report anytime between two days and one week. But if the market is particularly busy, it can take up to two weeks for it to end up in the lender's hand.

A: An appraisal is generally considered a professional opinion of the market value of a property, not a fact. Although it's both legally and ethically necessary to disclose a material fact, the same requirement doesn't apply to an opinion.

The lender will order the home appraisal during escrow, but it is almost always paid for by the borrower. After your mortgage lender orders and receives the appraisal, the finished report must be shared with the mortgage applicant.

Will the homebuyer receive a copy of the appraisal? A. Yes! Regulations allow real estate agents, or other persons with an interest in the real estate transaction, to communicate with the appraiser and provide additional property information, including a copy of the sales contract.