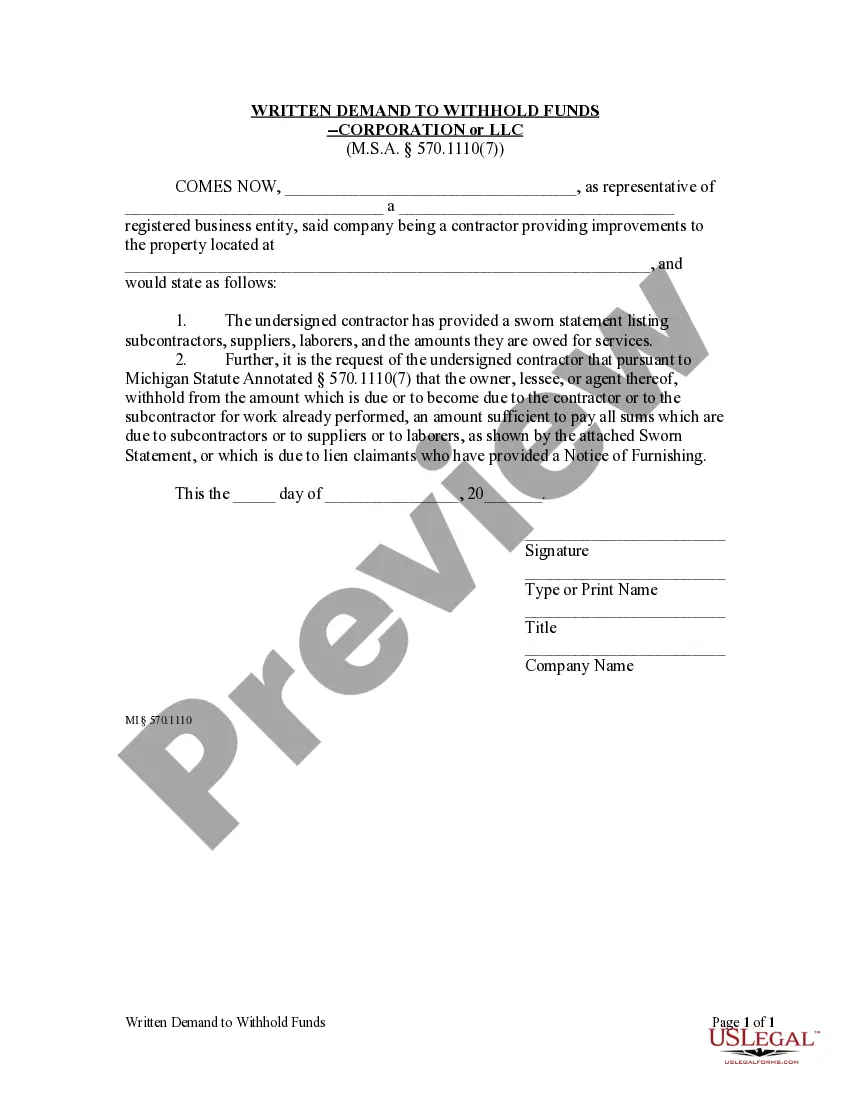

Michigan Request to Withhold Funds - Individual

Overview of this form

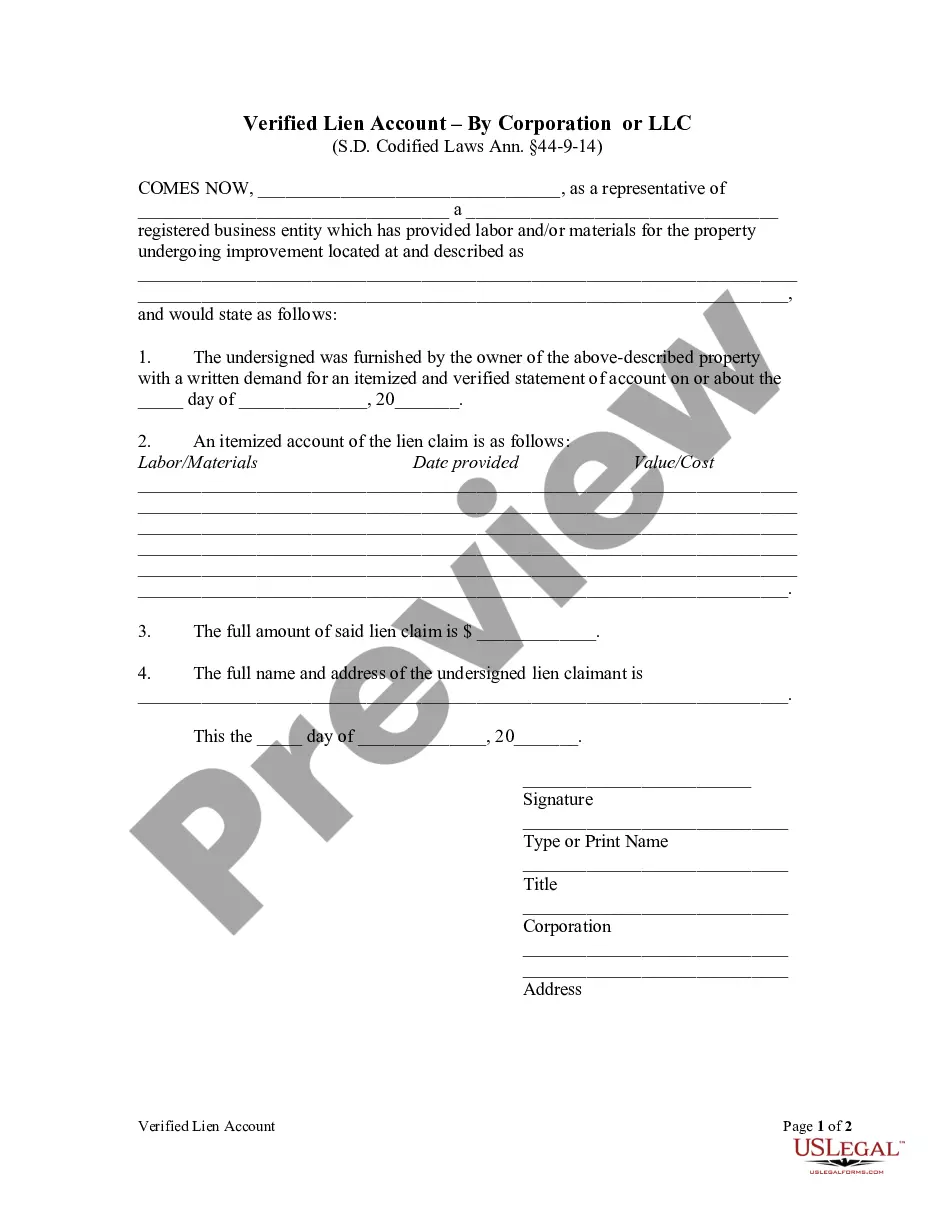

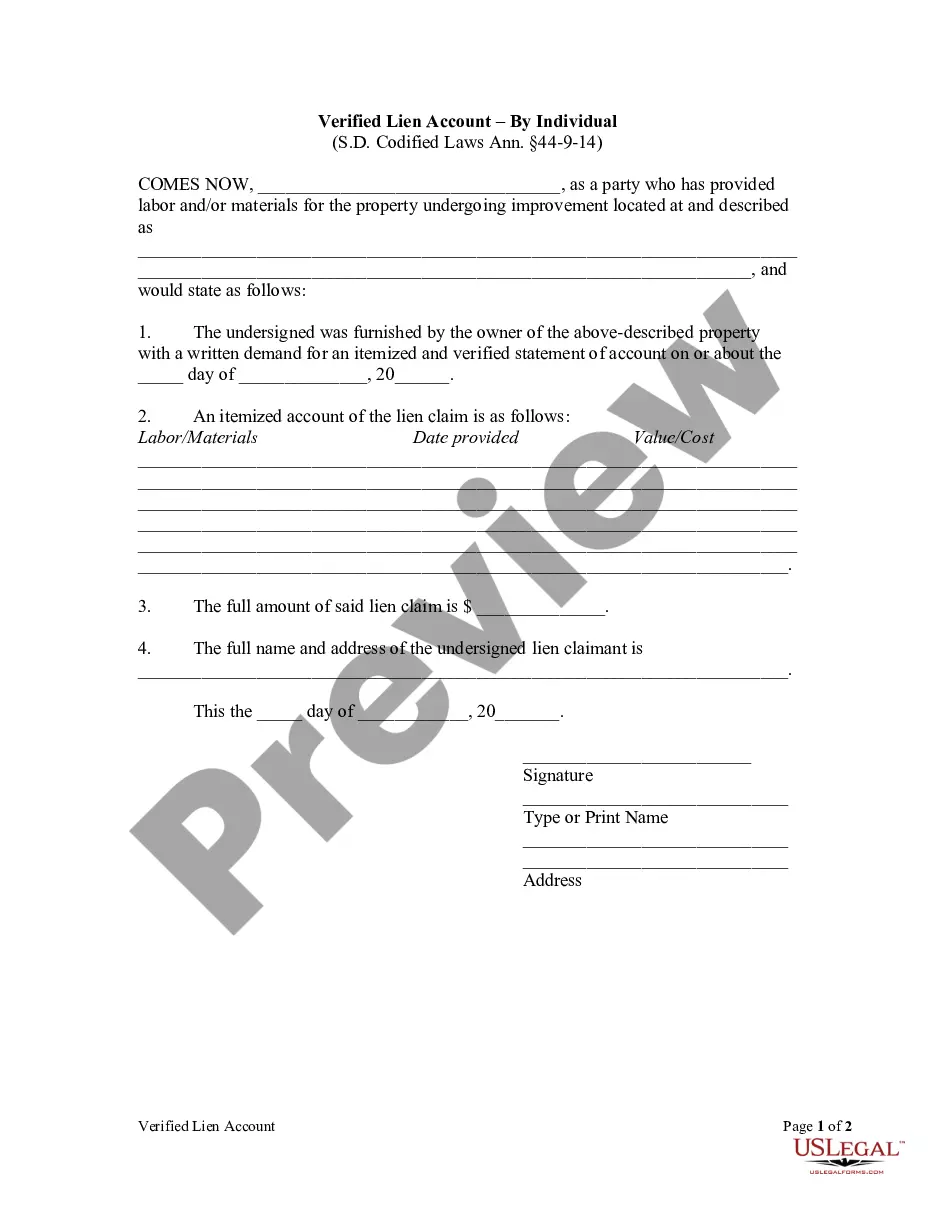

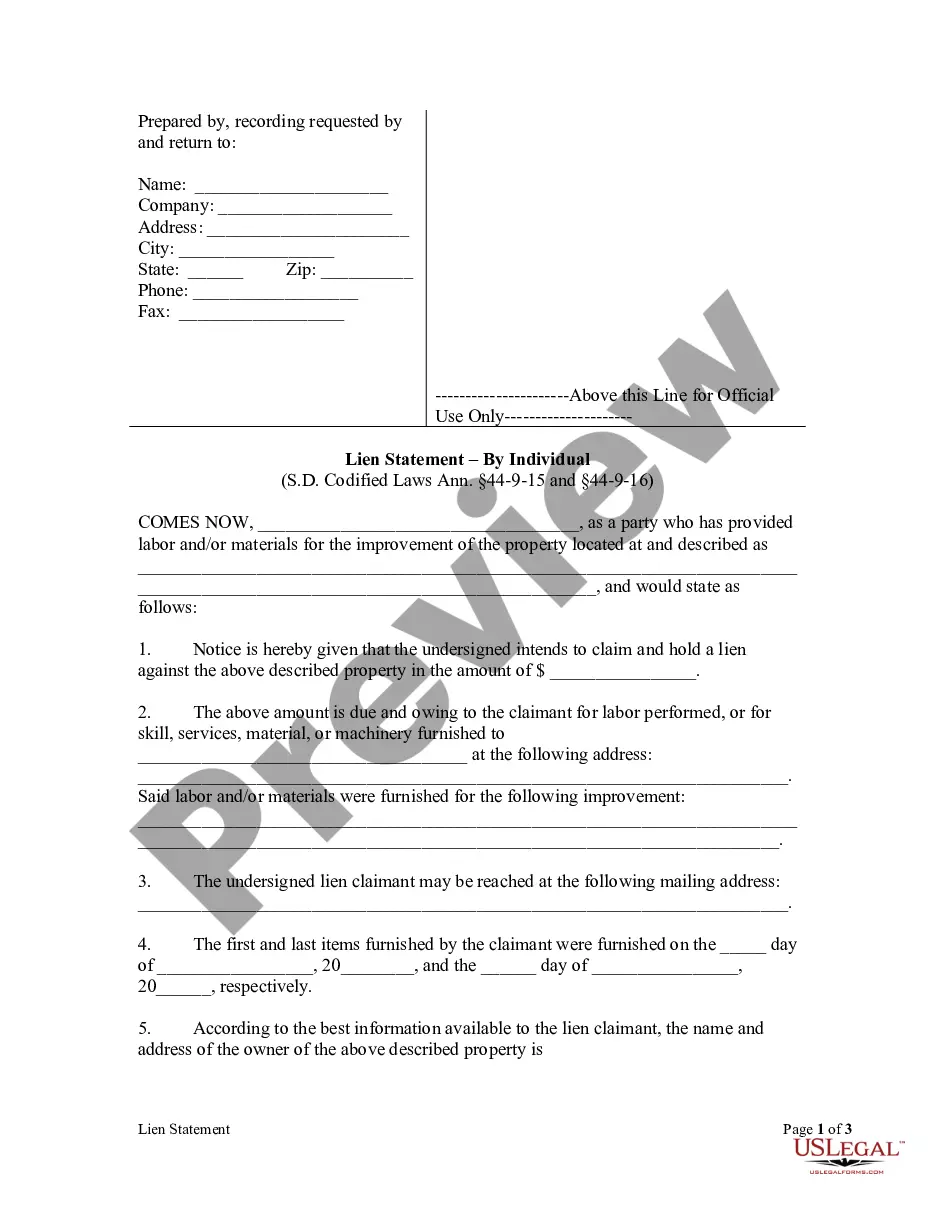

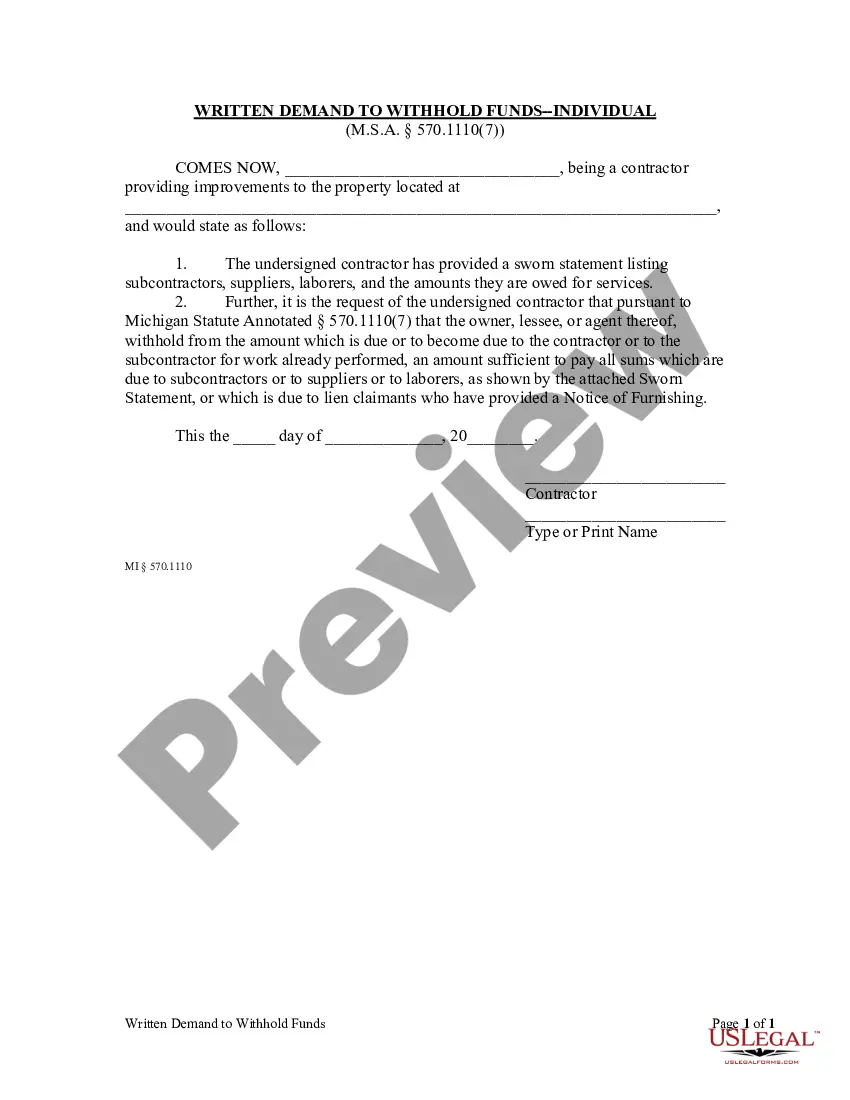

The Request to Withhold Funds - Individual form is a legal document used by contractors to formally request that an owner or lessee withhold payment to ensure that all subcontractors, suppliers, and laborers are paid as indicated in a sworn statement. This form is essential for protecting the financial interests of those who have provided labor or materials and ensures compliance with Michigan law regarding liens and payment obligations.

Key components of this form

- Contractor's information: Name and property details where improvements are made.

- Sworn statement: A declaration of all subcontractors, suppliers, and laborers owed payment.

- Request to withhold funds: A clear demand for the owner or lessee to withhold specified amounts.

- Dates and signatures: Indicates the date of the request and the contractor's acknowledgment.

Situations where this form applies

This form should be used when a contractor has completed work on a property and received a sworn statement detailing amounts owed to subcontractors, suppliers, or laborers. It is necessary when the contractor wants to safeguard these parties' rights to payment by requesting the owner to withhold amounts sufficient to cover these debts from any payments due to the contractor.

Who can use this document

- Contractors involved in property improvements in Michigan.

- Subcontractors or suppliers seeking assurance of payment for services rendered.

- Owners or lessees who need to comply with legal obligations regarding payment withholding.

Steps to complete this form

- Identify the parties involved, including the contractor and property owner.

- Specify the property address where improvements have been made.

- Attach the sworn statement listing all subcontractors, suppliers, and laborers owed payment.

- Enter the date of the request and the signature of the contractor.

- Print the name of the contractor below their signature for clarity.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the sworn statement with the request.

- Not specifying all subcontractors and amounts owed, leading to incomplete information.

- Submitting the form without proper signatures and dates.

Why complete this form online

- Immediate access to a professionally drafted legal document.

- Convenience of completing the form at your own pace.

- Editable templates that allow for customization as needed.

Looking for another form?

Form popularity

FAQ

Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

The Michigan Income Tax Act requires that all employers required to withhold federal income taxes that have employees working in Michigan register and withhold state income tax from residents and nonresidents performing services within the state.

The verb withhold means to deduct from a payment and hold back. Your job will withhold money from your paycheck for things like taxes. You may also choose to withhold money from your check for healthcare, retirement, and numerous other voluntary accounts. The past tense of the verb withhold is withheld.

Please call 517-636-4486 for tax inquiries or check your account online.

Every Michigan employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. What is Michigan's 2020 payroll withholding tax rate? The tax rate for 2020 is 4.25%.

An employee may claim exemption from Michigan income tax withholding only if they do not anticipate a Michigan income tax liability for 2017 because employment is less than full time AND exemption allowances are greater than annual compensation.

Withholding Rate: 4.25% Personal Exemption: $4,400 2019 Michigan Income Tax Withholding Tables.

If the FTE is owned by a non-resident individual or is owned by a C corporation or a flow-through entity and has more than $200,000 in business income allocated or apportioned to Michigan, then the flow-through entity must file and pay flow-through withholding.