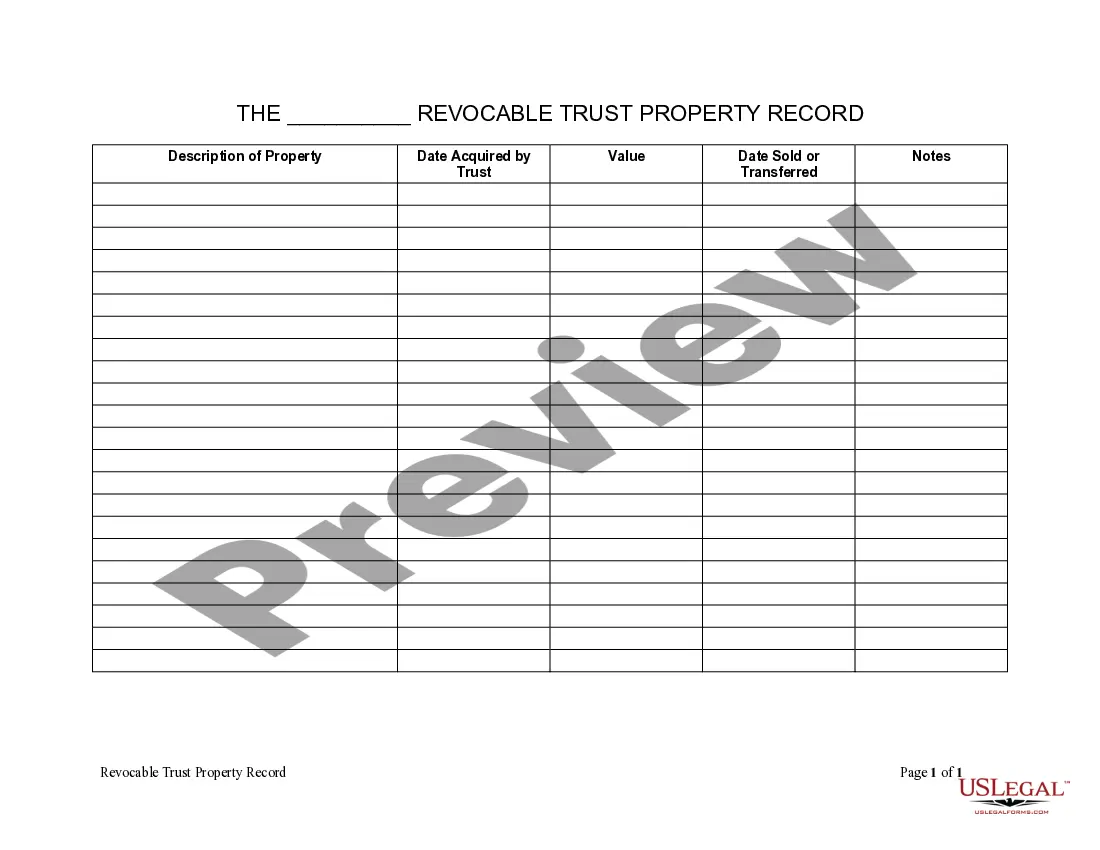

Minnesota Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Living Trust Property Record?

Obtain any template from 85,000 legal documents including Minnesota Living Trust Property Record online with US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you possess a subscription, Log In. When you’re on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the guidelines outlined below: Check the state-specific criteria for the Minnesota Living Trust Property Record you wish to utilize. Browse through the description and preview the sample. When you’re certain the template is what you require, simply click Buy Now. Choose a subscription plan that genuinely fits your budget. Set up a personal account. Make a payment using either of the two available methods: by credit card or through PayPal. Select a format to download the file in; two options are available (PDF or Word). Download the document to the My documents tab. Once your reusable template is ready, print it out or save it to your device.

- With US Legal Forms, you’ll always have instant access to the appropriate downloadable sample.

- The service provides access to forms and categorizes them to streamline your search.

- Utilize US Legal Forms to obtain your Minnesota Living Trust Property Record quickly and effortlessly.

Form popularity

FAQ

Yes, you can file a living trust yourself, but completing the process correctly is crucial. You will need to prepare the trust document, transfer your property into the trust, and keep all records organized. Consider using USLegalForms to access easy-to-follow templates and resources to streamline the creation of your Minnesota Living Trust Property Record.

You do not need to record a living trust with the county, as it is a private document. However, you should keep it in a safe place and inform your successor trustee of its location. For real estate owned by the trust, you must record the deed in the county where the property is located to update the Minnesota Living Trust Property Record. This step ensures that your trust’s intentions are honored.

Yes, you can write your own trust in Minnesota, but it is crucial to follow state-specific laws to ensure its validity. Utilize resources, such as templates or guides, to help you draft the document correctly. However, seeking legal advice can provide peace of mind and ensure your Minnesota Living Trust Property Record is accurate and enforceable.

Listing property in a trust involves transferring ownership from your name to the trust's name. You will need to prepare a deed for real estate and possibly other documents for personal property, ensuring they reflect the trust's name appropriately. Additionally, maintaining a comprehensive Minnesota Living Trust Property Record is essential for clarity and future reference. Consulting with a legal professional can simplify this process.

To fill out a living trust, begin by gathering essential information about your assets, beneficiaries, and any specific instructions you want to include. Next, use a reliable template or consult an experienced professional to ensure compliance with Minnesota laws. After completing the document, review it thoroughly and sign it in front of a notary. This process helps create a solid Minnesota Living Trust Property Record.

The purpose of a certificate of trust is to summarize the essential details of the trust without revealing the entire document. This allows trustees to prove their authority to manage the trust without compromising sensitive information. It is particularly useful when dealing with financial institutions or other parties. For assistance in creating a certificate that meets Minnesota requirements, consider using US Legal Forms.

In Minnesota, a living trust does not need to be filed with any government office. You simply retain the trust document in a safe location. It is essential to inform your trustee and beneficiaries about where they can find it. This ensures your Minnesota Living Trust Property Record is accessible when needed, simplifying the management of your assets.

Generally, a certificate of trust does not need to be recorded. Its purpose is to provide a summary of the trust without disclosing the entire document. This allows you to maintain privacy while fulfilling legal requirements. Utilizing a platform like US Legal Forms can guide you in preparing a certificate that aligns with your specific needs.

No, a certificate of trust does not need to be recorded in Minnesota. This document acts as a verification of the trust's existence and essential information, while keeping sensitive details private. You can present it to banks or other institutions when managing your Minnesota Living Trust Property Record. Consider using US Legal Forms to ensure your certificate meets all legal standards.

A certificate of trust does not need to be recorded in Minnesota. Instead, it serves as a summary of the trust's key details without revealing the entire document. This approach protects your privacy while providing necessary information when dealing with third parties. Using a service like US Legal Forms can help you create a certificate that satisfies Minnesota requirements.