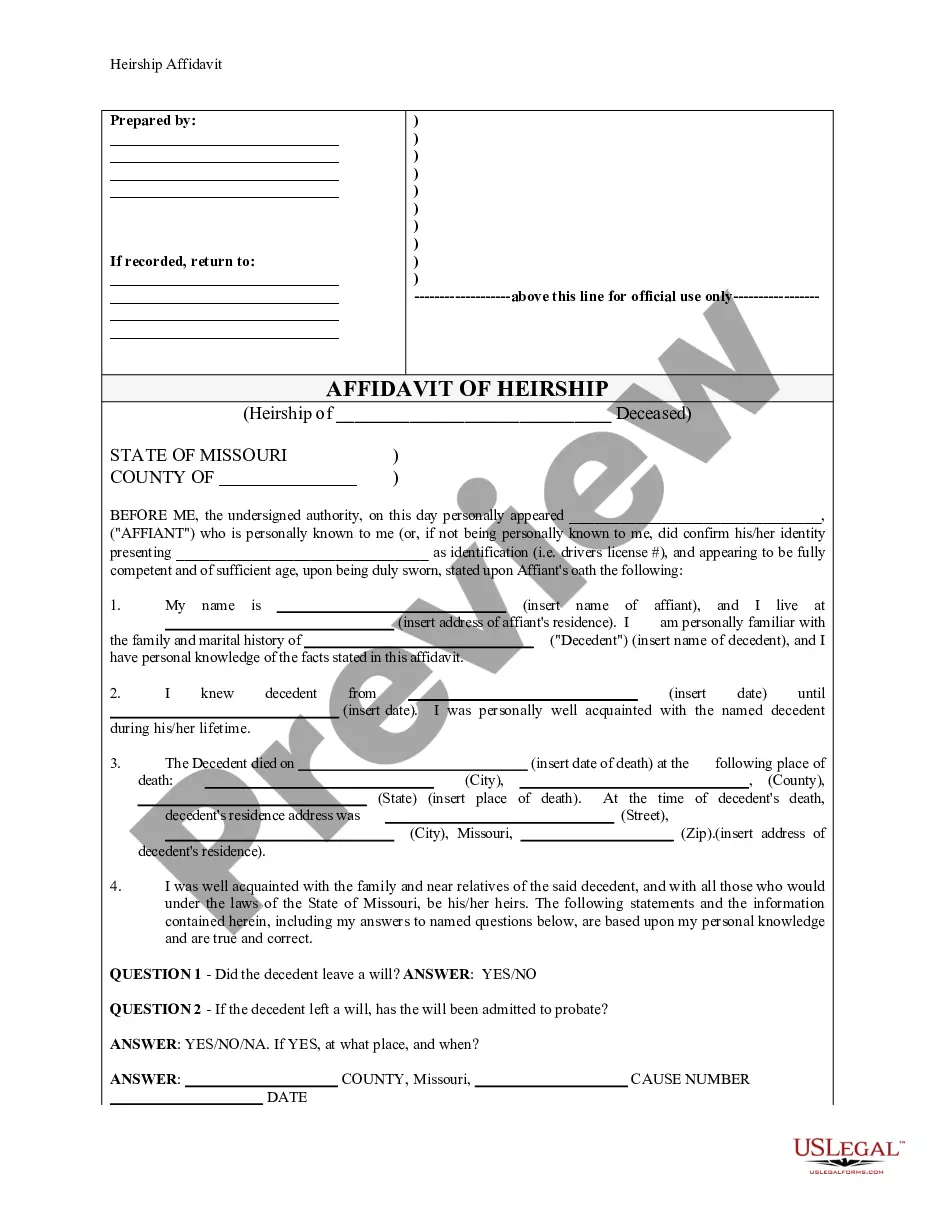

Minnesota Living Trust for Husband and Wife with One Child

Description

How to fill out Minnesota Living Trust For Husband And Wife With One Child?

Acquire any template from 85,000 legal documents such as Minnesota Living Trust for Husband and Wife with One Child online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to gain access to it.

In the event you have not subscribed yet, adhere to the guidelines below.

With US Legal Forms, you will consistently have swift access to the appropriate downloadable template. The service grants you access to forms and categorizes them to facilitate your search. Utilize US Legal Forms to acquire your Minnesota Living Trust for Husband and Wife with One Child swiftly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Living Trust for Husband and Wife with One Child you wish to utilize.

- Examine the description and preview the template.

- Once you are confident the sample meets your needs, simply click Buy Now.

- Select a subscription plan that genuinely fits your budget.

- Establish a personal account.

- Make a payment in one of two convenient methods: by card or through PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Having a living trust can still be beneficial, even with just one child. A Minnesota Living Trust for Husband and Wife with One Child allows you to outline specific wishes for asset distribution, making the process easier for your child after your passing. It can also help avoid probate, ensuring a quicker transfer of assets. By using platforms like uslegalforms, you can create a tailored trust that meets your family's needs.

Yes, a husband and wife can establish a joint living trust. This type of trust allows both partners to combine their assets into one trust, simplifying management and distribution. A Minnesota Living Trust for Husband and Wife with One Child can help ensure that your child receives your assets seamlessly, without the need for probate. Additionally, a joint trust can provide tax benefits and greater control over your estate.

The 2-year rule for trusts typically refers to the time frame in which a trust can be contested after a person's death. In the context of a Minnesota Living Trust for Husband and Wife with One Child, it is crucial to understand that any disputes must usually be filed within two years. This rule helps maintain clarity and stability in estate planning. Therefore, it is wise to set up your trust correctly to avoid potential challenges.

Yes, you can write your own trust in Minnesota. However, it is essential to ensure that your document meets all legal requirements. A Minnesota Living Trust for Husband and Wife with One Child can be complex, and any mistakes may cause issues later. Consider using a trusted platform like US Legal Forms to guide you in creating a legally sound trust.

If the ultimate beneficiaries of the Living Trust are family members of the person who created the trust, the trust will often be referred to as a Family Trust. If those beneficiaries include friends, charities, or other non-family members, then the trust is typically called a Living Trust.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.