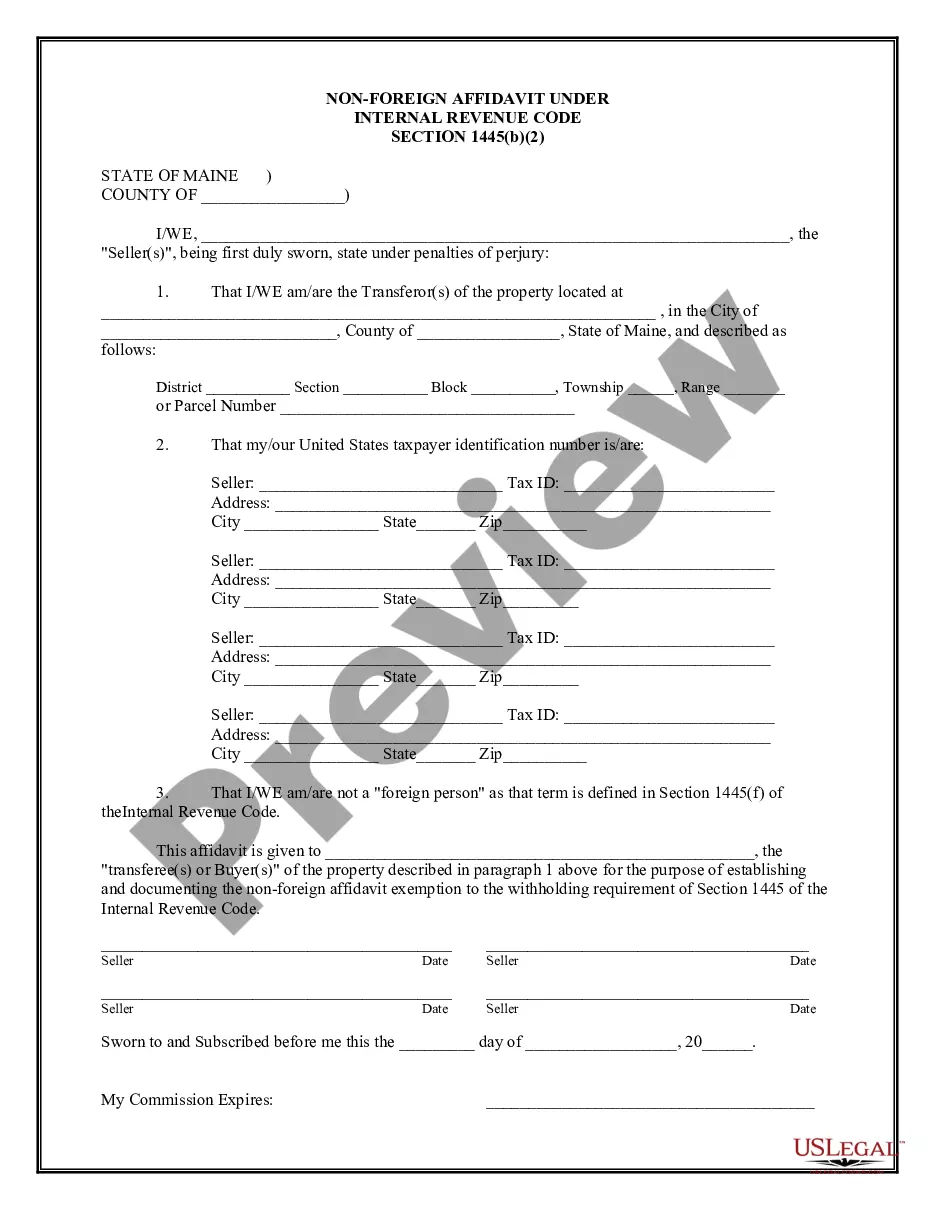

Maine Non-Foreign Affidavit Under IRC 1445

What is this form?

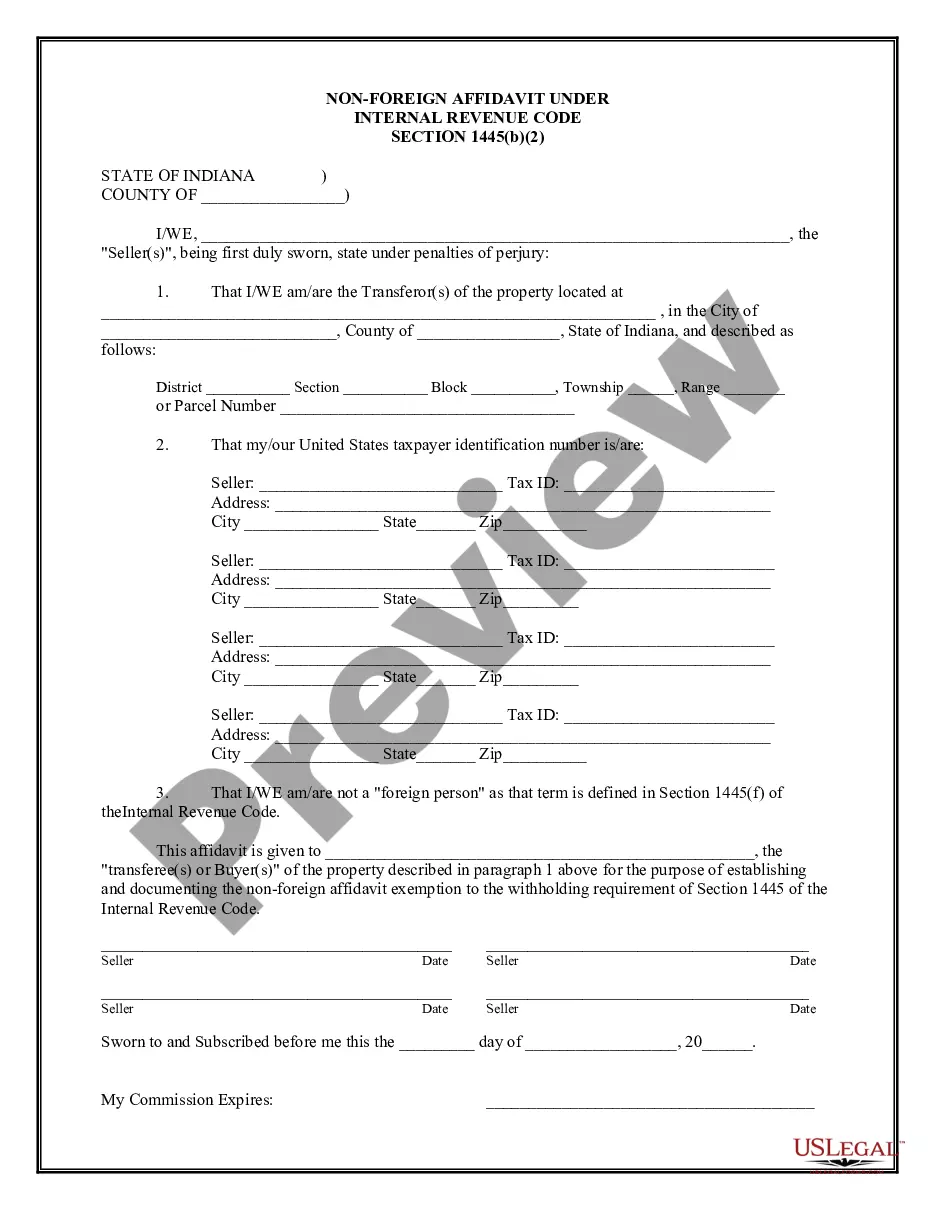

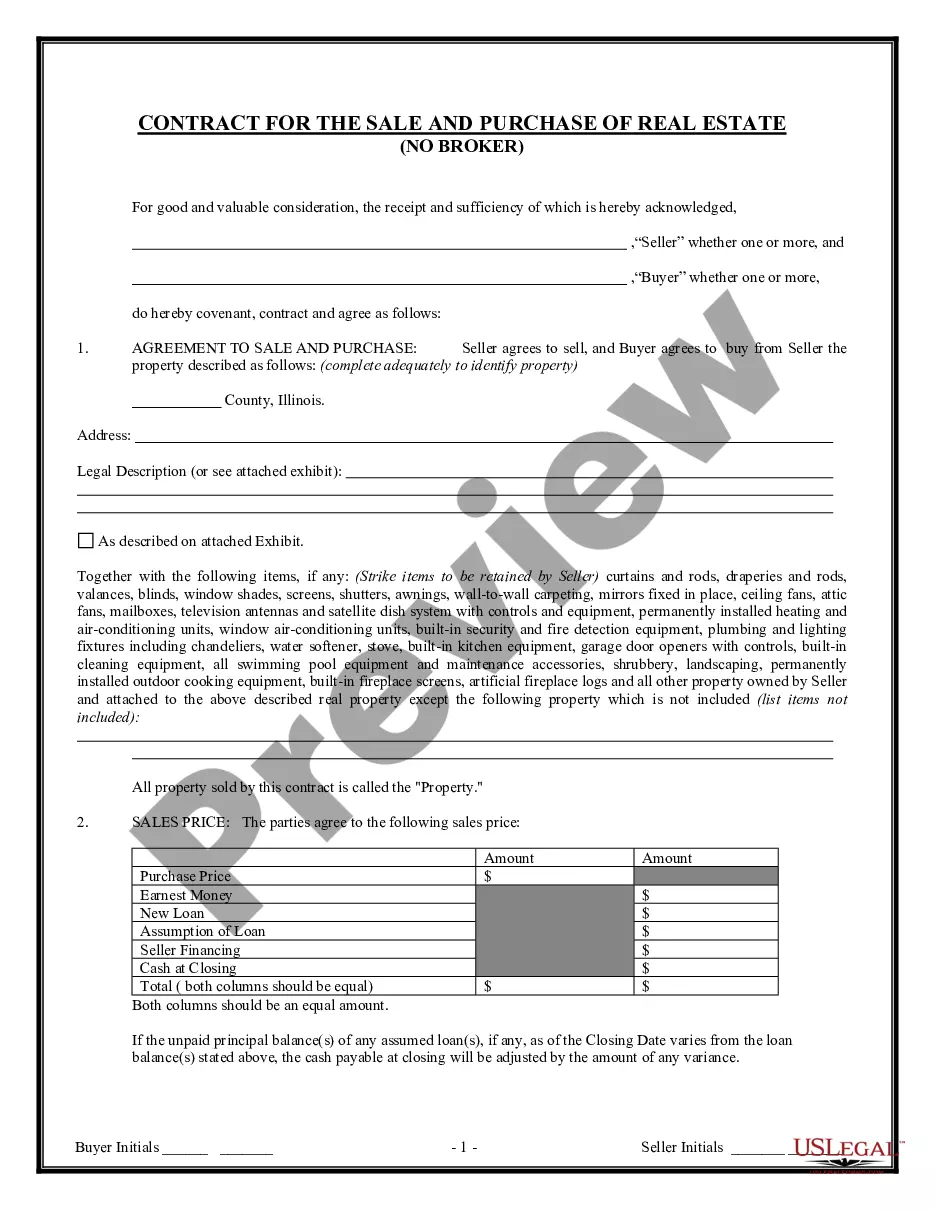

The Non-Foreign Affidavit Under IRC 1445 is a legal document used by sellers of real property to affirm that they are not foreign persons as defined by the Internal Revenue Code Section 26 USC 1445. This affidavit serves to exempt the seller from the withholding requirement imposed on foreign sellers during real property transactions, ensuring compliance with tax regulations. It is distinct from other affidavits as it specifically addresses foreign status and related tax obligations.

Key parts of this document

- Identification of the seller(s) including names and taxpayer identification numbers.

- Details of the property being sold, including its location and legal description.

- A declaration that the seller(s) are not foreign persons as defined by tax law.

- Signatures of the seller(s) to validate the affidavit.

- Notary section to be completed for legal acknowledgment.

When to use this form

This form should be used in real estate transactions when the seller wishes to certify their non-foreign status to avoid withholding taxes mandated by the Internal Revenue Code. It is applicable when selling residential, commercial, or other types of real property where the transaction involves a buyer within the United States.

Who should use this form

This affidavit is intended for:

- Sellers of real property who are U.S. citizens or individuals not classified as foreign persons for tax purposes.

- Buyers who require this affidavit from the seller to comply with tax withholding obligations.

- Real estate professionals and attorneys managing property transactions.

How to prepare this document

- Identify the seller(s) by entering their full names and taxpayer identification numbers in the designated fields.

- Specify the property address and legal description accurately to identify the real estate in question.

- Confirm the seller's non-foreign status by ticking the appropriate statement.

- Have all sellers sign and date the affidavit in the provided areas.

- Complete the notary section to finalize the form's legitimacy.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Forgetting to provide the full legal description of the property.

- Not including all seller names and taxpayer identification numbers.

- Failing to ensure that all signatures are dated appropriately.

- Neglecting to have the affidavit notarized, which is necessary for validity.

Why use this form online

- Convenience of accessing and downloading the form at any time.

- Editability allows for easy customization of the affidavit to fit your specific transaction.

- Assurance of reliability as the forms are drafted by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

A withholding certificate is an application for a reduced withholding based on the gain of a sale instead of the selling price. If 15% of the selling price is more than the tax you will owe on this sale, then a withholding certificate may be ideal for you.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.